The home appliance retail giant is in arrears of salary storm cash flow, where should Gome go?

Author:Peninsula Metropolis Daily Time:2022.09.28

Volkswagen · Poster Journalist Zhu Xiaochong reports

Recently, the news of Gome's arrears of Gome on home appliance retail giants appeared on the hot search on social platforms, which has aroused widespread concern for public opinion. It is understood that many Gome employees said that Gome has not paid a August salary to employees on time, and the specific distribution time and proportion were unclear, and the semi -annual performance of employees had not been distributed before.

Gome responds to the arrears of salary to board the hot search

In response to issues such as arrears and cash flow crisis, Gome responded on September 26 that due to a series of factors internal and external factors, Gome has indeed encountered unprecedented huge difficulties and severe challenges. Obviously, although Gome has also made the greatest extent through continuous focus on the main business and promoting strategic transformation, the operating costs of high -enterprise are still the most heavy burden at present. In order to ensure the company's normal operation, the company has made some temporary and emergency adjustments on salary distribution this month. At the same time, the company does not rule out that it will continue to implement a job reduction plan to further reduce operating costs.

Gome said that the company apologized for the helpless movement at the moment. At present, the company's operations are normal. The company promises that temporary adjustments this month are only short -term and phased emergency measures. Once the company's operation improves, the company will make up for the salary as soon as possible, and at the same time fulfill the resignation of resignation. Employees are compensated accordingly. In the future, the company will also introduce more positive short -term and medium and long -term incentive policies to support employees and enterprises jointly entrepreneurship and develop together.

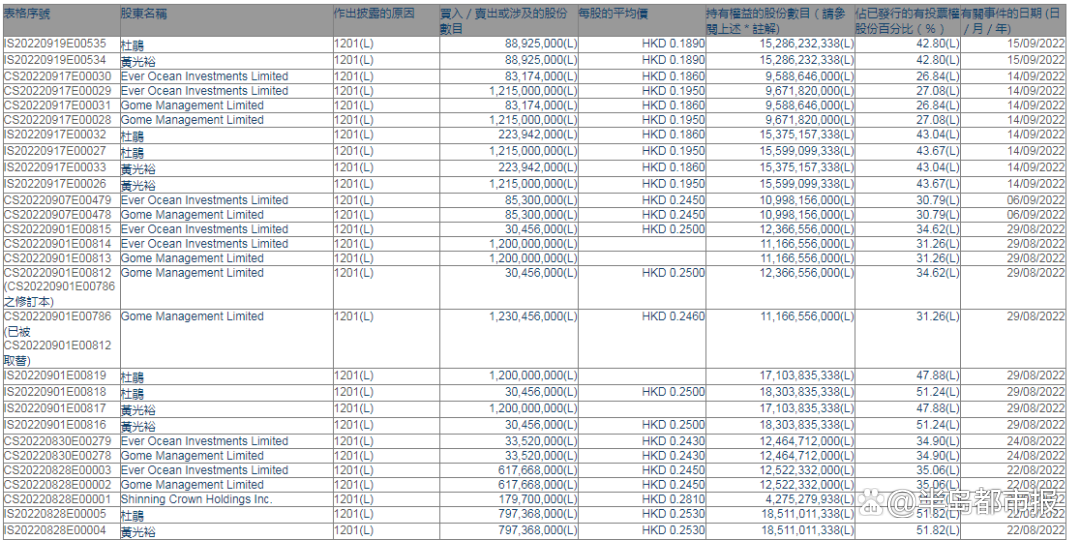

It is worth noting that since this year, many platforms under Gome Retail have been revealed to have shrinking business, layoffs, towing wages, etc. According to the major shareholders' equity form disclosed by the Hong Kong Stock Exchange on September 19, Gome retail shareholders Huang Guangyu, Dujuan, Henghai Investment Co., Ltd. and Gome Management Co., Ltd. reduced their holdings of 2.737 billion shares on September 14, totaling about 531 million Hong Kong dollars Essence

Screenshot of the changes in the equity of the Gome Retail Hong Kong Stock Exchange

Huang Guangyu's reduction of Gome retail has triggered a chain reaction of the stock price. On the same day, Gome's retail stock price plummeted, and the market once fell more than 24%. As of the closing, Gome Retail reported at HK $ 0.175/share, with a total market value of 6.25 billion Hong Kong dollars. Just a few days before Huang Guangyu's reduction of Gome, Gome Retail just released the first half of the financial report on the evening of August 31, but his financial report was not optimistic.

According to Gome retail financial reports, in the first half of 2022, Gome's total revenue was 12.109 billion yuan, a decline of 53.5%compared with the total revenue of 19.075 billion yuan in the same period last year, and the net profit of the mother was about 2.966 billion yuan. Losses were 1.974 billion yuan, and the loss increased by 50.3%. In the announcement, Gome explained in the announcement that "in the first half of the year, the national epidemic situation was repeated, and offline business has been significantly affected. Since the epidemic, online business has also been affected by logistics."

Gome 2022 mid -term financial report

Not only is the financial reports not optimistic, but the Gome business line and personnel have also begun to have problems. Gome has been suspended on the entire business of Dangju, the founders and CEOs in July; Really happy executive vice president was removed from office.

In fact, with the advent of the e -commerce era, the home appliance consumption at home has changed hugely, and JD.com has risen rapidly and firmly occupies the first throne in the home appliance market. Gome has begun to retreat in JD.com, Suning and Tmall. According to the "2021 China Home Appliance Market Report" data, the entire home appliance market ranks first with a market share of 32.5%, Suning occupies a second position with 16.3%, and the third is Tmall's 14.8%. This is the market. The top three companies with a share of more than 10%.

Although Gome is ranked fourth, 5%of the market share is less than 1/6 of JD.com, and even only 1/3 of Tmall ranked third in the third place. Gome has declined through the original industry overlord. As Pinduoduo, Douyin, and Kuaishou have continued to work in the home appliance market, Gome's market share is likely to continue to fall.

It is understood that Gome's continuous losses from 2017 to the first half of this year have reached 22.289 billion yuan. Among them, Huang Guangyu's one -year loss was also as high as 7.368 billion yuan. The huge losses have also caused extremely tight cash flow in Gome. The financial report shows that the cash and cash equivalents of Gome Retail in the first half of this year were 15.713 billion yuan, but the short -term debt was as high as 27.987 billion yuan. The other short -term liabilities were 7.644 billion yuan. These two items. Total 35.631 billion yuan.

Gome released an open letter

On August 19, Gome issued an open letter in its official WeChat public account. The founder of Gome Huang Guangyu summarized and reflected on the results and shortcomings since returning to Gome, and said that he proposed that the plan to "restore Gome's original market status in 18 months" is too optimistic. After reviewing the insufficient expectations of the difficulties, I hope that the market can give him another three years to achieve the strategic development goal of "1+1+1", that is, the higher profit in 2023 and reach the previous high level. In 2024, it has reached history The best level, the best level in history in 2025. The three -year plan looks great, but in combination with Gome's continuous decline in recent years and the situation of continuous losses, there are still many unknown uncertainty that can still be realized.

- END -

7 times of impact IPO failed, and had valued tens of billions. Can Luo Zhenyu still be a "friend"?

The business that pays for knowledge has been blocked outside the door of the IPO....

The same is a Chinese fast -food company, why is a takeaway commission 4%and a 25%?

Author / Jin DeluThe pictures of this article are from the InternetThis year, Chin...