Tax big data for the media to start the industrial chain supply chain

Author:State Administration of Taxati Time:2022.06.22

Help more than a thousand households to achieve the purchase sales amount exceed 5 billion yuan-

Tax big data for the media to start the industrial chain supply chain

The smooth and stable industrial chain supply chain is the basis for the stable and healthy development of the economy. In order to implement the decision -making and deployment of the Party Central Committee and the State Council on the prevention and control and economic and social development of the Party Central Committee and the State Council, the State Administration of Taxation organizes the local tax authorities to make full use of tax information such as value -added tax invoices, screening and determining the shortage of raw materials or poor product sales. Together to understand the difficulty and actual needs they are facing, and use the "National Taxpayer Supply Chain Inquiry" system to find potential suppliers or buyers for enterprises with purchasing and selling demand, and to promote the matching of supply and demand, they voluntarily follow the principle of marketization in accordance with the principle of marketization. Realize effective purchase and sales, help stabilize the industrial chain supply chain and hold the economic market.

Since May, the national tax authorities have helped 1564 enterprises to effectively achieve procurement, involving a amount of 5.57 billion yuan. Among them, it helped 1209 household manufacturing companies to effectively achieve procurement, involving a amount of 4.02 billion yuan; supported 187 transactions of Shanghai Enterprise Re -production and re -production, with a transaction value of 590 million yuan.

The picture shows the "helping enterprise rescue" team in Jinghe County, Xinjiang Uygur Autonomous Region, using the "National Taxpayer Supply Chain Inquiry" function to query and match suppliers to accurately help enterprises to solve supply and demand problems. Zhang Jin/Photo

Establish a special class insurance chain to promote the heat of both ends

As the nation's affected areas affected by the affected area gradually resumed work and re -production, the enterprise orders gradually became "hot", but raw materials were restricted into corporate problems, and the supply chain was cold and hot.

"There are more orders, but the inventory of the main raw materials 'hot -rolled round steel' has turned on the red light." Ren Haifeng, the procurement person in charge of Jiangxi Suqiang Hydraulic Co., Ltd., frowned for a while.

The dilemma of "no rice down" allows this company with the largest domestic hydraulic hose connector connector production base and the leading company in the field of construction machinery pipeline connectors. This means that enterprises not only have limited capacity, but also facing risk of breach of contract.

"The production and sales chain is the" lifeline 'of the enterprise. When we encounter difficulties, the tax department helps us make up for the' broken chain 'to solve the actual problems for us. " Finally relieved.

"We query the" National Taxpayer Supply Chain "function, search for the" hot -rolled round steel "product coding, and use tax big data to accurately query potential suppliers for enterprises." They accurately matched the steel production enterprise Hunan Hua Ling Xiangtan Steel Co., Ltd. through the cloud platform, and actively coordinated with the tax department where the supplier was located, helping these two upstream and downstream companies to achieve the docking of production and sales, and solved the problem of tension between raw materials.

Under the bridge of the taxation department, these two companies have reached a long -term purchase and sales agreement and have completed a transaction value of 10.51 million yuan. "Recently, we have purchased 1035 tons of steel from Hua Ling Steel. The supply of raw materials has kept up, and our production capacity has also been mentioned." Ren Haifeng introduced that the company recently received several big orders and is running for production.

In Jiangxi, tax authorities at all levels have set up leaders of the Sub -Regulatory Bureau, led by data risks, tax service departments, and participating in the "National Taxpayer Supply Chain inquiry" function participating in the management of science and technology, tax sources and other departments. , Clarify the work responsibilities of the department, coordinate and coordinate related work, and so far, 1596 potential key enterprises have been selected.

Not only in Jiangxi, the General Office of the State Administration of Taxation has recently issued a special notice, proposing that the provinces should establish the provincial (autonomous region, municipal) tax bureau to use the "National Taxpayer Supply Chain Inquiry" function to support enterprises to re -production and re -production. As the team leader, coordinate and coordinate the resources of the upper and lower, inside and outside the department, optimize the "national taxpayer supply chain query" function, clarify discipline requirements, prevent data leakage and abuse, and do a good job of accurate assistance.

