After falling below the 200 trillion yuan mark, the total scale of private equity fell again in May, and 178 private equity fund managers in a single month canceled

Author:Daily Economic News Time:2022.06.22

Following the data of the private equity industry as of April on June 21, the reporter of "Daily Economic News" was informed that this evening of the evening of the China Securities Investment Fund Industry Association (hereinafter referred to as the China Foundation Association) also released the private equity fund manager of May Registration and product filing monthly report.

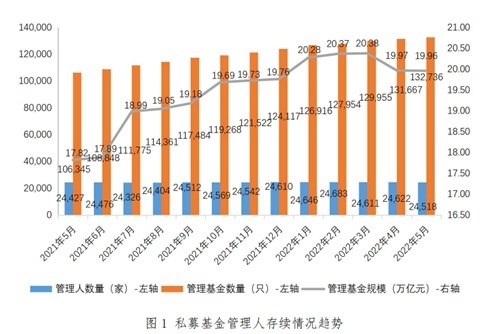

The monthly report shows that following the total scale of private equity funds fell below 20 trillion yuan in April, the number further decreased in May, with a total scale of the duration fund of 1.996 trillion yuan, a decrease of 7.727 billion yuan from the previous month, and 24,500 private equity fund managers Home also decreased by 104 compared with last month. Among them, the size of the Investment Fund of the Survival Securities was 5.79 trillion yuan, and the private equity investment fund was 1.084 trillion yuan, which appeared in a shrinking month -on -month.

Photo source: Photo Network-500622996

After falling below 200 trillion, the total scale of private equity funds continued to decline

In January this year, the total scale of the private equity fund exceeded the 20 trillion yuan mark, and this number has remained up in a rising trend within a few months. By April, a wave of private equity funds declined significantly, falling below 20 trillion yuan to 1.997 trillion yuan, a decrease of 411.675 billion yuan from March and a decrease of 2.02%from the previous month. In May, it continued to decline, further decreased by 7.727 billion yuan from April, and the latest management scale was 1.996 trillion yuan.

On the whole, as of the end of May 2022, there were 24,500 private equity fund managers, a decrease of 104 from the previous month, and a decrease of 0.42%month -on -month; the number of management funds was 132,700, an increase of 1069 from the previous month, an increase of 0.81%month -on -month; The size of the management fund was 1.996 trillion yuan, a decrease of 0.04%from the previous month from the previous month.

Among them, there were 9,132 private equity investment fund managers, a decrease of 20 compared with the previous month, and a decrease of 0.22%from the previous month; 15,000 private equity and entrepreneurial investment fund managers, a decrease of 67 from the previous month, decreased by 0.45%month -on -month. Both data increased in April. In addition, there are nine managers of private equity asset allocation funds, which is the same as last month; 450 other private equity fund managers, a decrease of 17 from the previous month, and a decrease of 3.64%month -on -month.

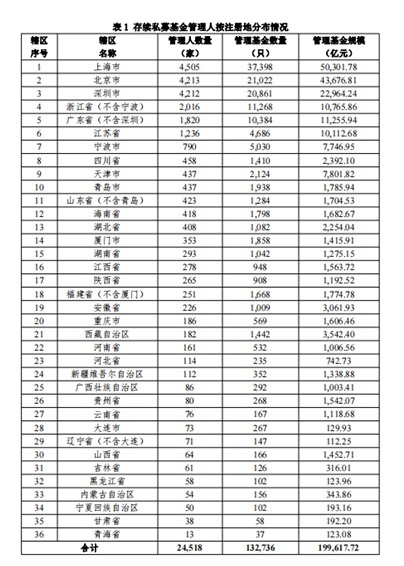

From the perspective of the registration place of private equity fund managers, as of the end of May 2022, the fund managers were concentrated in Shanghai, Shenzhen, Beijing, Zhejiang Province (except Ningbo) and Guangdong Province (except Shenzhen). 68.38%, this concentration decreases compared to April.

Among them, there are 4505 in Shanghai, 4,213 Shenzhen, 4212 Beijing, 2016 in Zhejiang (except Ningbo), and 1,820 in Guangdong (except Shenzhen). 8.22%and 7.42%.

From the perspective of the size of the management fund, the top 5 major jurisdictions are still Shanghai, Beijing, Shenzhen, Guangdong (except Shenzhen) and Zhejiang Province (except Ningbo), with a scale of 25.20%, 21.88%, 11.50%, respectively. , 5.64%and 5.39%, accounting for 69.62%, which is also lower than 69.68%in April.

It is worth noting that the registered place of the private equity fund manager has always been relatively stable, but in May, a relatively obvious change has emerged: Hainan Province surpassed Hubei Province with 418 managers, rising to the 12th of the total ranking. The position is close to 423 in Shandong Province (excluding Qingdao). With this rapid development, the ranking of June may still have variables.

Logged out 178 private equity funds managers in May

Judging from the situation of the private equity funds that survived, the existence scale of private equity funds and private equity funds has declined. Among them, there are 83,000 private equity securities investment funds, with a duration scale of 5.79 trillion yuan, a decrease of 0.04%from the previous month; private equity investment; The fund was 31,600, with a duration of 1.084 trillion yuan, a decrease of 0.13%month -on -month; 16,400 funds for the Entrepreneurship Investment Investment, with a duration of 2.56 trillion yuan, an increase of 0.49%month -on -month.

The number of newly filed private equity funds also continued to decline. In May, the newly recorded funds were only 2040, a decrease of 10.45%from the previous month; the scale of the new filing was 42.938 billion yuan, a decrease of 17.52%from the previous month, showing the significant decline in the market heat. Among them, only the newly recorded private equity investment funds increased compared with April, and the number of new filing of private equity funds and entrepreneurial investment funds decreased by 33.30%and 11.73%respectively.

In fact, this situation is not difficult to understand. Since the since this year, the cold winter of the first -level market has continued, especially the fundraising market is even more cold. New fundraising funds have continuously set a new low in recent years. Dowager. However, with the establishment of a large number of tens of billions of government guidance funds, more "living water" will enter the first -level market, which may improve the current situation.

In addition, with the strengthening of private equity supervision, the number of private equity registered by the China -founded collaboration or active cancellation has also increased. In April of this year, the China -Foundation Association suspended the registration application for private equity fund managers of 14 relevant institutions to cancel 160 private equity fund managers; by May, these two numbers were 10 and 178, respectively.

Daily Economic News

- END -

China's ten years · series of theme press releases 丨 Over the past decade, my country's adherence to stable monetary policy has strongly supported economic development

Xinhua News Agency, Beijing, June 23 (Reporter Wu Yu) Chen Yulu, deputy governor o...

Four Seasons Village · Sanxia | Niuzhuang Town: Serve "Sanxia" to win a bumper harvest

Recently, a large area of wheat is about to start. In the wheat fields of Suid...