The price of sky -high breakup is reproduced!Reader cultural executives have received hundreds of millions of equity, and the original amount is less than 120,000

Author:Radar finance Time:2022.09.26

Radar Finance Hongtu Products | Editor Wu Yanrui | Deep Sea

Recently, the A -share market reappeared for the sky -high divorce breakup fee.

Divorce of readers' cultural executives, the current market value of the shares of the two parties exceeds 100 million. However, the stock is still in the guarantee period and cannot be listed and circulated. The lifting period is April 2023.

According to Tianyan check data, the capital layout is not related except for the listed company. In the listed company, Liu Di is currently a shareholder of the readers and is responsible for film and television copyright -related work in the company. When the news of the divorce was announced, Zhu Xiaoxiao resigned from the company's board secretary position, and still served as the company's director and general manager.

Public information shows that the two parties entered the post of readers in 2009. In 2013, the two parties obtained the company's shares that the two parties received shares transfer and became shareholders of readers.

Divorce in executives, stock breakup fees have a market value of over 100 million yuan

Recently, the Reader Culture announced that the company's director Zhu Xiaoxiao and Liu Di signed the "Divorce Agreement" to make relevant arrangements on the divorce property segmentation. Liu Di divided 1116.24 million companies held in his name (2.79%of the company's total shares) to Zhu Xiaoxiao.

As of the disclosure date of the announcement, the transfer procedures involved in the shares of the above shares have been completed. Liu Di's shareholding ratio has changed from 4.93%to 2.14%, and Zhu Xiaoxiao changed from 1.23%to 4.02%.

The announcement states that there are no violations of laws, regulations, and standardized documents in the event changes. The shares involved in this shares do not have restrictions on the rights of pledge and freezing, there is no situation of being restricted to transfer, and it will not affect the company's management and management.

In this divided shares, the shares that are not available in circulation are not available in the current shares of the two parties. In October 2021, Liu Di resigned as the general manager of the company for his personal reasons. According to his commitment in the "Public Public Publishing Stocks and Listing Prospects for Listing in the GEM", he did not transfer himself directly or indirectly within half a year after his departure. The company shares held; if I apply for resignation within six months from the date of the first public offering of the stock listing, they shall not transfer the company shares I directly hold within eighteen months from the date of declaration. The shares of this division are still restricted by the above commitments, so the division shares obtained by Ms. Zhu Xiaoxiao will not be listed and circulated before April 21, 2023. After the relevant commitment content expires, the shares of this division will be based on relevant regulations. Management.

According to the data, the listing date of the readers' culture was in July 2021, and Liu Di resigned within six months of listing in the company. In the semi -annual report of 2022, it was only the company's shareholders.

At the same time, the Board of Directors of the Readers received a written resignation report submitted by Zhu Xiaoxiao, secretary of the company's board of directors on September 23, 2022. In order to focus on fulfilling the responsibilities of good directors and general managers, it is no longer a secretary of the board of directors of the company, and the resignation will take effect on the date of resignation and application for the board of directors.

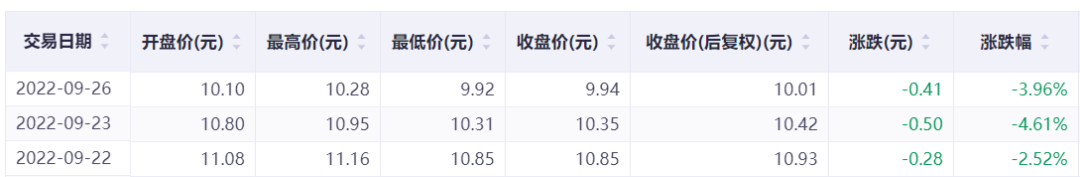

Since the announcement of the divorce of the company's director, the stock price of the readers' culture has fallen every day. It has fallen for three consecutive trading days. Based on the closing price on September 26, the stock market price of this divorce division was about 111 million yuan.

Except for listed companies, the two parties have no other business layout connection

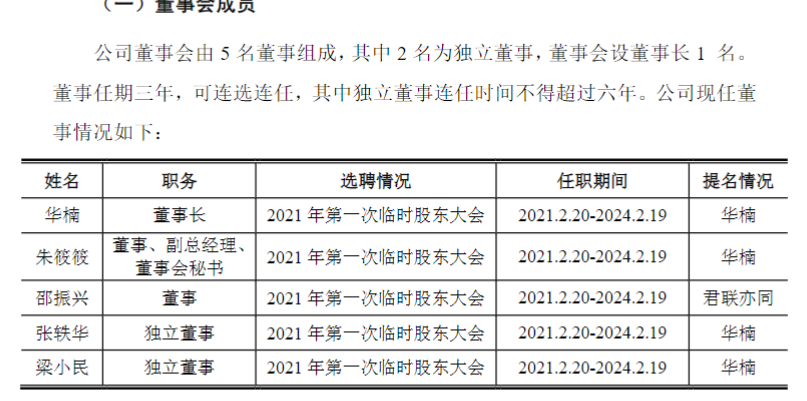

At the beginning of the listing of readers, the company's board of directors consisted of five directors, two of which were independent directors and one chairman of the board of directors. Zhu Xiaoxiao is the company's director, deputy general manager, and secretary of the board of directors. Liu Di is the general manager of Reader Culture Company, with a term of office from February 2021 to February 2024.

