China Import and Export Bank Zhang Wencai: Focus on key areas and provide capital guarantee for the real economy

Author:Dahe Cai Cube Time:2022.09.24

[Dahe Daily · Dahecai Cube] (Reporter Xu Bing) On September 24, the Global Wealth Management Forum 2022 Autumn Summit was held online. The theme of this summit was "Finding Determination under uncertainty". Zhang Wencai, deputy governor of China Import and Export Bank, said that in the face of the Global Macro Bureau, governments, enterprises, financial institutions, and international organizations should strengthen pragmatic cooperation, enhance communication and coordination, and work together Financial institutions, including policy banks, should play an important role in it.

At present, the global economy, finance, and political pattern accelerate the reconstruction. It is "three lows and one high" (low growth, low interest rate, low inflation, high debt) after the international financial crisis in 2008 Growth, high interest rates, high inflation, high debt), "stagnation" characteristics have become increasingly obvious. In Zhang Wencai's view, the risk challenges facing the recovery of the world economy are even more severe, mainly reflected in four aspects: global imbalances in supply and demand are frequent; radical interest rate hikes have limited effects on flat inflation; Highlights; the negative impact of financial turmoil is increasingly apparent.

So, how can finance help promote the world economy out of trouble? In this regard, Zhang Wen has made five suggestions:

The first is to focus on key areas and provide capital guarantee for the real economy. Finance is of great significance to improving the efficiency of resource allocation and optimizing the industrial layout. The urgent priority is to guide more monetary funds into the real economy, thereby alleviating the contradiction between supply and demand in some fields. At present, whether it is a developed country or a developing country, there is a lot of room for improvement and development in the fields of infrastructure construction, industrial chain supply chain, green low -carbon, small and micro enterprises, etc., and it is necessary to provide accurate and moderate financial support.

For example, some countries are still weak in infrastructure and large funding gaps, which has become a bottleneck that limits its in -depth integration into international cooperation. For another example, there are still blocking points and breakpoints in the global industrial chain supply chain. In order to make up for the investment and financing gap in key areas, we can actively broaden the sources of diversified capital, give full play to the joint effort of direct financing and indirect financing, tailor -made professional financial solutions for market entities, and pour the flower of the real economy with financial live water.

The second is to follow the concept of green development and promote the improvement of green financial product services. "Green development has become a global consensus, and the realization of green development cannot be separated from the support of green finance." Zhang Wencai said that on the one hand, ESG needs to penetrate the entire process of financial services, carefully evaluate the environmental and social risks of financing projects, strictly check the control of the environmental and social risks of financing projects, strictly check the control of the environmental and social risks of financing projects, strictly check the control of the environmental and social risks of financing projects, strictly check the control of the environmental and social risks of financing projects, and strictly check the control of the environmental and social risks of financing projects. Essence At the same time, it is inseparable from the project participating enterprises to comply with environmental protection requirements, and consciously take the initiative to take the initiative to environmental and social responsibility. On the other hand, accelerate the innovation and application of green financial products, and provide investment and financing support for green industries such as clean energy, environmental protection, and climate change through green credit, green bonds, and green funds, and promote economic green transformation and development.

The third is to strengthen the empowerment of science and technology and continuously improve the quality of financial services. "At present, the global digital technology has developed rapidly, and the degree of digitalization has deepened. New technologies, new products, new formats, and new models are becoming an important driving force for economic growth. It has put forward new requirements for financial services." Zhang Wencai believes that the financial industry needs Explore with the industry, under the premise of ensuring security, reliability, and compliance, improve the adaptability of finance to the development of the digital economy as soon as possible, and further enrich the application scenarios of fintech. Using modern technologies such as the Internet, big data, cloud computing, artificial intelligence, etc., improve the exhibition, risk control, and service levels through financial technology, and improve the accuracy, acquisition and coverage of financial resources allocation.

The fourth is to make overall development and security and build a financial wind control firewall. Maintaining the security and stability of the financial system is essential for the stable and healthy development of the economy. While actively supporting the development of the real economy, financial institutions need to prevent and resolve various types of financial risks in a more important position. At present, financial fragile risks have intensified, and under the help of capital profit -seeking, financial risks are in a period of susceptibility. This requires the financial industry to adhere to the bottom line of thinking, enhance the awareness of worry, do a good job of responding to plans, improve risk control capabilities, prevent excessive speculation, and avoid risk infection. Keep the bottom line that does not occur without systemic financial risks to promote more secure development.

Fifth, adhere to mutual benefit and win -win, and strengthen multi -bilateral international financial cooperation. In order to promote the recovery of the international economic recovery and maintain global financial stability, the financial industry not only needs to strengthen collaboration with governments, enterprises and international organizations, but also continuously deepen cooperation between financial institutions.

