Application to make up 2.3 billion!The Western Securities Asset Management Plan "Stepping on Lei" Jiuding Group, from seven years ago, Jiuding tens of billions of dollars fixedly increased

Author:Daily Economic News Time:2022.09.26

In the evening of today (September 26), Western Securities announced a 2.3 billion litigation incident, and the relationship was dating back to the new three -board star (NQ430719, the stock price of 0.29 yuan, a market value of 4.350 billion yuan) at a high price. increase.

According to the announcement, in August 2015, Western Securities established the asset management plan "Western Securities -China Merchants Bank -Western Hengying China Merchants Fast Deer Jiuding Investment No. 1 Asset Management Plan" (hereinafter referred to as Western China Merchants Kuaulu No. 1), the initial asset scale Total 2 billion yuan. However, after the termination of the asset management plan, the relevant obligations did not settle the money. Therefore, the Western Securities' "Western Merchants Kuaulu No. 1" applied for arbitration on behalf of the Western Securities, and requested the ruling to make a total of 2.355 billion yuan in the total amount of supplementary funds. The "Arbitration Notice" was issued in September 2022 to decide to file the case.

Western Securities: Litigation will not affect the company's profits

In the announcement, Western Securities briefly explained the ins and outs of the lawsuit.

In August 2015, Western Securities established the "Western Merchants Kuaulu No. 1". In the same month, the company signed the "Compensation Contracts" as a manager and the duty of Ningbo Kuangke Hongwen Holdings Co., Ltd., Xu Chunlin, Shanghai Kualu Investment (Group) Co., Ltd., Shao Wu, Jiang Feng, Feng Yuan, Ye Genpei, Yu Zhuyun, etc., and agreed to make up for complement Obligations shall fulfill their obligations from the asset management plan after the corresponding conditions are met. In addition, Xu Chunlin provided pledge guarantees for the aforementioned voluntary obligations in the "Compensation Contract" item.

Western Securities stated that after the termination of the asset management plan, the above -mentioned supplementary obligations did not perform their obligations in accordance with the contract. And pay late fees and bear the fees, arbitration costs, premiums, etc. of the case, and the fees shall be borne by the respondent. The price of the pledge is preferred within the scope of the aforementioned arbitration request. The above arbitration requests are 23.55 billion yuan.

Western Securities pointed out that as the manager of the asset management plan, the company strictly follows the regulatory regulations and the asset management plan contract to fulfill the duties of the manager. influences. The company's current operating situation is normal and the financial situation is stable. All bonds pay the interest payment on schedule, and no breach of contract occurs. The company will continue to pay attention to the progress of the case and fulfill the obligation of information disclosure in a timely manner.

Western securities will not be lost as managers, but for investors in the above -mentioned "Western Merchants Kuaulu No. 1", this is not good news -because even if resorted to arbitration, can this money recover if this money can be recovered There are still uncertainty.

Jiuding Group: Landing on the New Third Board in 2014, once a star company

In 2015, Jiuding Group earned the eyeballs of 10 billion yuan. According to the fixed increase report released by Jiuding at the time, the contribution of "Western Investment Merchants Kuaulu No. 1" was 2 billion yuan. It can be said that "Western China Merchants Quick Deer No. 1" is set for this.

However, with the changes in the capital market environment, this 2 billion yuan asset management plan has a floating loss. Jiuding's original crazy expansion road took the end, from prosperity to decline. In 2018, the CSRC filed a case for the Jiuding Group, and then the company's series of violations of laws and regulations surfaced. On January 29, 2021, the Securities Regulatory Commission disclosed that Jiuding Holdings was fined by 600 million yuan because of manipulating the stock price. Both chairman Wu Gang and Jiuding Group were punished.

In September 2021, because Wu Gang's relevant acts were suspected of violating the relevant laws and regulations of the fund, in accordance with laws and regulations, on July 23, 2021, the Securities Regulatory Commission decided to investigate Wu Gangli.

After the Jiuding system fell down the altar, the market value of 100 billion yuan was disintegrated. The stock transfer system market shows that the current Jiuding Group is still traded in the basic layer, and the latest price is 0.29 yuan per share. In the first half of 2022, Jiuding Group had a huge loss of 1.379 billion yuan. At present, the company's mortgage, pledge, and limited assets of litigation exceeded 7.8 billion yuan. It is worth mentioning that the host of the Jiuding Group is also Western Securities.

However, the above -mentioned "Western Merchants Quick Deer No. 1" has traced back to 2016. In this asset management plan, Western Securities is a manager, China Merchants Bank is a custodian agency, and Kuaulu is a bad background.

