Sudden!The former general manager of Nuoan Fund, Ao Chengwen, was checked

Author:Red Star News Time:2022.09.25

Hongxing Capital Bureau News on September 25, the former party branch secretary and general manager of Nuoan Fund Management Co., Ltd. Ao Chengwen was suspected of serious disciplinary violations and is currently under investigation.

The Red Star Capital Bureau noticed that as a well -known online celebrity fund, the Nuoan Fund has recently fallen into public opinion storms. Not long ago, the referee document network disclosed that Zou Mou, a former fund manager of the Noon Fund, was involved in the "mouse warehouse", and the illegal profit was about 23.554 million yuan.

Subsequently, there was news that Cai Songsong, the star manager of the Nuoan Fund, "lost contact." Nuoan Fund responded that Cai Songsong was on vacation.

↑ Screenshot of integrity Shenzhen WeChat public account

The former general manager of Nuoan Fund, Ao Chengwen, was checked

Exemption in November 2019

On September 25, the Red Star Capital Bureau was informed that according to the public account of the General Office of the Inspection Committee of the Shenzhen Municipal Commission for Discipline Inspection of the Communist Party of China, "Integrity Shenzhen", the former party branch secretary and general manager of Nuoan Fund Management Co., Ltd. Accept the disciplinary inspection and supervision team of China Sinochem Holding Co., Ltd. and the supervision and investigation of the Supervision Committee of the Longhua District of Guangdong Province.

Resume shows that Ao Chengwen, male, Han nationality, born in July 1968, Pucheng, Shaanxi, a master's degree, joined the Communist Party of China in March 1991, and joined the work in July 1991.

He has successively served as senior manager of the investment department of China Chemical Export and Export Corporation; China Sinochem Group's subordinate China Foreign Economic and Trade Trust Investment Co., Ltd. Investment Banking Department staff, assistant manager, deputy general manager (chairing work), fund business group deputy team leader; Noon Fund Management Company Inspector and Secretary of the Board of Directors, Secretary of the Party Branch and General Manager. In November 2019, the party branch secretary and general manager of the Noon Fund Company were removed.

Noon Fund management scale exceeds 140 billion

The net profit in the first half of the year plummeted

The official website shows that the Noon Fund was established in December 2003 and is one of the national public fund management companies approved by the China Securities Regulatory Commission. The company's headquarters is established in Shenzhen, with branches in Beijing, Shanghai, Guangzhou, Chengdu, Wuhan and other places. It has public -raised securities investment fund management, fund sales, specific customer asset management, overseas securities investment management, trustee management insurance funds and other businesses Qualifications, business spread at home and abroad.

Data show that as of the middle of 2022, there were 60 public funds under the Noon Fund, and the scale of public fund asset management exceeded 140 billion yuan, and the cumulative dividend exceeded 31.2 billion yuan.

According to the official website, the shareholders of Noon Fund include Shenzhen Jielong Investment Co., Ltd., China Foreign Economic and Trade Trust Co., Ltd., and Daheng New Era Technology (600288.SH), which are holding 40%, 40%, and 20%respectively. Essence The company's legal representative and chairman are currently Li Qiang.

红星资本局查阅大恒科技近年来财报后发现,2022年上半年,诺安基金实现营业收入5.02亿元,同比增长7.24%,自2018年以后,公司半年营收重回5亿元以上;净The profit was 128 million yuan, a year -on -year decrease of 42.29%.

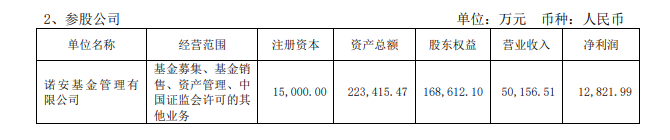

↑ Screenshot of Daheng Technology Half -annual Report

Affected by this, in the first half of 2022, the investment income of Daheng Technology's investment in the Noon Fund was 25.644 million yuan, a decrease of 42.29%from the same period in 2021.