Finally, Zhang Wencai said that financial institutions should actively participate in the formulation of international financial standards and rules to promote the reform of global economic and financial governance; make full use of their respective professional and resource advantages to increase the project financing efforts of regional and country and other levels, including common common levels Carry out third -party market cooperation to promote economic and social development in relevant countries and regions; strengthen information sharing and experience exchanges, promote the transfer of knowledge, technology, and advanced management concepts to developing countries, and share the results brought by human scientific and technological progress.

Responsible editor: Chen Yuyao | Review: Li Zhen | Director: Wan Junwei

- END -

Five CPIC forward -looking PMI in August: It is expected to rise slightly from the previous month

According to the National Bureau of Statistics' work arrangements, this Wednesday will be released in August China Manufacturing Purchasing Manager Index (PMI). Securities Daily reporter interviewed...

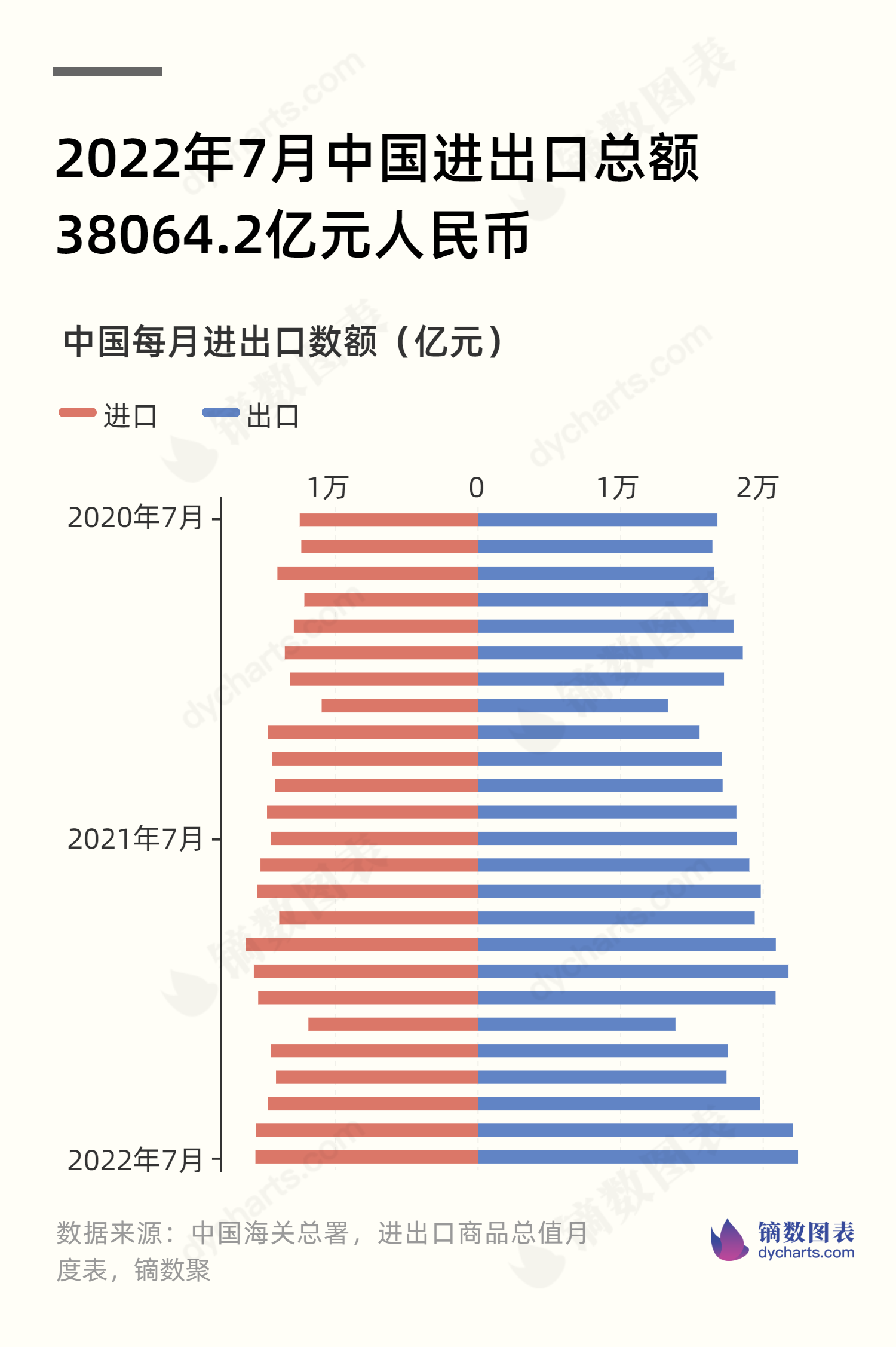

In July 2022, China's total import and export value was 3806.42 billion yuan

In July 2022, China's total imports and exports were 3806.42 billion yuan.Data sou...