New financial infrastructure 丨 The banking industry is fully embracing the native cloud. Can small and medium banks really usher in new opportunities?

Author:21st Century Economic report Time:2022.09.26

21st Century Business Herald reporter Li Lianqing Shanghai report

The construction of the cloud platform of financial institutions has entered a new stage.

With the continuous improvement of financial digital transformation and controlling and controlling, banking institutions that have initially realized the IT system "Shangyun" are accelerating the application of cloud native technology.

In the interim reports released by major listed banks recently, Bank of China, Construction Bank, Ping An Bank, Industrial Bank, Minsheng Bank, Everbright Bank, Bank of Beijing, Bank of Shanghai, Zhejiang Commercial Bank, etc. all disclosed the relevant progress of its application of its cloud native technology applications breakthrough.

However, in the process of the transformation of the banking industry, head banks have also gone through many "detours", such as high technical liabilities, difficult to meet personalized demand, long system construction cycle, high trial and error cost, insufficient system stability, etc. Series issues. Under the blessing of Yun's native technology, will it be a key opportunity for small and medium banks that do not have the advantage of scientific and technological investment and scientific and technological personnel.

The "Shangyun" process of the banking industry

Yunyuan is derived from cloud computing, and its construction and deployment are based on the cloud platform. It is a technical method of building and running applications. Traditional cloud computing services include infrastructure, such as service (IaaS), platform, service (PAAS), and software, such as SaaS, and after the clouds have been implemented in infrastructure, platforms, and software, the next step will be unified through the next step through unification. The standard is built on the cloud, which is the original cloud. The use of cloud native applications from architecture design, development to deployment and maintenance is carried out on the cloud platform.

Compared with the traditional hardware infrastructure, the cloud computing platform is limited to departments, levels, and regions, which can realize the highly reused, flexible scheduling and effective supply of resources. Based on standardized cloud native technology, it further reduces the difficulty of application development on the cloud, and continuously split the product into "microservices", making the development decision -making efficiency more agile.

The 21st Century Business Herald reporter combed the current situation of the current cloud platform of 18 listed banks based on the annual report of the listed bank 2021 and the semi -annual report of 2022. Currently, in the six major banks, the ICBC strengthens the promotion and implementation of the cloud platform, and the scale continues to maintain the scale. Leading in the industry, the average daily service content of strengthening the distributed technology system exceeds 15 billion; the computing resource cloudization rate of Agricultural Bank of China has reached 91%; the retail terminal of the Postal Savings Bank has completed the private cloud platform deployment of 190 systems. Among the joint -stock banks, CITIC Bank's infrastructure cloudization rate reached 99.7%; China Merchants Bank made more than 90%of cloud progress, and the retail business has entered the era of cloud service; Ping An Bank infrastructure and operation and maintenance automation rates have exceeded 90%exceeded 90% ; Everbright Bank's business application system is close to 90%.

In addition, Bank of China, Construction Bank, Ping An Bank, Industrial Bank, Minsheng Bank, Everbright Bank, Bank of China, Bank of Shanghai, Zhejiang Commercial Bank, etc. have disclosed the breakthroughs in the progress of its cloud native technology application in the financial report.

The bank is "Shangyun" Road

The banking industry "Shangyun" began with the requirements of the financial information system independent, safe and controllable.

In 2014, the Banking Regulatory Commission, the Development and Reform Commission, the Ministry of Science and Technology, and the Ministry of Industry and Information Technology jointly issued the "Guiding Opinions on Application Security and Controlling Information Technology to strengthen the network security and informatization construction. The application of information technology has increased year by year, and it has increased year by year, until 2019 reached a total proportion of not less than 75 %.

The changes and policy guidance of hardware infrastructure have continuously promoted the migration of the banking information system to the cloud computing architecture platform.

In 2016, the "Thirteenth Five -Year Plan" of the Development of the Bank of China Information Technology "further clarified that the banking industry should be steadily implemented. By the end of the" Thirteenth Five -Year Plan ", all important information systems for the Internet scene migrated to the cloud computing architecture platform The migration ratio of other systems is not less than 60%.