Motor bridge and ask if you need to ask if it is difficult to help the gangs on both sides

While making full use of the "National Taxpayer Supply Chain Inquiry" function, the local tax departments formulate the data screening rules for key enterprises, screen the list of key enterprises, organize a special person to connect with the households, and learn about the production of enterprises in the form of online or field visits The difficulties and actual needs faced in the operation can make precise policies.

In Yongchuan District, Chongqing, the taxation department has set up a working group in the production and sales of difficult enterprises. Each taxation has set up a special work liaison to visit the enterprise regularly, ask the difficulties, establish the "difficult corporate account", and use the "nationwide nationwide The taxpayer supply chain query function "function, point -to -point query the supplier required by the difficulty in the company, shall be responsible for follow -up tracking and docking by the liaison officer of the tax office to ensure that the purchase and marketing channels are unblocked.

Not long ago, more than 6,000 tons of coal gangsters worth 1.03 million yuan were shipped out of the warehouse of Chongqing Yongfu Industrial Co., Ltd.

These two companies are the "good marriage" promoted under the "bridge carriers" of the tax department.

Since this year, due to the poor sales, Yongfu Industrial Company's large number of coal vermiculite has been sold out, which has led the company's cash flow and can only stop working. And Huaxin Jingtian Cement Co., Ltd. is purchased from foreign provinces such as Guizhou, and the transportation cost and purchase cost are high, and they need to find local suppliers. After the local tax cadres learned about the situation during the visit, through the "National Taxpayer Supply Chain Inquiry" function, they were connected to the bridge, and the supply and demand docking between the two enterprises quickly signed the purchase and sales contract in accordance with the principle of marketization. In Shenzhen, the taxation department arranges the tax source administrator to dock the bottom -to -one research through WeChat, telephone or field visits, to understand the actual needs of difficult enterprises in the household, and arrange for a special person to pass the "National Taxpayer Supply Chain inquiry" function. The list of merchants or buyers actively cooperates with the tax department where the supplier or buyer is located to jointly promote one -to -one docking between the supply and demand matching enterprises of the two places.

Similarly, in Guizhou, the local tax department establishes a solution mechanism for supply and demand problems in production enterprises, and sets up the "demand inquiry service team" and "special working group" in various places. Industry enterprises have carried out access to visit, and actively informed the company's "National Taxpayer Supply Chain Inquiry" function, so that companies can seek the help of the tax department when they encounter difficulty in supply and demand.

Precise matching supply and demand multi -party implementation of front line

Enterprises are the cells of the economy and society. Only cells are healthy can the body be healthy. Through the "National Taxpayer Supply Chain Inquiry" function, the taxation departments of various places have used blood transfusion, burdens, and loosening for enterprises to help enterprises through difficult periods and rejuvenate.

Since May, the epidemic prevention and control situation in the Yangtze River Delta region has become increasingly stable. Various market entities have grabbed the work and promoting development through replenishment of raw materials, grabbing production progress, and expanding market sales. Affected by the early epidemic, Yixing Leqi Textile Group Co., Ltd.'s products were unstable and the inventory backlog was serious.

During the visit, the tax department learned that the company's product sales dilemma responded to the company's demands as soon as possible. Timely through the "National Taxpayer Supply Chain Inquiry" function to match 199 pieces of enterprise information for the enterprise to print, dyeing, and denim demand, and actively contact the tax department where the demand enterprise is located to jointly do a good job of the production and sales of both supply and demand, which promotes the company and the company and the company and the company and the enterprise and the company and the enterprise and the company and the enterprise and the company and the enterprise are with Six demand companies reached a cooperation intention, and the total contract exceeded 32.3 million yuan.

