Back blood, tears full of eyes — Daoda Investment Notes

Author:Daily Economic News Time:2022.09.27

Source: WeChat public account "Daida" (WeChat public account ID: daoda1997)

Early morning, I saw a message, which was too surprising.

According to media reports, on the 26th local time, Jia Yueting led a partner company to reorganize the FF board of directors and received another $ 100 million in financing.

For a bit, since 2014, Boss Jia has raised approximately 40 billion yuan, and it still can't enter the kind of flowers. By the way, the financial documents of the company's future company. The operating cost of this year is $ 700 million, that is, this time, the $ 100 million financing should be spent soon.

Return to home, come back and talk about A shares.

A shares finally ushered in a decent rebound today. You know, this is the first time that the market has a decent rebound in the past 10 trading days. The median of the rise and fall of the Shanghai and Shenzhen stocks rose 2.23%. The general rising market with a very good blood recovery effect was slightly better than expected.

In the article that notes yesterday, the grasp of market emotions and short -term rebounds can be said to be good. Thank you for the face of A shares. Yesterday, the only company in the market was directly at the top of the market. It is expected to be too strong. The subsequent probability can be used as a vane of short -term funds.

On the market, most of the leading sections are new faces, and a small part of the week began to be strong last week. Food processing, beer, pets, white wine, medical services, Chinese medicine, tourism, aviation, and airports rose across the board. In particular, the food processing is very strong. The six stocks in the sector have daily limit, and the volume is obvious. It is involved in funds.

The restless consumption was rumored that the chief of the seller called all institutions this morning, and then in the afternoon, the scope of communication gradually expanded, and some funds in the market began to grab consumer stock chips. Affected by this, the consumer stocks of Hong Kong stocks also showed signs of restlessness, such as Laibu and Haidilao.

Of course, it is also related to the research report of the International Investment Bank last night. As for what it is, there is not much discussion here, and there is news about the restarted cross -border railway freight from China and North Korea. Da Ge felt that the mainly because these sectors had fallen too much, and the oversold caused elasticity. It could burst a little about Mars, and it was normal to have such a performance.

However, today's big consumption belongs to the general rise. Under the general rise, you can't see the real gold. You can observe it patiently. Which segment can come out, it is not too late to do the latent after it is clear. Buying now is not a wise choice. Even if there is a section that can go cattle, buying points will appear repeatedly.

In addition to large consumption, medical devices, medical services, and traditional Chinese medicine sectors have strengthened. Medical devices are good for good. In addition, there are news that star fund manager Zhang Kun lays up the trend of pharmaceutical stocks. The big medicine is hammered by the market. Some funds start to lay out.

However, the above -mentioned pharmaceutical -related sector indexes are difficult to say that it is bottom -up and still needs to be observed. Two days ago, I read a meeting of the meeting in the pharmaceutical industry. At the end of the meeting, no one asked, indicating that the market sentiment of the industry had reached the freezing point.

In general, today's leading sector has obvious defense properties, indicating that the funds are still cautious, but it is better to understand before the festival, but it is difficult to say whether this direction can lead the market reversal. In addition, the market volume is insufficient, and the subsequent probability is mainly based on differential rotation. From the perspective of operation, if there is no first hand, you can't stare at the leading up today, but pay attention to the recently strong and just followed sections.

Based on today's market, Da Ge thinks that the main points are mainly the following:

First of all, the market rebound is conducive to emotional repair, but it still needs to be treated with caution without changing the trend. At present, everyone's views on the current position of the market are mainly divided into two categories: the decline and the bottom of the stage. Anyway, the three major A -share indexes are still in a downward trend, and the index will be under pressure after today's rebound.

From the perspective of technical analysis, my point of view of the Shanghai Stock Exchange Index yesterday was that it was pulled back to the area where the sideways fluid last week, and the rebound will be greater. Rush up. However, before this sideways area, it can only be qualitative into weakness, the operation is mainly short -term, and the position must be strictly controlled.

In particular, be careful to stretch the shock time in the area of the sideways last week. In terms of short -term, this means that the pattern of the disk surface is still rotation and differentiation. It is not advisable to chase up and low.

Secondly, pay attention to the opportunity to recover from Lian Ban style. Yesterday, after more than two years of rare consecutive single stocks for more than two years, today the market has increased to 10 stock stocks, which is a resonance for superimposed market emotions. Opportunities for hype. Even if the market may be adjusted later, local structural opportunities will be more than a few days ago.

Finally, we must correct the attitude towards the market today. Neither the brain is short, nor changes his faith due to a yang line. The current market is only a bottom -building stage. It may not be far from the bottom of the market, or it may be the bottom today, but these are not judged at the moment.

What we have to do is to deal with, set the strategy in advance, which step is the market for buying points, and which step is to sell points. It can be traded according to our own strategy. It does not matter.In this way, it will not be lost.(Zhang Daoda)

According to the latest regulations of relevant national departments, this note does not involve any operating suggestions, and the risk of entering the market should be borne.

Daily Economic News

- END -

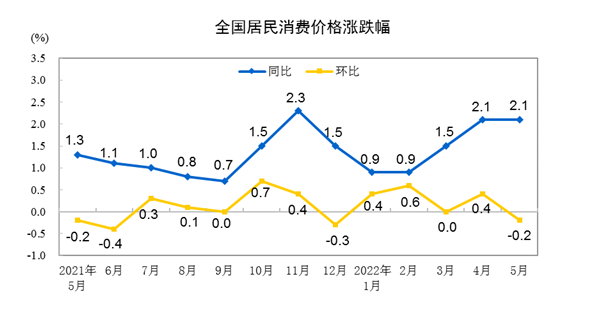

In May, the consumer prices nationwide rose by 2.1% year -on -year decreased by 0.2% month -on -mont

According to the National Bureau of Statistics, in May 2022, consumer prices acro...

Taicang Demonstration Industrial Community holds the start and investment launching ceremony of China Merchants

On the morning of September 21, the Digital Integrated Port Industrial Community, ...