The "Fengkou Research Report · Company" company has just achieved a breakthrough of a parity seaside of 200 million yuan. At the end of the year, there will be 1 billion yuan+orders are expected to ensure the order with geographical advantages.space

Author:Federation Time:2022.09.26

① The company has just achieved a breakthrough of a cheap seal cable to 100 million yuan. At the end of the year, there will be 1 billion yuan+orders are expected to ensure the order with geographical advantages. Analysts look at more than 80%of the valuation repair space; ② new energy vehicle The demand for high -voltage and high -speed cables has increased greatly. This company has the advantages of large customers+cost dividends, and its market share has strongly improved. Analysts expect the compound growth rate of performance in the next three years by 50%+.

"Fengkou Research Report" Today Introduction

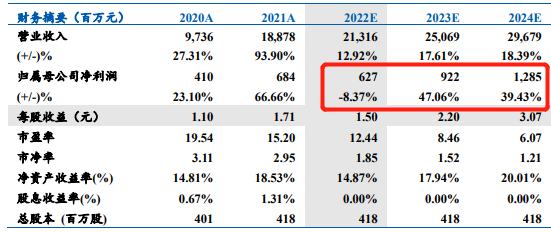

1. Company 1: ① The company's winning Huaneng Cangnan No. 2 Sea Wind Power Project 35 kV sea cables and affiliated equipment procurement, the winning bid amount is 94.7934 million yuan. The zero breakthrough of the cable consolidates the company's market competitive strength; ② The company will start the construction of Beihai's foundation this year. It is expected to be put into production at the end of 2023. It is expected to benefit from the outbreak of the Guangxi sea breeze, obtaining 1 billion yuan+sea cable orders; ③ the company's orderly expansion of land cables It is expected to add 15%+each year. After the production capacity of Chizhou reaches the production capacity, the total land cable production capacity can cover at least the next three years of land and cable orders; ④ Han Jincheng believes that the company's land and cable bargaining ability is strong and the order of seal cables is expected to usher in an outbreak. It is expected that 2022 is expected to be 2022. -The net profit of home mother in 2024 was 6.27/9.22/1285 billion yuan (land cable target 6.2/75-8/900 million yuan, seaside 0/2/4 billion yuan), and a valuation of 2024 times was given. Corresponding to the reasonable valuation of 17 billion yuan, over 80%of the valuation repair space over 80%; ⑤ risk factors: The seaside base is less than expected.

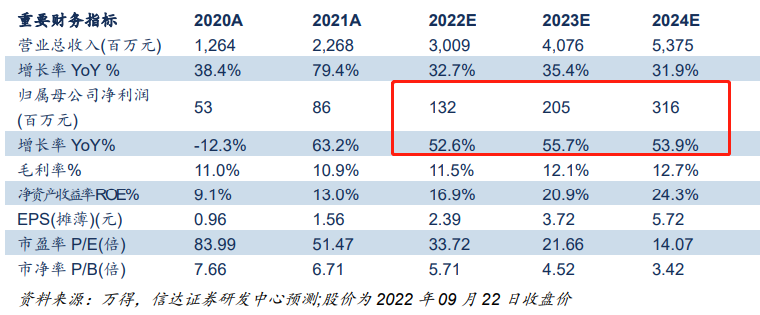

2. Company 2: ① The company is a professional automobile cable supplier. In recent years, the main business has been expanded from conventional cable to new energy cable business, and its net profit has increased significantly; Increased value, and aluminum materials replaced copper materials under the trend of lightweight, cost dividends appear; ③ the company's core competitiveness is outstanding, and the market share is expected to continue to increase; /2.1/3.2 billion yuan, a year -on -year increase of 52.6%/55.7%/53.9%, the first coverage was given to "buy" rating; ⑤ risk reminder: new energy vehicles are less than expected; special cable proportion is less than expected.

Theme one

The company has just achieved a breakthrough of a cheap sea cable to 100 million yuan. At the end of the year, there will be 1 billion yuan+orders are expected to ensure the order with geographical advantages.