"The matchmaking of the taxation department not only helps us to accurately match the potential customers, but also enhance the mutual trust among the enterprises, which greatly accelerates the cooperation process of both parties to the supply and demand." Xu Ling, deputy director of the financial financial financial financial management, said, "The tax department's service is strong, helping help We go to the road of re -production and re -production, the more smooth, the wider the more, and the wider. "

Not only does Lei Qi have such feelings, Shandong Jiayu Rong Shengmu Industrial Co., Ltd. also feels the same. Song Wenjun, the financial manager of the company, said that the epidemic was come back at the beginning of this year, and the long -term cooperative downstream construction enterprises were insufficient. In addition, the logistics was seriously blocked. The order volume was greatly reduced, and the production line was only 50%. Song Wenjun is very worried about future operations.

"In the company's most needed to pull the bone eyes, the tax bureau extended the hand of assistance." After learning about the situation of Jiayu Rongsheng Wood Industry Company, the tax department of Linyi, Linyi, Shandong, immediately launched the "National Taxpayer Supply Chain "Query", filtering and matching many wood demanders for Jeru Runsheng Wood Industry Company, and contacted through multiple channels.

"We have successfully reached a cooperation with more than 10 companies." Song Wenjun deeply felt the power of tax big data, "tax big data provided more possibilities for our sales. The current company operation has returned to normal, 14 production lines are comprehensive, and 14 production lines are comprehensive. Dama production, sales in May reached 16.54 million yuan, we have confidence in the company's next development! "

In the Altay area of Xinjiang, Jimomine County Guangming Flour Factory mainly carries out the production and processing business of flour. Affected by the epidemic, the company encountered difficulties in raw materials procurement and product sales. As the company's business scale continued to expand, funds were also facing shortage.

"Since the epidemic occurs, the sales of our enterprises are not as good as before. Thanks to the tax department's" matchmaking. "Zhao Erjing, the financial leader of Kyoko County Guangming Flour Plant Information, we connected to the acquired enterprise based on this information, reached a supply and marketing agreement quickly, and successfully signed a purchase and sales contract of more than 30,000 yuan. "

The work of the taxation department's active chain assistance enterprise has achieved positive results. The relevant person in charge of the State Administration of Taxation said that the taxation department will further play the role of tax big data, continue to optimize the "national taxpayer supply chain query" function, strengthen the guidance of the taxation departments of various places, do a detailed tax enterprise docking, and strive to promote more The actual transaction project helps enterprises to accelerate the resumption of work and re -production, and make positive contributions to stabilizing the macroeconomic market. (Reporter Yang Zhicong Zhou Ning He Yan, Lin Jianrong Guo Yong, Zhou Ting Sun Jun Li Wen)

- END -

The Fifth Expo "Cloud Recruitment Exhibition" Asia Pacific Special Promotion Conference was successfully held

On June 17, the China International Import Expo and Bank of China jointly held the...

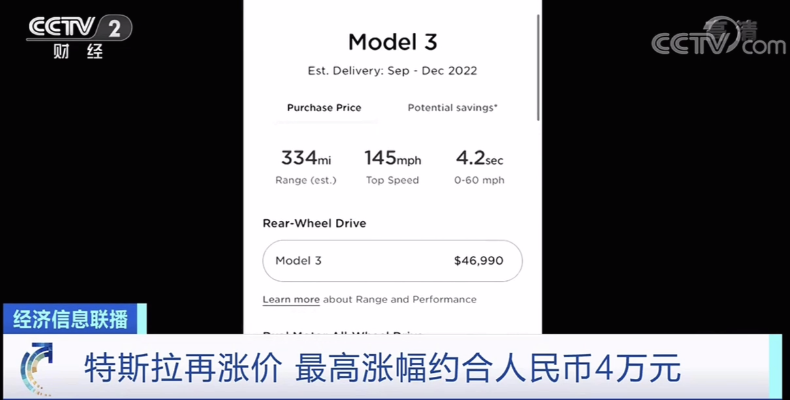

Tesla rose again, rising 40,000 yuan in one breath!what's the situation?

Source: CCTV FinanceThe copyright belongs to the original author, if there is any ...