10 years of US debt yields exceeded 4%, a new high in 14 years

Author:21st Century Economic report Time:2022.09.28

The 21st Century Business Herald reporter Ye Mai Sui Guangzhou reported that the US debt was crazy! As of 15:00 Beijing time, 10 years of US debt yields hit a maximum of 4.011%today, refreshing the high since October 2008. Under the blessing of US debt soaring, the US dollar index once again refreshed the high point of nearly 20 years, and once touched 114.764 points.

US debt yields soared

The 10 -year US debt yield has long been defined as the "anchor of global asset pricing" in the global market, and its fluctuations have played a role in the global capital market. According to previous experience, the yield of 10 -year Treasury bonds of the US 10 -year Treasury will reach 1.5%, which will be a critical point that is generally considered by the international financial market. Once 1.5%is exceeded, the market will consistent with inflation. The hedge fund will start short -term national bond futures. The 10 -year national debt yield will soar, and a round of global assets will have a round of squeezing bubble.

Obviously, the 10 -year US debt yield has already exceeded this critical point, and inflation has been like a tiger. Chicago Fed Chairman Charles Evans said on Tuesday that he was worried about the Federal Reserve ’s response to inflation over control. He admits that before the implementation of another interest rate hike, the Fed did not have enough time to fully evaluate the impact of previous interest rate hikes. "There is a lagging effect of monetary policy. We have quickly moved and raised 75 basis points for three consecutive interest rate hikes. Some views believe that the interest rate will increase to 4.25%to 4.5%at the end of the year, leaving us to observe the monthly economic data. "He expects that interest rates may reach peaks in March next year. In terms of economic prospects, Evans said that without further external impact, he would still be "cautious and optimistic" to the US economy to avoid decline.

San Louis Fed Chairman James Bullard pointed out that the US inflation situation is severe and the Federal Reserve must not repeat the great inflation in the 1970s. The strong employment market provides policy space for the Fed's confrontation with inflation. He said that interest rates can currently be said to be in a restricted range, and it will continue to raise interest rates in the future, and the peak interest rate may be around 4.5%.

CICC's risk of 5%of terminal interest rates has become an intensified situation of the benchmark situation. If the terminal interest rate falls at 4.5%-5.0%, it is expected that the level of 10-year US bond interest rates will reach 3.5%-3.8%.

However, it is obvious that the judgment is still conservative. The 10 -year US debt yield has exceeded 4%on September 28, with a maximum of 4.011%. It refreshes the high point of nearly 14 years (since October 2008).

The US dollar index refreshes the 20 -year high again

The rapid increase in risk -free interest rates means that risk assets may be transferred to risk -free assets. Recently, US stocks have continued to call back, especially the Nasdaq index that has been greatly affected by funds, which has fallen sharply.

Wall Street Da Bank has pessimistic views on the short -term prospects of the stock market. Goldman Sachs and Bellaide warned that the market did not take a valuation of the global economic recession, and the short -term stock market prospects were empty. Goldman Sachs has reduced the global stock investment rating in the next three months to "reduced holdings", while increasing its cash. Bellaide said that the central bank's tightening policy will bring economic pain. The agency is avoiding stock investment and suggested investors "tactical reduction in developed market stocks."

The US debt yield has also risen to rise in the US dollar index. At present, the US dollar index (as of 15:00 Beijing time) has already touched 114.764 points, and the sword index is 115 points, and the high point over 20 years has been refreshed again.

As the US dollar index rises and the trend of many currencies has collapsed, the euro has continued to fall below the lowest price to the lowest of 20 years.

Han Han also had a significant depreciation this year. At present, the US dollar is 1: 1444.84 to 13 years. Qiu Qinghao, Deputy Prime Minister and Minister of Planning Treasury, recently held the "Emergency Macroeconomic and Financial Conference" at the Seoul Bank Guild Hall on the U.S. dollar exchange rate trend on the exchange rate of the Han Dynasty to strictly control the specific factors that affect the price variables behind the exchange rate, and according to the exchange market, and according to the exchange market Corresponding plans are taken in stages in stages to solve problems such as overseas investment direction of domestic residents and uneven foreign exchange supply and demand of import and export companies.

However, the above two currencies are not the most miserable currencies this year. On the 22nd of this month, the US dollar went up to 1: 145.895, a new exchange rate in 24 years after August 1998. The dollar has risen more than 25%against the yen since this year.

The pound was almost unable to hold it. On the 28th, the exchange rate against the US dollar fell to around 1 to 1.06, and it was close to the US dollar.

- END -

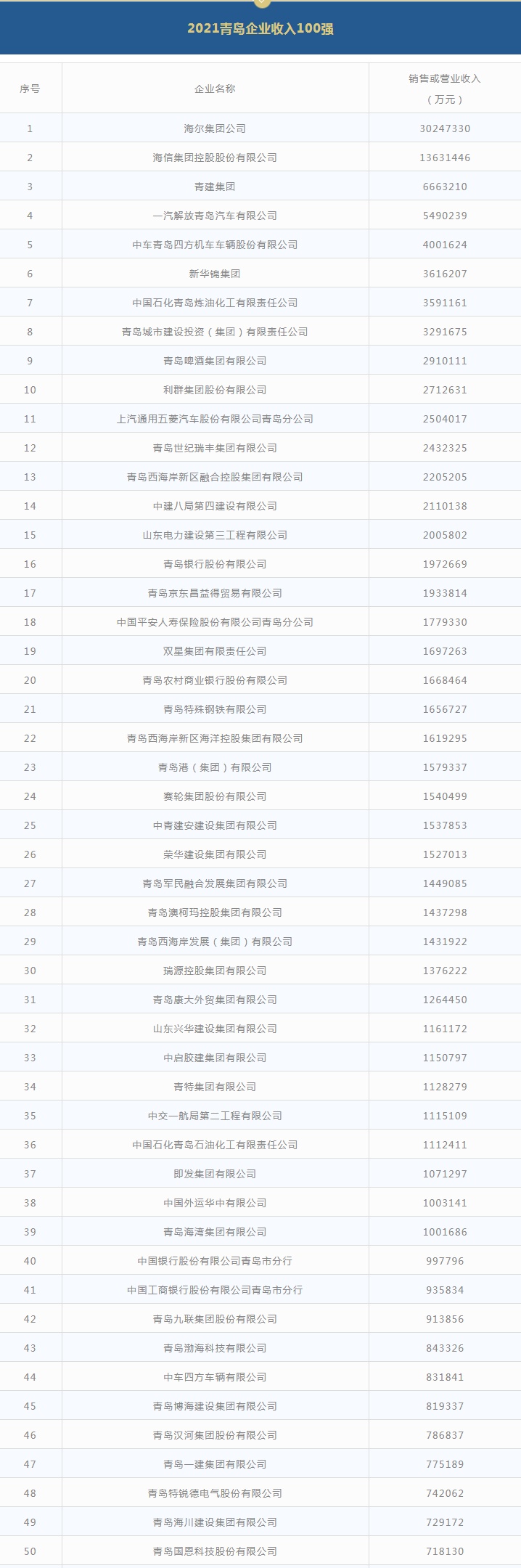

2021 Qingdao Enterprise 100 released, of which 30 are the most profitable!

A few days ago, the 2021 Qingdao Enterprise 100 List was officially released. The ...

The city successfully signed 6 projects at the 19th China -ASEAN Expo signed ceremony

On the afternoon of September 16, at the signing ceremony of the 19th China -ASEAN Expo held in Nanning, the city successfully signed 6 projects with a total investment of 30.2 billion yuan, involving