According to public reports, in 2016, the "Fast Deer" fund -raising fraud case was led by the movie "Ye Wen 3". Shi Jianxiang, the actual controller of the Kuaulu Department, fled the United States on the eve of the break on the fund chain. In 2019, the "Kuaulu Department" raised fund fraud case was sentenced. For illegal fund -raising a total of more than 43.4 billion yuan, Kuaul Group was fined 1.5 billion, and the former CEO was sentenced to life. In addition, there are news that in November 2021, Shi Jianxiang was arrested in the United States for fraud and abuse of non -immigrant visa in the United States.

Merchants Bank's "Back Shengjin 8699" becomes the third largest shareholder of Jiuding

At present, "Western Merchants Quick Deer No. 1" has been liquidated, but from the announcement of Western Securities and sorting out the regular reports of Jiuding today, there are many remaining issues to be solved.

First of all, the Shenzhen International Arbitration Court may eventually judge the asset management plan to win. However, it is very unknown whether the duty of complementing obligations involved in is to be implemented.

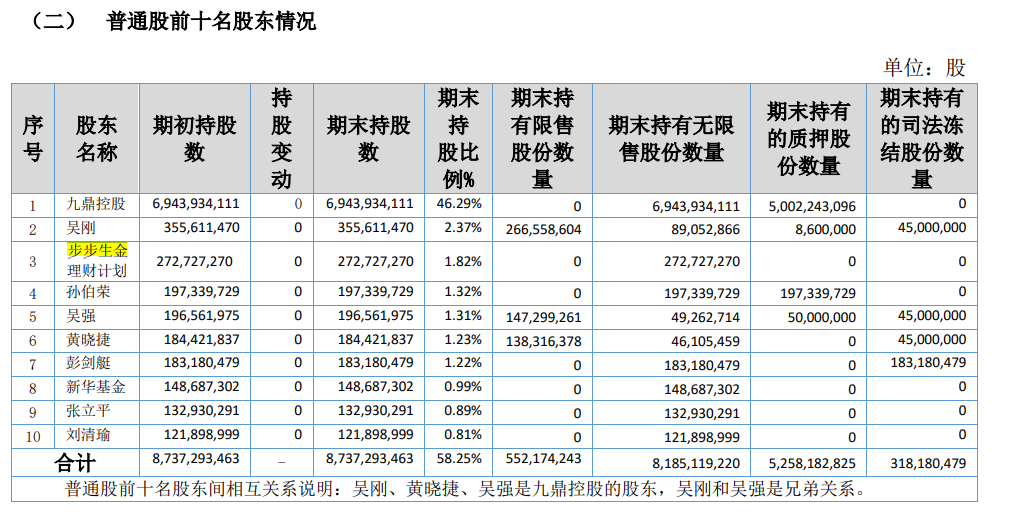

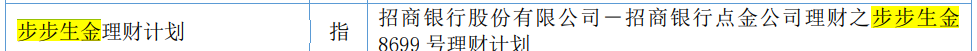

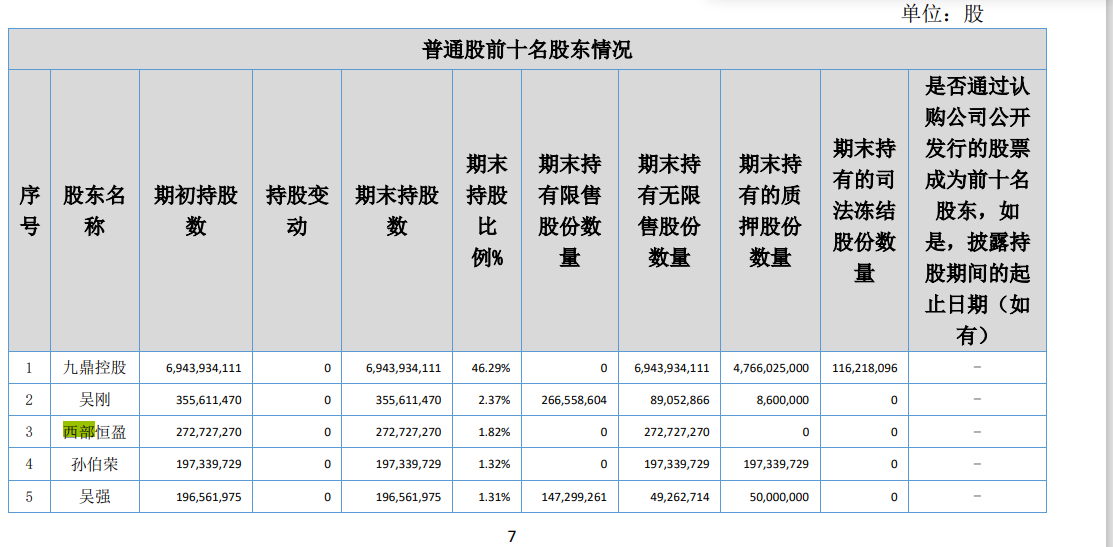

Secondly, until the third quarter of 2021, "Western Investment Merchants Kuaulu No. 1" has always been the third largest shareholder of Jiuding Group, holding 272 million shares. However, the 2021 annual report began, and the "Western China Merchants Kuaulu No. 1" has withdrawn from the ranks of Jiuding Group's shareholders. An "China Merchants Bank Co., Ltd. -China Merchants Bank Point Gold Company Financial Management Fortune 8699 Wealth Management Plan" (hereinafter referred to as "Step Shengjin 8699") has become the third largest shareholder of Jiuding Group, and " The Western Hengying China Merchants Kuaulu No. 1 "holds a few