In September 2019, the central bank issued the "Financial Technology Development Plan (2019-2021)", which requires a reasonable layout of cloud computing, guided financial institutions to explore cloud computing solutions, build a safe and controllable financial industry cloud service platform, build centralized and concentrated and concentrated and concentrated and concentrated and concentrated and concentrated financial industry. Distributed and coordinated development information infrastructure architecture, strengthening cloud computing security technology research and application.

By this year's "Financial Technology Development Plan (2022-2025)", it further requires to accelerate the application of cloud computing technology specifications, and steadily promote the transformation of the distributed structure of the information system to multi-node parallel operation, data distribution storage, and dynamic load balancing to achieve realization to achieve realization. The allergenic and steady -state dual -mode coexist, distributed, and concentratedly interact with each other.

Over the years, head banks have also gone through many detours in the course of exploring "Shangyun".

The reporter learned that although some large state -owned banks have not disclosed the cloudization rate of specific businesses, the scale of clouds is far beyond the same industry. As the information system is too large, the migration process is very difficult, and the overall progress is not as expected.

"The migration of the leftover system is the most difficult." Xu Xinzhang, a senior technical expert of Hang Seng Electronics, told reporters that in the process of helping the bank to the cloud platform, how to put the original system based on traditional technology stacks and servers, under the condition of ensuring stability to ensure stability "Shangyun", and eventually realizing the unity of the entire platform, requires a very large workload.

The technical expert of a cloud computing service provider analyzed the problems that had occurred in the transformation of the bank in the cloud native transformation to reporters. , Pay high trial and error cost. Secondly, it is difficult to meet personalized demand. Because different manufacturers' cloud service technology stacks are not standard, it is difficult to develop self -research and development, and the production cycle of innovation business is extended. Finally, the system architecture is not uniform and cannot adapt to flexible changes, resulting in insufficient stability. The 21st Century Economic Herald reporters have been concerned that CITIC Bank and Everbright Bank have deployed the cloud platform 1.0 stage with virtualization as the core in 2012, and opened the full stack cloud construction in 2021.

"CITIC Bank launched the financial full cloud project in 2021. The goal is to cover five years of full replacement in two years in a year, which means that all business systems of CITIC Bank will be migrated to the full stack cloud platform in the next 5 years."

Kou Guan, general manager of CITIC Bank Information Technology, frankly said to reporters that when banks began to expose Yunxing technology, different technologies, manufacturers and management tools were introduced on different nodes such as server, network end, and storage. Compared with Internet companies, banks do not have their own full -stack cloud architecture, and the introduction of cloud native technology is not enough systematic. The full stack of the public cloud architecture is introduced into a private cloud environment, facing many technical challenges. At the same time, the operating and maintenance costs of full stack clouds are relatively high, not only simple technology introduction, but also the support of operating and maintenance talents. To this end, CITIC Bank is accelerating the introduction of talents in related fields to support the construction and maintenance of full stack clouds.

"The cloud native transformation practice of the head bank is at the forefront of the financial industry, and it is constantly trial and error during the whole process. It is inevitable that the detours are inevitable." In recent years, in the case of rigorous risk compliance supervision, the deployment requirements of different businesses in different environments such as mixed clouds and private clouds have also different.

Can small and medium banks usher in new opportunities?

For head banks with advantages in technology investment and personnel, IT "Shangyun" is still difficult. How can small and medium banks that "lack money" enhance their business innovation capabilities through cloud platform construction?

Yun's native technology reduces the difficulty of development of cloud applications for small and medium -sized banks.

Containers, microservices, statement APIs, and service grids are all representative technologies of clouds. Its common characteristics are standardized and immutable infrastructure. This means that the application development based on cloud native technology can ignore the difference in traditional hardware infrastructure, and improve the resource utilization rate as much as possible. At the same time, through microservices to adapt to business needs, enhance the agility of business, so that Make decision -making and development efficiency.

