Bao Li Food tortuous increases the "empty mind" but gives the growth rate of continuous decline prediction

Author:Economic Observer Time:2022.09.24

Judging from the asset -liabilities and profits of the kitchen Affin and the empty network, if the performance of the two companies has not increased very rapidly, it is expected to directly reduce the current assets of Baoli Food Company and increase some revenue of some revenue. , Reduce profits.

Author: Ye Xinran

Figure: Tuwa Creative

On the evening of September 20, the announcement of Baoli Food (SH: 603170) showed that the company received a regulatory letter of supervision involving the acquisition of a minority equity.

The cause of the incident, on September 19, Baoli Food issued an announcement, intending to acquire a controlling subsidiary Hangzhou Kitchen Affen Affin Technology Co., Ltd. (hereinafter referred to as "Kitchen Affen") with a controlling subsidiary of 63.75 million yuan. , Holding subsidiary Kitchen Affen plans to acquire a 10%equity held by a minority shareholder of Hangzhou Air Carvings Network Technology Co., Ltd. (hereinafter referred to as "empty network") at 35 million yuan.

After the completion of this transaction, the kitchen Affin will become a wholly -owned subsidiary of Baoli Food, and the proportion of the direct shareholding of the kitchen Affen's empty carved network will also increase from 70%to 80%.

The trading party of the kitchen Affin is two natural persons of Wang Miao Miao and Jiang Zhang.

The air -engraved network mainly sells the Internet celebrity pasta -empty brand Itopathy. According to the report issued by Baoli Food, during the 618 period of 2022, the empty mind was the first place in the three platforms of Tmall, Douyin, and JD.com. Essence The audit report shows that in 2021, Affen's revenue reached nearly 500 million yuan, of which the revenue of the empty carved network reached 458 million yuan and net profit was 28.54 million yuan.

It is worth noting that this acquisition does not involve changes in the scope of the merger statement. Why is Baoli Food still shot again?

The price of 63.75 million yuan and 35 million yuan, the premium rate of more than 600%. According to the announcement, the kitchen Affin's net assets were 34.603,800 yuan, the evaluation value reached 255 million yuan, the net assets of the empty network were 48.739 million yuan, and the evaluation value reached 351 million yuan.

Jin Le function analyst Liao Hekai pointed out that these two acquisitions are the premium acquisition, and it seems more about the withdrawal of the early investment financial investors. This part of the shareholding seems to have limited significance to listed companies. Judging from the asset -liabilities and profits of the kitchen Affin and the empty network, if the performance of the two companies has not increased very rapidly, it is expected to directly reduce the current assets of Baoli Food Company and increase some revenue of some revenue. , Reduce profits.

In the first half of 2022, Baoli Food achieved revenue of 911 million yuan, realized net profit of 92.769 million yuan in mother, and a net operating cash flow of 153 million yuan. Liao Hekai said that from the semi -annual report of Baoli Food, the acquisition of 63.75 million yuan is obviously a major issue for Baoli Food.

Baoli Food and Kitchen Affin Relations Erted

The relationship between Baoli Food and Kitchen Affin is not simple.

In March 2021, Baoli Food acquired 75%of the kitchen Affen's shares from Shen Lintao, to realize the holding of the kitchen Affin. %.

From the perspective of the prospectus, in 2018, when the kitchen Affen was established, Shi Qiangtao held 95%of the equity, which was held for Yang Lin at the beginning; then Yang Lin transferred 20%of them to Hangzhou stupid children electronics electronics Business Co., Ltd. (hereinafter referred to as "Stupid Child Company"), and then, Yang Lin transferred 5%of the equity to Hangzhou Relashing Brand Planning Co., Ltd. (hereinafter referred to as "Hangzhou Gaowang"), which mainly depends on its food packaging Industrial design ability. By the end of 2018, 95%of the equity of Yang Lin held 70%of the shares, the stupid child company held 20%of the shares, and the Hangzhou heat wave shares were 5%.