Event: Winfan cable win the 35 kV sea cable and affiliated equipment procurement of Huaneng Cangnan No. 2 Marine Wind Power Project. × 95 ~ 3 × 30026/35KV) and its auxiliary equipment, the winning amount was 94.7934 million yuan.

The latest China-Guang-CUU 1GW Sea Wind Project, the power of the bid model is between 11-14MW and the wind wheel diameter is between 225-262M. Strive the process of sea breeze parity.

Northeast Securities Han Jincheng covered the sail cable (605222) for the first time. The company's Yichang Water Cable Base at the end of the year was 2 billion yuan. Market competitive strength.

In addition, the company will launch the construction of Beihai's foundation (the only sea cable factory in Guangxi) this year. It is expected to be put into production at the end of 2023. It is expected to benefit from the outbreak of the Guangxi sea breeze and get 1 billion yuan+sea cable orders.

At the same time, the company's orderly expansion of land cables is expected to be newly added each year. After the production capacity of Chizhou reaches the production capacity, the total land cable capacity can cover at least three years of land and cable orders.

Han Jinxu believes that the company's land-cable bargaining ability is strong, and the order of seascapes is expected to usher in an outbreak. It is expected that the net profit of 2022-24 is 6.27/9.22/1.285 billion yuan (land cable target 6.2/7.5-8/900 million yuan , Sea cable 0/2/4 billion yuan), 13 times the valuation of 2024, corresponding to the reasonable valuation of 17 billion, and the valuation of more than 80%of the valuation repair space above.

The sailing cable breaks through the cheap waters cable market, and the Yichang Water Gable Base expands production

The company currently has a 35KV seaside vertical cable-armor production line and 1 220kV and Shanghai cable production line. Another high-pressure sea cable production line is under construction. At the end of the year Yuan.

The launch of the seal cable has seasonal characteristics. The capacity of the head enterprise is saturated, and the order overflow increases. The company also actively expands downstream central enterprise owners and local governments to strengthen the ability of seaside to take orders.

The company's submarine cable has achieved 400 million yuan+operating income in 2021, and has a wealth of array cable delivery performance. This time, the bidding of Zhejiang's array cables can achieve zero breakthroughs in affordable seaside cables and consolidate the company's market competitive strength.

The sailing cable layout of the Guangxi Water Cable Base, the seaside cable business is expected to break out

The company will start the construction of the Beihai foundation land this year. It is expected to be put into production by the end of 2023. It is planned to plan three vertical tower production lines and three suspension chain production lines. The capacity of the production capacity can reach 4.5 billion yuan. The standing tower production line can produce 220kV-500KV waters. The company already has 220kV and the production capacity of Shanghai cables and soft connecting heads.

The 2.7GW project of Guangxi racing will begin bidding at the end of this year. The planned sea -wind field address has a capacity of 22.5GW. Considering that the land cable has a strong attribute, it is optimistic that the company (the only sea cable factory in Guangxi) is expected to accompany the high speed of Guangxi Haifeng. In addition, the company also has a good ability to take orders in Shanghai and Zhejiang, and this year's overseas seaside is also expected to obtain order breakthroughs.

Chizhou orderly expansion of land cables, and the distribution channels consolidate the barriers

The company's land and cable revenue target is to maintain 15%of the year. The expansion of Anhui Chizhou has started. After production, the total land cable production capacity can reach 30 billion yuan, which can cover at least the next three years of land and cable orders.

The company's land and cables are mainly for small and medium -sized customers. They have established mature and rich distribution channels. They have strong bargaining capabilities and channels to build the company's competitive barriers.

Theme two

New energy vehicles have driven high -voltage and high -speed cable demand to increase greatly. This company has the advantages of large customers+cost dividends, and its market share is strong. Analysts expect the compound growth rate of performance in the next 3 years

Intelligent electrifying cable demand upgrades, Cinda Securities Lu Jiamin's latest coverage of cardiac (300863). In recent years, the company's main business has expanded from conventional cable to new energy cable business, and its net profit has increased significantly.

