Shanghai banking assets have increased by more than 140%in ten years, and the depth density of insurance is close to developed markets

Author:Huaxia Times Time:2022.09.23

China Times (chinatimes.net.cn) reporter Hu Jinhua Shanghai report

A few days ago, Bank of Shanghai Insurance Industry made a dazzling ten -year answer.

Since the 18th National Congress of the Communist Party of China, Bank of Shanghai's insurance industry has been deeply cultivated in the construction of international financial centers, focusing on serving the national strategy, real economy, and social livelihood, and realizing new leapfrog development. In the past ten years, the status of Shanghai's financial center has been continuously strengthened, and the development of the bank insurance market has also attracted much attention.

On September 22, at the "Ten Years of Glory and Great Change -Shanghai Banking Industry Insurance News Pentament" jointly held by the Bank of Shanghai Interbank Association and the Shanghai Insurance Association, it announced the ten -year transcript of the bank insurance industry in Shanghai. Data show that in the past ten years, Shanghai Banking assets and bank loans have increased by more than 140%, and the average annual growth rate has reached double -digit; the depth of the insurance market has increased from 4.08%to 4.56%, and the insurance density has increased from 3421 yuan per person to 7917 yuan per person to 7917 yuan. /Each person is close to the per capita insurance depth and density of the developed insurance market, providing strong support and risk guarantee for the healthy development of the real economy.