In March 2020, the stupid child company transferred 15%of the equity to Shen Weifeng, and Shen Weifeng was entrusted to the transfer of the transfer of the transfer. In February 2021, Shen Weifeng was entrusted by Zhantao and transferred 10%of the equity of the kitchen Affen to Wang Miaomiao as a equity incentive for the management of the kitchen. Also in February 2021, a total of 75%of the equity held by Yang Lin and Shen Weifeng conducted a replacement of a total of 75%of the equity.

It was not disclosed in the announcement. Whether Wang Miao Miao's other 10%of the holdings were acquired from stupid children and Hangzhou heat waves, but it is certain that stupid children and Hangzhou heat waves are no longer among the shareholders. Total 20%. According to the information of the national corporate credit information publicity system, the legal person of the kitchen Affin was changed to Wang Miaomiao in February 2021, and in April 2022, he changed to He Hongwu.

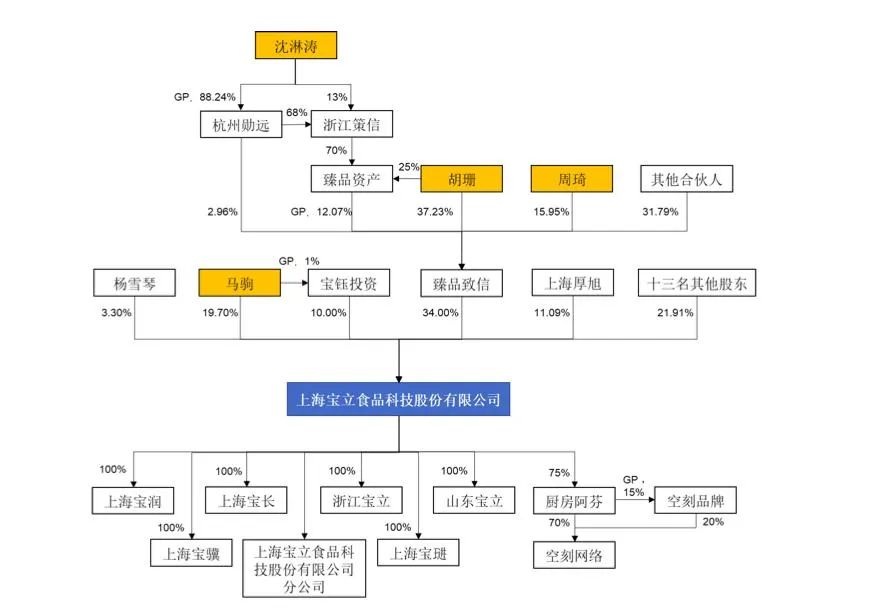

It is worth noting that the key characters in the above series of operations, Maski Tao, is also one of the actual controller of Baoli Food. Maju, Hu Shan, Zhou Qi, and Qintao are the common actual controller of Baoli Food, and controlling 67%of the company's share voting rights. Furthermore, through the stake through the eyes of Tianyancha, the suspected actual controller of Baoli Food is Ginitao.

(Screenshot from Sky Eye Check)

The prospectus disclosed that since January 2015, Zhantao has been the chairman and general manager of Zhejiang Cexin Investment Management Co., Ltd., and since December 2017, he has served as the director and vice chairman of Baoli Food.

As a result, it is not difficult to find that Bao Li Food's acquisition of the kitchen Afen's equity, the above two companies have contacted Qintao. Rely on the empty network pull

The main products of Baoli Food include composite seasoning, light cooking solutions, and drink dessert ingredients. Customers include KFC, Pizza Hut, McDonald's, Deks, Hamburg King, Damile, etc. Baoli Food entered the Yuman direct supplier system in 2007, and in 2014 it became one of the five major seasoning suppliers.

In the first half of 2022, the company realized revenue of 911 million yuan, an increase of 26.97%year -on -year; net profit attributable to mothers was 92.769 million yuan, a decrease of 3.86%year -on -year. In fact, the revenue growth of Baoli Food in the first half of the year mainly depends on the empty -oriented revenue of some income pockets in April 2021.

The empty operating company is a empty network. It was established in March 2020 and is the holding subsidiary of the kitchen Affin.

