The main force Haval's sales decline!Where is the growth point of Great Wall Motor's new energy transformation?

Author:Investment Times Time:2022.09.28

Entering August, although the sales growth rate of Haval H6 was a positive year -on -year, it ranked fourth; since mid -August, Haval Chi Rabbit has been complained by the owner.

"Investment Times" Researcher Prince Xixi

There are more than one car company affected by the supply chain in August.

A few days ago, Great Wall Motor Co., Ltd. (hereinafter referred to as Great Wall Motors, 601633.SH) disclosed the production and sales data in August, and its monthly sales of Harvard, Great Wall pickup, and tank brands fell month -on -month. Generally speaking, the company achieved a total sales of 88,200 units in August, an increase of 18.81%year -on -year; from January to August, the cumulative sales volume was 708,700 units, a year -on -year decrease of 9.61%. The cumulative sales of new energy vehicles are positive year -on -year, but the monthly sales volume decreases compared with the same period of the previous year.

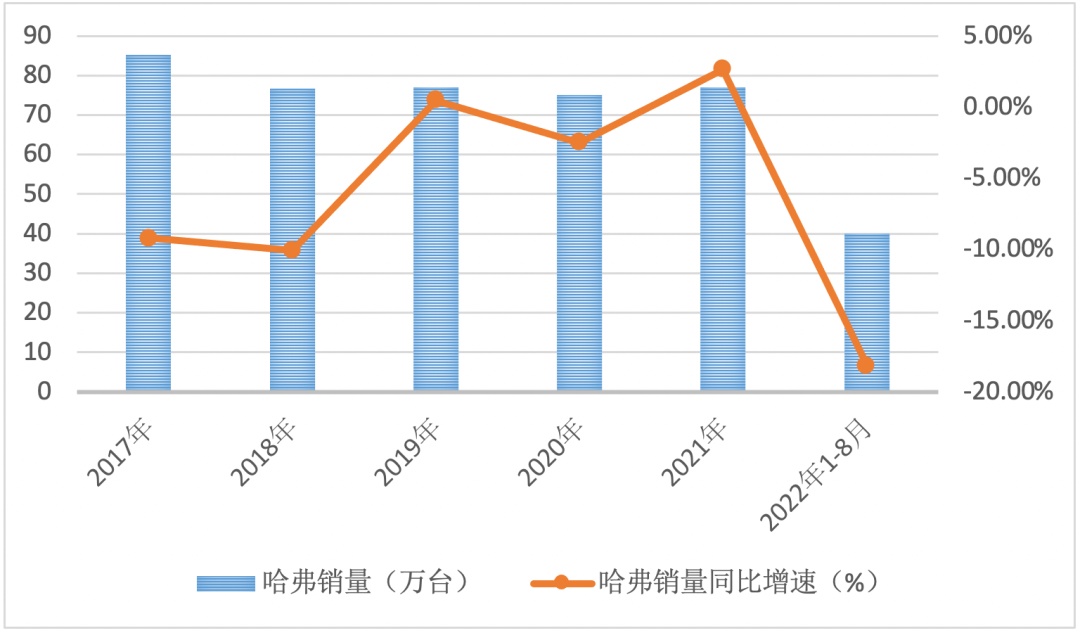

It is worth noting that the cumulative sales of the first eight months of the company's five major vehicle brands were positive year -on -year except Euler and tanks, and the sales of the remaining brands were negative year -on -year. In terms of extended time, the company's main sales of Haval have basically maintained the sales of 750,000 to 770,000 vehicles in recent years, which is significantly declined compared with the peak period. The cumulative sales of cumulative sales in January to August this year are still negative, and it is difficult to touch 700,000 units throughout the year.

Some analysts believe that Haval's continuous sluggish sales are related to the aging of the main model H6 and the rise of the SUV at the same price. Combing the information, the Researcher of the Investment Times noticed that in the first half of this year, in the single -month SUV retail sales list statistics from the Federation of Federation, the sales of Haval H6 were negatively double -digit year -on -year, and the rankings were almost squeezed out. " Previous". Entering August, although the sales growth rate of Haval H6 was positive year -on -year, it ranked fourth; since mid -August, Haval Chi Rabbit has been complained by the owner. It is unknown whether it will affect the sales of brand models in the short term.