It is learned from the resume that Liu Di worked in the readership culture in May 2009. In September of the same year, Zhu Xiaoxiao served as a readership culture. Before, Chongqing Publishing Group Book Distribution Co., Ltd. was planned.

In February 2013, Liu Di and Zhu Xiaoxiao obtained 6%of the company's equity (original capital of 120,000 yuan) and 2%of the equity (original capital 40,000 yuan) through shareholders' transfer. In October 2016, Zhu Xiaoxiao once again obtained 1.2%of the equity of the shareholders' equity transfer company (the original capital was 24,000 yuan).

In February 2017, Zhu Xiaoxiao transferred 1.2%of the company's equity (original capital of 24,000 yuan) to the new shareholders of the company at that time, and transferred a consideration of 300,000 yuan.

Since then, the readers have made two capital increases and set up the company's overall change of the company. After the change, Liu Di held 5.48%of the company's shares, and Zhu Xiaoxiao held 1.83%of the company's shares.

When the company was listed, Liu Di and Zhu Xiaoxiao had no other part -time units.

In the annual report of the readership culture, Liu Di will continue to work in the company after resignation and be responsible for film and television copyright -related work. In the related affiliated transactions disclosed by the company, Liu Di had 370,000 yuan in the book tax.

In the first half of 2022, the book tax for Liu Di and the reader culture was 6334.27 yuan.

Sky Eye Check information shows that Liu Di participated in 4 companies. Among them, Shanghai Nange Film Co., Ltd. was canceled in July 2017. Although the other three companies were not within the subsidiary of the listed company's readership culture, the suspected actual control of the three companies was Hua Nan, the chairman of the readers' culture.

Zhu Xiaoxiao participated in the two companies, one of which is the parent company of the visitors, which holds 4.11%of the equity of a listed company.

Another Yutang (Shanghai) Industrial Co., Ltd. was established in 2018. It is a company that is mainly engaged in the wholesale industry. Zhu Xiaoxiao holds 48%of its shares and is the company's legal representative. Zhu Xiaoxiao also served as a supervisor in Yuyao Xinbang Trading Co., Ltd., which is mainly engaged in the wholesale industry. Reader culture in the first half of 2022 revenue of 254 million

In the first half of 2022, the cultural revenue of the readers was 254 million yuan, an increase of 6.19%year -on -year; the net profit of the mother -in -law was 31.3044 million yuan, a year -on -year increase of 14.20%.

The main source of revenue of the reader culture is paper books, accounting for 86.12%of the total revenue, followed by digital content, accounting for 11.87%. According to the statistics of the opening information, the company's solid share in the first half of 2022 was 1.31%, an increase of 0.25 percentage points from the same period last year, ranking third among the public book companies.

Digital content business mainly includes e -book business and sound book business. It mainly experiences four links: copyright purchase, project planning and production, marketing promotion and authorization. At present, the company's Platinum partners on WeChat reading, Himalayan, and Zhihu, including the main e -reading and audio novel drama platforms.

From the perspective of financial ratio, in the first half of 2022, the company's 34.28%gross profit margin was slightly higher than the average value of the industry in the public publishing industry of the listed company. In addition, the inventory turnover rate of readers' culture is 1.22, which is far lower than 7.88, and it is also less than 1.44 medium numbers, ranking 11th among the 18 companies.

The proportion of sales costs and management expenses and operating income of readers' culture is lower than the industry average, and the company's cost control is generally comparable to the industry.

The asset -liability ratio of 20.92%of the reader culture is also lower than the industry average. Specifically, the company's assets were totaling 790 million yuan and a total liabilities of 165 million yuan. During the same period, readers' cultural flow assets were 740 million yuan, and the total liabilities were 153 million yuan.

- END -

The "Accounting Measures for Road Traffic Accident Social Rescue Foundation" issued

Notice on Printing and Distributing the Accounting Measures for the Social Rescue ...

Robin decided to gamble again

Source | Tech PlanetWen | Qiao XueAfter a few entrepreneurial projects failing, Lu...