Just now, the central bank took the shot: raised from 0 to 20%!RMB 300, the stock market counterattack, expert interpretation ...

Author:Daily Economic News Time:2022.09.26

In the early morning of September 26, the central bank shot.

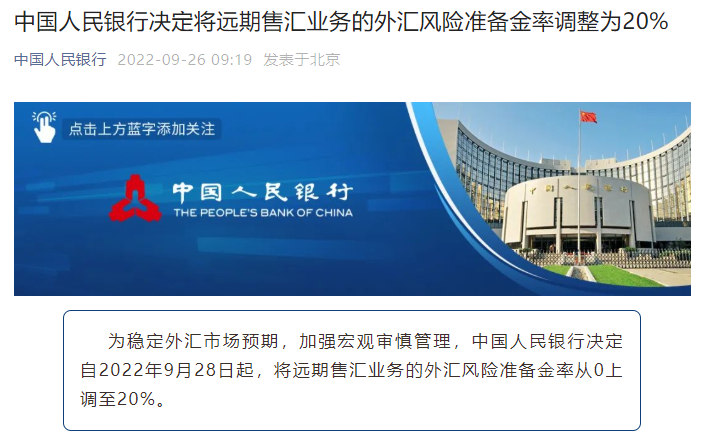

First, the central bank decided that from September 28, 2022, the foreign exchange risk reserve ratio of the long -term foreign exchange sales business was raised from 0 to 20%.

Second, the central bank today launched a 7 -day period of 42 billion yuan and a 14 -day period of 93 billion yuan in reverse repurchase operations. Because there is a 2 billion yuan reverse repurchase expiration today, the net investment is 133 billion yuan.

The central bank took the shot, the RMB was pulled straight at 300 points

On Monday, September 26, the People's Bank of China decided to adjust the foreign exchange risk reserve rate of the long -term foreign exchange sales business to 20%.

The Central Bank announced that in order to stabilize the foreign exchange market expectations and strengthen macro -prudential management, the People's Bank of China decided to increase the foreign exchange risk reserve rate of the long -term foreign exchange sales business from 0 to 20%from September 28, 2022.

According to the surging news report, after adjustment, assuming that a bank's signing signing for a long -term exchange of US $ 10 billion last month, then the central bank needs to pay a $ 2 billion reserve for this month. One year later, the central bank will return to the bank. Before the adjustment, the bank does not need to pay the money.

The foreign exchange risk reserve of the long -term exchange sales business began after the "811" exchange reform in 2015, and was also called the Chinese version of "Tobin Tax". At that time, the renminbi depreciated a large extent. At the end of August of that year, the central bank requested that from October 15, 2015, financial institutions (including financial companies) to carry out foreign exchange sales business to pay foreign exchange risk reserves to the central bank to prepare to prepare to prepare for preparations. The gold rate is tentatively set to 20%. Later, it became one of the tools for the central bank to regulate the foreign exchange market.

