The Federal Reserve's interest rate hike will bring a good time to configure gold

Author:China Gold News Time:2022.09.24

1

The Federal Reserve Eagle Intelligence Path is clear

The Federal Reserve's September Intersection Conference announced the 75 basis points of interest rate hikes, raising the benchmark interest rate to a range of 3%to 3.25%, and the interest rate level was new high since 2008. The Federal Reserve has raised interest rates 5 consecutive times this year, and the last three times are 75 basis points in interest rate hikes. It is the most powerful interest rate hike since November 1994. The main reason is Closer to the expected target of 2%, but after many high -intensity interest rate hikes, the US inflation pressure continued. Fed Chairman Powell stated at a press conference that he would always persist in fighting with inflation until the pace of inflation has slowed down significantly, and hinted This year will further raise interest rates.

Judging from this meeting, although the results are in line with market expectations, the Fed will be committed to fighting inflation within the year, and the median value of the interest rate line is significantly raised. It is predicted that the interest rate will rise to 4.4%at the end of this year. Therefore, at least 75 basis points will be raised in 2022, and interest rates will not be cut until 2024. From the perspective of the Fed's monetary policy path, the overall will be tightened, supporting the US dollar index and U.S. debt yields all the way, an important suppression of the gold trend since April, and it is expected to undergo pressure during the year. Slowness, the pressure of gold is reduced, and it is expected to usher in a transfer.

▲ From April to the Federal Reserve ’s interest rate hike in September

2

Geopoical situation is tight and provides the motivation to rebound

In terms of hedging, the Russian -Ukraine conflict has passed the most tense stage, and the risk of continuing to expand has declined. However, the Russian and Ukraine conflict may enter the final stage, and then the geopolitical situation is turbulent or stimulated the gold rebound.

3

Global economic recession expectations or stimulus to hedging heating up

Although the U.S. economy has not yet substantially recession, economic indicators such as consumption, manufacturing, and real estate have weakened, and market period spreads are close to inverted. In order to control the level of inflation, the Federal Reserve estimates the economic and employment impact of interest rate hikes at the September meeting. The medium value of GDP growth in 2022, 2023, and 2024 is 0.2%, 1.2%, and 1.2%. 1.7%, below 1.7%, 1.7%, and 1.9%below June; while the unemployment rate is expected to increase significantly, the median value of the unemployment rate at the end of 2022, 2023, and 2024 is 3.8%, 4.4%, and 4.4%, respectively. It is higher than 3.7%, 3.9%, and 4.1%higher than June, which means that the Fed's confidence in soft landing is weakening, and to control the importance of other indicators to control inflation. At the same time, the Fed's rapid interest rate hike attracts the return of funds, bringing pressure on other economies to affect the weakening of global economic indicators. The market has expected to decline. The hedging logic is expected to support the trend of gold and silver.

4

Frequent confidence in market funds is not conducive to gold prices

From the perspective of market funding, the New York Commercial Exchange (COMEX) market has declined. In addition, the world's largest golden trading open index fund (ETF) also shows a continuous outflow, which is now close to 2016. The precious metal market lacks funding support, the market is not interested in transaction, and the trend needs to change space in time.

5

Comprehensive analysis

In the short period of medium, the price of gold is weak, and it takes time to build a bottom. From the perspective of long -term, gold currency attributes have long -term gold prices, especially domestic gold demand will be strong for a long time. At the same time, the economic cycle is at top, global exit, rising world economic stagnation, currency superb development, the scientific and technological revolution at a conversion node, and intensified geopolitical games. Global facing major declines and depression, it will have long -term profitable gold. In the next 10 years, gold shall be based on defensive assets.

The technical side shows that the golden moon line is relatively low, the weekly is neutral, the daily line is weak, and the golden technology form is similar to early 2013. The relevant varieties are in the middle of June 15 in the middle -term bear market after June 15th. Suppression of gold prices; the US dollar index oscillation, US debt yields, actual interest rates and other support range oscillations.

From the perspective of handicap transactions, the market holding volume is at an inflection point. Domestic banks' personal customers withdraw from transfer transfer, ETF reduction, the neutrality of capital flow, investor structure partial institution, etc. The downside facing the market weakens.

Looking forward to the trend, international gold prices will not have more than 2,300 US dollars per ounce in the next year. At present, the key support of $ 1480/ounce below the technical face target. According to the current actual interest rate of US $ 1,600/ounce, the comprehensive judgment is an oscillation of the interval.

Silver does not have a basic support of more than $ 30/ounce in one year. The current technical target is 16 US dollars/ounce, the intermediate value is $ 18/ounce, and it is expected that the volatile range is 16 to 23 US dollars/ounce. This time is factors such as the Fed's control of interest rate hikes to suppress inflation, superimposed geopolitical conflicts. At the end of the rate hike, the market bottom is the timing of buying, and the time window watch the Fed's interest rate hike policy. At present, the formation of the market and the policy of policy still takes time. Generally speaking, the best time to buy time should be around December this year.

It should be noted that the taboo of the cycle is long -term problems and long -term problems. The short -term problem should be analyzed and judged by a short -term interest framework. Fiscal policy and monetary policy have a short -term adjustment of regulation, but they can't stop the trend of rolling in the long cycle.

