Oriental Shenghong: Pay attention to 100 billion liabilities, "increasing increasing increasing income" in the first half of the year

Author:Radar finance Time:2022.09.25

Produced by Radar Finance Hongtu | Li Yihui Edited | Deep Sea

Dongfang Shenghong's money raising action frequently.

On September 21, Dongfang Shenghong announced that six assets under the company's name and wholly -owned subsidiary names were transferred to the start price, and the transaction price was 1.088 billion yuan.

Radar Finance has noticed that since this year, Dongfang Shenghong has raised funds through various means. In addition to selling assets, the company has recently plans to issue no more than 3 billion green corporate bonds, borrowing no more than 3. billion yuan from the controlling shareholder, and the plan to be ordered to issue about 4.1 billion yuan.

Market analysis believes that frequent financing actions or debt pressures carried by the company. Data show that in 2018, Oriental Shenghong's backdoor Oriental Market was listed. Last year, the merger and acquisition of Jiangsu Serbang Petrochemical Co., Ltd. (hereinafter referred to as "Silbang Petrochemical") was completed. field.

With the pace of expansion, the scale of the company's debt has also increased sharply. As of the end of the first half of the year, the asset -liability ratio was 78.77%, and the total debt scale reached 119.211 billion yuan. Especially in terms of short debt repayment, the company's pressure is not small.

In addition, Oriental Shenghong's performance is not stable. From January to June 2022, when the company's revenue increased, the net profit attributable to shareholders of listed companies was 1.636 billion yuan, a year-on-year decrease of 44.06%. The institutional research report believes that in 2022, due to high oil prices and cold needs, the long silk industry has entered a trough. Whether it can usher in the bottom half of the year should look at the recovery of the demand for "Gold, Nine Silver Ten".

Selling 100 billion liabilities behind assets

On September 6, Dongfang Shenghong disclosed the announcement of packaging and sale of multiple assets.

According to the announcement, in order to focus on the development of new energy and new materials, the company needs to be peeled before the reorganization of the relevant inefficient assets related to traditional businesses in 2018. To this end, it is planned to pack up the company's six assets under the name of the company and the wholly -owned subsidiary. Transfer through public listing through Suzhou Property Rights Trading Center Co., Ltd..

The target of this transfer includes the company's Xinda Building, Shengze Town, Wujiang District, Suzhou City, the original market management committee building, the sample factory, the real estate of the Silk Co., Ltd. , Logistics Center assets.

The above -mentioned asset package was evaluated by Shanghai Dongzhou Asset Evaluation Co., Ltd., and the asset evaluation price based on July 31, 2022 was 1.088 billion yuan.

On September 21, Dongfang Shenghong disclosed the results of the listing transfer. Six assets under the company's name and the wholly -owned subsidiary were sold at a transfer price of 1.088 billion yuan. Essence

Regarding the purpose of this asset sales, although Dongfang Shenghong repeatedly emphasized that "stripping inefficient assets related to traditional business and focusing on the main business of new energy and new materials", some investors will still be related to the company's debt situation related to the company's debt situation. United.

Tongllow iFind data shows that at the end of 2018, Oriental Shenghong liabilities were only 8.9 billion yuan. After that, the company's liability scale surged, increased to 19.742 billion yuan in 2019, and reached 53.19 billion yuan in 2020, with a corresponding asset -liability ratio of 64.17%.

On November 5, 2021, the company announced that from January to October of that year, the company added a total of 32.511 billion yuan, accounting for 144.19%of the net assets at the end of 2020. Among them, 26.276 billion yuan was a new loan for banks, and 5.262 billion yuan was a new net for bonds.

Further disclosure pointed out that the company's new borrowing in 2021 was mainly used for major projects such as Shenghong Refining and Chemical (Lianyungang) Co., Ltd. 16 million tons of refining and chemical integrated projects.

The annual report of 2021 shows that as of the end of the period, the company was responsible for 102.6 billion yuan, an increase of 93%year -on -year, and the asset -liability ratio was 77.72%, which exceeded 70%for the first time.

The latest financial data shows that after the scale of 100 billion liabilities, Dongfang Shenghong's asset -liability gauge expansion did not stop. As of the end of the first half of 2022, the company was always responsible for 119.211 billion yuan, and the balance ratio of assets was further increased to 78.77%.

According to the company's announcement on July 7, Dongfang Shenghong's cumulative borrowing balance in the first half of this year was 19.771 billion yuan, of which the bank loan was 21.024 billion yuan.

According to the announcement, the company's new borrowing from January to January 2022 was mainly used for the construction of major projects such as Shenghong Refining and Chemical (Lianyungang) Co., Ltd. 16 million tons of refining and chemical integrated projects, which belongs to the company's normal business activities.

Among them, the Shenghong Refining and Chemical Integration Project has been successfully carried out in May 2022. With the gradual opening of each device of the project, the company's overall development of the company's overall development and anti -risk ability will be greatly enhanced.