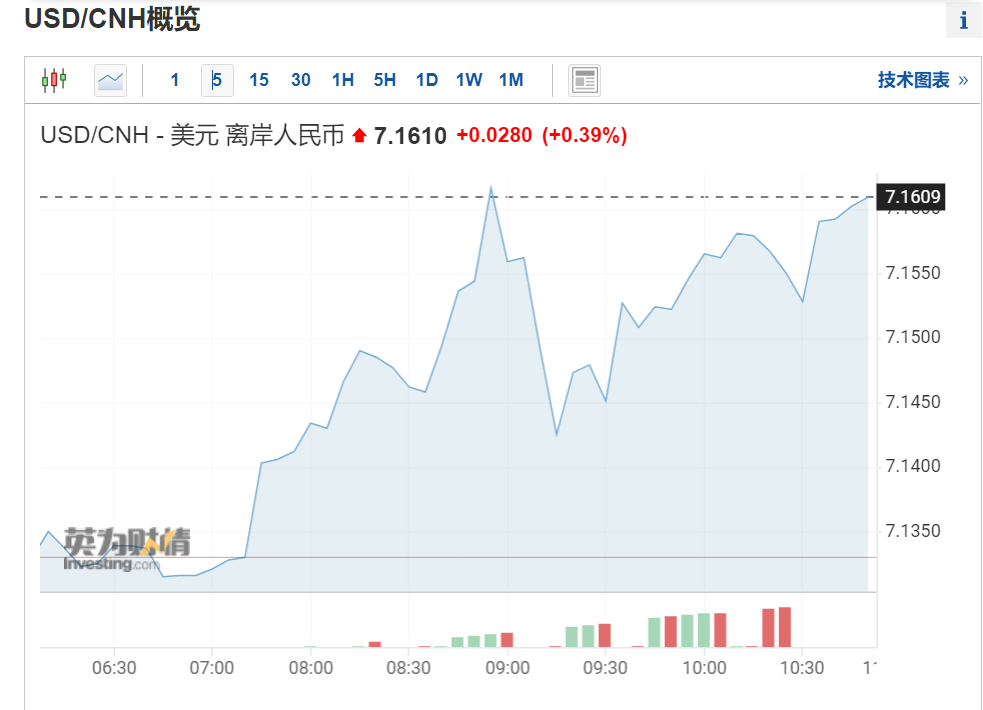

Boomedies by the above news, the offshore RMB rose more than 300 points against the US dollar, and then fell again. As of press time, the offshore RMB reported to the US dollar 7.1610, depreciating 280 basis points.

As of press time, 324 basis points were depreciated on the shore RMB against the US dollar.

Guan Tao, the chief economist of BOC Securities, said in an interview with the reporter of "Daily Economic News": "From the perspective of previous experience, upside -down foreign exchange risk reserve ratio is an important and effective macro -prudential measure to respond to the fluctuation of exchange rate fluctuations. The second restart will help regulate the demand for long -term foreign exchange purchase, inhibit the periodic effect of the cyclical sheep, and promote the stability of the RMB exchange rate. "

The middle price of the RMB to the US dollar fell below "7"

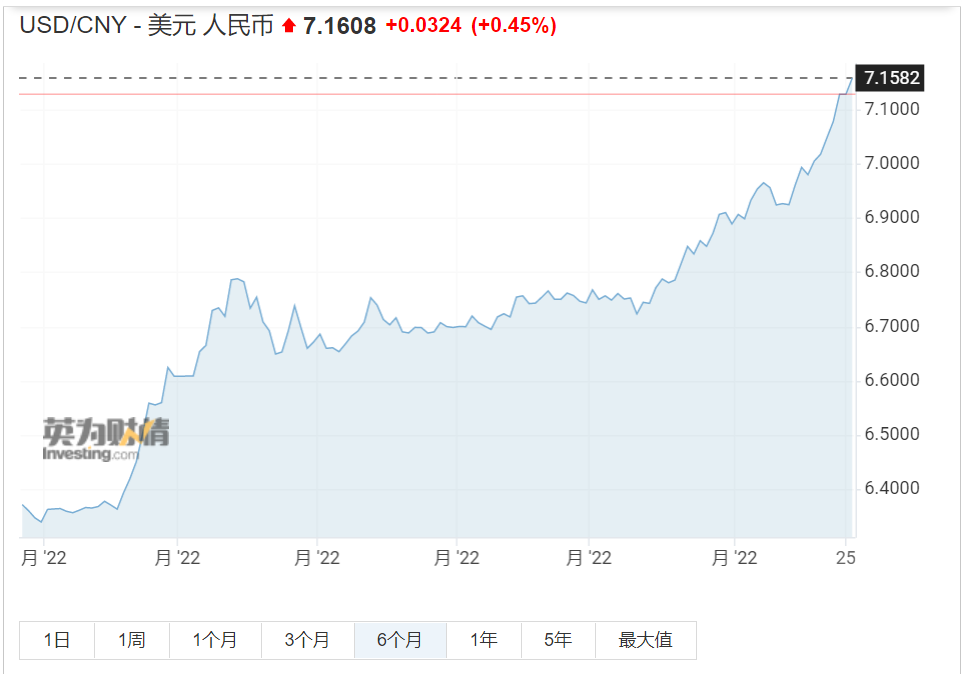

Since the beginning of this year, due to the continuous interest rate hikes of the United States, the US dollar index has continued to strengthen, and non -US dollar currencies, including RMB, have depreciated to varying degrees. The reporter noticed that since August 15, the exchange rate of the RMB to the US dollar has begun to decline significantly. Recently, offshore RMB and the exchange rate of the US dollar on the shore have both fell below "7.1".

Data show that on September 26, the US dollar index rose straight to 114.6882. In addition, on September 26, the RMB's intermediate price of the US dollar was 7.0298, which was degraded by 378 basis points from the previous trading day. Since the beginning of this year, the central price of the RMB has fallen by more than 10%.

In fact, this month is the second time that the central bank has shot the exchange rate. On September 5th, the central bank announced that starting from September 15, 2022, the foreign exchange deposit reserve ratio of financial institutions has been reduced by 2 percentage points, that is, the foreign exchange deposit reserve ratio is reduced from 8 % to 6 %. After the central bank shot that day, the offshore RMB rose nearly 200 basis points against the US dollar.

