The Securities and Futures Commission announced the "whitelist" of the brokerage firms in June.

Author:Daily Economic News Time:2022.06.22

On June 22, the Securities Regulatory Commission released a new issue of the "whitelist" of the securities firm. A total of 30 securities firms were shortlisted in this issue. Compared with 27 in March, the increased 3 brokerage firms were Caixin, Guangfa, and Xingye.

The seventh "whitelist" in the industry, three newly added finalists for the first time

According to the official website of the CSRC, according to the dynamic adjustment mechanism of the "Whitening List", combined with the compliance risk control and business risks of securities companies, the initial evaluation of the Securities and Supervision Bureau and the relevant departments within the meeting formed this "white list".

This is the seventh "white list" released by the industry so far, with a total of thirty brokers shortlisted. Compared with the sixth "whitelist" in March, the three companies were shortlisted for Caixin, Guangfa, and Xingye, and the remaining 27 unchanged.

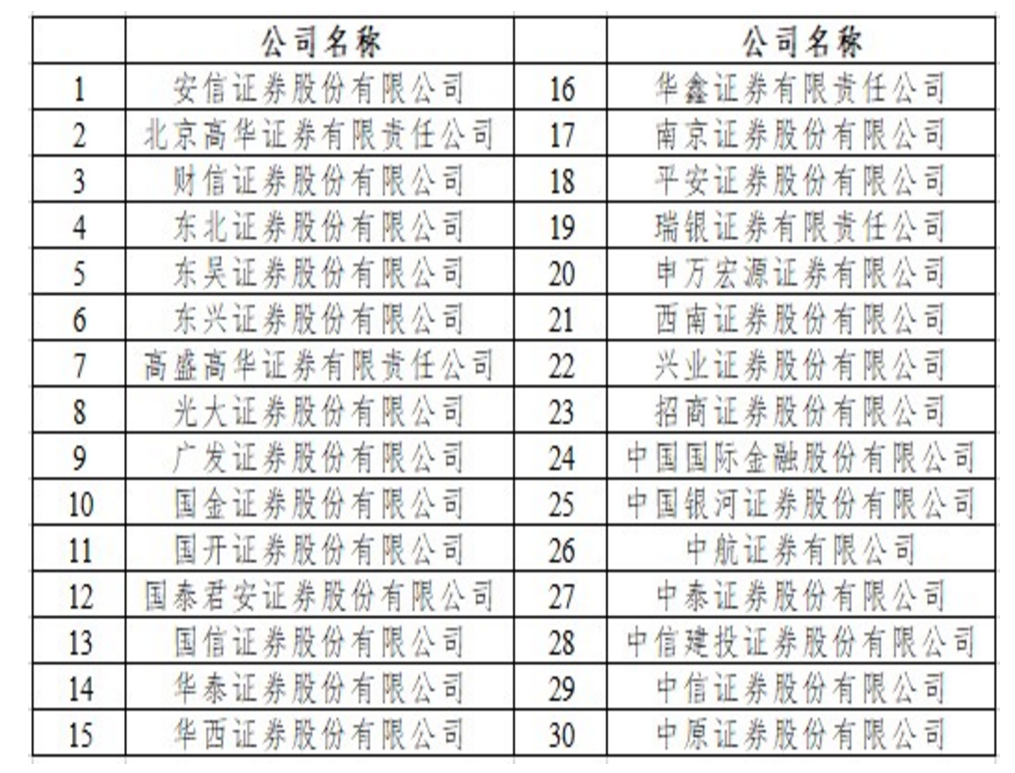

The specific 30 list is shown below:

It can be seen that the shortlisted list has both head brokers and regional brokers. Foreign securities firms such as Goldman Sachs, Beijing Gaohua, and UBS are also listed in the "whitelist".

The "white list" system of the securities industry began in May 2021. In order to implement the requirements of deepening the reform of the "decentralization service", compact the responsibility of the main body of the internal control of the securities company, focus on the use of limited regulatory resources, improve the effectiveness of the supervision of the institution, and promote the high -quality development of the industry. In May 2021, the Securities Regulatory Commission announced that A "whitelist" system is implemented for securities companies that are effective in company governance and compliance risk control. The first batch of 29 brokers was shortlisted. The "white list" is mainly used for securities regulatory authorities, and securities companies must not use it for commercial purposes such as advertising, publicity, and marketing.

From July to December 2021, the Securities and Futures Commission released four batch of "white lists", of which the National Kaishi Securities was added in the period of September 2021; the rest were not changed.

In the sixth batch of "white lists" in March 2022, Huabao, West, and Zhejiang merchants were transferred, and this time still failed to return to the list. The newly shortlisted Caixin, Guangfa, and Xingye have been included in the "whitelist" for the first time.

Companies of innovative pilot business must be generated from the "white list"

For the securities company incorporated into the "whitelist", the CSRC will cancel some regulatory opinions requirements. At the same time, the supervision opinions that are really necessary to retain, simplify the workflow, and transfer it to strict supervision and inspection before the event. Therefore, for securities companies, it can be shortlisted for the "whitelist". When the "Whitening List" was first released in May 2021, the Securities Regulatory Commission made a explanation. details as follows:

The first is to be reduced. For securities companies incorporated into the "white list", cancel the issuance of perpetual sub -debt and provide a guarantee commitment to a guarantee for overseas subsidiaries, increase capital for overseas subsidiaries, or provide financing.

The second is to be simple and simple. Simplify the process of issuing some regulatory opinions. Applications for the initiative, issuance, distribution, convertible bonds, short -term financing vouchers, financial bonds, etc., no longer solicit opinions and Shanghai and Shenzhen exchanges in accordance with previous procedures, and directly issue regulatory opinions after confirming the statutory conditions.

The third is that companies that innovate pilot business must be generated from the "whitelist", and the application for innovative pilot business of innovation pilot business without accepting the company's innovative pilot business is not accepted. In accordance with the principles of law and prudential, the company that included in the "whitelist" continued to apply for an innovative business supervision opinion in accordance with the existing rules and processes.

Fourth, securities companies that are not included in the "whitelist" are not applicable to regulatory opinions to reduce or simplify procedures, and continue to apply for various regulatory opinions in accordance with the existing process.

In addition, it is worth mentioning that from the requirements of the CSRC, it is necessary to be shortlisted for the "whitelist" to apply for itself. According to the requirements of the CSRC, in accordance with the requirements of "the declaration is promised, the commitment is responsible", the preliminary securities company applied to the regulatory authorities in accordance with the "white list" system standards to respond to the real, accurate and complete commitment of the application materials. The regulatory authorities will conduct random inspection and inspection of the submitted materials. If the company finds the company's reporting materials, missed reports, and concealment, it will insist on penetrating supervision and full chain accountability. measure.

Daily Economic News

- END -

"Economic account" for reducing grain loss: one more "moisture" or reduction of

Wind Financial Reporter Wang HaoThis year's full -process mechanical harvesting, 2...

CCTV special report Gaozhou: county digital inclusive financial trading lychee industry

On June 20, according to CCTV special reports, in recent years, Gaozhou, Guangdong...