Stunning investment bank circle!The 100 billion commercial giant consultant fee is only 5 cents?The company responds quickly ...

Author:China Fund News Time:2022.06.22

China Fund reporter Mo Lin

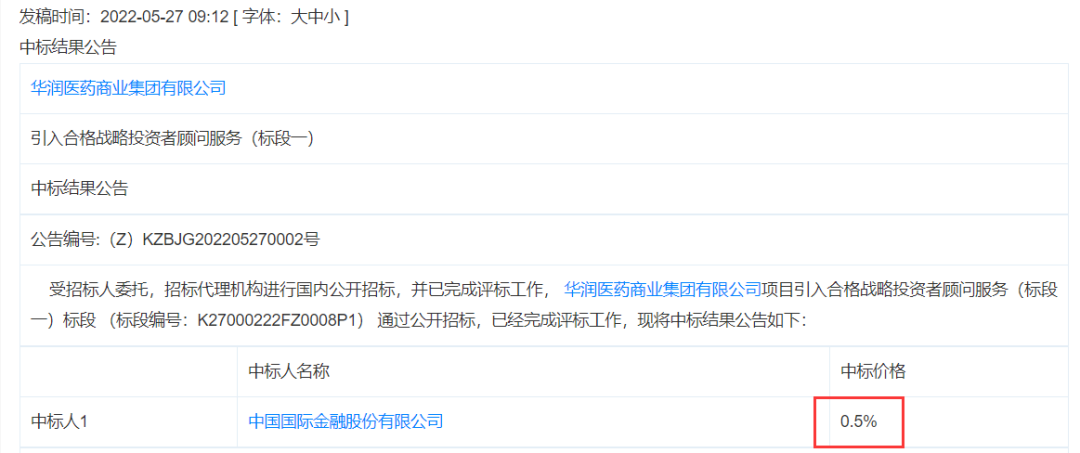

The investment bank's price war is resurrection? Yesterday evening, a consultant project of a bid for China Resources and China Resources Business Group, the final winning price of the bid, was only 5 cents, which caused heated discussion among the industry.

