Central Bank: Promoting a higher level of financial markets open two -way opening

Author:Securities daily Time:2022.09.24

On September 23, the central bank issued the "RMB International Report of 2022" (hereinafter referred to as the "Report"). The "Report" pointed out that since 2021, the People's Bank of China has adhered to reform, opening up, and mutual benefit. Based on market -driven enterprises' independent choices, it has carefully promoted the internationalization of the RMB and provided strong support for the steady operation of the real economy. The various indicators of the RMB are generally improved, the RMB payment currency function has been steadily improved, the investment and financing currency functions have been further deepened, the reserve currency functions have continued to rise, and the currency function has gradually increased.

The "Report" shows that since 2021, the RMB cross -border receipt amount has continued to grow on the basis of the last year. In 2021, the total number of cross -border receipts of banks was 36.6 trillion yuan, an increase of 29.0%year -on -year, and the receiving amount reached a record high. The overall balance of RMB cross -border income and expenditure, with a cumulative net inflow of 404.47 billion yuan throughout the year. According to data from the Global Bank of Financial Telecommunications Association (SWIFT), the RMB international payment share increased to 2.7%in December 2021, and exceeding the yen became the world's fourth payment currency. In January 2022, it further increased to 3.2%, a record high. According to the official foreign exchange reserve currency composition (COFER) data released by the International Monetary Fund (IMF), in the first quarter of 2022, the proportion of RMB in global foreign exchange reserves accounted for 2.88%, which was just added to the RMB in 2016 (SDR ) The currency basket rose by 1.8 percentage points, ranking fifth among the main reserve currency. In May 2022, the International Monetary Fund (IMF) raised the weight of the RMB from 10.92%to 12.28%in the special withdrawal right (SDR), reflecting the recognition of the RMB free degree of free use.

According to the "Report", the settlement volume of cross -border RMB in the real economy has remained rapidly growing, and the fields of commodities and cross -border e -commerce have become new growth points, and cross -border two -way investment activities continue to be active. The RMB exchange rate generally shows a two -way fluctuation, and the endogenous demand for market entities to avoid the risk of exchange rates has gradually increased. RMB cross -border investment and financing, transaction settlement and other basic systems have continued to improve, and the ability to serve the real economy has continued to increase.

The "Report" shows that my country's financial markets have continued to advance, RMB assets have maintained high attractiveness to global investors. The cross -border receipts under securities investment are generally net inflows. As of the end of 2021, overseas entities holding domestic RMB stocks, bonds, loans and deposits such as financial assets were 10.83 trillion yuan, an increase of 20.5%year -on -year. The offshore RMB market has gradually recovered and transactions are more active. As of the end of 2021, the main offshore market RMB deposits were close to 1.50 trillion yuan.

The "Report" pointed out that in the next stage, the People's Bank of China will coordinate development and security, based on market -driven and independent choices of enterprises, and carefully promote the internationalization of the RMB. Further consolidate the basic institutional arrangements for cross -border use of RMB, meet the needs of the RMB use of good entity departments, promote the two -way opening of the financial market in a higher level, and promote the virtuous cycle of the RMB in the shore and offshore market. At the same time, the cross -border capital flow macro -prudential management framework that continues to improve the integration of domestic and foreign currency, establish and improve the surveillance, evaluation and early warning system of cross -border capital flow, and firmly adhere to the bottom line that does not occur without systemic risks. (Liu Qi)

- END -

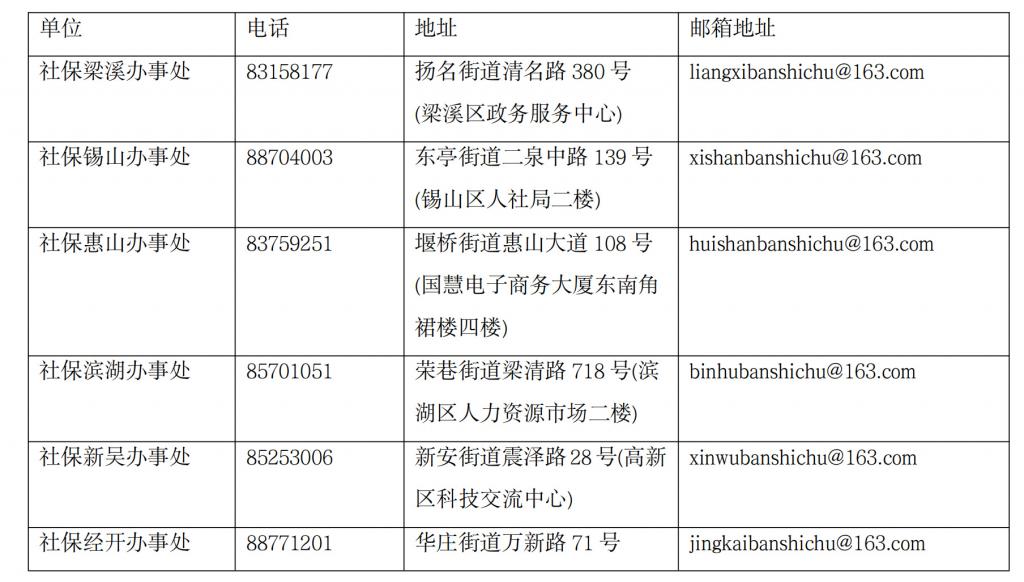

@, Small and medium -sized enterprises, please check this social insurance premiums!

Modern Express News (Reporter Chen Min) According to the Notice of the Provincial ...

People's Daily released the Guide to Investment in Free Trade Port -Coffee Processing and Manufacturing Base settled in Hainan's good analysis

If you open the column:On June 10, 2021, the Hainan Free Trade Port Law of the Peo...