Stone Technology transformed into a "withdrawal machine"?Important shareholders and directors of directors have reducing holdings of over 8 billion yuan

Author:Zhongxin Jingwei Time:2022.09.28

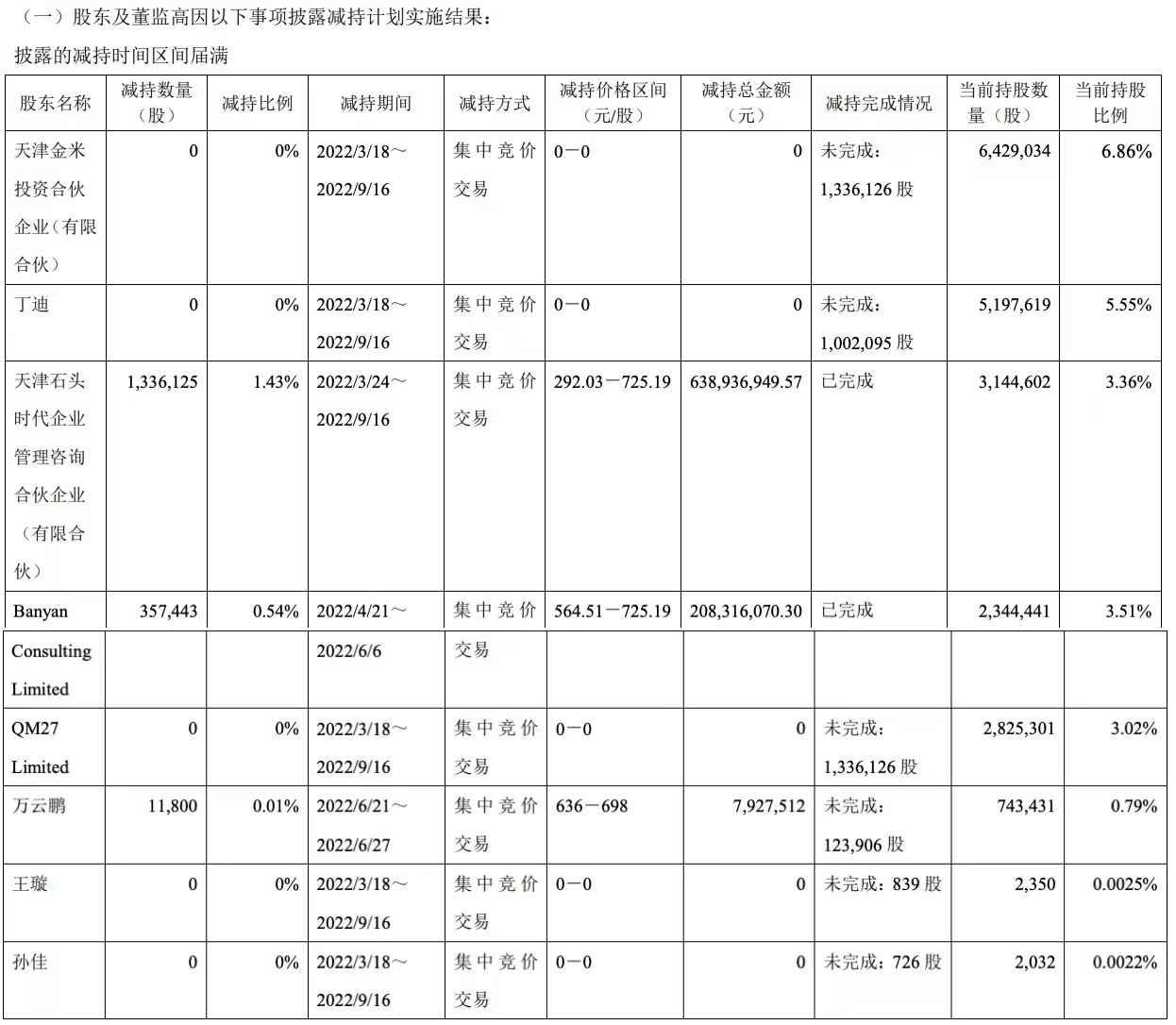

Zhongxin Jingwei, September 28 (Deng Yiruo) Recently, Stone Technology disclosed the "Announcement of Shareholders and Directors and Directors and Supervisors". With 118,000 shares, a total of 855 million yuan. This is the second time the three shareholders have reduced their holdings. According to the statistics of the Sino -Singapore Jingwei, since February 2021, 5 shareholders and 4 directors have implemented several rounds of shareholding plans, with a total cash of over 8 billion yuan.

