Increased over 200 million yuan to increase holdings: He Xiaopeng bought 2.2 million shares of Xiaopeng Automobile US stocks

Author:21st Century Economic report Time:2022.09.26

21st Century Business Herald reporter Song Doudou Guangzhou report

On the evening of September 25, Xiaopeng Automobile (XPEV.N/9868.HK) issued an announcement saying that the company's controlling shareholder Simplicity Holding Limited The average price of stocks is $ 13.58 per share.

Simplicity Holding is wholly -owned by the founder of Xiaopeng Automobile and CEO He Xiaopeng. Based on this calculation, He Xiaopeng's increase in his holdings was about US $ 29.876 million (about 210 million yuan).

After the increase in holdings, He Xiaopeng held about 328 million category B ordinary shares and 2.2 million U.S. deposit stocks, as well as the company held by RESPECT HOLDING in the company held by the company, holding the company 21 million. The shareholding ratio is 20.5%.

The board of directors of Xiaopeng Automobile believes that the increase in holdings shows He Xiaopeng's confidence in the prospects and growth potential of Xiaopeng Automobile, as well as his long -term promise in the company.

Affected by this news, Xiaopeng Automobile's Hong Kong stocks rose rapidly today, which rose more than 11%for a time. As of the closing, it was HK $ 56/share, an increase of more than 8%; Xiaopeng Automobile's US stock market rose nearly 5%.

In fact, from Weilai's successful landing on the New York Stock Exchange, countless hot money flooded to the smart electric track, and Tesla's trillion market value "myth" pushed capital carnival to a climax, and the head of "Wei Xiaoli" was the head. The new car company was once the darling of the capital market.

However, the time of transit has changed. The current financing environment has changed a lot compared to a few years ago. The capital carnival is also rapidly cooling. The valuation of the new energy vehicle sector has returned sharply.

As of 4 pm on September 23, the Eastern Time, Xiaopeng Automobile closed at $ 13.71/share, which was lower than the US stock issue price of $ 15/share two years ago; the ideal car closed at $ 25/share, Weilai Automobile Newspaper News Receive $ 17.64/share. Rough statistics have evaporated more than 310 billion yuan in the US stock market in the US stock market for nearly three months, and the market value has shrunk sharply. From the beginning of this year to the present, Weilai, ideal, and Xiaopeng's market value fell 40%, 22.5%, and 72.7%, respectively.

If the timeline is extended, the three stock prices and market value of the three "Wei Xiaoli" have fallen more obvious. Weilai's stock price reaches about 57 US dollars/share, Xiaopeng is up to about 55 US dollars/share, and the ideal is over 40 US dollars/ In contrast, Weilai and Xiaopeng's stock prices were less than half of the peak.

It is worth mentioning that Xiaopeng G9, the fourth model of Xiaopeng Motor's high hopes of gross profit, has gone through 48 hours of "shock" -at 7 pm on September 21, G9 was officially listed, claiming "receiving Pacific Jetsu Chengcheng The new benchmark "" sells more than the Audi Q5 next year ", with a price range of 309,900 to 469,900 yuan.

However, due to the messy naming method, complex optional logic, the main intelligence, but not equipped with any auxiliary driving functions on low -profile models, social platforms are full of sounds such as "unintelligible" and "recreational".

At 4:30 pm on September 23, Xiaopeng G9 did not announce the order volume, but officially announced the product naming, price and configuration. After the configuration upgrade, the price of G9 models is 22,000 to 30,000 yuan, which is called "the fastest price reduction in history".

Xiaopeng, who is currently underway, is facing a lot of pressure.

According to the financial report data, in the first half of 2022, Xiaopeng's total revenue of Xiaopeng, who had the most daily amount of the three companies, had the lowest total revenue. Due to the lower price of the model and the limited profit space, Xiaopeng Automobile's gross profit margin (10.9%) is much lower than Weilai (16.7%) and ideal (21.5%).

At the same time, the weakness of the market has appeared, and the G3 is close to the end; the sales volume will usher in the replacement of P7 next year. Pull Model 3, Changan Deep Blue SL03 and so on. With the overall rise of the new energy vehicle market, the sales of Xiaopeng Automobile have declined month by month. The sales of Xiaopeng Automobile in July and August this year were only 11,524 and 9578, respectively.

The heavy task of impacting sales and increasing gross profit will fall G9. "With the launch of G9 and subsequent new platforms and new models, we will improve the gross profit margin of the model structurally. Our medium and long -term goal is to increase the company's overall gross profit margin to more than 25%." He Xiaopeng express.

However, the G9 is also facing fierce competition. Weilai ES7 and the ideal L9, which are both medium and large SUVs, have been delivered one after another. The ideal L8 also officially announced that it will be listed on the 30th of this month. In addition to new cars, the second generation of traditional car companies such as Avita 11, Ask Realm M7, Lan Tu FREE, etc. are also accelerating the new.

"I think the first generation of the new forces today is actually on the curve. There may be a little bit in front of the curve, and Xiaopeng is also in the curve. The curve means that the entire enterprise is entering the next generation of technology and product cycle. , Enter the new customer demand cycle. How to control the speed on the curve and be able to turn too fast, this is a challenge. "

- END -

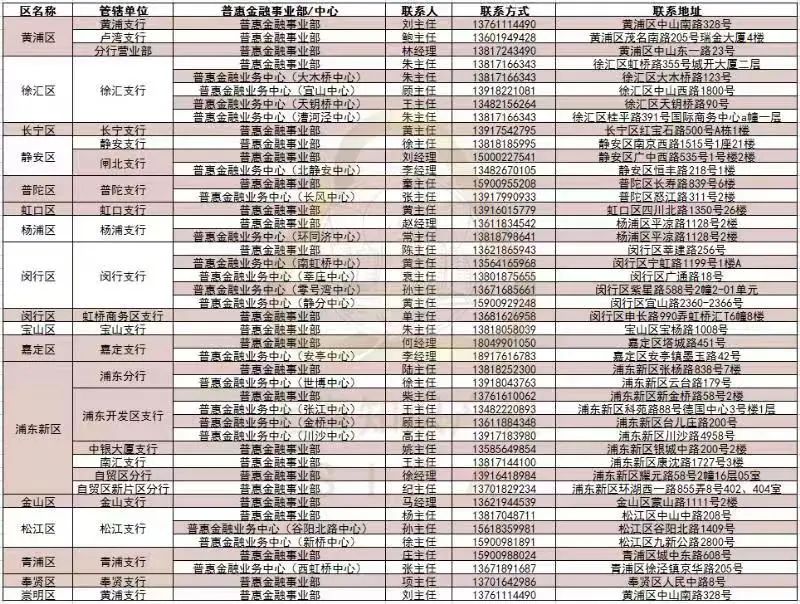

Shanghai starts the trademark pledge to help the city's restaurants such as catering, cultural tourism, and other key industries for bailout "Zhihui Bank" special activities

The Municipal Intellectual Property Office and the Bank of China Shanghai Branch c...

16 years after running, Sequoia Capital Clear Clearance Meituan, what should we think of the future of Meituan?

Recently, takeaway rivers and lakes can be described as changing. In this context,...