At present, the demand for special cables for automobiles is increased, and aluminum materials on the cost of cost materials are expected to rise. Lu Jiamin predicts that the company's net profit returned from 2022-2024 was 1.3/2.1/320 million yuan, an increase of 52.6%/55.7%/53.9%year-on-year. For the first time, the "buy" rating was given.

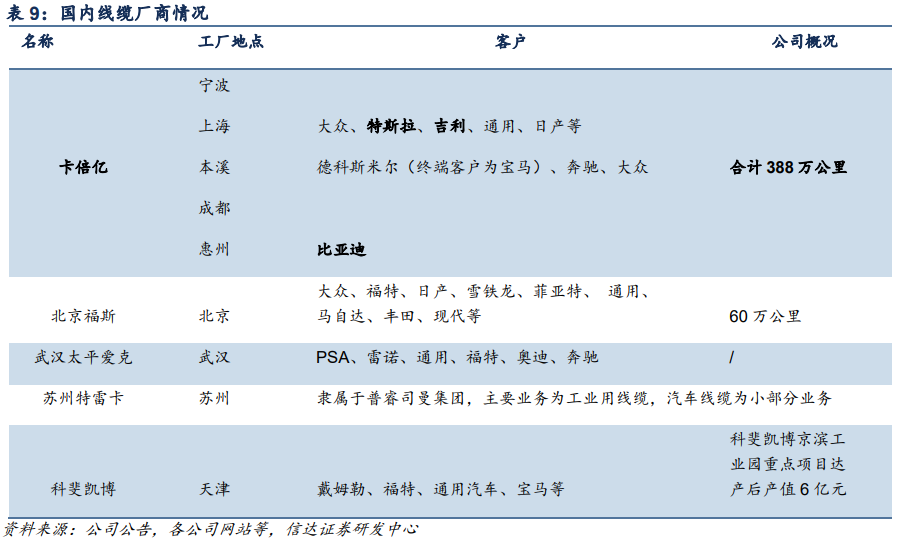

Professional automobile cable supplier, customer structure is high -quality and profitable

The company is committed to the development, production and service of automobile cables. The customer's structure is high -quality, and the company's terminal customers cover OEMs such as Volkswagen, BMW, Mercedes -Benz, Tesla and other OEMs; direct customers are leading companies such as Yasaki and Amborgin.