In addition, the sales of the Wey brand (Wei brand), which were highly hoped by the company a few years ago, did not improve. Not only did the sales decline year by year, the cumulative sales volume from January to August this year was only 28,100 units, and the year -on -year decrease was over 10 %. However, a number of new models at the Chengdu Auto Show recently appeared. In mid -August, the company released the Haval's new energy strategy. Many brokerage firms are optimistic. The new models of hybrid models are intensive, the performance improvement brought about by continuous optimization of product structure, and the company's new energy transformation.

In response to whether Haval's cumulative decline in sales means that the performance is weak, and the increase in the proportion of high -value model sales has increased on gross profit, the email communication outline of the "Investment Times" researcher to the relevant departments of the company has not received the reply as of the press time.

Haval's accumulated sales decline

Great Wall Motors owns the five major vehicle brands of Haval, Wei, Euler, tanks and Great Wall pickups. Haval is the sales of Great Wall Motors. Judging from previous data, the brand has set multiple sales myths. In 2016, the total sales of Haval's series of products were 938,000 units, of which Haval H6, the main model, contributed more than 580,000 vehicles. Since then, the brand has not surpassed this record.

In 2017, the brand had a total sales of 851,900 vehicles and about 510,000 Haval H6. From 2018 to 2021, Haval's annual sales were basically between 750,000 and 770,000, of which, the sales of H6 in 2018 and 2019 fell to 450,000 units and nearly 390,000 units. The proportion of Haval's brand sales has been reduced from nearly 90 % in 2016 to about 60 % year by year.

According to the production and sales express, in August 2022, the company's Haval's sales volume was 50,400 units, a year -on -year increase of more than 20%, but sales from January to August decreased by 18.13%to 40,600 units, and the proportion of sales fell to 56.53%. Judging from the current sales momentum, the Haval brand sales may be difficult to touch 700,000 units this year.

Some analysts believe that the decline in Haval's sales is related to the aging of the main model H6 and the continuous rise of SUVs at the same price. Check out the previous information of the Federation of Federation. Researcher "Investment Times" noticed that in the SUV retail sales list from January to December 2021, Haval H6 ranked first with 352,900 units, but fell 3.2 percentage points from the previous year. The third and fifth Honda CR-V, and BYD Song were about 130,000 and 150,000.

In the first half of 2022, the monthly sales of H6's single -month sales were negative double -digit, and the sales ranking was almost all squeezed out. In August, although the growth rate of H6 sales was 19,000, the list was fourth; from January to August, the total model of the main model was 166,800 units, ranking third in the list, ranking first than the first ranking, ranking first than the first ranking. The BYD Song was behind 760,000 units; and compared with the fourth Honda CR-V, the sales volume was less than 8,000. It can be seen that the sales of other models to catch up with the momentum.

However, in August, the new energy strategy of the Haval brand was released, and the third -generation Haval H6 hybrid version appeared. Anxin Securities believes that H6 DHT is priced at 149,800 yuan, which is only 20,000 yuan more expensive than the same configuration oil and vehicles. Relatively speaking, 30 % of the fuel -saving, driving experience similar to pure electricity, with a significant cost -effective advantage; H6 PHEV (110km version) pre -sale of 176,800 Yuan, the same price as the same configuration Song Plus DM-I, is expected to sell well.

A few days ago, the Harvard H-DOG new energy models displayed at the Chengdu Auto Show will also be listed on the market during the year. However, as new models such as H6, H-Dog are delivered, it remains to be observed whether it can be seen whether it can sell the Harvard brand. In addition, since mid -August, the company's Haval Chi Rabbit and other models have been "explosive paint" by car owners. Whether it affects sales in the fourth quarter also needs to pay attention. According to car quality network data, from August 11th to September 11th, Haval Chi Rabbit has accumulated more than 500 complaints. "Rabbit" "2022 Jinxiang Edition 1.5T Copper Rabbit", and the painting surface and cracking are the most complaints in the disaster area. In September, Haval's first love and Haval Dog were also complained by the owner, and the former also complained more than 300.