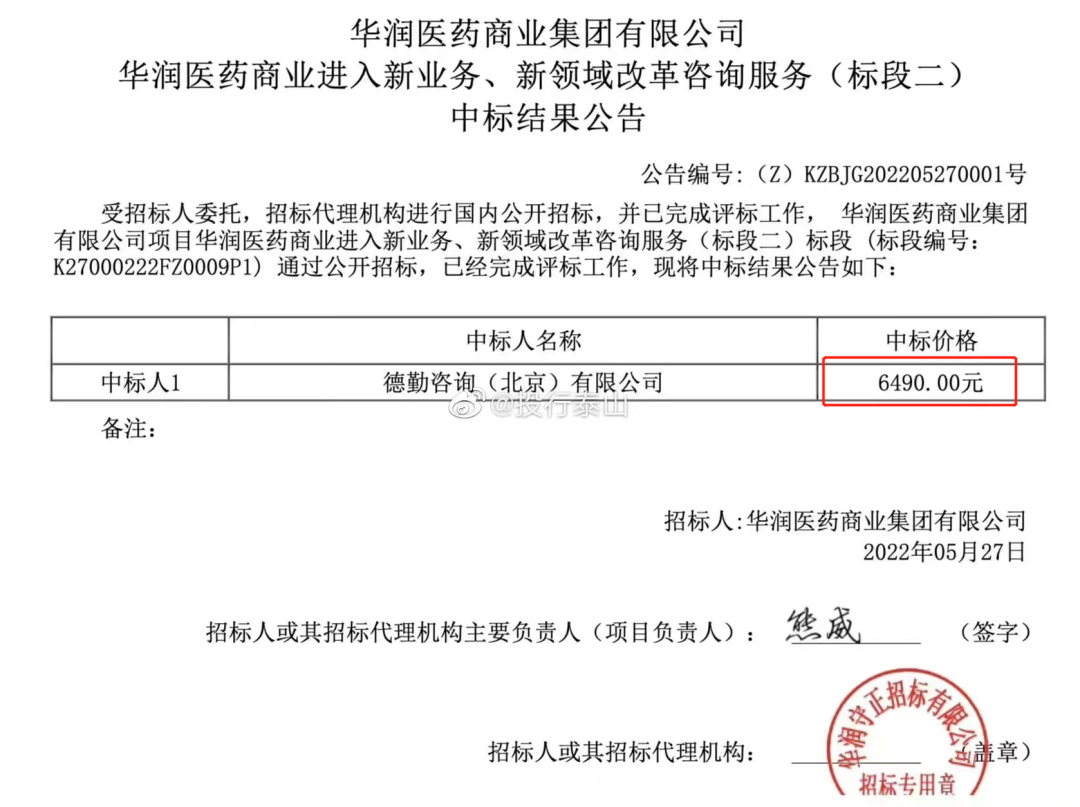

Instead of aroused heated discussion, another participant in the project Deloitte Consulting, Deloitte, who has always been known for millions of consulting fees, the price of this bid is only 6490 yuan.

Many netizens exclaimed that the investment bank and consulting industry had been rolled like this?

CICC response: website error

CICC responded to the reporter that "the price of the winning bid is 0.50 yuan" was caused by the wrong website, and it has now been showed normal.

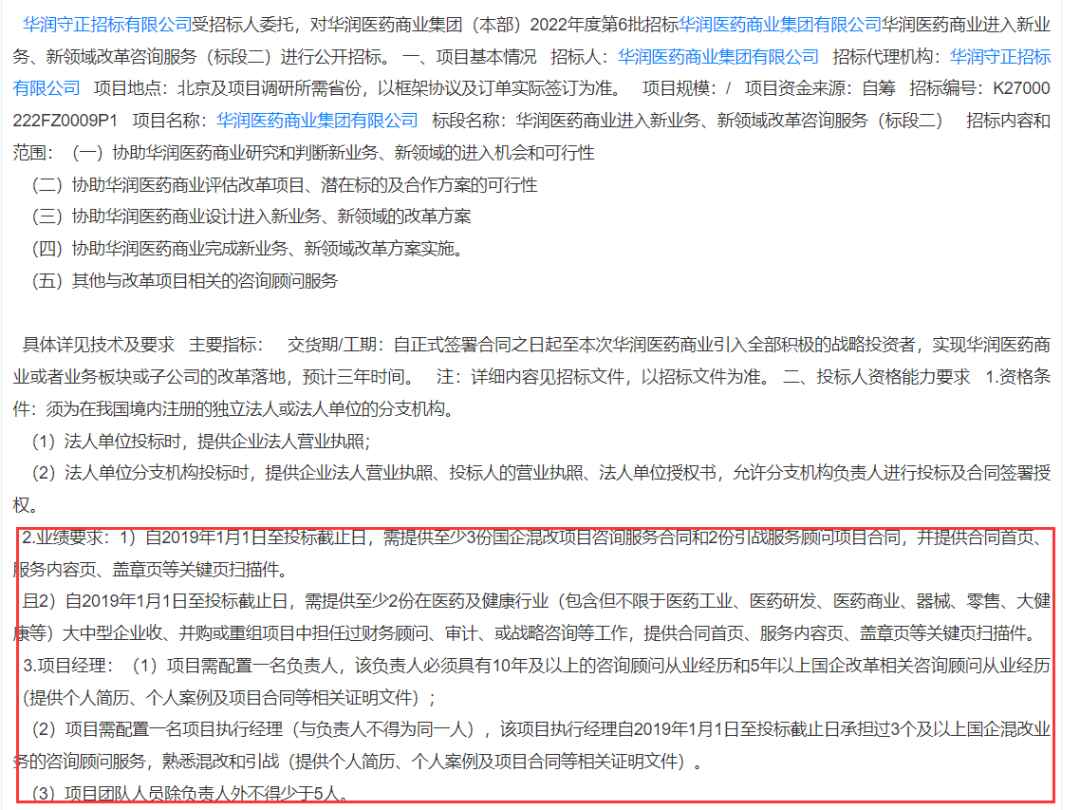

From the content of the bidding, as a bidder, China Resources Pharmaceutical Commercial Group Co., Ltd. will introduce a qualified strategic investor consultant service (bid section 1). There are as many as 11 items, including designing warfare plans, due diligence, design potential investors to select models and white lists.

In addition, it also requires that from January 1, 2019 to the deadline for bidding, the attraction consultant must provide at least 3 state -owned enterprise mixed reform project consulting services contracts and 2 lead service consultants; People, the person in charge must have a 10 -year or more consultant experience experience and the experience experience of consultant -consultants related to state -owned enterprise reform for more than 5 years.

