A week of market observation | The Federal Reserve has accumulated interest rate hikes 300 basis points global central bank receiving interest rate hikes during the year

Author:Cover news Time:2022.09.26

Cover Journalist Zhu Ning

On March 17, 25 basis points, 50 basis points on May 5th, 75 basis points on June 16 and July 28, respectively, on September 22, the Fed announced that it would raise 75 more interest rates again Base point, the federal fund interest rate target range is adjusted between 3%and 3.25%.

At this point, the Fed has raised interest rates five times in the year, with a total of 300 basis points. It is worth noting that this interest rate hike is also the third consecutive interest rate hikes of the Federal Reserve this year, and it also set the Federal Reserve's fastest interest rate hike record for more than 40 years.

300 basis points have been raised

Subsequent or still raise interest rates at 125 points

On September 21, local time, the Federal Reserve announced the third time to raise 75 basis points between the federal fund interest rate target range to 3%and 3.25%, the highest level since 2008. This is the fifth rate hike this year, and it is also the largest continuous interest rate hike since the 1980s. According to the Federal Reserve statement, the prediction of medium value shows that the federal fund interest rate at the end of 2022 was 4.4%, indicating that the probability of two major interest rate hikes in the remaining time this year was great.

The reporter reviewed the previous Powell's speech and found that when it announced in June, it announced that the Federal Reserve raised interest rates for the first time in 28 years, "75 basis points in interest rate hikes were extraordinary, and it is expected that the interest rate hikes will not occur often." At the time, the market is expected to be mostly 25 basis points or 50 basis points for subsequent interest rate hikes. The market generally believes that the probability of 75 basis points for continuous interest rate hikes is less likely.

However, after the Federal Reserve's two -day monetary policy meeting ended on September 21, it was announced that the federal fund interest rate target range was raised between 75 basis points to 3%and 3.25%, which is the third time in just a few months.

At the same time, Powell reiterated its eagle signal released in late August on the 21st, that is, emphasizing the determination of the Federal Reserve to reduce inflation, and be alert to the serious consequences of premature relaxation of monetary policy and high inflation to solidify high inflation. He emphasized that if the Federal Reserve shrinks to reduce inflation, the public will eventually suffer more and longer pain.

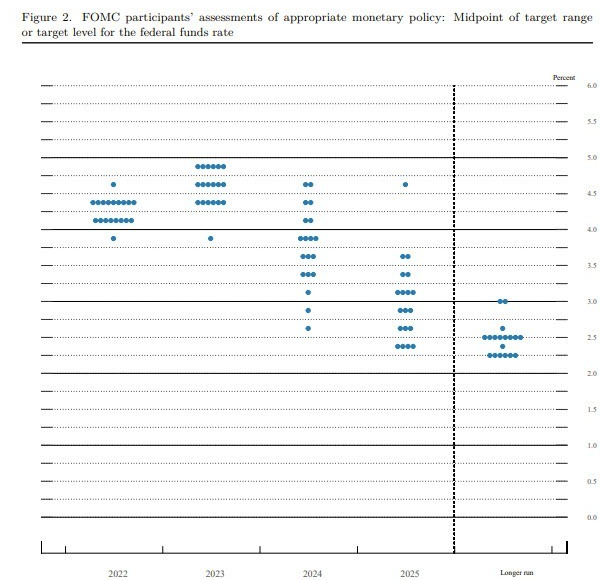

It is worth noting that the Federal Reserve will announce a dot -matrix diagram of interest rate expectations every three months, which shows that the President of the Federal Reserve Bank of the Federal Reserve will have the expectations of the federal fund interest rates in the short -term and long -term long -term. The Fed's interest rate path "dot -matrix map" has always been considered an important part of the Federal Reserve policy tools and one of the important ways to predict the Federal Reserve policy.

The reporter compared to the last two -line map and found that more than half of the members in June did not think that the end of interest rate hikes would be higher than 4%. In September, the dot -matrix chart showed that the end of interest rate hikes will be raised to more than 4.5%. This means that the interest rate hikes of the last two interest rates during the year may reach 125 basis points. The median expectation was to raise interest rates to 4.4%by the end of this year, and continued to rise to 4.6%in 2023. The first rate of interest cuts will wait until 2024 and fall to 2.9%in 2025.

