"Town Youth" won!From 6 yuan, milk tea, revenue exceeds 10 billion, net profit is nearly 2 billion, this company will come to the A -share IPO

Author:China Fund News Time:2022.09.23

China Fund reporter Nan Shen

Zhang Hongchao and Zhang Hongfu, the younger town from Shangqiu, Henan, brought their milk tea brand "Honey Snow Ice City" with their main town youth, to impact the IPO.

On September 22, the CSRC's website showed that the listing application of Mixue Bingcheng Co., Ltd. Shenzhen Stock Exchange was accepted and pre -disclosed the prospectus. The company plans to apply for public issuance of no more than 401 million shares, and it is planned to raise 6.496 billion yuan. However, a series of data disclosed by the listing of Mixue Bingcheng is more "disruptive" than the listing itself.

Relying on 3 yuan a ice cream, a lemonade of 4 yuan, and a cup of milk tea of 6-8 yuan, Honey Snow Ice City's final sales of 2021 actually exceeded 20 billion yuan, the company's operating income reached 10.3 billion yuan, and net profit It is also close to 2 billion yuan. With the continuous high -speed growth, the company's key financial data is very beautiful. The asset -liability ratio remains in the early 20%, and the operating cash flow continues to increase. The latest cash plus wealth management products on the account is as high as 3.5 billion yuan, which is completely "not bad."

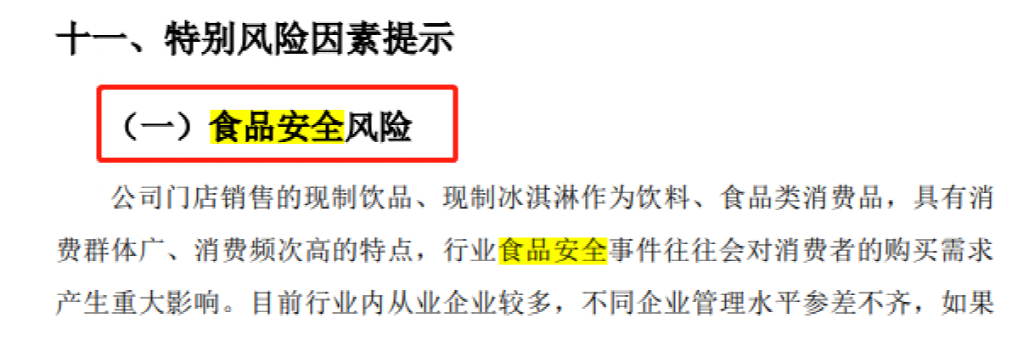

The risks of Mixue Bingcheng are mainly from food safety. In 2019, a branch of the company's branches was punished by the local municipal supervision department of Zhengzhou because of failure to obtain food operation permitting business. There are countless cases of being punished and complaining.

If it is successfully listed, Mi Xue Bingcheng is expected to become the second new tea listed company after Jinai.

The number of stores exceeds 20,000

Performance high -speed growth

The prospectus shows that Mixue Ice City is mainly engaged in the development, production, sales and brand operation management of current drinking, current ice cream and its core ingredients. One of the chain companies.

As of the end of March 2022, the company had more than 20,000 stores, and the store network covered 31 provinces, autonomous regions, and municipalities in the country. The number of stores ranked first in the current tea industry. At the same time, the company actively walked abroad, and the company has opened 317 and 249 "Honey Snow Ice City" stores in Indonesia and Vietnam overseas.