The Federal Reserve's interest rate hike suppressing inflation, causing a short -term decline to fluctuate. However, the high -level oscillation of commodities is a pessimistic response to the future world situation and monetary policy. Recently, the game game has weakened, and the market tension has been relieved, but the torrent of the game will still increase from the long cycle. From the perspective of the general pattern, the short -term risk relief is still the mainstream, but the inflation of materials involved in people's livelihood is almost irreversible in the future. The global economy reappears, shrinks, and inflation, and the result of the behavior of neighbors led by the United States will inevitably point to "big water+large fluctuations". The varieties with a particularly large increase in the past 30 years will rise in the next 20 years. There is a long -term relatively stable ratio between goods, so it is currently selling a variety that has been seriously increased in the past and buying ultra -low basic material varieties.

In the future, investment should be based on value preservation. Gold is not the highest benefits, but it is the simplest and most common value preservation product. The relatively low price of silver and platinum are also the investment preservation standards of large -scale assets with good future assets.

The Federal Reserve ’s interest rate hike suppression of the price of goods before and after the interest rate hike at the end of the year, it may be the opportunity to deal with. Considering that the future interest rate cut may be in 2024, the price of gold may occur for a period of time before that, but the relative depreciation of the RMB will hedge the decline in domestic products to a certain extent.

- END -

"One-stop service!Hainan International Investment "Single Window" upgrade

After nearly half a year of development and construction, on August 3, the optimiz...

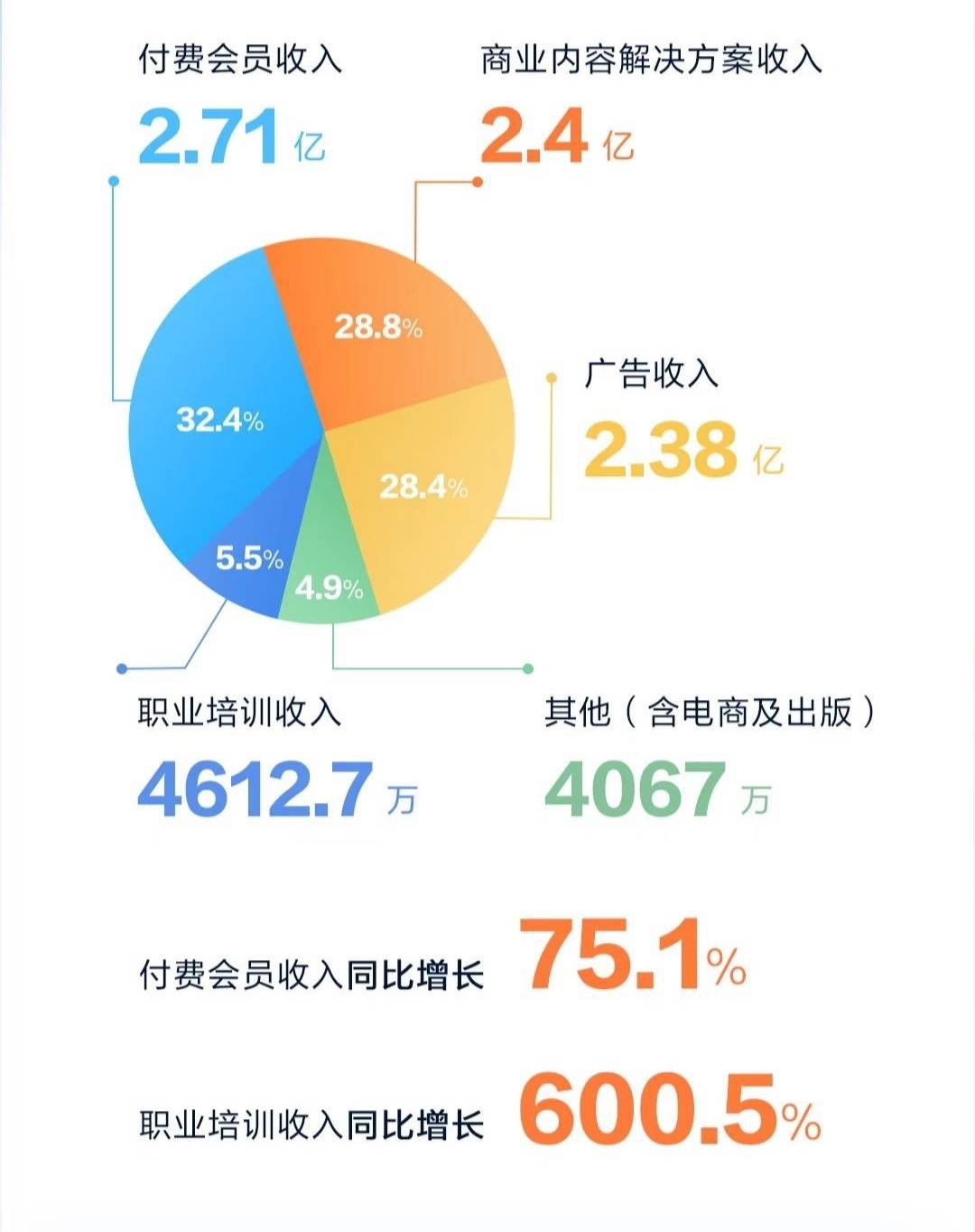

Zhihu Q2 net loss narrower the monetization ability to improve the product from the previous month

Cover Journalist Ouyang HongyuOn August 30, Zhihu announced unaudited financial re...