American media: The worst of the global bond market in 73 years

Author:Global Times Time:2022.09.26

[Global Times Reporter Ni Hao] "The global bond market is experiencing the worst year since 1949." Bloomberg reported on the 25th that the radical interest rate hikes of many central central banks including the Federal Reserve, which led The foam rupture. Michael Hartnett, chief investment strategist of Bank of America Securities, stated in a report that the current situation of the global bond market is extremely severe. In 2022, the global bond market will be more fierce in 1949, 1931, and 1920. Michael Hartnett has accurately predicted the plunge of the US stock market in the first half of this year and is known as "Wall Street Most Masked Analysts this year."

It is reported that the Fed's announcement on the 21st was the main reason for the plunge in the bond market. On the 23rd, the yields of Two -year and 3 -year US Treasury bonds exceeded 4.25%since 2007. But compared to British Treasury bond yields, it is still much inferior. After the British government announced large -scale tax cuts, the British 5 -year Treasury bond returns rose 57 basis points. At present, the US 2 -year Treasury yield has risen for 12 consecutive days, the longest rose since 1976. Bloomberg said that many central banks will continue to raise interest rates to fight inflation, and the market is facing the worst "bond bear market" in decades.

Hartnett analyzed in the report that the collapse of the bond market may bring a credit default incident and increase the difficulty of investors to withdraw from the world's most crowded transactions when necessary, including more US dollars, US scientific and technological stocks, private equity and other transactions.

Wu Jintuo, chief analyst of Great Wall Securities Solid Harvest, told the Global Times reporter on the 25th that bonds have ticket prices and agreed fixed yields. In the actual transaction, if the market is not optimistic, it will be easy to encounter market selling. The actual transaction is actually traded. The price will fall, and the market yield will be higher. Therefore, the higher the bond yield, the lower the price, the greater the pressure on the market, and the more dismal the market is. Wu Jinsuo believes that due to the strong interest rate hike in the Fed, the global bond market fluctuated significantly in the "Black Friday" last week. Since 2022, every Federal Reserve's expected interest rate hike will cause severe fluctuations in the bond market.

The Chinese bond market is basically not affected by overseas markets, and this year's performance has been relatively stable. Wu Jinsuo said that China's 10 -year Treasury yields have a small fluctuations per month, and the overall performance is very stable. In summary, China's bonds are significantly better than other countries, and RMB bonds held by overseas institutions are still rising.

- END -

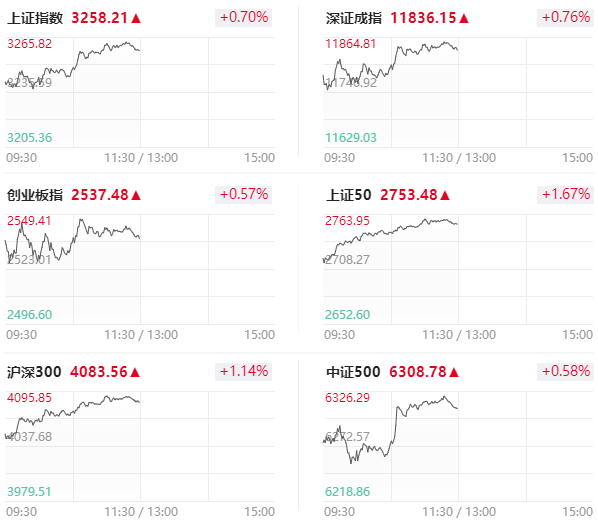

The Shanghai Stock Exchange 50 rose over 1.5%, and the net inflow of the northbound capital exceeded 10 billion yuan

On September 9th, the market rebounded in the early trading, and the three major i...

The Federal Reserve raised interest rates in September to rise, and why did the US dollar index rush up early?

The 21st Century Economic Herald reporter Chen Zhi reported that when the Federal Reserve raised interest rate hikes in September, the 75 -basis point was expected to rise in heating up, but the US do