The well -known brand has applied for bankruptcy less than a week, and the stock price skyrocketed 456%!what happened?

Author:China Fund News Time:2022.06.22

China Fund Reporter: Chen Mo Intern: Wang Jialin

On June 16th, the century -old international beauty brand Luouvlon applied for bankruptcy from the New York District Court, and the stock price fell to a freezing point of $ 1.50. But on the market yesterday, Louvon's stock price soared to $ 6.84, an increase of 456%.

Less than a week after applying for bankruptcy, but the stock price was "rapidly soaring". What happened?

Full of retail investors crazy: reconstruct Hepz mythology

The rush of the stock price after the bankruptcy of Louvonon made many investors call "seeing each other." The myth of the American car rental giant Hertz was mentioned again.

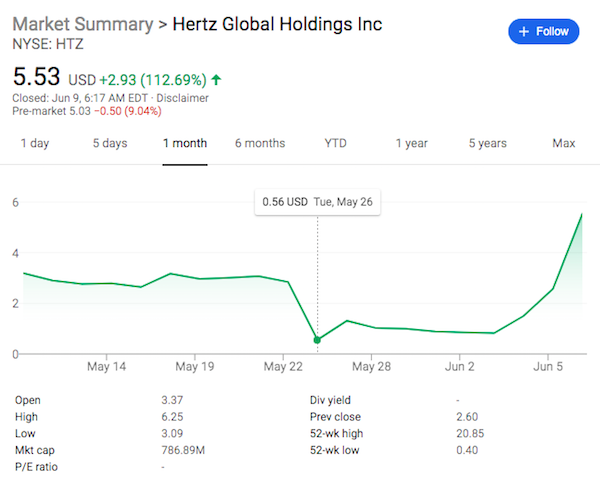

Back to 2020. On May 22, 2020, Herz applied for bankruptcy protection. The procedure for delisting in the NYSE, Hertz's stock price plummeted, fell to a low point of 40 cents on May 26. But strange things happened. From June 4th, three consecutive trading days, Hertz's stock price soared from $ 0.82 per share to $ 5.53, a cumulative increase of 574%.

Figure 1: Announce the five trading days before and after bankruptcy, Hertz's stock price trend

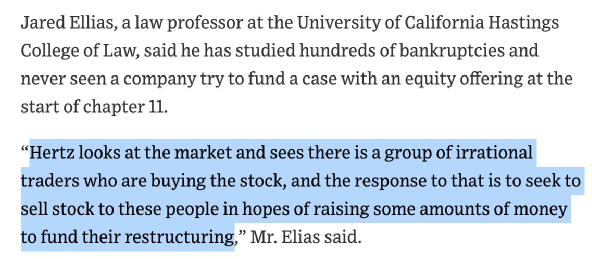

Why did the stock price suddenly rise? It turned out to be a "ghost" of retail investors. According to foreign media reports, 96,000 people built a shares of Hepinhood's investment applications at the time of Robinhood. The trading volume of the stock in June increased to an average of 197 million shares daily, more than 60 times in 2019.

This is too similar to Louvon's current situation. According to Bloomberg, since the application for bankruptcy protection on June 15, the transaction volume has exceeded 183 million shares, which is more than 31 times the average transaction volume in the past three months. Yesterday, Louvioon was one of the 10 largest transactions on the Fidelity platform. The purchase order almost matched the selling order.

According to Vanda Research, in the past week, Louvon has attracted about $ 10 million in retail dealers' cash, and nearly $ 6 million has flowed into the company on Friday alone. According to US media reports, VANDA staff said that "retail investors have indeed increased their purchases of Revlon, which may be because they tried to" buy dips "after the declaration of bankruptcy."

Or is it acquired? Indian richest man shot

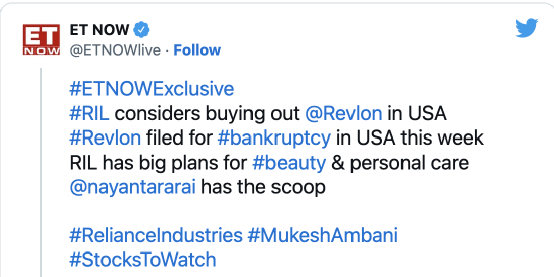

There is also a "gossip" that allows Lukouvon's stock price to soar: India's richest man or to acquire Louvon.

Last Friday, ET NOW quoted sources as saying that the Indian Petroleum Retail Enterprise Group led by Mukesh Ambani was considering bidding for Luohon.

But as of now, India's richest man, Muksh Ambani and his company have not responded publicly.

In addition, Louvon is also "actively starting self -help." Last Friday, the company received a $ 375 million loan that could be used for continuous operation. Louvon said it requires funds to solve the supply chain problem. At present, it has only $ 6 million in cash, but is carrying billions of dollars in debt.

History as a mirror: Opportunity or trap?

In fact, the stock price rose because of applying for bankruptcy. In 2020, in the company that entered the bankruptcy process with Hertz, Cocypik Energy Company rose 181%, GNC Holdings Inc. rose 106%; in 2020, the company that did not replace debt also had a stock price rising. It has risen 167%since May 15 of that year, and White Petroleum has risen by 835%since April 1 of that year.

It is worth noting that under the rise of market sentiment, the short -term soaring stock price of bankruptcy companies may not be sustainable. Taking Hertz as an example, within one month when the stock price was pushed up by retail investors, it fell rapidly.

Figure 2: Six months before and after the announcement of bankruptcy, Hertz's stock price trend

Former bankruptcy credit trader Kirk Ruddy said in an interview with Bloomberg, "I always think that people have a psychological impulse to buy stocks at a low price ... retail investors may buy them to know them to know Large companies did not realize how rare that shareholders have gained anything in bankruptcy. "

You know, according to the US bankruptcy law, shareholders are ranked at the end in any form of payment -behind lawyers, lenders and suppliers. In other words, once liquidation occurs, the creditors will get assets priority than shareholders; the remaining part will turn shareholders.

In 2020, when Hertz became a hot stock on the stock market, Columbia Broadcasting Corporation (CBS) published a comment saying, "This is not a normal operating model of the stock market, this is a bad phenomenon." Economist Paul Cruggow Man also stated in the report that "the trend of Hertz's stock indicates that the stock market is in some kind of bubble."

Bloomberg reported that with the 2.5% increase of the S & P 500 index, Louvon's stock price showed that "individual investors are turning attention to the stock, with a view to rapid profitability and ignoring the fundamental aspect."

After a year of bankruptcy and reorganization, Herz has now entered the right track.

Edit: Joey

- END -

@Harbin citizen, scan code and ride -car discount activities here

The reporter learned from the Harbin Transportation Group that the transportation group smart card company and the provincial UnionPay work launched a variety of travel preferential policies for user

Solidly promote the modernization of agricultural and rural areas (2)

[Endeming the new journey to build a new era, study and implement the spirit of th...