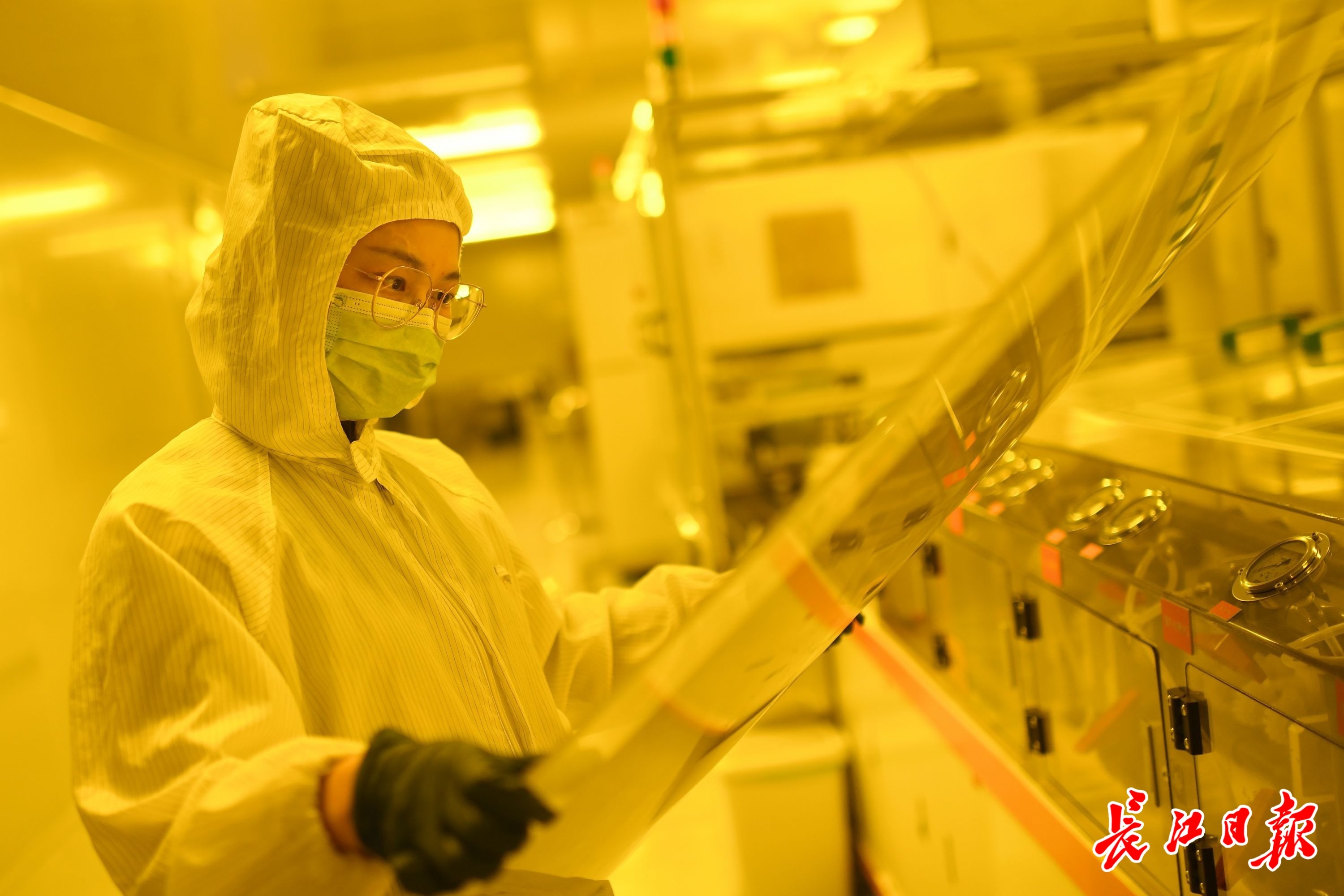

"The Shanghai Banking Regulation Bureau has always adhered to the road of financial development with Chinese characteristics, continuously promoted the high -quality development of the banking industry insurance industry in Shanghai, and implemented a series of major strategic deployments such as the central government's related four functions and enhancement of four major functions. Provide strong financial guarantees. In the high -level local area of Shanghai that serves the real economy, it actively supports high -level technology self -reliance and self -reliance to help the construction of a strong country. As of the end of August, the manufacturing loan within its jurisdiction was 1.23 trillion yuan, and the loan balance increased by 96%; promoted the establishment of the establishment; China's integrated circuit insurance community has provided a guarantee amount of nearly 700 billion yuan for key customers of 12 integrated circuits; build a metropolitan -type inclusive finance. At the end of July The growth rate exceeded 30%. "Li Hu, a first -level inspector of the Shanghai Banking Regulatory Bureau, introduced at the press conference that day.

The continuous improvement of the Shanghai financial insurance market has also attracted more and more foreign companies to enter. On the same day, Sino -German Life Life, which is headquartered in Shanghai, announced that the company has completed the registration of equity change. %Of the equity and the end of last year were transferred to Allianz (China) Insurance Holdings Co., Ltd., which held 100%of the equity of Sino -German Life Life, becoming China's first wholly -owned life insurance company in China. After the insurance, the second domestic foreign -funded legal person's wholly -owned life insurance company.

From the perspective of Shanghai's financial insurance industry, Sino -German Andership's formal completion of equity changes also proves that foreign capital continues to be optimistic about my country's insurance market.

Ten years of building a new highland for bank insurance

"China -German Andership Life officially opened in Shanghai in 1999. Last year, it became China's first Life Insurance Company, which was wholly -owned by a joint venture to foreign -funded foreign -funded. With the acceleration of China's financial industry opening, the pace of Andlian Group's efforts to develop the Chinese market is also accelerating , China -Germany Andy Life Life is committed to successfully grafting Allian's service resources to the Chinese market, providing Chinese insurance consumers with more attractive products and services. "Xu Chunjun, executive director and CEO of Sino -German Andersea Life "Huaxia Times" reporter said in an interview.

The development of Sino -German Life Life in the domestic insurance market is only a microcosm of the development of the insurance industry in Shanghai. At the news ventilation conference held on the 22nd, a series of data disclosed showed the strong financial pulse of Shanghai.

Data show that in the past ten years, Shanghai has taken the lead in carrying out and continuously standardized the "dual record" work in the market for sales risks of bank wealth management products. It has established the first domestic non -corporate non -enterprise industry dispute mediation center, and has completed a total of 34,100 mediation. Successful online cities with custom -based commercial supplementary medical insurance "Shanghai Hui Insurance", which reduced the burden of medical expenses for Shanghai citizens exceeding 1.1 billion yuan. The implementation of the comprehensive reform of Shanghai Auto Insurance is steadily and orderly, and nearly 90 % of consumers enjoy the premiums after the car reform. The "10+N" new citizen comprehensive financial service plan was formulated. As of the end of June, the balance of loans of new citizens was 60.8 billion yuan, and the risk protection of new citizen insurance products exceeded 600 billion yuan.