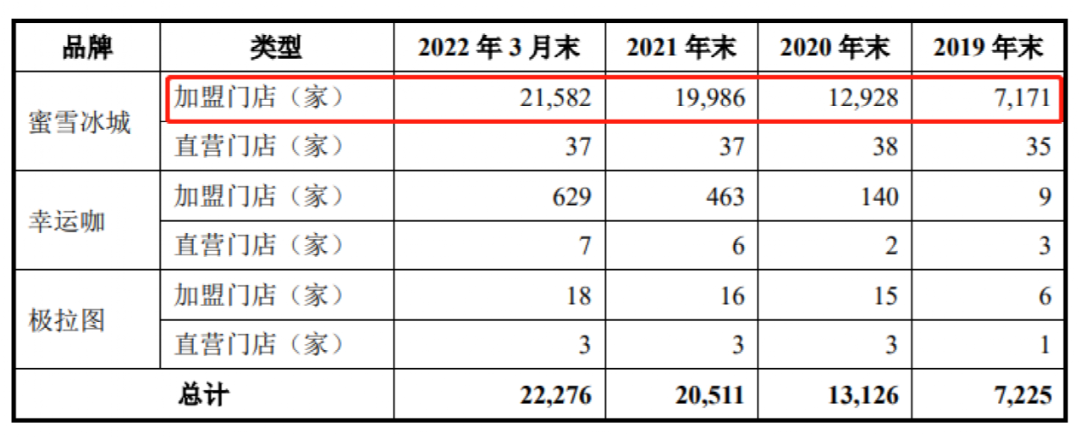

In the first three years (in the first quarter of 2019, 2020, 2021, and 2022), more than 96%of the company's stores are franchise stores. Among them, Mixue Bingcheng franchise store increased from 7171 at the end of 2019 to 21,582 at the end of 2022, an increase of 200%; while Mixue Bingcheng Direct Store was 35 in 2019, and 37 at the end of the first quarter of 2022 , Have almost no increase.

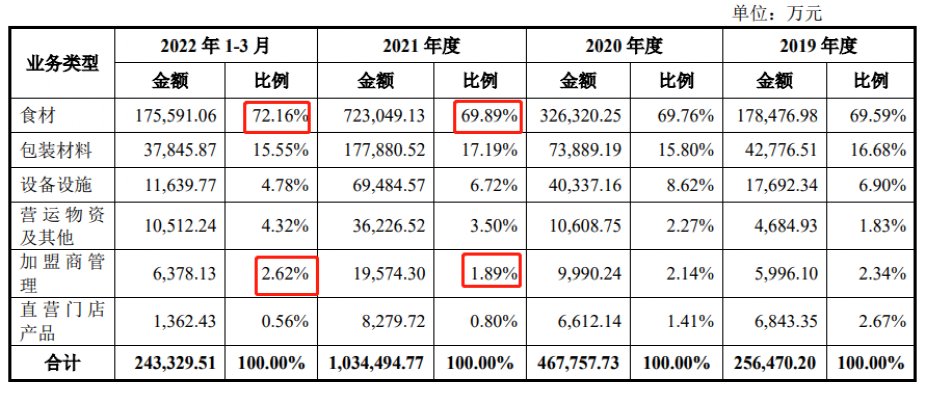

According to the Ai Media Consultation Report, the sales of the company's "Mixue Bingcheng" brand store terminal in 2021 were about 20 billion yuan, accounting for about 7.15%of the current market size of the tea drink industry. However, the terminal sales of the terminal are not the company's revenue. In the franchise model, the company's income is actually from the sales of franchisees, mainly selling ingredients, packaging materials (milk cups, etc.) and equipment and facilities to franchisees. The income of ingredients and packaging materials accounted for nearly 90 % of the recent two financial reports.

Relying on the supplier and manager of the franchisee, the company has achieved approximately 2.566 billion yuan, 4.68 billion yuan, 10.351 billion yuan, and 2.434 billion yuan in the past three years. E00 million yuan, 1.912 billion yuan and 391 million yuan, the compound growth rate of revenue and net profit 2019 to 2021 exceeded 100%. The company's operating net cash flow was 528 million yuan, 1.139 billion yuan, 1.692 billion yuan, and 208 million yuan, respectively, and the operating cash flow was abundant.

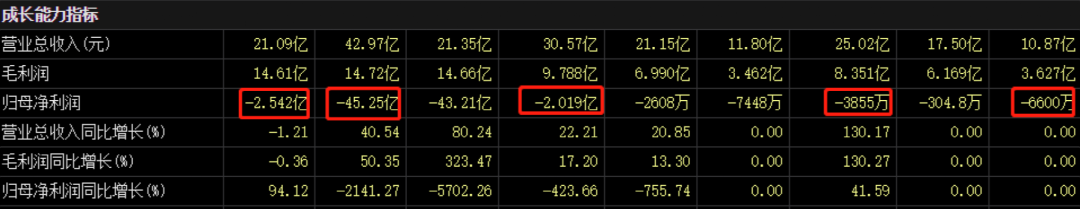

Compared with "Naixue's Tea" listed in Hong Kong stocks in June 2021, I know how beautiful the data of Mixue Bingcheng is.

