2021 The comprehensive income of individual taxes ends on June 30, please declare in time

Author:Tianshan.com Time:2022.06.22

Tianshan News (Reporter Mi Ri Guli Nasr report) On June 22, the reporter learned from the tax bureau of the Autonomous Region: The comprehensive income of personal income tax in 2021 was calculated from March 1st to June 30th this year. It is necessary to apply for a tax exchange before June 30.

The annual exchange calculation refers to the annual income of four comprehensive income of the annual income of four comprehensive income of wages and salary, labor remuneration, manuscript remuneration, and franchise fees after the end of the year. In accordance with the annual tax rate sheet of the comprehensive income, calculate the personal income tax for the whole year, and then reduce the tax that has been paid in prepaid within the last year. In short, on the basis of pre -paid taxes on the basis of pre -paid taxes, "check the legacy, summarize the revenue and expenditure, settle the accounts annually, and refund more."

In Shuimogou Park in Urumqi, the State Administration of Taxation Urumqi City's Water -Mane District Taxation Bureau staff promoted the special additional deduction policy for personal income tax (taken on April 26). Figure/State Administration of Taxation, Urumqi City Water -Manegou District Taxation Bureau provided

"Comprehensive income annual exchange calculations will not only help balance different income tax negatives, better play the role of personal income tax income distribution and regulation, but also better protect the legitimate rights and interests of taxpayers through annual exchange." Zhou Yi introduced, "For example, the medical expenditure of major illnesses in the special additional deduction can only know the annual expenditure amount only when the end of the year, and it is necessary to replenish the deduction at the annual exchange calculation, so as to reflect the principle of tax fairness."

So what impact will it not be declared within the specified time?

"Taxpayers who need to pay taxes for annual settlement, and if the annual exchange period is not paid in full after the end of the annual exchange period, the tax authority will increase the late fees in accordance with the law and mark it in its" Personal Income Tax Tax Record "." Zhou Yi introduced When the taxpayer handles the annual settlement, the reporting information is incorrectly refunded or pays less taxes. If the taxpayer takes the initiative to make corrections in time after being reminded by the tax authority, the tax authority may follow the principle of "the first violation" principle. Free punishment.

With the deepening of personal income tax settlement work, the tax department will continue to increase policy publicity and counseling, so that taxpayers and deductible obligations will further grasp the relevant personal income tax related policies and enjoy reform dividends.

- END -

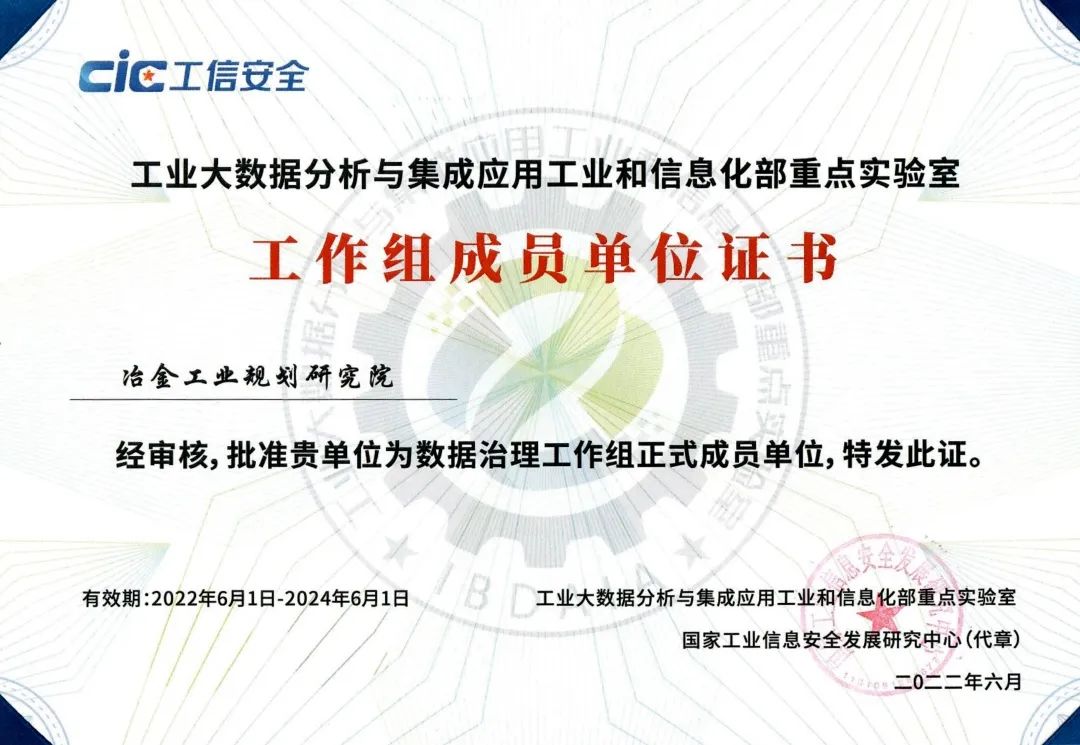

Metallurgical Planning Institute was selected as members of the key laboratory of industrial and integrated application industry and informatization of industrial big data analysis and integrated application industry and informatization

Recently, the key laboratory of industrial big data analysis and integrated applic...

Chengyang Story | Wang Wei- "It is a very happy thing to provide more and better services for r

Peninsula all media reporter Ge MengjieAt 8 o'clock in the morning, Wang Wei arriv...