Xinhua Insurance Personnel Change: Xu Zhibin resigned, Li Quan was elected as the chairman and Zhang Hong planned to serve as president

Author:Daily Economic News Time:2022.09.26

On the evening of September 26, Xinhua Insurance (SH601336, stock price was 26.85 yuan, and a market value of 83.76 billion yuan) continuously released two announcements, announcing its recent personnel changes. The announcement stated that the board of directors received a letter of resignation from Chairman Xu Zhibin on September 26, 2022. Mr. Xu Zhibin resigned from the position of chairman, non -executive director, and chairman of the strategic committee of the board of directors due to work reasons.

Source: Xinhua Insurance Announcement

Another announcement shows that at the board of directors on September 26, Xinhua Insurance reviewed and approved the "Proposal on the Chairman of the Seventh Board of Directors of the Company" and the "Proposal about the President of the Company". The chairman of the seventh board of directors and Mr. Zhang Hong as the president of the company. At present, the above two personnel appointments are approved by the Banking Regulatory Commission.

Li Quan was elected as the chairman

Public information shows that Li Quan was born in 1963 and obtained a master's degree in economics from the Graduate Bank of the People's Bank of China in 1988; then he entered the banking department of the banking of the Rural Trust and Investment Corporation of China; In 7 years, he served as the general manager of the funding department and assistant to the company's general manager; in May 1998, he became the director of the Boshi Fund, deputy general manager, executive deputy general manager, and deputy secretary of the party committee. Essence

According to the information of Xinhua Insurance's official website, Li Quan is currently internal and several positions within Xinhua Insurance: Executive Director, CEO, President, and also concurrently served as asset management companies, asset management companies (Hong Kong) and Xinhua Pension Insurance Chairman. During Li Quan's president of Xinhua Insurance, he partnered with two chairman, including Liu Haoling and Xu Bin. Today, Li Quan is also expected to become the new chairman of Xinhua Insurance.

Source: China Reinsurance Group Announcement

It is worth mentioning that, in addition to Li Quan's plan to serve as the chairman of Xinhua Insurance, the candidates who replaced Li Quan's proposed president also appeared in the announcement, that is, in 2019, the chairman of the Supervisor of China Reinsurance Group (resigned in July 2020) Zhang Hong, the deputy secretary of the party committee (right) of Xinhua Insurance. Judging from the official website information, Zhang Hong is the first vice president (right) among Xinhua Insurance executive team.

Source: Xinhua Insurance Official Website

Public information shows that Zhang Hong, born in 1964, has a bachelor's degree in English in English in the International Relations College. He originally served as China People's Insurance Corporation and China Insurance (UK) Co., Ltd., and then entered China Reinsurance Group. He used to work in China. He used to work in China. He used to work in China. The executive director, president, supervisor, chairman of the China Real Estate Insurance, the general manager and chairman of the China Real Estate Insurance, the Director of the Earth Insurance, the Director of China Real Estate, and the chairman of the China Nuclear Insurance Community.

At present, the qualifications of Li Quan and Zhang Hong are yet to be regulated and approved.

It will focus on the three major areas of Kangyang, Technology and marketing

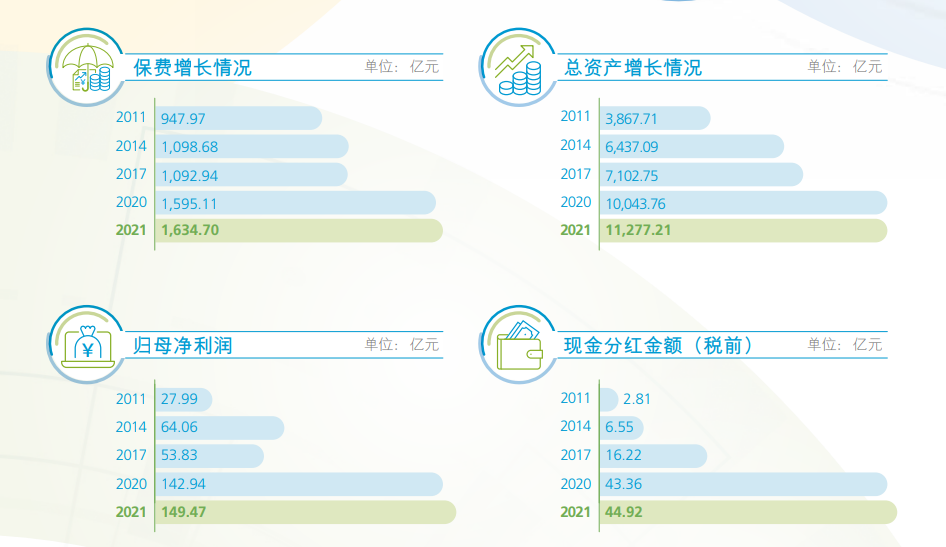

Public information shows that Xinhua Insurance was established in September 1996. It is one of the top 500 companies of the State -owned Holding Listed Life Insurance Corporation, China Investment Direct Management Enterprise, Fortune and Forbes. The company's main shareholders are Central Huijin Investment Co., Ltd., China Baowu Iron and Steel Group Co., Ltd., etc. In 2011, Xinhua Insurance was listed simultaneously on the Shanghai Stock Exchange and the Hong Kong Joint Exchange. In 2021, Xinhua Insurance has established a sales and service network covering the country, with a total of more than 1,770 branches. The original insurance premium income exceeded 160 billion yuan and the total assets exceeded trillion yuan.

Source: Xinhua Insurance 2021 Financial Report

In June 2022, Xinhua Insurance's 2021 Annual shareholders' meeting reviewed and approved the "Company" Fourteenth Five -Year Plan for Development Plan ". Deeply cultivate the main channel of life insurance, promote the "one ship, three engines to speed up the voyage", that is, focusing on deep -cultivating life insurance main channels, focusing on promoting the three aspects of the pension industry, the development of a healthy industry, and strengthening the asset management business, helping to achieve "secondary flying excellent Xinhua" Milestones. In order to ensure the implementation of the floor, the planned planning includes sub -planning of ten areas including products, channels, investment, finance, capital, and talent teams as the implementation of the entire "Fourteenth Five -Year Plan", and determine the marketing capabilities and recreational industry from it. And science and technology empowerment as three key projects. At present, the "three major projects" have achieved staged results.

Source: Xinhua Insurance Announcement

Xinhua Insurance stated that under the leadership of the company's "three meetings and one floor", it will adhere to the "Fourteenth Five -Year Plan" as the starting point, and force the "three major key reform projects" to land, accelerate the promotion of high -quality development and transformation, and comprehensively activate the company Develop vitality and create more advanced products and services that meet customer needs.

Daily Economic News

- END -

German media: This statement about China is the myth of "boosted" in the United States

Germany's Munich Embassy on August 10, the original title: between the so -called ...

Heavy!"Digital Collection Application Reference" release

Yuan Shi, which provides underlying technology with the underlying technology of the Chinese Digital Literature Chain, is the first platform for the national -level Wenbo resource exchange platform.