Wanhe Electric's stock price "roller coaster", the net profit of the first half of the year doubles and the product complaints are many

Author:Discovery net Time:2022.09.27

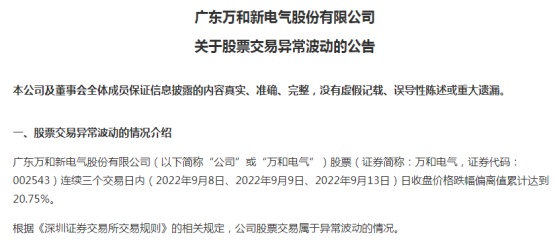

Recently, Guangdong Wanhe New Electric Co., Ltd. (hereinafter referred to as: Wanhe Electric, 002543.SZ) issued an announcement saying that the company's closing price declines from three consecutive trading days on September 8, September 9, and September 13th, deviated from the trading day. The cumulative value reached 20.75%. The company's stock price fell or was caused by the previous indirect controlling shareholder Guangdong Wanhe Group Co., Ltd. (hereinafter referred to as: Wanhe Group) reduced its holdings of the company's shares.

It is worth noting that Wanhe Electric's stock price has recently appeared many times. After the performance in the first half of the year, Wanhe Electric's stock price rose for four consecutive days. After the shareholders reduced their holdings, it fell more than 20%for three consecutive days. The semi -annual report of Wanhe Electric shows that Wanhe Electric has doubled revenue in the first half of the year, its main business growth is weak, the proportion of invention patents is less than 10%, and the products are repeatedly complained by consumers.

In response to the above situation, it was found that the interpretation of the interview letter from Wanwa Electric, but as of press time, Wanhe Electric did not give a reasonable explanation.

The stock price has fluctuated in the recent recently, and the stock price has fluctuated in a large fluctuation

Public information shows that Wanhe Electric's main business is the research and development, production and main sale of kitchen and bathroom appliances, and mainly based on the water heater series and supporting kitchen appliances. In recent years, Wanhe Electric has developed multi -dimensional brands such as "Zhanfu", "Satomi" and "Meisai Sai".

On September 14th, Wanhe Electric announced that the company's closing price declines from three consecutive trading days (September 8th, September 9th, September 13th, September 9, and September 13) reached 20.75%, which was an abnormal fluctuation. Among them, on September 8th and 9th, Wanhe Electric's stock price declined 10.01%and 10%, respectively.

(Picture source: wind, company announcement)

On the news, Wanhe Electric has recently reduced shareholders. On September 7, Wanhe Electric issued an announcement that in order to support its own industrial ecological layout, the company's indirect controlling shareholder Guangdong Wanwa Group reduced the company's shares of the company's shares through the Shenzhen Stock Exchange's large trading system on September 5, accounting 0.2999%of the share capital.

It is understood that the shares of Wanhe Group's reduction in this time are part of the shares directly held by Wanhe Group. After the implementation of this reduction plan, Wanhe Group directly held 61.652 million shares, accounting for 8.291%of the total share capital; The proportion of total shares is 29.6591%.

(Picture source: wind, company announcement)

From the end of August to the beginning of September, Wanhe Electric's stock price rises and falls. On August 25, Wanhe Electric disclosed the results of the semi -annual report. On August 25th and 26th, the closing price of Wanhe Electric's stock closing price increased from 21.61%. A total of 21.46%, the daily limit for 4 consecutive days. Within a few days, after Wanhe Electric issued the announcement of shareholders' holdings, the stock price fell more than 20%for three consecutive days. Wanhe Electric said that the company's production and operation in the near future is normal, and the information disclosed by the company in the early stage does not have something to be corrected and supplemented. As of September 14, Wanhe Electric's closing price was 10.53 yuan, with a total market value of 7.8 billion yuan.

(Picture source: Wind)

In the first half of the year, the net profit of revenue was doubled, and the invention patent accounted for relatively low

The semi -annual report released by Wanhe Electric recently showed that during the reporting period, the company achieved total operating income of 3.829 billion yuan, a year -on -year decrease of 2.81%; net profit attributable to the mother was 423 million yuan, a year -on -year decrease of 5.66%.

Among them, in the first quarter, Wanhe Electric achieved a revenue of 2.22 billion yuan, an increase of 5%year -on -year; net profit of home mother was 159 million yuan, an increase of 2.87%year -on -year. In the second quarter, Wanhe Electric achieved revenue of 1.609 billion yuan, a year -on -year decrease of 11.85%; net profit at home was 265 million yuan, a year -on -year decrease of 10.13%.

(Picture source: Wind)

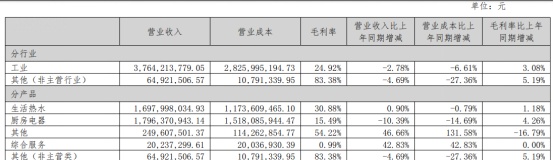

From the perspective of the main products, the revenue of Wanhe Electric's hot water and kitchen appliances products were 1.698 billion yuan and 1.796 billion yuan, respectively, with a year-on-year growth rate of 0.9%and -10.39%, accounting for total revenue, respectively 44.34%and 46.91%; operating costs were 1.174 billion yuan and 1.518 billion yuan, a year-on-year growth rate of -0.79%and -14.69%; gross profit margin was 30.88%and 15.49%, a year-on-year growth rate of 1.18%and 4.26%.