Haval brand sales and year -on -year growth rate from January to August 2022 (10,000,%)

Data source: company production and sales fast report

WEY brand performance is dim

There is also Wei brand who has declined. The brand was founded in 2016. In 2017, VV7 and VV5 were launched, and the total sales of the year exceeded 80,000. At that time, Great Wall Motors intends to build it into the first brand of China ’s luxury SUV and is committed to the operation of Haval and WEY.

In the past few years, the company has successively launched the brand's first plug -in hybrid model P8, traditional model VV6, VV7 GT, VV7 PHEV, etc. to broaden the product line, and also improve the product layout in the new energy field. In 2021, Great Wall Motors launched the We brand latte DHT and Wei brand Mocha. The former was equipped with 1.5T intelligent DHT technology, and the latter was the first landing product of the "Coffee Smart" platform. Since then, Wei brand positioning has transformed towards high -end new energy.

However, from the perspective of production and marketing data, since the sales of Wepai reached 139,500 vehicles in 2018, it has declined year by year, from 100,000 vehicles in 2019 to 78,500 vehicles and 58,400 units in 2020 and 2021. The year -on -year decrease is more than 20%. In August 2022, the Wey brand sold 3091 units, a year -on -year decrease of 31.40%; from January to August, it was 28,100 units, a decrease of more than 10%, and the sales were dim.

The sales of Great Wall pickups are not ideal. The sales of more than 120,000 units in the first eight months, a year -on -year decrease of 13.92%, which was second only to Haval. However, Euler and tanks increased. From January to August this year to August this year, 77,100 and 76,600 were sold, a year -on -year increase of 7.16%and 71.88%. However, the volume of the two brands is not large, and the total sales volume accounts for only more than 20 %. The Euler Lightning Cats, Ballet Cats and Tank 300HEV and 500PHEV plug -in hybrid version of the Euras Lightning Cats, Ballet Cats and Tanks at the Chengdu Auto Show are how? Also to be observed.

In terms of performance, in the first half of 2022, the company realized revenue of 62.134 billion yuan, a slight increase of 0.33%year -on -year; the net profit attributable to mothers was 5.601 billion yuan, an increase of 58.72%year -on -year. The increase in net profit is mainly the company's optimized product structure. The rise in the price of bicycle has brought gross profit growth, and at the same time, the increase in exchange rate income increase. In the first half of 2022, the company's exchange income was more than 2.6 billion yuan.

From the perspective of profitable indicators, the gross profit margin of Great Wall Motors in the first half of the year was 18.38%and a net interest rate of 9.0%, an increase of 2.13 and 3.3 percentage points from the same period last year. Due to the improvement of the product structure, the proportion of sales of high -priced models increased, and the level of revenue of bicycles has also increased. According to the previous Cinda Securities, in the first half of 2021, the second half of the year, and the first half of 2022, the company's bicycle revenue level About 10 million yuan, 112,000 yuan, and 12 million yuan, climbing slowly. However, if unless of recurring profit or loss, the net profit of the bicycle in the first half of 2022 was 3971 yuan, a decrease of more than 10 % year -on -year.

According to the research report of Huaxi Securities and Soochow Securities, from January to August this year, the sales of more than 200,000 yuan of Great Wall Motors accounted for 14.4%, and the sales proportion of intelligent models increased to 85.6%. Essence However, some people in the industry believe that the company's high -end is not as good as expected, and the new models need to be checked after the new models are listed. At present, the new energy track is fiercely competitive, and the company may urgently need a new growth point to improve its performance.

- END -

Xinmi Caiyuan Investment Group intends to issue 2 billion yuan private equity bonds has been feedback from the Shanghai Stock Exchange

[Dahecai Cube News] On June 20, according to the information platform of the Shang...

Important notice!Hurry up next Monday

Towards the stop!Hubei Social Insurance Service CenterI will issue a notice todayP...