Health Yuan officially officially issued an A -share listed company in Switzerland to the Swiss Stock Exchange.

Author:Daily Economic News Time:2022.09.26

On September 26, the Health Yuan (SH600380, the stock price of 9.8 yuan, and a market value of 18.9 billion yuan) was officially issued to the global deposit certificate (GDR) and was listed on the Swiss Stock Exchange. According to the previous announcement disclosed by the company, the final price of this issuance is $ 14.42 per copy, and the number of GDR issued this time is 6.3825 million. Dollar.

Health Yuan said that the company's GDR issued this time from 120 days from the date of listing (hereinafter referred to as the "Restricted Restriction Period") must not be converted to A shares. After the expiration of the rejuvenation period, qualified investors can cross -border conversion through cross -border conversion agencies. Cross -border conversion includes qualified investors to cancel GDR through the cross -border conversion mechanism and sell the corresponding A -share stocks, and buy A -share stocks and generate new GDRs.

"After the global deposit certificate is issued overseas and listed on the Swiss Stock Exchange, the funds raised will be mainly used for the company's international business, further promoting the company's internationalization process, and helps to improve the company's profitability and comprehensive competition for comprehensive competition Force, it meets the company's strategic planning and long -term development goals. "Health Yuan said that this is also an important measure for the company to respond to the call of domestic capital market policy, deepen the China -Europe capital market interconnection, and use the overseas capital market to promote the development of the real economy.

"Daily Economic News" reporter noticed that in February this year, the China Securities Regulatory Commission officially issued the "Regulations on the Business Supervision Regulations on the Business Supervision of the Interoperability Exchange Credit Volleyball Teacher of the Stock Exchange at home and abroad" (hereinafter referred to as the "Regulations on Supervision"). It is reported that the interconnected deposit certificate business is the interconnection mechanism between the Shanghai Stock Exchange and the eligible overseas stock exchange, including the two businesses of China Stock Volleyball (CDR) and Global Stock Certificate (GDR). Enterprises listed on overseas stock exchanges have issued CDRs in the country and listed on the main board of domestic stock exchanges. Eligible domestic listed companies issued GDRs overseas and listed overseas.

The "Regulations on Regulatory" allows qualified Shanghai Stock Exchange and Shenzhen Stock Exchange to issue GDRs overseas. It also simultaneously expands the scope of application of interconnected deposit certificates from previous Britain to Switzerland and Germany. In July of this year, the China -Swiss Securities Market Interconnection Trusted Certificate Business was officially opened.

In this context, the pace of "going global" A -share listed company has accelerated. Cada Manufacturing (SH600499, shares of 16.91 yuan, market value of 32.9 billion yuan), Greenmi (SZ002340, a stock price of 7.74 yuan, a market value of 39.7 billion yuan), Guoxuan Hi -Tech (SZ002074, a stock price of 32.61 yuan, a market value of 58 billion yuan), Shashan shares (Shan Shan shares SH600884, the stock price of 22.88 yuan, and a market value of 51.2 billion yuan) has become the first A -share listed company to issue GDR on the Swiss Stock Exchange. Health Yuan has also become the sixth A -share listed company to issue GDR in Switzerland since July this year.

Huang Tiejun, Executive Vice President and Secretary -General of the Shenzhen Listed Companies Association, said at the listing ceremony of the Health Yuan September 26 that as one of the long -standing financial centers and well -known stock exchanges in Europe, all mature and stable markets with Ruijiao Structure and rapid and efficient listing processes provided international innovation companies with opportunities to continue to borrow the Swiss capital market. Switzerland is gradually becoming one of the mainstream destinations for domestic listed companies' new ways of financing.

Daily Economic News

- END -

Qintai | (1) Books enter the new machine and change of the live broadcast room

On the morning of June 9th, the anchor Dong Yuhui sold books and agricultural prod...

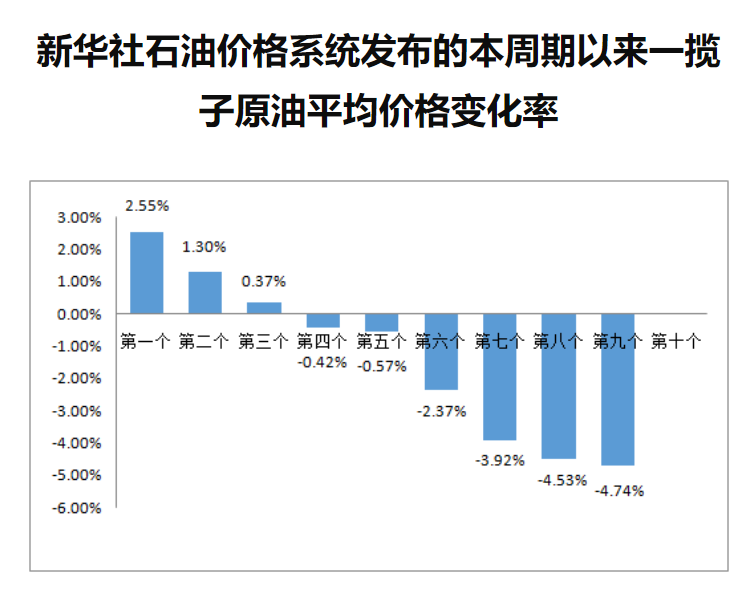

Tomorrow Steam and diesel prices are expected to welcome "two consecutive declines"

This cycle (since June 28), due to the heating up at the level of oil demand, it h...