From 2019 to 2021, Naixue's revenue increased from 2.5 billion to 4.3 billion, but its net profit continued to lose money and continued to expand. In 2019, it lost 3.8.55 million yuan, lost 202 million yuan in 2020, and lost 4.5 billion yuan in 2021. In the first half of 2022, Nai Xue continued to lose 254 million yuan.

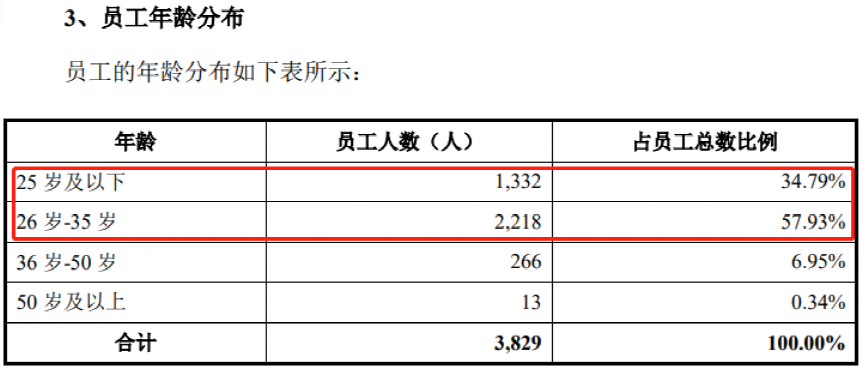

It is worth mentioning that the staff of the Mixue Bingcheng employees are extremely young. As of the end of 2022, the number of employees in the company was 3829, of which about 35%were under 25 years old, and 58%of the 25 to 35 years old, which means more than nine more than nine. Employees are under 35 years old.

Cash plus financial management exceeds 3.5 billion

Gao Yan and Meituan appeared in the top ten shareholders

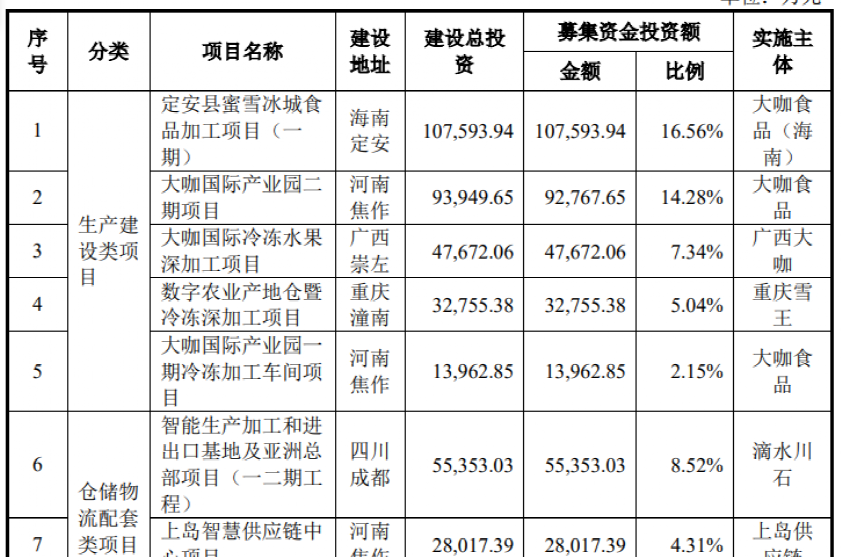

This time Mixue Bingcheng plans to raise 6.496 billion yuan in IPO, and plans 11 specific projects in three major categories, including production lines, warehousing logistics facilities and other comprehensive supporting facilities. In addition, some of them are supplementary funds.

It is worth noting that the company raised the "lion's opening", but it seemed that there was no shortage of money on the account. Nearly 30 % of the raised funds for this plan are actually preparing to use to supplement mobile funds, reaching 1.9 billion yuan, and the actual investment project is about 4.6 billion yuan. In fact, thanks to the company's ultra -high performance growth and continuous increase in cash flow, the company's accounts are very abundant, and there is basically no liabilities, and the space for leverage is still very large.