"In recent years, the development of open source technology communities has flourished, making it easier for Yunxing technology to obtain and verify, but the cost of using Yunyuan in the core business scenario is still very high." Zhu Jianfeng told reporters that for small and medium banks, limited resources within the resources of small and medium -sized banks, in the limited resources, within the limited resources, within the limited resources, in the limited resources, in the limited resources, the limited resources are within the resource. It is also important to learn from the scenes that head banks have practiced, and it is also important to choose a service provider with strong technical background and actual experience in head banks.

At the same time, for small and medium -sized banks, the lack of scientific and technological personnel is still a difficult problem.

Xu Xinyu pointed out that for small and medium banks with a high degree of "cloudization" in infrastructure, standardized cloud native technology can help it achieve pilot innovation in some business. The application development threshold, but in the process of subsequent operation and maintenance, the support of the internal cloud computing talents inside financial institutions still requires the support of cloud computing talents. If it is purchased by external procurement, further operation and maintenance cost pressure will be formed.

Kou Guan suggested that for small and medium -sized banks that are slightly insufficient in funds and personnel, it should not be simple and blindly introduced to advance technology. It should start with some business pilots and comply with its own actual innovation.

(Coordinated: Zhou Yanyan)

- END -

64.8 billion Honey Snow Ice City, overestimated or underestimated?

@新 新 新Author 丨 Bai Yan Editor 丨 Moon SeeIn 1997, Zhang Hongchao opened a cold...

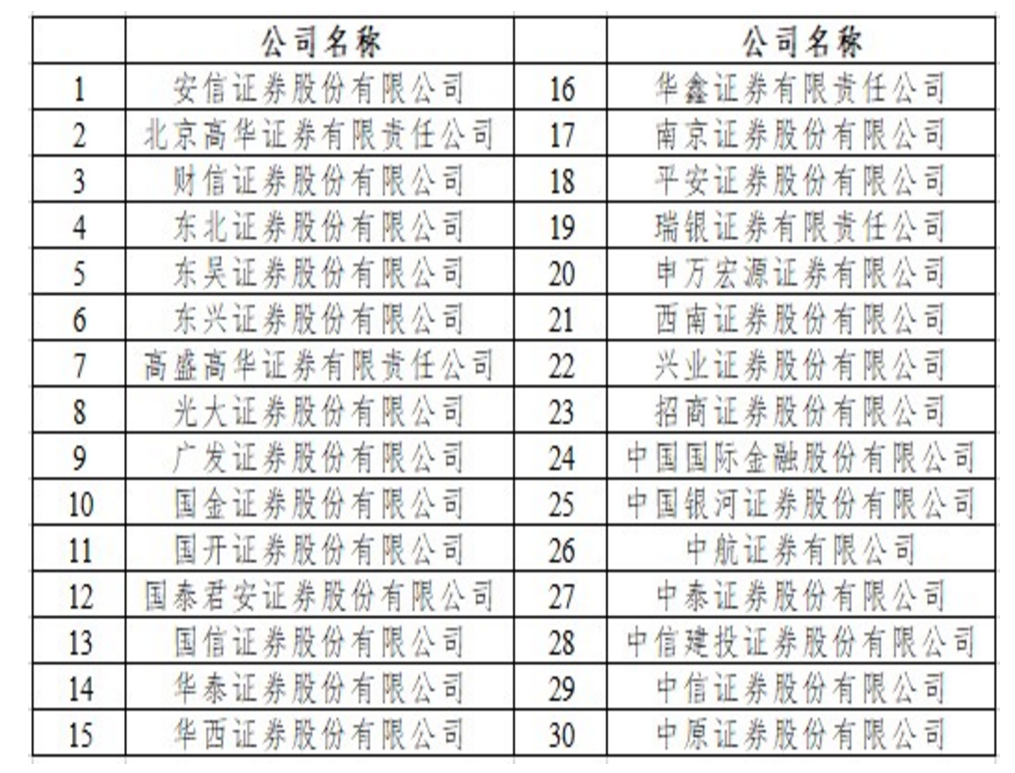

The Securities and Futures Commission announced the "whitelist" of the brokerage firms in June.

On June 22, the Securities Regulatory Commission released a new issue of the white...