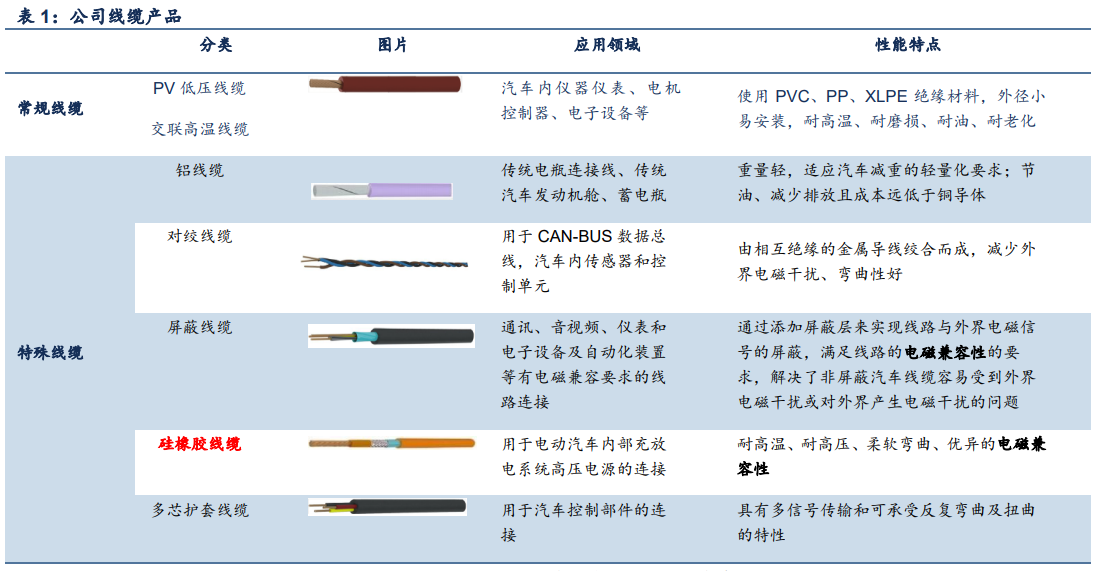

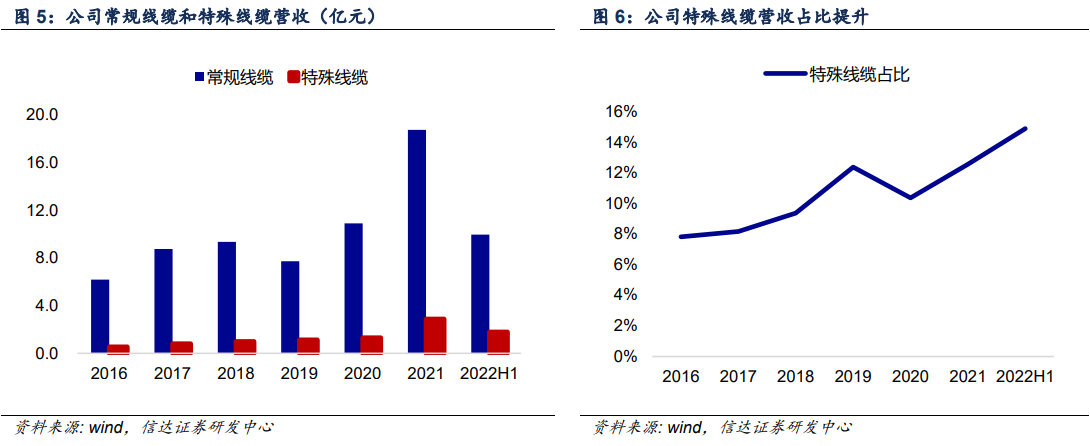

In 2021, the company's conventional cable revenue was 18.75 billion yuan, accounting for 82.7%, and special scope of special lines with higher profitability increased to 14.9%in 2022.

Intelligent electrifying cable demand upgrade, the trend of quantitative double rise is expected to continue:

1) The demand for special cables under the transformation of electrification is increased.

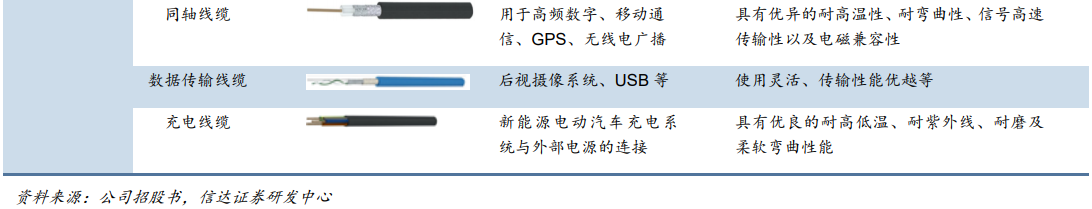

2) The wave of intelligence has arrived, and the demand for high -speed cables such as axis cables and data transmission cables has increased;

3) Under the trend of lightweight, aluminum is replaced by copper, and the head of the wiring industry, such as Thaiko, has developed a Litealum pressing cylinder for contacting aluminum conductors. The Kaidi has already available aluminum cable products.

Therefore, in recent years, the company is expected to directly benefit from the industry's intelligent electrification transformation, the revenue end has increased, the cost end has decreased, and it is expected to meet the double income.

