After the sale of major assets, the newly opened source has been traded by a transaction opponent for $ 18 million.

Author:Daily Economic News Time:2022.09.26

New open source (SZ300109, stock price of 27.98 yuan, market value of 9.656 billion yuan) announced on the afternoon of September 26 that the company recently received ABCAM PLC and ABCAM US (ABCAM US as ABCAM PLC all -funded subsidiary, hereinafter referred to as ABCAM). Based on its understanding of related matters, the "Change letter" put forward the company's pursuit of not less than 18 million US dollars compensation.

Earlier, the newly opened in 2021 was sold for major assets and sold related medical assets to ABCAM. For nearly a year before the above -mentioned assets have been transferred above, I did not expect that the end payment had twists and turns.

However, for the relevant demands of ABCAM, the listed company claims that the other party is "intending to pass the relevant costs" and cannot accept it.

The trading opponent is not less than 18 million US dollars

In ABCAM's "Enlightenment Letter", ABCAM claims that during its due diligence to related companies Biovision, Inc. Two supplementary agreements. ABCAM believes that the two supplementary agreements signed by Biovision with the client are not good for it, and it intends to pay the client to $ 18 million at one time to terminate the agreement.

For this 18 million US dollars, ABCAM believes that "the company (new open source) did not provide it in a complete, accurate and reliable provision of the previous two supplementary agreements during its due diligence." As a result, ABCAM proposes to listed companies for the pursuit of less than 18 million US dollars for compensation based on the "Shares' Purchase Agreement".

Looking back at history, the newly opened up in 2021 has implemented major assets for sale. The new open source creature and ABCAM of the company and company subsidiaries signed the "Shares' Purchase Agreement". The following is referred to as NKY US) 100%equity; NKY US is a special destination company that indirectly holds Biovision for the new open source.

The above transactions are priced at $ 349 million. In October 2021, the ABCAM USA remitted US $ 322 million in cash, and the remaining $ 27.2 million will be paid in accordance with the relevant agreement; in late October 2021, the new open source announcement disclosed that the transfer of 100%equity of NKY US's equity The procedures have been completed.

In the "Enlightenment", ABCAM put forward the demands of "deducting relevant expenses in the remaining $ 27.2 million transaction margin that has not been paid".

For the relevant content of ABCAM in the "Enlightenment", the new open source calls itself objections.

Listed companies stated that, under the premise of "doing their best", the company has provided ABCAM's required relevant information to ABCAM in accordance with the requirements of ABCAM, and assisted ABCAM to arrange its interviews with Biovision management, and Receive ABCAM's field inspection of Biovision.

"The company provides convenience for ABCAM's due diligence in Biovision as much as possible, and there is no motivation for subjective intentional concealment, deception or misleading ABCAM; there are no subjective malicious concealment, deception or misleading ABCAM." Listed companies said.

The listed company said

From the perspective of the new open source, based on its own business interests and purposes, ABCAM chooses to lift the relevant customers with relevant customers to terminate the relevant customer's related costs. The company cannot accept ABCAM's intention to pass the relevant expenses to the company.

"The company maintains an objection to the" Change letter "and will actively seek solutions including negotiation or arbitration. In the future, if the incident cannot be properly resolved, the company may bear certain compensation liability." Listed companies said.

Data show that ABCAM PLC is a biotechnology company providing reagents for life science research activities and related tools. The company's products include antibodies, biochemical reagents, polypeptides, proteases, ELISA kits, etc. New Open Source has disclosed that ABCAM PLC is the first research antibody company in Citeab, which is ranked first in CITEAB in 2019.

"Daily Economic News" reporter noticed that the new open source signed a strategic cooperation agreement with ABCAM PLC in late October 2021. According to the agreement, within the five -year period after signing the agreement, ABCAM PLC will provide the affinity reagent and customized services in the new open source for new open source in the development and commercialization of product development and commercialization in the field of in vitro (IVD); ABCAM PLC will grant the exclusive permits of non -unique licenses and reagents for new open source and related companies to a directory affinity and reagents for reagents for new open source for IVD applications, research and development activities of third -party institutions, and sales of products developed by new open source products. Essence At the same time, the new open source has the right to purchase customized and directory affinity from ABCAM PLC, and use ABCAM PLC's affinity reagent to develop approved clinical products.

At that time, the new open source believes that ABCAM PLC will help the company have more comprehensive product portfolio and services in the field of in vitro diagnosis. The company can use ABCAM PLC's brand influence and global market channels to further enlarge and strengthen the field of in vitro.In the semi -annual report of 2022, listed companies also continued this statement.Daily Economic News

- END -

Dao Guanhe Reservoir is full of Baikoutang weir, and Xu Yicun has more than a thousand acres of farmland to relieve thirst

The Yangtze River Daily Da Wuhan client August 16th Everyone has hurriedly irrigat...

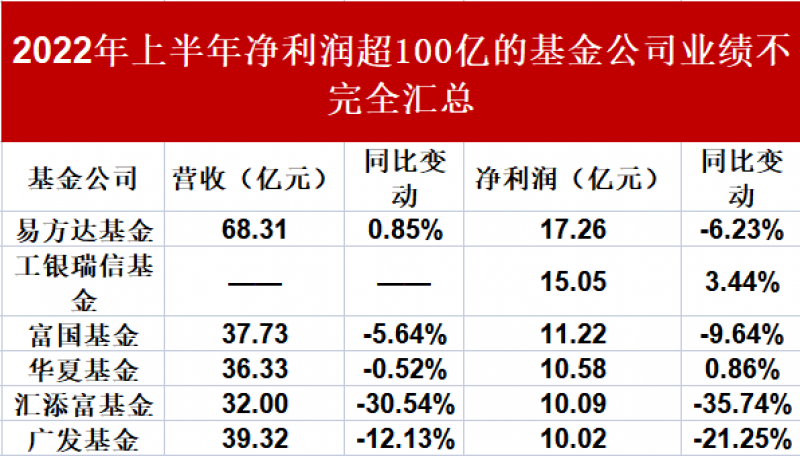

In the first half of the year, the profitability of public funds was shrinking!Guangfa Fund's insurance fell out of the "billion club", and the net profit of revenue was doubled

Data source: half -annual report of listed companies; deadline: August 30, 2022Chi...