From 2018 to 2021, the operating income of the Noon Fund was 205 million yuan, 721 million yuan, 981 million yuan, and 1.12 billion yuan, respectively; net profit was 13.17 million yuan, 190 million yuan, 274 million yuan, and 310 million yuan.

The Red Star Capital Bureau noticed that on the official website of the Noon Fund, the funds managed by it were divided into various types of funds such as stock -type, mixed type, bond type, currency type, index type, QDII and other types of funds.

This year, stock funds have been green across the board, and the largest declines are Nuoan's advanced manufacturing stock securities investment fund (001528), a decline of over 26%. Except for a slight rise in a hybrid fund, the rest of the other side fell across the board. The largest decline in the year was Nuoan Innovation Driver flexibly allocated a hybrid securities investment fund C (002051), which was 42.62%. Introduce its "another masterpiece of Manager Cai (Cai Songsong)." Most of the bond funds have risen this year, with an increase of 2%-4%. What is more eye -catching is the Nuoan Oil and Gas Energy Stock Securities Investment Fund (163208) in the QDII Fund, which has increased by 43.19%this year.

Noon Fund has trapped public opinion many times

Responsible President Cai's loss of contact: during vacation

The Red Star Capital Bureau noticed that as a well -known online celebrity fund, the Nuoan Fund has recently fallen into public opinion storms.

Recently, the referee document network shows that Zou Mou, a former fund manager of the Nuoan Fund, used the convenience of his position to disclose his brother's brother with a convenient information during the executive director and fund manager of the investment department. Even for the sake of cancellation of the case or lighter treatment, Zou also bribed 3.5 million yuan in national staff.

In September 2021, the Chongqing First Intermediate People's Court made a first -instance judgment on the case, determining that Zou had been executed for 11 years in prison and fined 14.45 million yuan; Zou A younger brother was sentenced to 3 years in prison and fined 10 million yuan; the two of them illegally obtained about 23.5504 million yuan to recover them in accordance with the law and paid the state treasury.

↑ Screenshot of referee documents

Subsequently, there was news that Cai Songsong, the manager of the Nuoan Fund Star Internet Red Fund, "lost contact."

In response, the Noon Fund officially responded to the Chinese reporter of the securities firm on September 21 that Cai Songsong, the fund manager of the Nuoan Fund Company, is currently on vacation.

The Red Star Capital Bureau noticed that as a star manager of the Noon Fund, Cai Songsong preferred semiconductor investment, and the representative of the manager was a Nuoan growth hybrid fund. As of the end of the second quarter of this year, Cai Songsong's fund managed the cumulative scale of more than 30 billion yuan, which was less than four years before he was the fund manager for the first time. According to regular reports, Cai Songsong's top ten stocks have a total of 78.04%, and one among the top ten heavy stocks accounted for more than 5%.

In addition, not long ago, the Nuoan Growth Fund managed by Cai Songsong also held a 5G RF leader Zhuo Shengwei (300782.SZ). Zhuo Shengwei announced that the Nuoan Growth Hybrid Fund passed a centralized bidding transaction on September 8 to increase its shareholding of 519,500 shares. In the past six months, Noon has increased its sixth time to increase its holdings. Its shareholding ratio has touched the license line, reaching 5.0065%, becoming Zhuo Shengwei's sixth largest shareholder.

For a single public fund product product, due to the six months after the card is raised, it is very rare for liquidity to consider liquidity issues. In some people in the industry, Cai Songsong costs up to 2.5 billion yuan. If the Nuoan Growth Hybrid Fund is redeemed, or hidden liquidity risks.

Red Star News reporter Xie Yutong

Editor -in -chief Tang Huan Editor Pan Li

- END -

Huangshi CPI rose moderate in the first half of the year

On the 1st, Huangshi Investigation Team of the National Bureau of Statistics released the latest data. Since the beginning of this year, with the gradual recovery of domestic market demand and the imp

Smart agriculture promotes the transformation and upgrading of traditional planting models

On September 16th, in the Wuxi Fulongjing Smart Agricultural Ecological Park, Long...