From this reasoning, such heavy and professional consultants, the quotation of 0.5 yuan is absurd.

However, as of now, Deloitte has not publicly responded to the low price of this low price. After the reporter's verification, as of press time, Deloitte's winning price was still 6490 yuan.

According to the requirements of the bidding, the work content and work performance of the strategic investment consultant of CICC will also require team personnel to not be less than 5 except the person in charge.

Some netizens joked that there were more than 6,500 interns who asked for 5 interns.

Low price underwriting provokes anger

China Securities Association

The "0.5 yuan project consultation fee" is hotly discussed because it is because this is the "investment bank price war" from China Securities.

On January 19, 2021, the main body of the comprehensive energy business under the Southern Power Grid Southern Network Energy was listed on the small and medium -sized board. The total fundraising amount was 1.061 billion yuan, and the four trading days of the listing rose 91.43%. It was originally a good thing that was happy, but the sponsorship of the project, Zhongxin Building Securities, was in a vortex of public opinion because of 0.77%of the low -cost sponsorship costs of 0.77%. Some investment banks pointed out that the securities firms "do not talk about martial arts"!

The "price war" has always been a big pain point for the investment bank's exhibition industry. Supervision has also reversed the industry's atmosphere by issuing internal control guidelines, issuing administrative supervision measures, and starting self -discipline investigations.

In April 2019, due to the existence of participation in the bidding of corporate bond projects below the cost price, Guangfa Securities was punished by the regulatory authorities and became a "price war".

In July 2020, in the bond underwriting project of the China Nuclear Financial Leasing Company, Guotai Junan and CITIC Securities entered the winning candidate list with the first and second places. The underwriting rate was 0.015%and an annualization of 0.01%, respectively. In May 2020, CITIC Securities and Industrial Bank bidd for the issuance of the first phase of the mid -term bill of Hainan Development Holdings Co., Ltd. with a underwriting rate of 0.003%. To this end, the CSI association launched a self -discipline survey on related matters.

In April 2021, the China Securities Industry Association issued the "Guidelines for the Internal Constitutional Internal Constitutional Internal Constitution of Corporate Bond underwriting", which clarified that underwriting agencies should establish an internal constraint system for corporate bond underwriting quotations. If the offer is below the internal constraint line, the underwriting agency shall perform the internal special approval procedures, and then submit the special explanation to the China Securities Association within three working days. The China Securities Industry Association will conduct on -site inspections in projects that are lower than the internal constraint lines to screen the corresponding underwriting agencies.

Two months later, the China Securities Industry Association once again attacked. On June 23, the China Securities Industry Association solicited opinions from the securities firm on the revised version of the "Evaluation Measures for the Evaluation of the Securities Company's Company's Bonds Business Practice Capability Evaluation".

From the perspective of the China Securities Industry Association, low -priced competition has a negative impact on the market ecology and industry image, and the long -term sustainable development of the company's bond market depends on the maintenance of benign competitive order.

According to the revised version of the "Evaluation Measures", the China Securities Industry Association clearly defines the definition of the "market order maintenance indicator", which mainly reflects the maintenance of market competition order in the company's bond business, including the internal constraint index of the company's bond underwriting quotation and the index Standardize competition indicators.

The revision guides the company to maintain the competitive order of the corporate bond market from both positive and negative aspects. On the one hand, the internal restriction line of corporate bond underwriting quotation is appropriately added to securities companies with average industry average to motivate corporate bond underwriting quotes.

On the other hand, the relevant behavior involving low -cost competition deducts accordingly, and exhibits the order industry in an orderly manner in the warning industry. The association also revised the deletion of the company's bond underwriting index, reducing the score of the number of the number of the company's main underwriting project.

After the "Evaluation Measures" was introduced, the industry rarely heard rumors of low -cost competition.

Sudden! Just now, many cadres were dealt with!

- END -

Logistics guarantee and keeping smooth | Freight logistics continues to recover better

Recently, with the active efforts of various regions and departments, the national...

my country's third aircraft carrier "Fujian Ship" is launched, and the relevant A -share carrier concept stocks have rushed in the afternoon

17.06.2022Number of this text: 1522, reading time for about 3 minutesGuide: On Jun...