Directors' suspected crimes attracted attention, Dongtian WeChat announced that "it has nothing to do with the company"

Author:Hubei Daily Time:2022.09.27

Dongtian Micro has performed since its listing (as of September 26)

(Picture source: Alipay stock)

For the 4 months of listing, the company's stock price set a minimum closing price record yesterday.

After closing yesterday afternoon, Dongtian Micro (301183.SZ) fell 7.45%to close 23.96 yuan/share, setting the lowest closing price record since listing. On the evening of the night, Dongtian Wei issued an announcement saying that he had received a notice from the family secretary and chief financial officer of the company's board of directors that Zhang Xiaobo was performed by the Public Security Organ in Taizhou City, Zhejiang Province for suspected crime.

The announcement also said that after a preliminary understanding, the case involved in Zhang Xiaobo has nothing to do with the company and the company's enterprises. The relevant situation is still under investigation, and the company's current operation is normal. The company's board of directors and management management decided that the company's general manager Xie Yundai is currently the responsibility of fulfilling the secretary and chief financial officer of the board of directors.

Zhang Xiaoboqi

Dongtian Weili landed on the Shenzhen Stock Exchange GEM on May 24 this year. According to the prospectus disclosed in May, on July 3, 2020, the first board of directors of the company reviewed and approved the "Proposal on the General Manager of Hubei Dongtian Micro Technology Co., Ltd., deputy general manager, etc." He is the secretary and financial person in charge of the company's board of directors, and the appointment time is from July 2020 to July 2023.

That is to say, Zhang Xiaobo is still in the appointment period. According to the information disclosed by Dongtian, when the company was investigated by the Industrial Fund more than 20 days ago, Zhang Xiaobo was still attending as a executive. Regarding whether his position retains, a fulcrum financial reporter called Dongtian Wei on September 27, and the relevant person in charge said that the company will terminate Zhang Xiaobo's appointment in advance.

Zhang Xiaobo's salary ranks among Dongtian micro -ranking. In 2021, his salary was 360,000 yuan with Xie Yun, the general manager of the company, and ranked third in the company.

The reporter noticed that Zhang Xiaobo was born in 1984 and graduated from Huazhong University of Science and Technology in 2007. He is a non -practicing member of China Certified Public Accountants. He joined Dongtian Wei in November 2019. He was originally worked at Dongguan Weiko, Dongtian Weisu. Earlier, Zhang Xiaobo had worked as companies such as Kunwu Jiuding and Jiuchuan Capital in Shenzhen in the PwC (special common partnerships) in Zhongtian Daozhongtian (special common partnership).

Zhang Xiaobo founded Shenzhen Ruilianjiachuang Investment Consulting Co., Ltd. in 2014. It takes investment consulting, entrusted asset management, and financial management consulting. 80%of the company's equity has been transferred to its mother.

Is Zhang Xiaobo suspected of criminal incidents related to Shenzhen Ruilian Jiachuang? The fulcrum financial reporter called the company. When the reporter showed his identity, the phone was hung up.

Zhang Xiaobo also invested 71,400 yuan in Shenzhen Xike Industrial Co., Ltd. in 2020, and currently holds 0.98%of the company's equity. The company was established in 2015 and focuses on the sales of automated equipment, smart electronic equipment, polishing materials, lubricant, hardware products and other products.

Dongtian Micro performance encountered the industry decline cycle

Dongtian Micro was listed for 4 months, the stock price has been falling, and this year's performance has also declined.

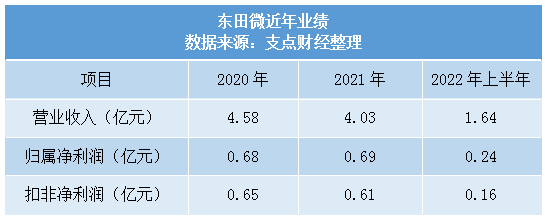

In the first half of this year, Dongtian Micro achieved operating income of 164 million yuan, and the net profit attributable to was 24 million yuan, and the non -net profit was 160 million yuan, a decrease of more than 20%year -on -year.

Dongtian Wei said that due to the influence of local wars, inflation, and new crown epidemics in the domestic area, and many unfavorable factors such as international trade frictions, the global smartphone shipments in the first half of the year have fallen significantly , Which led to a significant decline in the company's leading product smartphone camera filter income, which affected the company's performance.

According to the data of the market research institution Strategy Analytics, the data of the research report shows that in the first quarter, the global smartphone shipments were 314 million units, a year -on -year decrease of 11%; the statistical institution Canalys reported that in the second quarter, the global smartphone shipment decreased by 9%year -on -year; China faithfulness; China faithfulness According to the Tongyuan report, in the first half of the year, the total number of mobile phone shipments in the domestic market was 136 million, a year -on -year decrease of 21.7%.

Dongtian Wei's main product mobile phone camera filter filtration film is widely used in well -known brand smartphones such as Samsung, Huawei, Xiaomi, OPPO, vivo, etc. In the case of the industry cycle, how does the company respond to the decline in performance?

Dongtian Microchana's half -year financial report proposes that in order to ensure the leading position of the industry in the fierce market competition, the company continues to increase investment in technology research and development and strive to develop new products, such as rotary filter films for high -pixel mobile phone cameras. This year, it has been this year. In the first half of the year, small batches were achieved.

At the same time, Dongtian Wei also chose to lay out optical communication element business to launch glass non -spherical lens products for communication to the market. In the first half of the year, the business revenue achieved operating income of 0.37 million yuan, an increase of over 100%year -on -year, and it will gradually become a new growth point for the company.

Reporter Lin Nan

Edit 丨 Liu Dingwen Hu Xinyue

The Hubei Daily client, paying attention to the major events of Hubei and the world, not only pushing the authoritative policies for users, fresh hot information, and practical convenience information, but also launched a series of features such as reading newspapers, newspapers, learning, online interactives.

- END -

The signing of 36 port trading logistics projects in Caofeidian, Hebei is expected to achieve trade volume exceeding 80 billion yuan

Recently, at the investment promotion promotion conference of the port business lo...

The three red lines have not yet been loosened, the developer: "Water" has not yet come here

China Economic Weekly reporter Li Yonghua | Hunan ReportI bought a wealth manageme...