Yan Weidong of the Information Center of the Ministry of Natural Resources: Next year, gold and copper will still be the main mineral species

Author:China Gold News Time:2022.09.24

"In 2022, the probability of large -scale energy and minerals will slow down or call back, but there is still great uncertainty in geopolitical conflicts. The supply of lithium, rare earth, nickel, cobalt, copper and other mineral products is still very tight." September 21st On the day of the 2022 China International Mining Conference, at the Evolutionary Forum Analysis Forum on the first day of the opening of the China International Mining Conference, Yan Weidong, director and researcher of the Ministry of Natural Resources' Information Center's Mineral Office, said at the global mining development of this year.

Affected by the multiple factors such as the new crown pneumonia's epidemic, geopolitical conflict, and soaring inflation, after the "V" type rising in 2021, the world economy performed poorly in 2022. In July of this year, the International Monetary Fund's economic growth expectations this year and next year. Except for a few countries, both developed economies and emerging and developed economies have lowered their growth rates. Yan Weidong believes that the price of energy, including natural gas and power coal due to the blocking supply chain. Since the beginning of this year, the economic growth rate of major mineral resources has slowed down, especially Russia has shrunk. In the first quarter of this year, of the 10 countries with the fastest -growing mining industry, African countries occupied half of the country, and Uganda and Mauritius ranked among the top two.

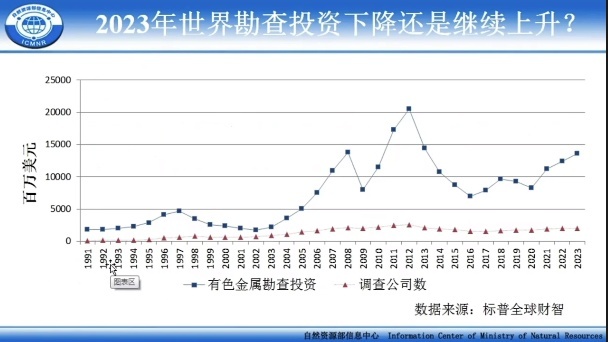

According to the S & P market, the financial intelligence survey predicts that the global non -ferrous metal exploration investment in 2022 is about $ 13 billion, an increase of 15%-25%over the previous year. In 2023, it may decline slightly due to factors such as financing. Yan Weidong said that lithium, rare earth, nickel, platinum metal metal, copper, gold and other minerals have become the main target mineral species of exploration. Western Australia, West Africa, and western Latin America became the hot spot for survey. In recent years, the world's large mineral discovery is concentrated in Australia, Ecuador, Chile, Bolivia, Guinea and other countries. Among them, Halimar Copper, Nickel, Platinum Metal Mine in Western Australia, Copper Mine of Ecuador Valovarina, Pastias Copper Mine in Chile, Golden Mine in Bolivia Karanga, and Guineanan Gold Mine Class mining bed.

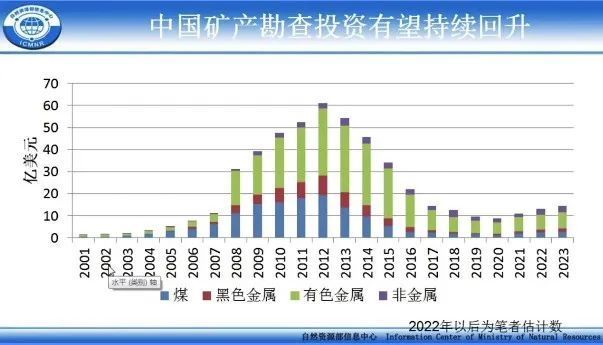

In the past 30 years, the world's mineral survey investment has shown relatively obvious periodic changes. In recent years, Australia, Peru and other countries have continued to grow. Especially in Australia, the development of mineral resources in the second quarter of this year is close to or exceed the highest level of history. When it comes to China's mineral survey investment, Yan Weidong said that after the trough of 2019 and 2020, from 2021, the Chinese mineral survey investment continued to rise. Especially for non -oil and gas mineral survey investments, the first time it has been growing since 2013 in 2021. Under the promotion of non -metals, the investment in fixed assets in China continued to rise, which may exceed the highest level of history in 2022.

From a new trend, Yan Weidong believes that under the drive of electric vehicles, 5G communication, drone, hydrogen economy, quantum technology, aerospace, "three rare" (rare, rare earth and scattered) minerals and platinum crickets The growth rate is significantly higher than other minerals; the concept of green mines and green mining is accepted and put into practice by more countries; on -site analysis, remote control, driverless, artificial intelligence and network security technology, it will apply more to the mining chain chain to the mining chain Essence

In the first seven months of this year, the world's largest copper production country, Chilean copper output was 3.048 million tons, a decrease of 6.6%from the previous year. The world's second largest copper country -Peru's copper output decreased slightly compared with last year. From the perspective of copper metal supply and demand, Yan Weidong believes that the relative shortage of copper supply this year will be more abundant next year. In the world's major copper metal trading market, copper inventory has gradually rebounded, but it is still at a historical low.

From the perspective of the world economy and global mining development, 10 years are a cycle. In 2012, the global mining industry reached a phased peak, including mining development investment and mining products at a relatively high level. Will 2022 will be a peak again in 2022? Yan Weidong believes that it is a high probability that the rise of large energy and minerals will slow down or call back. However, there is still great uncertainty in geopolitical conflicts, and the possibility of reaching a high possibility of oil prices will not be ruled out. Lithium, rare earth, nickel, cobalt, copper and other electric vehicles are still very tight.

- END -

Ecological governance and protection projects along the Silk Road are approved by the Asian Bank Council

On September 9, 2022, the Asian Development Bank (hereinafter referred to as the A...

A Rongqi participated in the 6th Silk Road International Expo and China East and West Cooperation and Investment and Trade Fair

Recently, the Deputy Secretary of the Banner and Government Banner Changzong Zhe p...