A fund gathered in the "Half of the Rivers and Mountains" in the casual food industry: giants such as Duck Neck and Qiaqia Food actively cross -border investment, and Yanjinpu also joined

Author:Daily Economic News Time:2022.09.27

Every time a reporter Li Peipei is edited by Xiao Ruidong

More and more leisure food giants have made investment.

"Daily Economic News" was informed that recently, the Jewelry Giants have released an announcement on the capital increase and extension of the subsequent raising period of the fund's participation in the establishment of a wholly -owned subsidiary. A fund, which is contributed to the establishment of 644 million yuan, has recently added a new LP -Hunan Yanjinpuzi Holdings Co., Ltd. The latter contributed 20 million yuan, and the fund's total subscribed capital contributed from 1.201 billion yuan to 1.21 billion yuan.

Public information shows that this fund was founded in September last year. Earlier this year, it caused widespread attention due to investing in red milk tea "Book of Fairy Cao". LP also included casual snack giants to Qiaqia Food and "Noodle King" Chen Keming, Chen Keming, under Chen Keming, Chen Keming, under Chen Keming, a subsidiary of Chen Keming, a subsidiary of Chen Keming, a subsidiary of Chen Keming, a subsidiary of Chen Keming, under the "king of noodles." Food Co., Ltd., etc. The entry of Yanjinpu "True Gold and Silver" not only shows the optimism of this fund, but also shows the trend of actively investing in the food industry giants to invest in new growth points.

A fund gathers the casual food track "Half of the Rivers and Mountains", and Yanjin Shop also joins

Yanjinpu also added the "ranks" of the peeling duck neck and Qiaqia food.

On September 24th, the Jewelry Duck Neck of the Lifei Giant released an announcement on the capital increase and extending the subsequent raising period of the fund to participate in the establishment of the capital of the wholly -owned subsidiary. The document shows that the fund is called Sichuan Chengdu Xinjinyiyi Yifu Equity Investment Fund Partnership (Limited Partnership) (hereinafter referred to as Sichuan Yifu Fund). Based on the future development needs of the fund, it is planned to expand the scale of the fund, change the structure of the partnership, Extend the subsequent raising period.

Specifically, this fund will add a LP, which is the Hunan Yasunpu Holdings mentioned earlier. The company will subscribe to the fund for 20 million yuan in money, which will increase the total amount of fund subscribing capital contributions from 1.201 billion yuan to 1.221 billion yuan. In addition, the fund's subsequent raising period will extend the end of December 31 at the end of the year.