shares and a lot. Until the 2022 semi -annual report, this "Step Born Gold 8699" was still unparalleled. In the announcement, Western Securities clearly stated that "Western Investment Merchants Quick Deer No. 1" has been terminated. What is the relationship between "Baying Gold 8699" and "Western Merchants Quick Deer No. 1"?

2022 Half -annual report screenshot

Screenshot of the three quarters of 2021

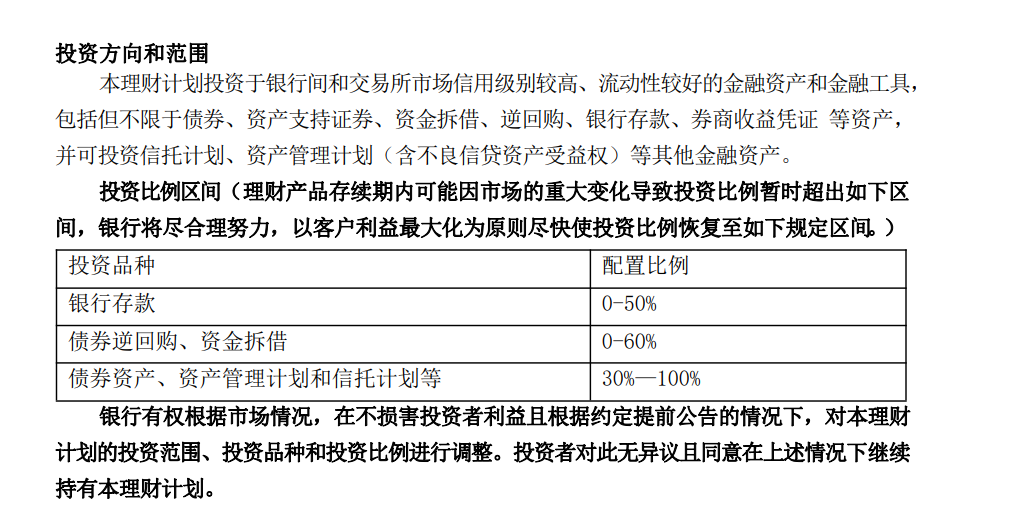

In addition, China Merchants Bank's official website shows that "China Merchants Bank Point Gold Company's Fortune Gold 8699 Wealth Management Plan Product Manual" clearly states that it is invested in financial assets and finance with high credit levels and good liquidity in the market between banks and exchanges. Tools include, but not limited to assets such as bonds, asset support securities, capital borrowing, inverse repurchase, bank deposits, brokerage revenue vouchers, etc., and can invest in other financial assets such as trust plans and asset management plans (including non -performing credit asset benefits). Its risk rating is only PR2.

So, how does "Baying Gold 8699" become the third largest shareholder in Jiuding Group?

In short, this announcement of Western Securities revealed the tip of the iceberg left by Jiuding Group's history. How to develop in the future, "Daily Economic News" will continue to pay attention.

Daily Economic News

- END -

It is expected to be 250,000 tons of wheat products this year!The acquisition of Xialiang in Yunnan Province is smoothly promoted

recentlyAccording to the Provincial Food and Material Reserve BureauAll department...

Policy development financial instrument funds to accelerate the development

Our reporter Bao XinganThe pace of 300 billion yuan in policy development financial instruments is accelerating to key areas of infrastructure. Recently, a number of major projects in Jiangsu, Zhejian