"In the past ten years, the Shanghai banking industry has accumulated more than 260 billion yuan in non -performing loans. As of the end of August, the bank industry's non -performing rate in the banking industry was 0.85%, and the quality of assets was among the best in the country. Internal and external credit balances decreased by 87%compared with early 2012, which made useful explorations for the disposal of similar risks in the country. At the same time, it has steadily promoted the risk resolution and disposal of some non -silver high -risk institutions, established a three -party business mechanism of the commercial banks in different places, and steadily promoted the network. The special rectification work of loan risks, accurately crack down on illegal and illegal acts such as surrender black production, and promotes risks in an orderly manner. "The relevant person in charge of the Bank of Shanghai Interbank Association told the reporter of Huaxia Times.

As the "bridgehead" of my country's financial market, Shanghai also does not allow a gathering place to attract various financial institutions at home and abroad. As of now, there are more than 50 foreign insurance institutions in Shanghai, more than 100 foreign branches of foreign -funded provincial -level branches, and 77 foreign bank insurance representative office. The number of domestic and foreign -funded legal person banks accounted for more than 50 % of the country, and the asset size of specialized institutions increased by nearly 6 times compared with ten years ago. At the same time, the first shipping insurance product registration system for shipping insurance; through the establishment of the innovation supervision and interaction mechanism of the free trade zone, and promoting the establishment of the Shanghai Free Trade Zone Lingang New Terminal Science and Technology Insurance Innovation Leading Zone, it supports the construction of the Shanghai Free Trade Zone and Lingang New Trinity Zone; The four bureaus of Su, Zhejiang, Anhui, and Yongyi formulated a collaborative credit business guidelines, and together with the Yangtze River Delta G60 Science and Technology Corridor Office and other units to introduce financial support for advanced manufacturing high -quality development comprehensive service solutions to help the Yangtze River Delta integrated development. By the first half of this year, the value -added of Shanghai's financial industry reached 412.5 billion yuan, accounting for 21%of the GDP of Shanghai, an increase of 9 percentage points from ten years ago.

"Finance not only provides valuable blood for the growth of the real economy in Shanghai, but also an important cornerstone of Shanghai's economic growth. Facing the severe and complex epidemic prevention and control situation since this year, the Shanghai Banking Regulation Bureau guides about 5,000 people in the bank insurance institutions in their jurisdictions to adhere to their posts. , Ensure that the basic financial services guarantee is continuously file; introduce the working mechanism of bailout financing, promote seamless renewal of the "10 billion billion" project, and solve problems for small and medium -sized enterprises and individual industrial and commercial households. As of the end of July, the cumulative amount of bailout financing amount is 1741 100 million yuan, indirectly providing employment support for more than 2.6 million people; a total of more than 600 billion yuan in seamless renewal. "Li Hu said.

Actively integrate into the overall situation of national and regional development

In the eyes of many interviewed bank insurance institutions on that day, in the past ten years, the bank insurance industry in Shanghai has always kept in mind the mission of financial services to the national strategy of the financial service, actively integrated into the overall national and regional development situation, and focused on creating a Pudong socialist modern construction leading zone, promoting self -reliance The coordinated development of the construction of the new trial area, the integration of science and technology finance and the Yangtze River Delta in the Lingang New Trip of the Trade Zone, helps enhance the energy level of the Shanghai International Financial Center, and achieves a series of breakthroughs in institutional layout, product services, and financial ecological construction.

"Industrial and Commercial Bank of China Shanghai Branch actively connects the major national strategy. In the strategic layout, the group's advantages are used to serve the integrated service of the Yangtze River Delta and the construction of the Pudong Leading Area. Institutional reforms in the demonstration area, new area, and even Pudong region, enhance the level of institutional operating energy, increase strategic resource investment; in terms of product services, take the lead in piloting the Yangtze River Delta One Netcom's government cooperation projects, and the number of digital renminbi pilot scenes in the demonstration area leads the lead; Quality service has become a comprehensive partner; exploring a new model of comprehensive finance, cross -border finance, and offshore finance, and obtained a number of first orders in the fields of gold international boards, south direction, panda bonds, cross -border mergers and acquisitions. Establishing on the shore -cross -border -offshore service system, "the relevant person in charge of the Bank of ICBC said in an interview.

