The foreign exchange risk reserve rate of the remote sales sales business focuses on stable expectations

Author:Dong Ximiao Time:2022.09.28

In order to strengthen macro -prudential management, on September 26, the People's Bank of China decided to increase the foreign exchange risk reserve ratio of the long -term foreign exchange sales business from 0 to 20%from September 28. This is since the central bank lowered the foreign exchange deposit reserve ratio of financial institutions on September 15, the central bank once again used the macro -prudential policy tools to regulate the foreign exchange market against the foreign exchange market. The RMB exchange rate remains basically stable.

The foreign exchange risk reserve ratio and foreign exchange deposit reserve ratio of the long -term exchange business are important cross -border capital flow macro -prudential policy tools. It is regulated and guided to the foreign exchange market and cross -border capital flow from two different directions. Foreign exchange deposit reserve is levied to financial institutions for domestic foreign exchange deposits, and foreign exchange risk reserve is required to collect from financial institutions for long -term foreign exchange purchases. Decreased foreign exchange deposit reserve ratio, aiming to release foreign exchange liquidity to the market, increase the supply of market foreign exchange, thereby further suppressing foreign exchange appreciation and alleviating the pressure of the renminbi. On May 15th, the central bank lowered the foreign exchange deposit reserve ratio of financial institutions by 1 percentage point, and the foreign exchange deposit reserve ratio was reduced from 9%to 8%; on September 15, the central bank lowered the foreign exchange deposit reserve ratio of financial institutions by 2 percentage points, foreign exchange The deposit reserve ratio is reduced from 8%to 6%.

The foreign exchange risk reserve ratio of long -term foreign exchange sales business aims to affect the long -term foreign exchange sales demand by regulating the cost of foreign exchange sales in enterprises and other institutions. Generally speaking, when commercial banks do long -term foreign exchange purchase business for enterprises and other institutions, they need to pay a certain percentage of foreign exchange risk reserve to the central bank. In some cases, the foreign exchange risk reserve rate can be 0, that is, there is no need to pay the central bank reserve. The central bank raising the foreign exchange risk reserve ratio will appropriately increase the cost of buying foreign exchange for long -term banks, reducing the demand for forward foreign exchange in enterprises and other institutions, thereby reducing the demand for foreign exchange purchase in the market, and helping the foreign exchange market supply and demand balance. At the same time, the central bank has issued a clear signal to the market by raising the foreign exchange risk reserve ratio to stabilize the confidence and expectations of the foreign exchange market.

According to changes in the foreign exchange market, the foreign exchange risk reserve ratio of my country's long -term exchange sales business has been adjusted in the past few years, and the adjustment is between 0-20%. In August 2018, in order to prevent a large depreciation of the RMB, the central bank adjusted the foreign exchange risk reserve rate of the long -term foreign exchange sales business from 0 to 20%. In October 2020, under the pressure of a substantial appreciation of the renminbi, the central bank reduced the foreign exchange risk reserve ratio of the long -term foreign exchange sales business from 20%to 0. The main reason is that the RMB is still undergoing depreciation pressure from 0 to 20%from 0 to 20%.

At present, the RMB exchange rate, especially the RMB, is facing a certain pressure on the US dollar exchange rate because of three aspects. First, the foundation of domestic economic recovery is not stable. The exchange rate of a country is essentially determined by the national potential growth rate. However, since this year, although the domestic macro economy has signs of stability, the recovery situation is not as good as expected. The main economic indicators are relatively weak, and the downward pressure on the economy is still large. Second, the Federal Reserve raised interest rates, and the US dollar index hit a 20 -year high. Since the beginning of this year, in order to curb inflation and stabilize the level of price, the Fed has to increase the pace of interest rate hikes and conduct five continuous interest rate hikes. The US dollar index has continued to strengthen, and non -US dollar currencies have depreciated. Third, the Monetary policy of China and the United States goes back, and the spread is obvious. While raising interest rates in the United States, in order to reduce the cost of financing in the real economy, my country has guided market interest rates to decline through various measures. Since the beginning of this year, LPR has fallen three times, of which the 1 -year LPR has fallen two times a total of 15 basis points and a total of 35 basis points have been reduced by 3 times. The spread of China and the United States has expanded, to a certain extent increased the downward pressure on the RMB exchange rate. Therefore, in the context of the RMB exchange rate "breaking seven" and a large depreciation pressure, the central bank made decisive shots and re -adjusted the foreign exchange risk reserve rate of the long -term foreign exchange sales business to 20%.

