The market value of 20 billion, Jiu'an Medical invested five VCs a day

Author:Investment community Time:2022.09.26

Another super LP was born.

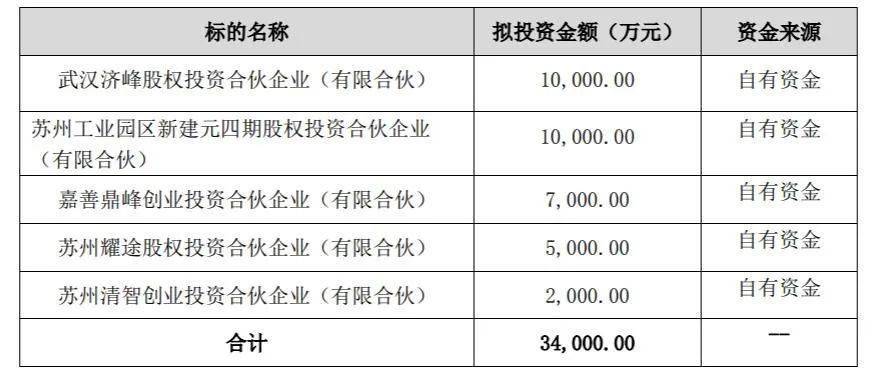

This time is Jiu'an Medical, known as the "King of the Demon King". The investment community was informed that Jiu'an Medical issued an announcement on Friday that the company subscribed for five fund shares with its own funds of RMB 340 million. Yaotu Capital and Huixin Investment. Such a big deal is precious in the current situation of RMB fundraising.

Who is Jiu'an Medical? Friends who are familiar with the secondary market should be familiar with. The founder of the company Liu Yi, a native of Anhui, graduated from Tianjin University in his early years. In 1995, Liu Yi and several graduate classmates founded Jiu'an Medical, relying on a foothold with an electronic sphygmomanometer to deeply cultivate home medical and healthy electronic products. The company's turning point is that Jiu'an Medical American subsidiary IHEALTH New Crown Antigen Testing Casual Solid Food is sold in the United States. Relying on a new crown antigen home self -test kit priced at $ 6.99/person, the stock price began to skyrocket. Essence In the first half of the year, the company's revenue was 23.267 billion yuan, an increase of 3989.1%year -on -year, and the latest market value was more than 20 billion.

There is money in hand, and Jiu'an Medical began to invest, and one of the ways is to do LP -hand over money to professional venture capital institutions. In fact, this year's A -share listed companies have started LP and joined forces to join the domestic front -line venture capital institutions, such as Betteni invested Sequoia China; ZTE joined forces in Shenzhen Venture Capital; After investing in Dachen; the seven wolves invested in Zhengxin Valley Capital .... This scene is mighty.

01

Can be called the annual super LP:

One day announced the funding for 5 VC funds

The so -called LP (Limited Partners), which is a limited partner, commonly known as "Golden Dad", is an investor of the venture capital institution. This time, Jiu'an Medical has invested five investment institutions.

The specific situation is -September 23rd, Jiu'an Medical issued an announcement saying that it participated in the subscription of five VC institutions' fund share, which was invested in Jifeng Capital of 100 million yuan; 10 million yuan invested in Yuansheng Venture Capital; 70 million yuan Investment in Wuyuefeng Capital; invested 50 million to invest in Yaotu Capital and 20 million yuan of investment in the capital investment, with a total amount of 340 million yuan.

From the perspective of sorting out, Jiu'an Medical's investment direction is very clear, almost all of them belong to medical health, as well as scientific and technological fields such as information technology, advanced manufacturing, and new materials.

Let's take a look at Jifeng Capital. Since its establishment in 2015, Jifeng Capital has been focusing on investment in the field of medical and health. So far, it has invested in Yingke Medical, Xiangyu Medical, Ping An Good Doctor, Yuekang Pharmaceutical, Aibo Biology, Nosh, Boydenen Star companies such as Special, Australian endoscopy, Shengtaier, Jiaste, Aibaikk, GM, Tianze Yuntai and other star companies, of which British medical treatment has obtained dozens of times the book return. It is reported that the scale of Wuhan Jifeng Equity Investment Partnership (Limited Partnership) Fund of Wuhan Jifeng Equity Investment in Jiu'an Medical Investment is mainly invested in the fields of medical health and life sciences.

Yuansheng Venture Capital also focuses on medical health. It was established in Suzhou Industrial Park (Biopharmaceutical Industrial Park) in 2013. At present, Yuansheng Venture Capital has completed the investment in more than 140 companies in the field of life and health, involving four directions: new drug creation, medical equipment, in vitro diagnosis and precision medical care, and medical services. Capital markets such as science and technology boards. Jiu'an Medical invested in the Suzhou Industrial Park Fourth -Phase II Equity Investment Partnership (Limited Partnership) Fund under the Suzhou Industrial Park, a subsidiary of Yuansheng Investment, with a target scale of 1.5 billion to 3 billion yuan.

