The subsidiary plans to increase the capital of nearly 500 million yuan. What new actions are there in Hengrui Pharmaceutical?

Author:Huashang Tao Lue Time:2022.09.23

Today, Hengrui Pharmaceutical issued an announcement saying that the subsidiary Shanghai Ruihongdi Pharmaceutical Co., Ltd. intends to introduce Jiangsu Hengrui Pharmaceutical Group Co., Ltd., Shanghai Shengdi Biomedical Private Investment Fund Partnership (Limited Partnership), Shenzhen City As a new shareholder, Yingtai Asset Management Co., Ltd. has a total capital increase of 498 million yuan. After the completion of the capital increase, Hengrui Pharmaceutical, Hengrui Group, Shengdi Fund, and Yingtai Asset Management holding the shareholding ratio of 38%and 28, respectively. %, 19%, 15%.

Earlier reports are rarely reported. What is the origin of this low -key Rui Hongdi? According to data, Shanghai Ruirong Di Pharmaceutical Co., Ltd. was established in August 2021. It focuses on gene therapy drug development. Product pipelines that will have neurodegenerative diseases and ophthalmology will enter the clinical research stage.

Facing the increasingly "inside volume" R & D ecology and severe market environment, Hengrui's development has faced technical adjustments. Recently, Hengrui is also actively trying to seek breaking the situation and continuously optimizing the pipeline structure. Hengrui's half -annual report in the 2021 mentioned that the company produced a number of new technology platforms with independent intellectual property rights and internationally, including gene therapy. It seems that Hengrui has already begun to deploy this field, and this announcement has also made Rui Hongdi officially "surface".

We all know that, as a domestic pharmaceutical "developed brother", the breadth and depth of Hengrui pipeline layout have always been far ahead. First of all, in the field of tumors with traditional advantages, covering kinase inhibitors, antibody drugs coupling (ADC), tumors Immune, hormone receptor regulation, DNA repair and episodes of genetics, support treatment and other widely research areas. There are also extensive layouts in other areas. In recent years, Hengrui R & D pipelines have also expanded to other fields such as ophthalmology and nuclear drugs.

Gene therapy has a strong and long -lasting advantage and the potential of cure for the disease, which has great clinical significance. With the continuous development of gene therapy clinical trials and the approval of products one after another, the global gene therapy market has developed rapidly. According to FROST & SULLIVAN data, the global gene therapy market size in 2020 will be US $ 2.1 billion, and it is expected to reach US $ 30.5 billion by 2025. At present, China's gene therapy industry is not yet mature. It can be said that gene therapy is still in the stage of dawn, and the future market prospects are broad.

As we all know, Hengrui has always attached great importance to R & D. In recent years, on the one hand, it has continued to increase investment in R & D and investment. In 2021, R & D investment was 6.203 billion yuan, accounting for 23.95%of operating income, and the R & D investment ratio was among the best in the industry. On the other hand, R & D centers or branches have been established in Lianyungang, Shanghai, Chengdu, the United States, and Europe, creating a global R & D team with a large -scale, professional, and comprehensive capabilities of more than 5,000 people. With this support, Hengrui has been approved for listing, and more than 60 innovative drugs are developing clinically. More than 260 clinical trials are carried out at home and abroad. Such listed products and the research pipe lineup can be called " luxury".

Although the stock price and performance are indeed not satisfactory in the past two years, the road to Hengrui has never stopped. The company has repeatedly stated that it will continue to vigorously promote the two major development strategies of "scientific and technological innovation" and "internationalization". R & D investment, steadily promote the internationalization of research and development innovation and preparation products. At the same time, it will also focus on the optimization and improvement of the product structure. Through product innovation and upgrading and the expansion of diversified product pipelines, the company's sustainable development is promoted, and the company's performance is sustainable.

Hengrui Pharmaceutical, who refused to "lie down", continued to deepen the development of the "moat" and gradually realized it in the research pipeline, and the future imagination space was still there.

——End —————

Welcome to pay attention to [Huashang Tao strategies], know the characters of the wind, and read the legend of Tao Tao.

- END -

Layout the entire industry chain business structure Guangwei Fusai's performance in the first half of the year increased steadily

Reporter Wang XiOn August 16, Guangwei Fuwa, a head company in the domestic carbon fiber industry, disclosed the semi -annual report. The semi -annual report shows that in the first half of this year,

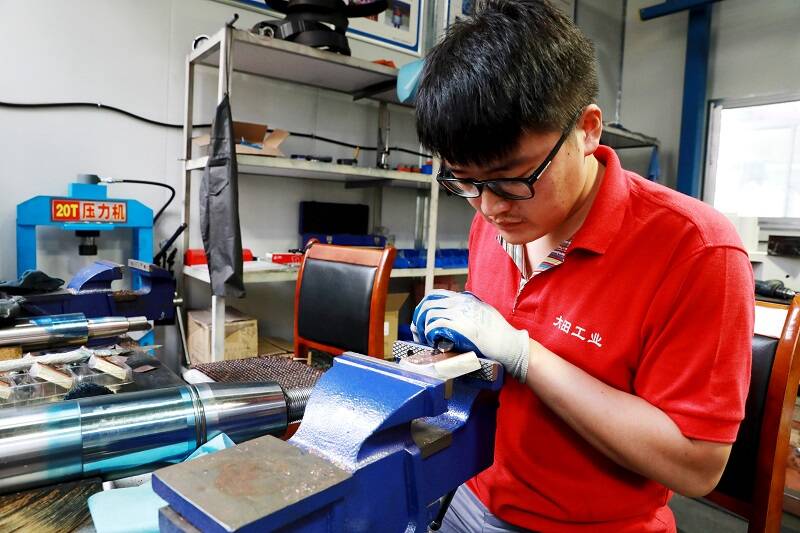

Qilu artisan Zhang Xuyang: perfect interpretation of the spirit of the craftsman

Qilu.com · Lightning News, September 13th Recently, the Shandong Federation of Tr...