From the disclosure of the company's prospectus, in the first quarter of 2022, excluding the revenue of Affen in the kitchen, the company's revenue was 318 million yuan, a decrease of 1.13%from the same period in 2021. Looking at the second quarter, the revenue of composite seasoning occupying half of the river last year dropped from 223 million yuan to 181 million yuan this year, and the category revenue of light cooking solutions increased from 136 million yuan to 278 million yuan this year.

However, the kitchen Affin's parallel has also brought a sharp increase in sales costs. In the first half of this year, the company's sales costs reached 142 million yuan, an increase of 191.40%year -on -year. The company pointed out that it mainly includes the consolidation of the kitchen Affen in April 2021. Therefore, the previous annual sales costs were only data in the second quarter of the kitchen Affin's second quarter. The business of the terminal consumer market has a large sales and promotion cost. Its incorporated scope and sales scale expanded to drive the company's sales costs to increase significantly.

Facing growth dilemma

The company increased holding the kitchen Affen this time, but it was strange that the company did not seem to have much expectations for the future growth of the empty network.

In the announcement of Baoli Food, it can be found that the company's expectations for the air -engraving network are continuously declining. In 2021, the revenue of the air -engraving network increased by 134.97%, and in the forecast, the growth rate in 2022 decreased to 60.82%, and the growth forecast by 2026 was 1%. In addition, the company predicts that the net profit margin of the air -carved network in 2022 will decline, and it is estimated that its net interest rate will not be able to return to the level of 2020 and 2021.

(Screenshot comes from Baoli Food Announcement)

In response, the reporter called Baoli Food in asked why the growth rate was predicted for the growth rate, and the relevant persons of the Securities Department stated that the evaluation report in the announcement was explained.

From the summary of the assessment report, the company's prediction basis is mainly that empty sales are mainly online, and the online market slows down, so that the increase in customer group growth will gradually decrease; in addition Growth and surge will gradually become gentle.

In the report, the company said that after nearly three years of market cultivation and development, consumers' consumption habits for fast food are more mature, and they have accumulated a large number of purchasing customers. Based on the judgment of the market capacity and the number of target groups, it is predicted. At the same time, the development rate of light cooking food industry is considered. It is expected that the number of active users in the next year will decrease compared to the previous year.

It was not two to three years after being out of mind, and quickly became an explosion of the Internet of the Internet. However, its severe dependence is online. In the estimated report, the company expects that the air -engraving network will income 282 million yuan in sales expenses in 2022, of which the drainage promotion cost will reach 184 million yuan. This model makes the company's net interest rate performance not outstanding. In 2021, the air -engraving network realized revenue of 458 million yuan, a net profit of 29 million yuan, and a net profit margin of 6.23%.

The research report of Guohai Securities pointed out that as the current cost of Internet e -commerce platforms is getting higher and higher, the net profit margin of vacant products itself is lower than that of the company's overall company's net profit margin. In the future, we need to develop offline sales networks.

Regarding the development direction of the company in the future, the above -mentioned securities department pointed out that it is currently focusing on the products of light cooking solutions, and the above acquisition is also a plan for management. The preliminary acquisition agreement is currently determined, and it has not been officially signed yet, and the changes will be disclosed in time.

This year, the wave of food raw material suppliers appeared in the capital market, which quietly discovered that investors quietly discovered that the C -side brand's horse -ups -style -style white competition was fed a number of upstream raw materials companies. Baoli Food is also listed in this wave. In July this year, Baoli Food successfully landed on the capital market. This side of the company on the B -end was used to acquire the kitchen Affen in 2021 to open the "B+C" dual line. Operation, the market is interpreted as the opening of the second growth curve. However, the company is expected to gradually narrow the future growth space of the empty network. I wonder if the company will continue to find the third curve next, or is it just a capital of capital?

Local fiscal self -rescue: Urban investment company's newly stove Ukraine announced the entry into Russia's referendum, Russia's Tuju dagger saw the new round of "gambling cards" in Macau

- END -

Subsidies to provide stabilized chain foreign trade enterprises busy (economic new orientation · sta

In the first May of this year, my country's total import and export value of goods...

[Fujian, Min Shui Huaxin] Party Organization Cooperatives!There are new ways to Fumin in Ninghuaqiang Village

In the early morning of the early autumn, the mist was gently walked around the Tu...