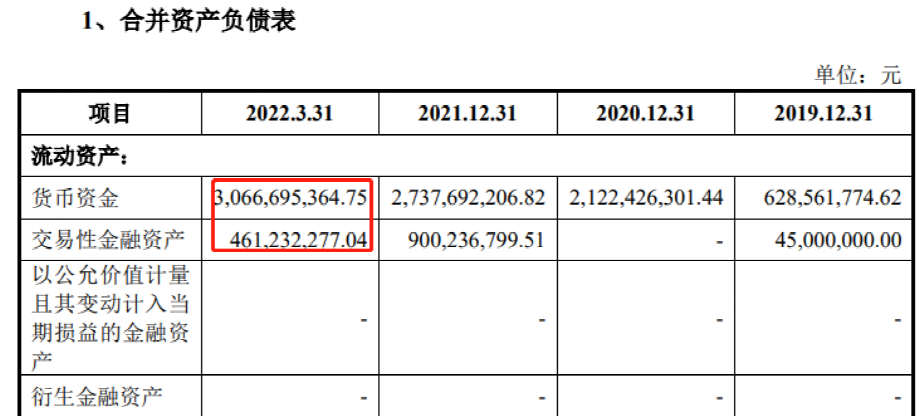

Specifically, as of the first quarter of 2022, the company's accounts had a monetary capital of 3.066 billion yuan and a "transaction financial asset" of 461 million yuan, which mainly composed of bank wealth management products. These two items added to 3.527 billion yuan. The company's total assets are only 7.5 billion yuan, which means that almost half of the assets are cash and cash -like assets. In terms of debt, the company does not have a penny for a long time, only less than 100 million (90.11 million yuan) short -term borrowing. The company's financial expenses continue to be negative, that is, interest income is far greater than interest expenses. Only 21.76%. China Fund reporter noticed that two well -known companies Gao Yan and Meituan appeared among the top ten shareholders of Mixue Bingcheng. The prospectus shows that on December 15, 2020, Dragon Ball Meicheng and Gao Yueqi subscribed for 4.53 million yuan for new registered capital for 933 million yuan, each obtained 4%of the shares, becoming the third and fourth largest shareholders, only the only shareholders. Only Substance to the founder of the founder of 85.56%of the shares.

The above -mentioned shares commitment is 12 months, which means that if Mixue Ice City is listed smoothly, the shares of Meituan and Gao Gao's shares of Meituan and Gaoma will be lifted 12 months after listing.

Pay attention to food safety risk

Stores have been punished and complained frequently

For the food and beverage industry, food safety is always the door of life, and Honey Snow Ice City is no exception. The company reminded in the prospectus that due to the long production and operation chain and many management links, product quality problems may occur due to negligence or unpredictable factors.

It said that if the company's product quality control in the links of procurement, production, packaging, storage, transportation, and store production does not meet the requirements of national laws, regulations, departmental rules, standardized documents, and food safety standards, or the procurement and inspection of raw materials, The irregular operations of ingredients, sterilization, and finished product testing and improper circulation and transportation will lead to unqualified product quality and even food safety accidents.

In fact, the black cat complaint platform shows that there are more than 4,000 complaints on Mixue Bingcheng, of which complaints in food safety and quality account for a considerable proportion.

According to the prospectus, in September 2019, the Dehua Street Branch of Henan Mixue Bingcheng Beverage Co., Ltd. was punished by the Market Supervision and Administration Bureau of the Erqi District of Zhengzhou City because of its business permits.

According to previous reports of the Southern Metropolis Daily, on July 6 this year, a store in Fengtai District, Beijing, Beijing, Beijing, was made of tea drinking for expired frozen litchi juice. A store in Gongcheng County, Guilin, Xuebing City, was punished for making drinking drinks with expired coffee powder; at the end of May this year, a store in Yan'an City, Mixuebing City, was fined 9,000 yuan by relevant departments for food raw materials and food additives that exceeded the shelf life.

In addition, on June 23 this year, the national corporate credit information publicity system disclosed that the Mixue Beverage Store in Longshan County, Hunan Province was fined 12,000 yuan by the Longshan County Market Supervision and Administration Bureau for violating the Food Safety Law.

Edit: Captain

- END -

[Entering the county seat to see development] Guangxi to the north: build a city of livable industry

CCTV News (News Broadcast): The series of Entering the County series reports. Toda...

Silver: Vigorously optimize the business environment to accelerate high -quality development

In recent years, Baiyin City has invested in the fertile soil, promoting new steps...