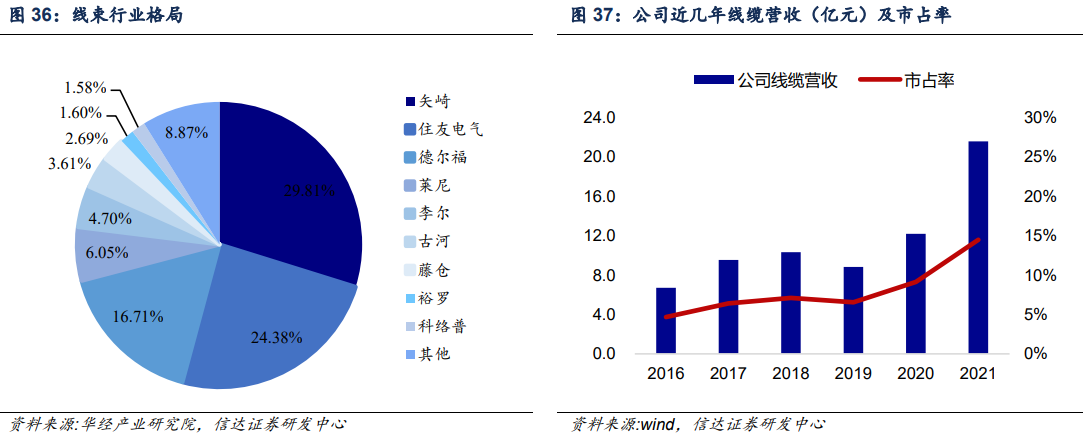

The domestic alternative process accelerates, and the company's market share is expected to continue to increase

The company's core competitiveness is as follows:

① Complete category advantages: cable products can cover the various needs of automobile wires. The company's cable product specifications cover the section from 0.13 square millimeters to 160 square millimeters, temperature-resistant level from -65 ° C to 250 ° C, which meets the national standard (QVR ), German Standard (FLRY), Japan Standards (AVSS), American Standards, etc.;

② The company has a warehouse in Shanghai, Nantong, Wuhan, Shenzhen, Changsha, Changchun, Yantai, and the Philippines, which is convenient for customers to supply customers.

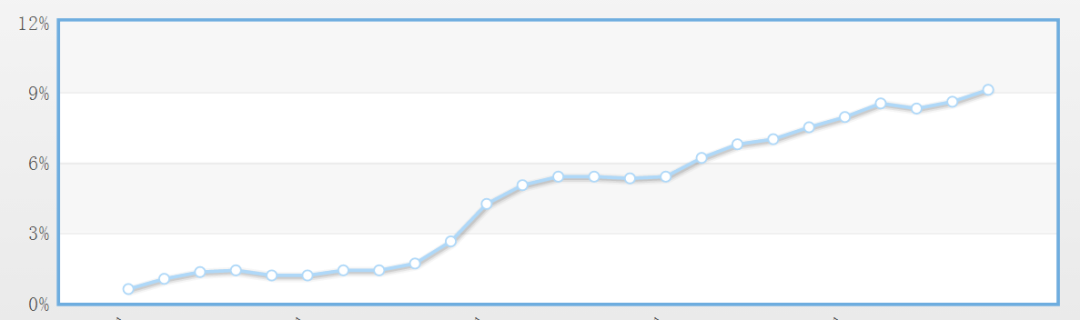

③ The advantages of large customers, the downstream line beam industry is highly concentrated. As a high -quality cable supplier, the company has increased its market share year by year, from 6.4%in 2016 to 14.6%in 2021.

The company has entered Tesla, Mercedes -Benz, BMW, Volkswagen, BYD, Geely and other supply systems. The total production capacity is 3.88 million kilometers, and its leading advantage is obvious.

Recent high -end manufacturing series in this column:

On September 26th, "Scenic Storage+New Energy Vehicle Electric Control+Smart Grid+Charging Pile. This company has more than 1,100 chip models and achieves" mainstream car companies+light storage leaders ". 4 times "September 25" Photovoltaic HJT core materials demand in the next three years may increase eight times. This company realizes batch supply Longji or the only military machine wing lightweight material supplier. "September 23rd" The performance in the next three years is expected to increase by more than 5 times. +Tongwei "Synchronous Episons" on September 20 "The upstream technology breakthrough brings the historic development opportunity of the chemical fiber. The company is the only domestic expansion enterprise and the scale of production capacity ranks first in China.

- END -

The demand for risk aversion has been pushed up. Can gold prices be further borrowed from Dongfeng?

Original Wang Yulin China Gold Network 2022-08-08 17:23 Published on BeijingIn Jul...

Han Yang, director of the Provincial Rural Revitalization Bureau, went to Antu County to investigate

On June 24, Han Yang, director of the Provincial Rural Revitalization Bureau, went...