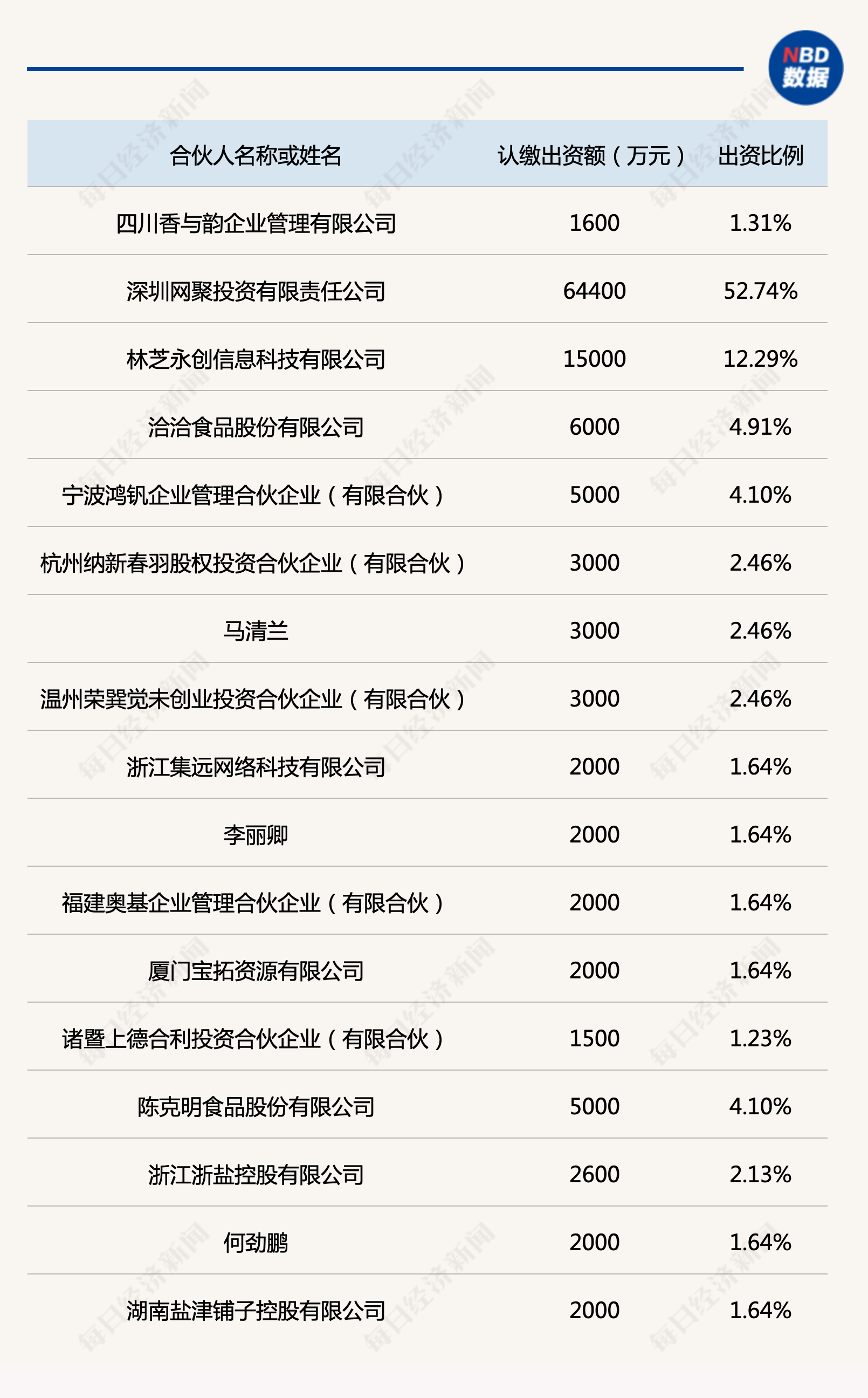

The announcement shows that all the latest partners and contributions of the fund are as follows:

According to Qixinbao Data and the Company announcement, Sichuan Yiyi Fund was established in August last year. At the beginning of its establishment, 12 LPs were established, and the total scale at that time was 1.1 billion yuan. After the fund has experienced three capital increases, there are currently 17 LPs, and the scale has increased to 1.221 billion yuan.

The fund manager is Sichuan Xianghe Yun Enterprise Management Co., Ltd., which is established by 100%of Changsha Wuyi Private Equity Fund Management Co., Ltd., while the legal representative and major shareholder of the latter are known as the "Sichuan Braised First Store" Liao Ji Food executive Peng Hui.

A fund brings together the "half of the country" in the domestic leisure food industry. It can also be seen that industry giants have enthusiasm for investing in investing.

Food giants actively invest, lay out the upstream and downstream of the industrial chain, and find business growth points

In fact, the Sichuan Yifu Fund at the beginning of this year has attracted industry attention due to the investment network red milk tea brand "Book of Fairy Cao".

According to private equity data, in February this year, Sichuan Book Management Co., Ltd., the operator of the book, has received a 157 million yuan A round of financing from Sichuan Yifu Fund.

Qixinbao Data further showed that since the establishment of Sichuan Yiyu Fund, it has shot 7 times since its establishment. In addition to the book, the investment target also burned fairy grass, as well as the four food brand Journey South, the frozen baking enterprise Enxi Village, the prefabricated vegetable brand Peng Jifangfang Wait. It can be seen that many of them are Internet celebrity companies and darlings of capital.

Why is the food giant keen to invest? We take the earlier and already savage duck neck as an example. The company clearly stated in the announcement of participating in the Sichuan Yifu Fund. By participating in the establishment of investment funds, on the premise of ensuring the development of the main business, with the help of the main business development, with the help The cooperative's professional investment experience and industrial resources accumulation provides more effective support for the strategy of "deep cultivation of duck neck and building a food ecology", and provides strong support for the company's continuous and rapid development of the company.

As early as 2014, Juewei Duck Neck established a wholly -owned subsidiary of the Capital Capital to focus on the investment and layout of the catering industry chain. Some of the catering brands that everyone are familiar with, such as noodles with Fufu, happy western cakes, etc., there are nets with gathered capital behind them. The Qianwei Chong Kitchen invested by the institution has logged in to the capital market last September. At the same time, Juewei Foods also used net gathering capital to become a fund LP that invested in catering tracks such as tomato capital, Wu Yizhen Fund, and the fund, and further expanded to the industry upstream and downstream.

On the other hand, the main business data of the food giants are not ideal. The latest semi -annual reports announced by Jueye Duck Neck and Zhou Heiya showed that the net profit of the two fell 80.36%and 92%year -on -year. At that time, some analysts said that the growth space of duck -neck products in the fulivin industry was limited, and the overall supply chain costs rose and consumer fatigue and other factors. Traditional marine giants' profitability will become more and more difficult. And this is also the dilemma facing most casual food giants.

In this context, with the help of investment to deploy ecology, increase new business growth points, and respond to industrial change and upgrade, it is obviously a very reasonable and efficient choice. Judging from the current investment method of "Guangsha.com", the taste and other food giants bet on the development rhythm of the entire Chinese catering industry. But it takes a little time to change from the signs to the harvester.

Daily Economic News

- END -

Only the compliance can drive to the blue oxygen oxygen release in 2022 China's injection medical beauty industry analysis report

If there is any industry a paradise and hell, it must be the medical beauty indust...

Public bidding and dietary raw materials suppliers outside the river!

In order to ensure the supply of dietary raw materials for teachers and students of the school in the 2022-2023 academic year, the School of Foreign Languages in the school will publicize the bidd...