Nevertheless, through the semi -annual report, it can be found that the company still has a funding gap. As of the end of the first half of the year, the balance of the money funds on the company's book was 22.578 billion yuan, while the short -term borrowing and non -current liabilities expired within one year reached 27.79 billion yuan.

In this case, the company uses a variety of means to obtain funds. Including the announcement of a fixed increase announcement on June 30 this year, it is expected to raise 4.089 billion yuan; in July, the company intends to apply for the controlling shareholder and related parties for no more than 3 billion yuan. Research instructions in the near future.

The project is delayed, and the pace of expansion is difficult to stop

Dongfang Shenghong debt has soared from the company's steps in recent years.

Tianyancha shows that Jiangsu Shenghong Technology Co., Ltd. (hereinafter referred to as "Shenghong Technology") holds 44.55%of Dongfang Shenghong, which is its major shareholder. Behind Shenghong Technology is Shenghong Holding Group Co., Ltd. (hereinafter referred to as "Shenghong Group"). The group was founded in 1992. It was formerly known as Shenghong Wash in Shengze Town, Wujiang, Jiangsu.

In 2003, Shenghong Group established Jiangsu Shenghong Chemical Fiber Co., Ltd. to build a 200,000 -ton melting direct spinning project and officially entered the chemical fiber industry.

In 2010, Shenghong Group successfully signed a contract with the Management Committee of the Xuyu New District of Lianyungang. The following year, the 1.5 million tons of PTA projects in Honggang Petrochemical officially started construction, marking the company's petrochemical industry in the upper reaches of the industrial chain.

In August 2018, Miao Hangen will focus on Guowang Hi -Tech, which focuses on the polyester filament business, placed into the Oriental market of the listed company, and renamed Oriental Shenghong to achieve the listing of backdoor.

The specific transaction process is that the Oriental Market issued 2.811 billion shares to the non -public issuance of Shenghong Technology, and purchased 100%equity of 12.7 billion yuan in Guowang Hi -Tech. After the reorganization, the actual controller of the listed company was changed from the State -owned Assets Office of Wujiang District to Miao Hangen and Zhu Hongmei couples. Production and sales.

It didn't take long after the backdoor, Miao Hangen started the capital operation. Including the acquisition of 100% equity of Shenghong Refining and Hong Kong Petrochemical in March and April 2019, and invested in the construction of 16 million tons of integrated projects of Shenghong Refining and Chemical.

On June 3, 2019, Dongfang Shenghong announced that the company intends to issue shares that do not exceed 20%of the company's total share capital, raised 5 billion yuan in funds, and funds will invest 16 million tons of refining and chemical integrated projects. In the end, the payment was raised by 3.6 billion yuan, and the company also raised funds by issuing 5 billion convertible bonds and 1 billion green bonds.

The total investment budget of the "Shenghong 16 million tons/annual refining and chemical integration project" is set to 67.7 billion yuan after two shrinking. Even so, the project is still the largest private manufacturing project in Jiangsu Province.

According to the plan, the project designs a crude oil processing capacity of 16 million tons/year, the scale of the combined device of aromatics is 2.8 million tons/year, and the scale of ethylene cracking device is 1.1 million tons/year. At the same time, the project is planned to pass the device on June 30, 2021, and it will be tested on December 31. After the birth, the annual operating income can be achieved by about 92.5 billion yuan, and the net profit is about 9.4 billion yuan.

However, the latest situation shows that the progress of the project is actually behind expectations. The project has officially launched the trial work in May this year.

With the rapid development of new energy in recent years, the expansion of Dongfang Shenghong has a new direction. In August 2021, Shenghong Group announced its strategic adjustment to the three major directions such as new energy, high -performance new materials, and low -carbon green industries.

As a listing platform, Dongfang Shenghong naturally undertakes the heavy responsibility of transformation. In December 2021, Oriental Shenghong will be in the bag of 100%equity of Silbang Petrochemical, which failed to play backdoor, with a transaction price of 14.360 billion yuan.

Tianyancha shows that Silbang Petrochemical was established in December 2010. Since 2012, the company has changed its capital through equity transfers and has previously increased its capital. As of 2015, the shareholders' change was changed to Shenghong Petrochemical Group Co., Ltd. and Lianyungang Bonhong Industrial Co., Ltd..

From 2018 to 2019, Silbang introduced two institutional investors, CCB Financial Asset Investment Co., Ltd. and BOC Financial Asset Investment Co., Ltd., but more than 80 % of the equity is still in the hands of Miao Hangen couples.

The reason why Srbang is important is that the company has an EVA (ethylene-ethyl acetate altosol) particles that can make photovoltaic glue membranes, which can help Oriental Shenghong from the traditional petrochemical industry to quickly enter new energy sources such as photovoltaic materials, high-end polyolefin materials, and other new energy sources. New material industry.