As a representative of the joint -stock commercial banks headquarters in Shanghai, relevant persons from Shanghai Branch of Pudong Development Bank pointed out that Pudong Development Bank fully serves the construction of the Pudong Leading Area. With the construction of the Pudong Leading Area as its core traction, it actively supports relevant key customers and key projects. COMAC realizes civil aircraft industrialization, Shanghai International Shipping Center Yangshan Shashui Port Project, Tesla Super Factory Construction, etc. At the same time, in -depth participation in the construction of the Yangtze River Delta integrated, continuously enriched the Yangtze River Delta integrated financial service toolbox, and successively landed in multiple Yangtze River Delta integrated special credit business. Functional cross -border two -way capital pool.

"Tai Insurance Property & Casualty Shanghai Branch has taken the initiative to integrate into the three major tasks of Shanghai, a large platform strategy, and gives full play to the role of insurance social stabilizers. Help the high -quality development of the new area and open it in all directions, and actively integrate into the planning and construction and service support of the new area. During the epidemic period, the inclusive insurance product of the new area of Lingang -Lingang New Area Enterprise Re -ELP Insurance Insurance; in -depth participation in the construction of the Lingang Science and Technology Insurance Innovation Leading Area to fully support the development of the science and technology industry. Development, take the initiative in the development demonstration zone of ecological green integration, and world -class industrial clusters, and jointly build a technology -enabled community service in the region with the brothers branch of the region. The relevant person in charge of the Shanghai Branch also said to the reporter of the Huaxia Times.

In fact, in the past ten years, the Shanghai Banking Insurance Industry has always regarded services for the real economy as the starting point and ending point, continuously strengthened the service of the real economy, and went to the insurance market to promote financial resources. In key areas such as enterprises, green and low -carbon, help enterprises to relieve difficulties, comprehensively stimulate the new momentum of the real economy development with financial live water, and promote a virtuous circle of financial and real economy.

For example, Bank of Shanghai, one of the large domestic urban commercial banks, revealed at the meeting that the bank has developed rapidly in the past ten years, especially in the past three years of a compound growth rate of nearly 60%. Specialized new "enterprises, nearly 30 % of high -tech enterprises, green loans are ranked among the top of 24 major banks across the country, and green debt financing instruments are ranked first in urban commercial banks. Deepen the "incremental, price reduction, quality improvement, and expansion" of small and micro enterprises. As of the end of 2021, the balance of loans to local small and medium -sized enterprises in Shanghai was 330.543 billion yuan, and the number of small and medium -sized enterprise loans exceeded 27,000. The balance of scientific and technological enterprises in the bank exceeded 63 billion yuan, and customers covered more than 30%of Shanghai's "specialized new" small and medium -sized enterprises and nearly 50%of the specialized new "little giant" enterprises. In addition, over the past ten years, China Taidao Property & Casualty Shanghai Branch has undergone a number of domestic head chip factories in the integrated circuit as the main underwriter to escort more than $ 35 billion in assets; 194 pharmaceutical companies cooperated with 370 clinical trial insurance for the development of drugs, and provided insurance guarantee for my country's application process to promote the application process of independent research and development of cutting -edge medical equipment. During the epidemic period, the first order of the anti -new coronary virus oral drug clinical trial insurance independently developed by my country was issued. In the field of technology -based SMEs, the first domestic technology -based SME loan performance guarantee insurance, focusing on and supporting related enterprises such as high -tech, "specialized new" and other related enterprises. So far Yuan.

Editor -in -chief: Xu Yunqian Editor: Gong Peijia

- END -

The number of new "little giants" in the fourth batch of national specialized specialized "little giants" chased the north, and Wuhan's "Little Giant" group started

Small and medium -sized enterprises can do major events. Some studies have shown t...

Doing a good business of DaaS is a knowledge

The picture comes from UNSPLASHText 丨 Intelligent Relators Mantis ObservationAut...