(Figure source: semi -annual report of 2022)

From the perspective of data, during the reporting period, the revenue growth of Wanhe Electric's main products is relatively weak, and the growth of its gross profit margin is mainly due to the decline in operating costs. Compared with the data of the 1822 sales gross profit margin in the first half of 2022, the average value of the gross profit margin was about 34%. The gross profit margin of and electrical sales was 25.92%, ranking 13th.

(Picture source: Wind)

In addition, in terms of industry trends, the competitive strategy of the kitchen and bathroom industry has risen through pure prices to more comprehensive and deeper comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive comprehensive. Sexual competition, currently Wanhe Electric is at the level of lack of performance growth.

In this regard, Wanhe Electric said that the company will accelerate the development of new technology research and advantageous series of products, accelerate the incubation, cultivation and promotion of intelligent equipment and service industries, and strengthen the construction of core manufacturing capabilities and supply chain capabilities; focus on core main business, effectively control the risks of effective control of risks Under the premise of actively carry out mergers and acquisitions of vertical or horizontal projects. The development and cultivation of new products and strengthening core manufacturing capabilities depend on the company's R & D technology. In recent years, Wanhe Electric has continued to invest in marketing scale on various platforms. All stars have been invited to endorse products. The sales costs during the reporting period have increased by 15.76%.

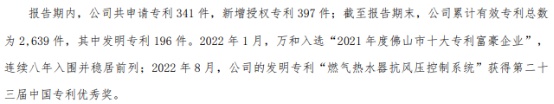

At the same time, during the reporting period, Wanhe Electric said that the company applied for a total of 341 patents and 397 newly authorized patents. As of the end of the reporting period, the total number of valid patents of Wanhe Electric was 2,639, of which only 196 invention patents accounted for 7.43%.

(Figure source: semi -annual report of 2022)

The company's early R & D and marketing level will be directly reflected in products and services. The black cat complaint platform shows that consumers have a total of 348 complaints on Wanhe Electric. The complaint content includes "false shipments of online self -operated malls, fraud consumers", "products in use", "difficult product maintenance", "difficulty in product maintenance", "difficulty in product maintenance" After the product is maintained, there are still many problems such as failure, covering various aspects such as sales, quality, and after -sales.

(Reporter Luo Xuefeng, financial researcher Gao Ran)

- END -

Expand consumer demand "Pengzhou Manufacturing Good Exchange" supply and demand docking series activities to start

Event site picture source: Pengzhou, Chengdu providedOn August 5th, the Made in Pe...

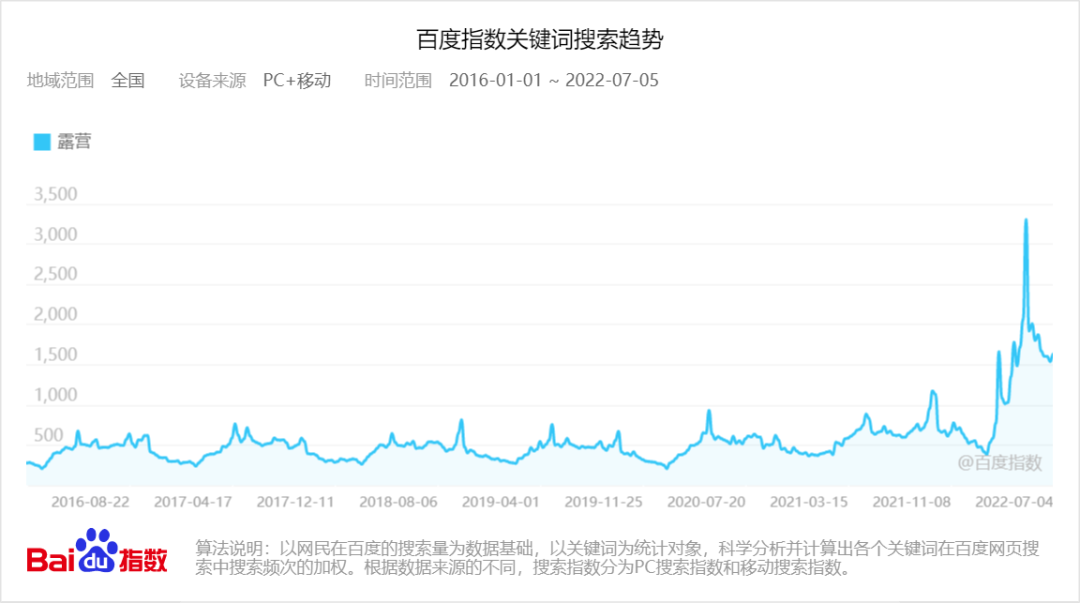

Camping fire to 618, the head brand is stable, niche brands rely on subdivided breakouts

In 2022, camping is undoubtedly one of the most outsiders lifestyles. Due to the p...