As soon as the stock lifts the ban, it has been sold for a total of over 8 billion cash -out

The announcement shows that among the 8 shareholders and directors of the shares of the shares, the Tianjin Stone Times Enterprise Management Consultation Partnership (hereinafter referred to as the "Stone Age"), the Banyan Consulting Limited (hereinafter referred to as "Gao Rong") and Wan Yunpeng The amount of three shareholders' holdings was reduced by 639 million yuan, 208 million yuan, and 79.275 million yuan, respectively. After the completion of the holdings, the shareholders of the three shareholders held 3.36%, 3.51%, and 0.79%, respectively.

Except for the above three shareholders, the remaining five shareholders did not implement their holdings. The announcement shows that Tianjin Jinmi Investment Partnership (hereinafter referred to as "Tianjin Jinmi"), Ding Di, QM27 Limited (hereinafter referred to as "Qiming") are based on the comprehensive consideration of the company's value and the current market environment. Implementing reduction; Wang Xuan, chief financial officer of the company, and Sun Jia, director and secretary of the board of directors, based on comprehensive consideration of the company's value and the current market environment, and combined with their own funding needs, they did not implement their holdings.

Picture source: Stone Technology Announcement

This round of holdings is no longer the first reduction in the stone age, Gao Rong and Wan Yunpeng.

Stone Technology's IPO restriction shares lifted the ban on February 22, 2021. The second day of lifting the ban, Stone Technology issued an announcement announcement. The announcement on the 23rd shows that 10 shareholders such as the stone age, Gao Rong, and Wan Yunpeng intends to reduce the holdings of the stone technology held by centralized bidding or transactions. No more than 11.10%, these shares are obtained in front of Stone Technology IPOs.

According to the announcement, from March 1st to June 11th, 2021, the stone age reduced its holdings of 1.488 million shares, which was 1.621 billion yuan. The reduction of 1.3361 million shares and cash out 639 million yuan. Through these two rounds of reduction, more than 2.2 billion yuan in the stone era.

From March 17 to June 15, 2021, Gao Rong reduced 666,700 shares of stone technology through centralized bidding, cash out 828 million yuan, plus 357,400 shares of this round, and Gao Rong's two rounds were reduced in two rounds. With 1.0241 million shares, a total of about 1.036 billion yuan.

Wan Yunpeng reduced its holdings of 179,900 shares from March 19th to May 28th, 2021, cash out 184 million yuan, plus 11,800 shares that reduced their holdings in this round.

In addition to the above three shareholders, since February 2021, a total of 5 shareholders including Tianjin Jinmi, Shunwei, and Qiming have implemented several rounds of shareholding share plans, with a total reduction of 6.7115 million shares, cash out about 7 billion yuan Yuan; In addition, Mao Guohua, Zhang Zhichun, Wu Zhen, and other four stone technology directors and supervisors have reduced their holdings of 1.1665 million shares, cash out about 1.212 billion yuan.

It is worth noting that Tianyancha shows that the actual controller of Tianjin Jinmi is Lei Jun. According to the announcement, from March 16th to June 10th, 2021, Tianjin Jinmi reduced its holdings of 1.333 million shares through centralized bidding and large transactions. Cash out 1.65 billion yuan. However, Tianjin Jinmi did not participate in this round of reduction.

Zhongxin Jingwei inquired on the official website of the Shanghai Stock Exchange that Stone Technology had 26 shareholders and directors and supervisors from the shareholders and directors of directors from February 22 to September 26, 2022.