CITIC Securities also stated that in September 2022, the Federal Reserve interest rate interest rate hike 75bps. Powell tried to stabilize the market emotions by speaking, but its noodle pigeon real eagle, limited incremental information, the eagle dot map passed the Fed's current tightening position. It is expected that the policy turning in the short term is expected. The end point of interest rate hike is around 5.0%.

Federal Reserve announced in September interest rate expectations

Affected by the Federal Reserve "Eagle School"

Multi -nation plans to continue to raise interest rates

Under the pressure of high inflation, many central banks have continued to take interest rate hikes. Due to the "explosive watch" of inflation, the pound depreciation, on the 22nd, the Bank of England announced that the 50 basis points of interest rate hikes to 2.25%were in line with market expectations. This is also the seventh rate hike of the central bank since December last year. On the same day, the central bank of Swiss announced a 75-basis point of interest rate hikes, raising the policy interest rate from -0.25%to 0.5%, ending the negative interest rate policy that lasted for eight years; the central bank of Norway also announced the interest rate hikes 50 basis points, which raised the policy interest rate from 1.75%to to 1.75%to to 1.75%to to 1.75%to 1.75%to 2.25%.

At this point, all central banks in Europe have been separated from negative interest rates, marking the end of an era.

European Central Bank governor Ragard said on the 20th that the European Central Bank will continue to raise interest rates to prevent high inflation from affecting economic behavior and become a long -term issue. She said that the inflation rate of the euro zone has been at high for 10 consecutive months and may continue to rise in the short term. In order to cope with continuous high inflation, the European Central Bank increased key interest rates twice in July and September this year, and raised a total of 125 basis points. Historically and rapidly adjusting interest rates shows the determination of the European Central Bank to deal with inflation challenges.

It is worth noting that the Bank of Japan and the Federal Reserve's monetary policy still show a differentiation trend. After the Bank of Japan ended the monetary policy meeting on the 22nd, it was announced that it continued to adhere to the current super loose monetary policy and maintained interest rates unchanged. According to the Kyodo News Agency, Kuroda Nodaga, president of the Bank of Japan, ruled out the possibility of recent interest rate hikes.

Chinese currency independence is still

A -share trend is mainly "I"

After the Federal Reserve's "violence" interest rate hikes, the market is concerned about whether this move will affect my country's monetary policy independence? In this regard, Yang Delong, chief economist of Qianhai Kaiyuan Fund, told reporters, "The first goal of the central bank of my country this year is to stabilize the growth. The central bank is now focusing on the problem of stable growth and the stability of the RMB exchange rate."

Yang Delong analyzed that there was a deviation in the China -US currency policy, which led to depreciation of the RMB, and the exchange rate of the RMB against the US dollar broke the "7". However, compared to other major currencies, the depreciation of the renminbi is relatively small, and it is also lower than the increase of the US dollar index. Recently, the central bank of my country has reduced the one -year and five -year LPR loan interest rate, and at the same time reduced the regular deposit interest rate of large banks, all in order to stabilize economic growth and achieve the goal of stabilizing growth. Regarding the later trend of A shares, Yang Delong believes that the external factors of the Fed's interest rate hike have also been fully reflected in the market adjustment of the past three months. Therefore The market turning point.

"From the perspective of data, in the past two years, the correlation between the stock market between China and the United States has been weak, and the two economic and policy cycles reflected behind it." Zhou Maohua, financial analyst of Everbright Bank, analyzed that domestic economy, policy, low valuation, liquidity Continue to facilitate the trend of the stock market, and in the middle and long term, the potential of my country's oversized economies and huge market potentials will be gradually released, and the stock market will also go out of the trend of "I".

Hai Futong Fund also pointed out that the valuation of the A -share market has been at a relatively low level, and the recent transaction has continued to shrink. The current market sentiment is close to the downturn in late April this year. At present, or a better time window for the mid -term layout, the configuration can be moderately balanced.

- END -

Zhenghai Biological Disclosure achieved revenue of 231 million yuan in the semi -annual report of 2022

On August 18, A -share listed company Zhenghai Biological (Code: 300653.SZ) released the semi -annual performance report in 2022.From January 1, 2022-June 30, 2022, the company realized operating inco

Total investment 7.18 billion!11 major projects in Caidian District started in the third quarter

Jimu News reporter Wang JunCorrespondent Zhou XiongOn the morning of August 12, Wu...