The foreign exchange risk reserve ratio of the remote sales sales business will increase the cost of long -term foreign exchange sales for banks; for enterprises, the direct impact is that the cost of long -term foreign exchange purchase will increase. However, increasing the capital cost of banks engaged in related businesses and the cost of purchasing foreign exchange in the company's long -term is obviously not the ultimate goal of the central bank. The more important purpose of raising the risk reserve rate of foreign exchange risk is to reduce the non -real demand in long -term foreign exchange purchase through this move, reduce various arbitrage behaviors, and then restrict the irrational behavior in the long -term foreign exchange market to suppress the unilateral side of the foreign exchange market. Changes are expected to prevent the irrational depreciation of the RMB and promote the two -way fluctuations of the RMB exchange rate at a reasonable and balanced level.

In the next step, affected by the continuous raising interest rate hikes and geopolitical demand caused by the United States, the US dollar may continue to be strong in the short term, but there is no basis for the renminbi to continue to depreciate. my country's economic and financial system has a lot of toughness. It has long -term expectations and preparations for the US interest rate hikes and retraction. Generally speaking, the U.S. and other developed economies such as the contraction of currency financial policies have limited impact on my country's spillover. With the implementation of a series of stable economic policies and measures, it is expected that my country's economy will resume significantly in the third and fourth quarters, and the growth rate will rise significantly compared with the first half of the year, which will laid the foundation for the basic stability of the RMB exchange rate. my country's current inflation level is mild and controllable, and the balance of balance of payments will continue its large surplus situation. It also helps to maintain stable RMB exchange rates and operate smoothly in the foreign exchange market.

- END -

Zhaoqing's industrial park, transformation and upgrading!

Everyone knows daily lifeIn addition to landfill treatment, waste paper, waste pla...

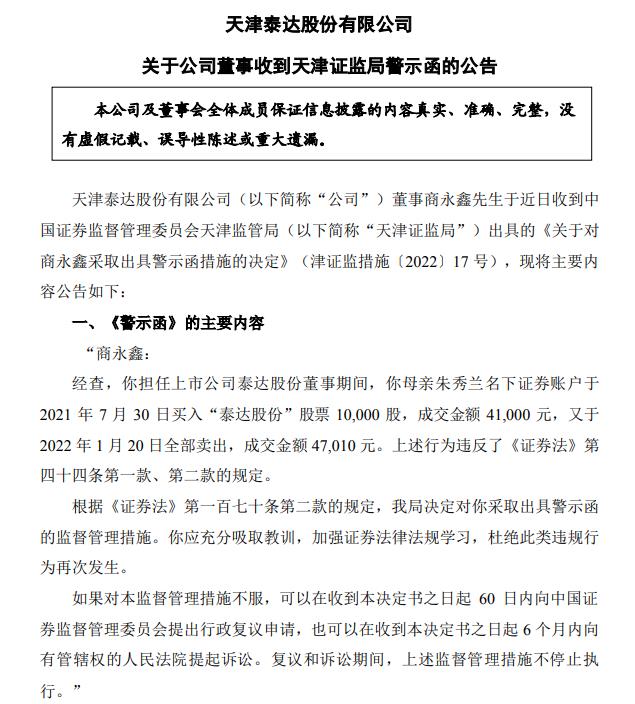

V View Finance Report | Relative account illegal short -term transaction TEDA shares directors'

Zhongxin Jingwei, June 13th. Teda shares announced on the evening of the 13th that...