In addition to medical health, Jiu'an Medical also invested Wu Yuefeng Capital, known for semiconductor investment. Jiu'an Medical contributed 70 million yuan, and invested in the Jiashan Dingfeng Entrepreneurship Investment Partnership (Limited Partnership), a subsidiary of Wu Yuefeng Capital, which has a target size of 1 billion yuan, mainly investing in intelligent sensing, 5G -related fields, integrated circuits, integrated electronics, equipment, equipment, equipment, and equipment Intelligent manufacturing, new energy, smart medical and health growth period or maturity projects.

There is also Yaotu Capital, which focuses on the new generation of information technology and energy technology early investment. Currently, the fourth -phase RMB fund and the second phase of the US dollar funds are currently managed. Investors include leading mobile phones, automobiles, storage, robots, and consumption of many industries. Electronic leading enterprises, well -known mother funds and front -line investment institutions.

And Huixin Investment focuses on entrepreneurial projects that invest in 5G and the digital economy industry chain, including the semiconductor integrated circuit, electronic materials, semiconductor equipment on the upstream of this industrial chain, and related to the downstream of the Internet of Things, artificial intelligence, AR and other industries application. Entrepreneurship companies that are mainly invested in the early stages of the investment funds and high -tech fields in the early stages of AI will give priority to companies that incubate, cooperate or IP permits of the Institute of Intelligent Industry Research Institute of Tsinghua University.

At present, RMB fundraising is still difficult. Jiu'an Medical invested 340 million yuan in one fell swoop. The shot was shocking. It was one of the annual super LP.

02

55 -year -old Anhui fellow, graduated from Tianjin University

The new crown test box is sold in the United States

Why is Jiu'an Medical so proud? The story of this company starts from an Anhuiist -Liu Yi.

Liu Yi was born in Anhui in 1967 and is 55 years old. He took the college entrance examination in 1985 and entered Tianjin University to analyze instruments to study. During college, Liu Yi was the class leader and chairman of the student union, and also won a TV. In my junior year, Jingyi organized a class for third -year students to minorize a dual degree in management and allow students to have the quality of engineering and management. This experience laid the foundation for Liu Yi to start a business in the future. Jiu'an Medical was established in 1995. Here is a small episode: at that time, Liu Yi learned about the "electronic sphygmomanometer" at a classmate party, and then found a few graduate students together. After half a year of hard work, the first qualified Jiu'an electronic sphygmomyometer was born, and the listing was the first place. Sell more than 1,000 units a month.

In 2002, Jiu'an began to open up overseas markets. In 2005, Jiu'an Company opened the German market in one fell swoop by the differentiated product "audio electronic blood pressure meter".

In 2010, Liu Yi team developed the world's first tools that can use iPhone and iPads to measure blood pressure and manage blood pressure, which received Apple's response and strong support. They finally got the iHealth trademark and set up their own companies in Silicon Valley.

In June of the same year, Jiu'an Medical was listed on the Shenzhen Stock Exchange and became the first listed company in the domestic sphygmomanometer industry. For a long time after listing, Jiu'an medical performance was mediocre. Data show that from 2013 to 2019, Jiu'an Medical Deduction's non -net profit lost money for 7 consecutive years.

In 2015, Liu Yi's alma mater Tianjin University's 120th anniversary, he donated 60 million yuan to the school. It is reported that this is the largest amount of donations in Tianjin University in recent years. Deeply digging Jiu'an Medical, you can find that the company has a lot of relationships with Xiaomi. The official website shows that Jiu'an Medical has received a strategic investment of Xiaomi $ 25 million and has become a partner of Xiaomi Ecological Chain. In September 2017, Xiaomi released the IHEALTH querometer product.

If there is no new crown epidemic, maybe Jiu'an Medical will always take root in the field of home medical and healthy electronics. In 2020, Jiu'an Medical finally ushered in the turnaround that the demand for epidemic prevention products such as the temperatureometer and blood oxygen instrument under the epidemic was soaring. Jiu'an Medical also achieved a substantial increase in performance and turned losses to profit. This year, Jiu'an Medical's revenue was 2.08 billion yuan, rising 18436%; net profit attributable to the mother was 242 million yuan, up 264.68%. The 2020 report showed that its domestic business ratio was 44%and 59%, respectively.

In the Overseas Sea, Jiu'an Medical American subsidiary, Ihealth, USA, has developed a new crown antigen home self -test kit, which once sold out in the US market. What's more dramatic is that by relying on the new crown testing test box, Jiu'an Medical has won more than 10 billion orders in the United States, filling the losses in the past 7 years in one fell swoop.

At the end of August this year, Jiu'an Medical Released Annual Report. Data show that the company achieved total operating income of 23.267 billion yuan in the first half of the year, an increase of 3989.1%year -on -year; the net profit attributable to the mother was 15.244 billion yuan, an increase of 27728.5%year -on -year; the income per share was 33.43 yuan. It can be said that the results of this year exceeded the imagination of many people.