Wen Bin, chief economist of Minsheng Bank, said: "The central bank's foreign exchange risk reserve ratio of foreign exchange sales business on the central bank will increase bank foreign exchange sales costs, reduce the demand for long -term foreign exchange purchase in the enterprise, and reduce the market for market foreign exchange purchase. Demand helps the foreign exchange market supply and demand balance. "

Wang Qing, chief macro analyst of Dongfang Jincheng, said: "Affected by the recent rapid tightening of monetary policy and the sharp rise in the US dollar index, the RMB exchange rate on the US dollar has depreciated rapidly, and the shore and offshore have fallen below the 7.1 mark. . On September 5th, the central bank lowered the foreign exchange deposit reserve ratio, which means that the policy surface has begun to release a stable exchange rate signal; this regulatory policy has shot again to increase the foreign exchange risk reserve ratio of the long -term foreign exchange sales business. In the long -term purchase cost, avoid excessive gathering expected to the exchange market. Considering that the current RMB exchange rate has not depreciated from the trend from the US dollar.

Wang Qing emphasized that the focus of the current stabilization rate is not to keep a certain fixed point, which has led to a sharp appreciation of the RMB to the US dollar to other currencies. Instead, the three major RMB exchange rate indexes are basically stable and the market expectations are stable. This is an effective response to both internal and external balance under the current situation. This means that the foreign exchange risk reserve ratio that increases the long -term foreign exchange sales business is not intended to reverse the depreciation of the RMB against the US dollar, but to appropriately increase the friction of exchange rate fluctuations to avoid the emergence of the RMB out of the trend of the US dollar and the rapid depreciation of the rapid depreciation of the RMB. Essence

A shares and Hong Kong stocks are out of independence

In the case of the central bank's shot, on September 26, the Asia -Pacific and other peripheral markets fell, but A shares went out of independence. As of the afternoon closing, the Shanghai Index fell 0.08%, the Shenzhen Index rose 0.65%, and the GEM index rose 1.84%.

In terms of sectors, hotel tourism, heat pumps, integrated die -casting, energy storage and other sectors have risen, and the decline in oil and gas, precious metals, agriculture, gas and other sectors.

On the disk, the track stocks rebounded again. Energy storage, heat pumps, TOPCON batteries and other directions led the rise. Multi -stocks such as Germany and Chuanyi Technology reached a record high. Consumer stocks are active, tourist hotel stocks have risen, and Huatian Hotels and Zhongxin's tourism daily limit. According to the data of Ctrip's "National Day Forecast of 2022", the order volume of the order of the National Day travel in the past week has increased by 64%from the previous week. Starting from the Mid -Autumn Festival, National Day tourism has entered a stable growth stage, and the average daily order growth rate exceeds 30%. From the perspective of the current product reservation trend, the National Day tourism reservation for half a month in advance is mainly long -term tourism, and local reservations in the surrounding area have also entered the heating stage. Data show that it is scheduled to be nearly 60%of the products in China, and the surrounding local products account for 40%.

AVIC Securities Research Report pointed out that during the upcoming National Day holiday, offline consumption and travel demand are expected to be accelerated. Combined with the current situation of epidemic prevention, short -distance tourism and micro -leave will become the first choice for recent tourism. Local scenic spots, theme gameplay, rural homestays, camping, and night travel multi -innovative leisure tourism forms are expected to continue to be heated. Promoting performance.

In the Hong Kong stock market, on September 26, the Hang Seng Index opened by 0.84%, the Hang Seng Technology Index fell 0.91%, and the Hang Seng State -owned Enterprise Index fell 0.65%. After the bottom of the bottom, Hong Kong stocks rose rapidly. As of the afternoon break, the Hang Seng Technology Index rose 2.39%. On the disk, gaming and online education increased.

It is worth noting that in the Asia -Pacific market, except for A shares and Hong Kong stocks, other stock markets have fallen to varying degrees. Among them, the Nikkei 225 Index, the South Korean KOSPI index, and the Vietnamese Ho Chi Minh index fell more than 2%.

(The content and data of the article are for reference only, and it does not constitute investment suggestions. Investors operate according to this, the risk is self -affordable.)

Edit | He Xiaotao Dubo

School pair | Sun Zhicheng

Cover picture source: Every reporter Zhang Jian

Daily Economic News integrated every app (Reporter: Xiao Shiqing),

Daily Economic News

- END -

Caifeng | Golden Fruit is full of splasm, and the smelting of the Central Plains adds scenery

Whenever the summer solstice comes, the golden golden fruit has been covered with ...

Zhang Ziyi Li Bingbing, listed on Dongbona Films, attended congratulations

Cover Journalist Dunen LakePhoto Conferry of Bona Film GroupOn August 18, Bona Fil...