Picture source: official website of the Shanghai Stock Exchange

The chairman is busy building a car once said not to pay attention to the company's short -term stock price

According to the financial report, the revenue from Shito Technology from 2017 to 2021 was 1.19 billion yuan, 3.051 billion yuan, 4.205 billion yuan, 4.53 billion yuan, and 5.837 billion yuan; net profit was 66.996 million yuan, 308 million yuan, and 783 million yuan. , 1.369 billion yuan and 1.402 billion yuan. From the data point of view, the revenue and net profit from Stone Technology from 2017 to 2021 have gradually increased.

The announcement shows that in the first half of 2022, Stone Technology achieved revenue of 2.923 billion yuan, an increase of 24.49%year -on -year, and a net profit of 617 million yuan, a decrease of 5.4%year -on -year. This is the first half -year net profit growth of Shito Technology since 2017.

On February 21, 2020, Stone Technology was listed on the Science and Technology Board for 271.12 yuan/share issuance. After listing, Stone Technology's stock price went up along the way. On June 21, 2021, the stock price of Stone Technology rose to its highest point since its listing. It touched 1061.58 yuan/share that day, and the cumulative increase of more than 200%. Mao ".

Picture source: wind

After touching, the stock price of Stone Technology shook down all the way. On June 21, 2022, Stone Technology had fallen to 477.43 yuan/share. In one year, the stock price fell from the highest point to 52.75%, falling at the altar of "Thousand yuan shares". As of the closing of September 27, the Stone Technology News reported at 276.88 yuan/share, and it had fallen 73.92%of its highest point of 1061.58 yuan/share.

The stock price fell, and the net profit was now negatively growing. Chang Jing, chairman of Stone Technology, was busy making a car.

Tianyancha shows that in January 2021, Shanghai Luoyu Intelligent Technology Co., Ltd. was established (hereinafter referred to as "Luo Yan Smart"), with a registered capital of 1 billion yuan. Essence The legal representative of Luo Yan is Chang Jing, and Chang Jing is also the company's chairman and the ultimate beneficiary.

On May 25, 2022, Stone Technology issued an announcement that it intends to sign a trademark and domain name transfer agreement with Luo Yan. Stone Technology and its wholly -owned subsidiaries, Shitou Hong Kong and All -funded Sun Company, Shitou Dutch intends to intelligently transfer some trademarks and domain names to Luo Yan. The evaluation value of the related exchanges is 298,800 yuan, and the transaction price is 298,800 yuan. Stone Technology also states that Changjing is the actual controller of Luo Yan.

Tianyancha shows that from April 9, 2021 to April 29, 2022, Luo Yan Intelligent completed a total of four rounds of financing. Fund Coatue, Qiming Venture Capital, Tencent Investment, Gao Rong Capital and many other investment institutions or companies.

Luo Yan's smart official website shows that the number of employees is currently exceeding 400, and it is expected to grow to 1,800 in 2022. It will reach 3,000 in 2023. The supply chain partners include Ningde era, German mainland tires, Bosch and other companies.

When Chang Jing had issued an internal letter during the listing of Stone Technology that due to the pressure of the stock price, many companies in history will make some short -term benefits, and the long -term benefits of damage to the company must be learned. "The stock price will definitely fluctuate, which will disturb our minds. Therefore, after listing, we must follow the principles of user first, employees second, and third shareholder. We should not pay attention to the short -term stock price and only pay attention to the company's long -term development." Multi -reporting clues, please contact the author of this article Deng Yiruo: dengzhiruo@chinanews.com.cn) (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no company or individual may reprint, extract or use it in other ways.

Editor in charge: Li Zhongyuan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Shandong listed company's hot list in one week | encounter price war!The performance dropped sharply by 93.16%, the "glove Mao" scenery is no longer

Fengkou Finance reporter Wang XueShandong listed companies have a fresh list in a ...

Shangfu Lin: Financial institutions may become an attractor of ESG governance to the society to give back to the society

The 21st Century Business Herald reporter Li Dushangyu intern Liu Yuqing reported on September 3, at the 2022 China International Service Trade Fair ESG and Sustainable Investment International Forum