From the perspective of the equity structure, Shihezi Sanhe Equity Investment Partnership (Limited Partnership) holds the most shares of Jiu'an Medical, reaching 27.49%, and the company's legal representative/unit leader is the chairman of Jiu'an Medical Care. Liu Yi, Liu Yi himself is also the actual controller of Jiu'an Medical.

03

A lively scene of venture capital:

Listed companies and VC/PE "make friends"

Jiu'an Medical is not an example of LP. Since the beginning of this year, LP has become a lively scene of the venture capital circle.

Take a rough look. At present, the VC/PE institutions participating in the listed company are mainly the fields of new energy, lithium batteries, high -end equipment, new generation information technology, semiconductor, integrated circuits, and medical and health (medical equipment, medical services, etc.). All are emerging industries. We have seen that more and more A -share listed companies have begun to appear behind Organ, Shenzhen Venture Capital, Gao Yan, Dachen, Source Capital, Gao Rong Capital, Zhengxingu Capital, Cornerstone Capital and other institutions.

From the perspective of the medical and health track, according to incomplete statistics from the investment community, about 50 medical listed companies have invested in LP -Betai, Hengrui Pharmaceutical, Tomson Beijian, Di'an diagnosis, Yangpu Medical, Yuexin Health, Lingkang Pharmaceutical, Beiyu Pharmaceutical, Anxu Biology, Kaipu Biology, Yingke Medical, Huaxi Biology, Jichuan Pharmaceuticals, China Pets, Hansen Pharmaceuticals, Chengda Biological, Baicheng Pharmaceuticals .... This is a long list.

At the end of June this year, Betai announced that he participated in Sequoia Capital as a manager and Sequoia Kunpeng as an ordinary partner. The fund mainly focuses on investment opportunities in industries such as technology, medical health, and consumer services. As early as 2014, Sequoia China participated in the early round of financing of Betai.

There is also "Medicine King" Hengrui Medicine. In early June, Hengrui Pharmaceutical intends to sign with the holding subsidiary Shengdi Investment and Hengrui Group's "Shanghai Shengdi Biomedical Private Equity Investment Fund Partnership (Limited Partnership) Partnership" to jointly launch a partnership with a total scale of 2 billion. The scale is 2 billion. The fund focuses on the investment of the pharmaceutical and health track, focusing on innovative research and development in the field of biomedical, and creating the cultivation of the biomedical industry ecosystem and the leading domestic biomedical innovation investment platform. Tomson Beijian also came -at the end of April, the company intends to invest in the equity investment management (Guangzhou) Co., Ltd. (referred to as the investment), Anhui Longyi Rural Revitalization Development Co., Ltd. (referred to as: Longyi Revitalization) joint investment Establish Anqing for Life Health and Green Food Investment Fund Partnership (limited partnership) (tentative name). The total scale of the fund is 200 million yuan. Food and targets with channel synergy. Earlier, Tomson Beijian had invested 7 funds to the abroad, the most famous of which was Dachen and Danfu Capital.

Earlier, at the beginning of this year, the Capital Big Health Industry Fund was launched and the first phase was raised. It is understood that the fund is a scale of 3 billion yuan, with a total level of more than 1 billion. The fund manager is Hua Gai Capital. The cornerstone investors not only have voices investment, Yizhuang Guotou and other investment institutions, but also have many medical listed companies such as Jingdong, Qi Anxin Technology and Lingkang Pharmaceutical, and Beiyu Pharmaceutical.

The most active is Tiger Medicine. Tianyancha shows that Tiger Pharmaceutical has invested 65 funds abroad, with Qiming Venture Capital, Yingke Capital, Yunfeng Fund, Junlian Capital, Yida Capital, Boyuan Capital, Mint Angel Fund, Hanyang Capital, Mi Fang Capital, Capital, Capital, Huagai Capital and other well -known institutions. "Everyone starts to raise funds, and usually go to Tiger -Bye Pier." A medical fund fundraising person told the investment community.

So why do listed companies do LP one after another? It is not difficult to see that listed companies that can do LP also need to have the following conditions: first of all, they must have considerable revenue and stable cash flow; second, the industry ecology of listed companies must be sufficiently ductile. Nowadays, the development of the industry is changing with each passing day. Many listed companies need to find new breakthroughs, and they often choose to join forces with excellent venture capital institutions to maximize their advantages in the upstream and downstream development of the industrial chain. The opportunity, this is already a valid path that has been verified.

It can be seen that there will be more and more examples of LP in the future. In the early years, under the blessing of VC/PE, startups grew all the way and embarked on the stage of IPO bell. After seeing the power of venture capital, these successful entrepreneurs in turn contributed money for VC/PE institutions. This is a touch of warmth in the cold winter of RMB.

- END -

Introduction to the "good butler" of the enterprise, the Wuhan Planning Research Institute actively carries out the "three people" practice activities

The Yangtze River Daily Da Wuhan client on September 1st The original comprehensiv...

Wang Qing Dongming Village grows into a large industry to help the villagers "jujube" to become rich

On June 21, the reporter walked into the apple jujube planting base in Dongming Vi...