Relying on the risk of large customers, Green Sini intends to listed on the New Third Board

Author:Daily Economic News Time:2022.09.26

Recently, Wuxi Green Sitong Automation Equipment Co., Ltd. (hereinafter referred to as Green Sitong) has made new progress in the basic layer of the New Third Board. At present, the company has responded to the first feedback from the listing of the National Stock Transfer Company.

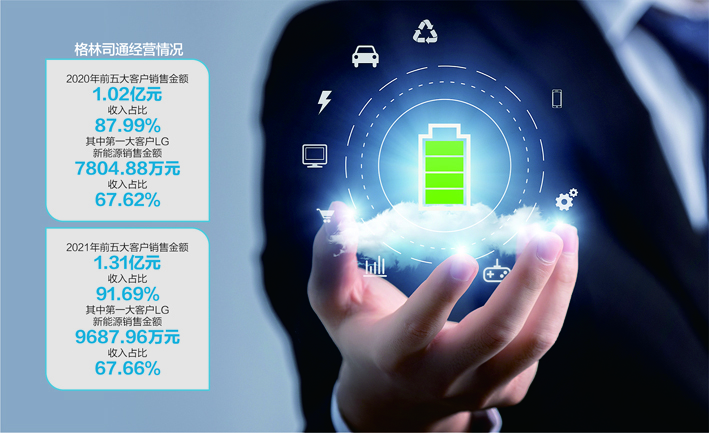

The main products of Green Sitong's production and sales are customized lithium battery manufacturing equipment. In 2020 and 2021, the company realized operating income of 115 million yuan and 143 million yuan. LG's new energy) sales amount is high, and the income accounts for 67.62%and 67.66%, respectively. There are risks that have a higher concentration of customers and rely on the largest customers.

Data source: Reporter sorted out the visual Chinese map Yang Jing map

The company's business scale is relatively small

In 2021, the battery industry has increased, and Green Sitong has gradually increased the amount of orders after the cooperation with customers gradually deepened, thereby achieving a year -on -year increase of operating income by 24.05%.

At the same time, the company's customer concentration has further increased. In 2020 and 2021, the total sales amount of the five major customers in 2021 was 102 million yuan and 131 million yuan, respectively, with revenue accounting for 87.99%and 91.69%, respectively; the largest customers LG, LG, respectively. The sales amount of new energy was 78.888 million yuan and 96.879 million yuan, respectively, and the income accounted for 67.62%and 67.66%, respectively.

Regarding the high concentration of customers, Green Sitong said that the company's main downstream industry lithium battery concentration is relatively high, LG chemical market share of LG new energy is relatively high, LG new energy procurement scale is large, and the company's business scale is large, and the company's business scale Relatively small, so the largest customers account for relatively high income.

The comparable companies listed by Green Sitong have also occurred in 2021. In 2021, the sales revenue of the top five customers accounted for more than 50%. However, compared to the leading intelligence (SZ300450, the stock price is 53.55 yuan, the market value is 83.739 billion yuan), Yingshe Technology (SZ300457, the stock price is 25.88 yuan, and the market value is 16.81 billion yuan). The proportion is higher (91.69%in 2021).

In this regard, Green Sitong said that the company and the two comparable companies are different in the development stage, customer groups, and products. Compared with the same industry, the company is small in size. high.

It can be seen that Green Sitong's operating performance depends on LG's new energy, and the stickiness of cooperation with LG new energy is very important. "Daily Economic News" reporter noticed that in January 2022, Green Sitong realized operating income of 1.195 million yuan, of which the sales of the top five customers accounted for 98.80%, but the customers in LG new energy only ranked only ranked No. Fourth, income accounts for 5.36%.

The income status in the first month of 2022 naturally does not have comparability. According to the feedback from Green Sitong, on January 31, 2022, the company's order amount was 196 million yuan; the new signing amount from February to June 2022 was 117 million yuan. Green Sitong said that the company has sufficient sources of new orders after hand orders and periods, the largest customers have stable operations, and their income growth is sustainable.

So how much is the proportion of LG new energy in the newly signing orders and after -date signing? In this regard, the reporter of the Daily Economic News called Green Sitong and sent an interview email on August 23, but as of the press time, no reply was received.

In terms of account receivables, as of the end of January 2022, the accounts of the top five units of accounts receivable are mostly "within 1 year", and the accounts of LG new energy are "within 1 year, 2 to 3 years "". Green Sitong explained that the business representatives of LG New Energy Korean legal entities were hospitalized for a long time and failed to fulfill their work responsibilities normally. Disputes in payment, the risk of unable to recover this amount is low, so no time to urge the money in time, nor does it prepare for the bad account of the bill. As of the date of the company's replies, the customer has paid the payment by the telephone promise in August 2022.

The net profit in 2021 decreased significantly

Although the company's revenue scale increased, the company's net profit in 2021 decreased significantly. In 2020 and 2021, the company's net profit was 20.284 million yuan, -59.118 million yuan, respectively, and the decline in 2021 was 129.15%; In 2020 and 2021, non -net profit was 17.6371 million yuan and 9.739 million yuan, respectively, and the decline in 2021 was 44.79%.

In 2021, non -net profit declined significantly, mainly due to the decline in gross profit margin, R & D expenses and sales expenses. Due to the increase in order volume in 2021, Green Sitong's business scale and personnel have expanded, and the cost of increasing the current profit and loss period increases. At the same time, the company's income confirmation cycle is longer, and the income growth is lagging behind the growth rate of order.

In terms of gross profit margin, Green Sitong's gross profit margin in 2020, 2021, and 2022 was 39.29%, 35.26%, and 33.50%. In 2021 In order to maintain the market price competition advantage, the sales side did not increase the price at the same proportion, which led to compression of gross profit. The required raw materials copper, steel, and iron such as metals such as steel, steel, and iron rose rapidly from 2020 to the end of 2021, resulting in a large increase in the company's main business costs. In January 2022, the company's gross profit margin continued to decline, mainly due to the higher proportion of accessories with relatively low gross profit margin. Green Sitong said that as the company's gross profit margin tended to stabilize in 2022, the delivery of hand orders caused a decline in performance, which was basically eliminated in the future.

When the price of raw materials rises, the product does not increase the price at the same time. Is the company's bargaining ability for downstream customers weak? Green Sitong said in the feedback response that when the price of raw materials rose, orders that have been priced and signed for contracts, if the price rises within the company's tolerance, the company generally does not increase the sales price. limit. For the new contract, the company will adjust the quotation to customers at the rise of raw material prices when pricing. The two parties will determine the final price in combination with the increase in raw material price gains and supply and demand relationship, so they have the ability to conduct price pressure downstream.

Daily Economic News

- END -

In 11 days, 10 days, Ganneng shares rose daily after resumption of trading on July 19

On the evening of July 18, 2022, Ganneng (000899.SZ) issued an announcement of the results of the shares suspension verification.The company's stock transactions have accumulated four abnormal fluctua...

The 7th China -Asia -Europe Expo will be held from September 19th to 22nd

Tianshan News (Reporter Hei Hongwei) The seventh China -Asia -Europe Expo will be ...