Another fund company holds a listed company!Yifangda holds the number of Haijia medical shares exceeded 6%

Author:Daily Economic News Time:2022.09.26

Following the fund managed by the Nuoan Fund Cai Songsong, Zhuo Shengwei, and the fund company has a listed company.

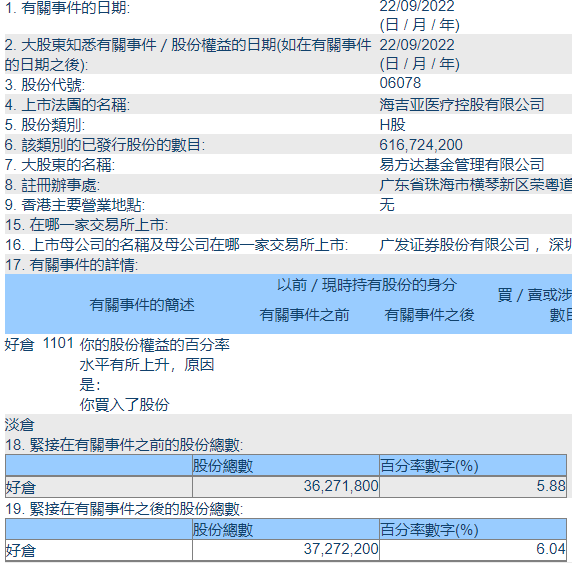

Recently, the relevant rights and interests of the Hong Kong Stock Exchange's listed company Haijia Medical showed that the number of Yifangda Fund held up 5%, and the number of holdings on September 22 was 37.2722 million shares, accounting for the number of shares issued by Haijia Medical. 6.04%.

Raise the card Haijia Medical

According to the information disclosure of the relevant rights and interests of the Hong Kong Stock Exchange's listed company Haijiia Medical, Yifangda's shareholding in Haijia Medical has continuously changed in recent times.

First, on September 14, the information disclosed showed that the number of shares held by Yifangda's medical treatment in Hailiga increased from 30.1388 million shares to 30.9746 million shares, accounting for 5%from 4.89%to 5.02%, which exceeded 5%.

Later, on September 22, the disclosed information showed that the number of shareholders of Yifangda's medical treatment in Hygia has further increased, from 36.2718 million shares to 37.272 million shares, accounting for further increase from 5.88%to 6.04%.

It can be seen that in less than 10 days, the number of shareholdings of the Yifangda Fund's Haili Medical has increased by more than 7 million shares, and the shareholding ratio has been bought by more than 6%all the way. It can be seen that this stock is quite optimistic.

Zhang Kun and Chen Hao bought a big buy in the first half of the year

So, which funds are owned by Yifangda to buy Hygia Medical?

According to the Fund Half -annual report, Yifangda has a total of 9 funds holding Haijia Medical, as follows:

From the perspective of these nine funds, the most holding number is the selection of Yifangda blue chips managed by Zhang Kun. It is worth mentioning that from the quarter report and the first quarter report of this year, the selected and heavy position stocks of Yifangda Blue Chip Blue Chips I did not see Haijia Medical, but in the semi -annual report of this year, the number of shares was 5.5 million shares.

It can be seen that in the second quarter, Zhang Kun began to buy Haijia Medical, but although he held a large number, from the perspective of the proportion, in the selection of Yifangda Blue Chips, the proportion of Haijia Medical's positions did not account for not the proportion To 0.5%.

In addition to this fund, Chen Hao managed the growth of Yifangda's Hong Kong Stock Connect, the future of E Fund's innovation, and the balance of balanced growth of the Balanced growth of Haijia, and also exceeded 4 million shares at the end of the second quarter. The signs of signs, from the perspective of the net value of the net position, the proportion of Hygia Medical in the holding of the Bida Hong Kong Stock Connect's growth is close to 7%.

From these public data, it can be seen that in the first half of this year, many funds under Yifangda shot, increasing their investment in Hygia Medical, but even from the total number of positions in the nine funds at the end of the second quarter, it also judges that, it also takes the total number of positions at the end of the second quarter. There are only about 218,000 shares.

Compared with the 372.722 million shares disclosed on September 22, there is still a certain gap. From the perspective of the information changes disclosed by the Hong Kong Stock Exchange, it is obvious that after the third quarter of the fund entered The number continues to rise. Of course, in addition to buying public funds, other products such as special accounts may also have the possibility of buying.

Daily Economic News

- END -

like!106 companies in Yunnan Province intend to be on the list of national lists

On September 23, 2022 National Intellectual Property Overview Enterprise and Demon...

Financial and Economics · One week hot news: The General Administration of Market Supervision has publicly disclosed 28 anti -monopoly punishments

1. [Macro Industry]1. Alibaba, Tencent, Bilibili and other anti -monopoly finesOn July 10, the General Administration of Market Supervision released 28 administrative penalties that did not declare