Entering the new energy track, the primary goal of Oriental Shenghong is to expand production capacity. According to media reports, on September 7, Dongfang Shenghong planned to build a 700,000 tons/year EVA, PO/SM and multi -alcohol, high -end polyolefin and other projects in Lianyungang.

According to reports, after the project is completed, Shenghong EVA production capacity will reach 1 million tons/year, of which the global market proportion of photovoltaic EVA will exceed 40%, ranking first in the world.

The prosperity is falling, the performance "increasing increasing increasing increasing benefits"

The Dongfang Shenghong, which is radical and expanded by debt, has not achieved simultaneous improvement in the revenue due to the delayed production of the project and the decline in product prosperity.

According to the financial report, in the first half of 2022, Dongfang Shenghong revenue was 30.242 billion yuan, an increase of 15.66%year -on -year; net profit attributable to shareholders of listed companies was 1.636 billion yuan, a year -on -year decrease of 44.06%.

During the institutional investigation activities, the company said that the factors that affect profits include the price of crude oil in the first half of the year, and the cost rose; the impact of the domestic epidemic repeatedly on the supply chain, suppressing the downstream demand side; Foreign demand.

In addition, as far as the company's internal factors are concerned, the total costs in the first half of the year increased by about 700 million yuan.Among them, management costs increased by 45%, financial costs increased by 105%, and R & D expenditure increased by 45%.Zhongtai Securities believes that in 2022, due to the high oil prices and cold demand, the long silk industry entered a trough.In the second half of the year, the "Golden Nine Silver Ten"+"Requirements for Request", the long silk industry may usher in the bottom reversal.

Everbright Securities said that crude oil prices continued to rise in cost pressure, and the demand for superposition of downstream was affected by the impact of the epidemic situation. As a result, the company's main product price spread fell year -on -year in the first half of 2022, which then affected the performance.Considering the sharp rise in crude oil prices, the company's costs are up and profitability has declined, so the company's profit forecast is lowered from 22-23 years.

For Dongfang Shenghong, the performance is significantly affected by the industry cycle. At present, the company's related projects still need huge investment. Whether it can resist the growing debt pressure in the future has also become the focus of investors' attention.

- END -

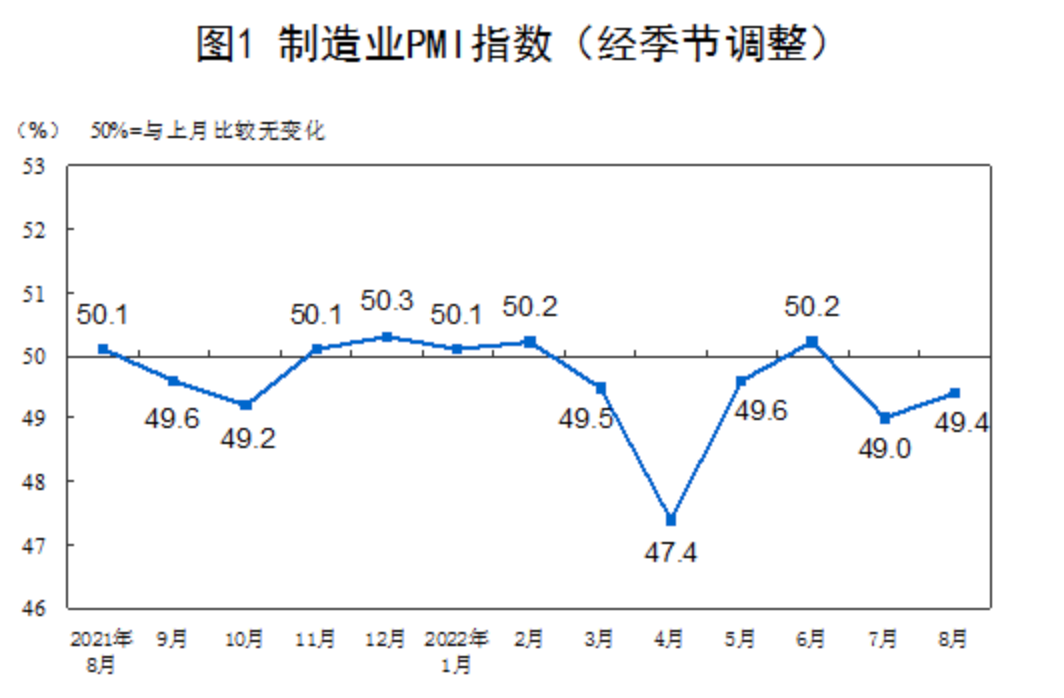

China's August PMI increased slightly, an increase of 0.4 percentage points from July

[Global Times Reporter Zhao Juezhen] China National Bureau of Statistics and China...

Announcement of Registration for Consumption Promotion Activities in Gulang County

The county's restrictions on business enterprises, sample companies, and business enterprises intended to be entered:In order to thoroughly implement the spirit of the Sixth Plenary Session of the 19t...