The GEM withdraws from the "Data Data" Shenzhen Main Board, Baza Tea Industry pre -disclosed the IPO prospectus and then rushed to A shares

Author:Capital state Time:2022.09.23

Baza Tea Industry Co., Ltd. (referred to as: Bama Tea Industry) pre -disclosed the prospectus of Shenzhen Main Board. Many companies have previously impacted the IPO, but they eventually failed. At present, there is no listing of tea companies in A shares.

On September 22, 2022, Baza Tea Industry Co., Ltd. (referred to as: Bama Tea Industry) pre -disclosed the Shande Main Board Prospectus, and the IPO sponsorship was CITIC Securities.

This is not the first tea company to be listed. Many companies have previously broke through the IPO, but in the end they have lost their failure. At present, there is no tea company in A shares.

Ba Ma Tea Industry is a national chain brand company in the country. It is mainly engaged in the research and development design, standard output and brand retail business of tea and related products. The products cover oolong tea, black tea, black tea, green tea, white tea, yellow tea, and processing tea Wuling in all category tea leaves, tea sets, tea food and other related products.

Baya Tea Industry is not smooth. In 2015, the company was listed on the New Third Board; in April 2018, due to "the need for long -term strategic planning and adjustment", it ended the listing on the New Third Board and began to sprint into the Shenzhen Stock Exchange. The Shenzhen Securities Regulatory Bureau conducted counseling filing; on April 15, 2021, I applied for the GEM IPO and obtained the acceptance of the Shenzhen Stock Exchange.

From September 2021 to April 2022, the Shenzhen Stock Exchange conducted a three -wheeled review inquiry on the listing application documents of Bama Tea. The positioning of GEM has attracted great attention. Baza Tea Industry said that the company's business philosophy has obvious innovation and creativity. The company carried out the "Four New" in the traditional tea industry retail with the "Four New" in the "Three Creation and Four New", which is a growth -oriented innovation and entrepreneurial enterprise.

On May 9, 2022, the company applied for the withdrawal of the listing application documents. On May 10, 2022, the Shenzhen Stock Exchange decided to terminate its first public offering of shares and listed on the GEM. Since then, considering the probability and time cost of subsequent listing, the company will replace the IPO from the GEM to the main board IPO, and the sponsors are still CITIC Securities.

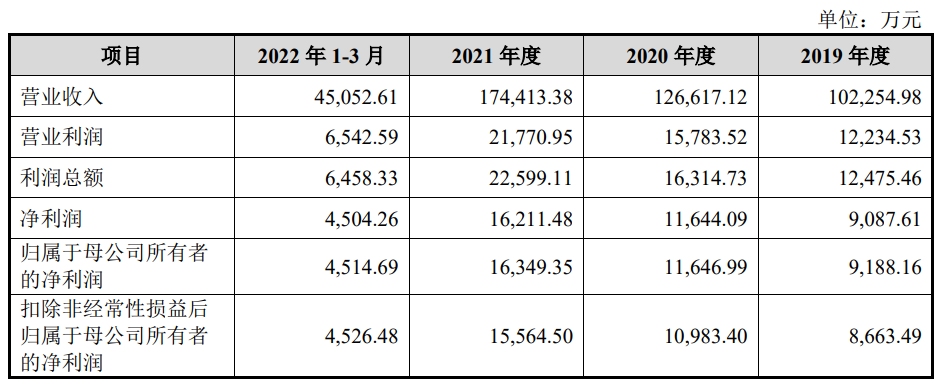

The latest version of the prospectus shows that in the first quarter of 2019 to 2022, operating income was 1.023 billion yuan, 1.266 billion yuan, 1.744 billion yuan, and 451 million yuan, and the net profit attributable to mothers was 91.8816 million yuan, 116 million yuan, respectively. Yuan, 163 million yuan, 45.146 million yuan.

During the reporting period, the main business revenue under the company's network sales model was 163 million yuan, 241 million yuan, 363 million yuan, and 136 million yuan, respectively, accounting for 16.08%, 19.15%, 20.98%, and 20.98%, and 20.98%, respectively 30.49%, of which the foreign sales revenue achieved by JD platform, Tmall platform, Douyin platform, and fast -handed platform accounted for relatively high foreign sales revenue.

During the reporting period, the company achieved sales revenue through JD platform, Tmall platform, Douyin platform, and fast -handed platforms, respectively, 124 million yuan, 185 million yuan, 300 million yuan, and 119 million yuan, respectively, and the proportion of online sales channels was 76.05, respectively. %, 76.83%, 82.66%, and 87.05%, there are risks of high concentration of sales channels in online sales models.

In addition, the franchise model is an important part of the company's channel expansion. During the reporting period, the company's sales models through offline franchise models were 480 million yuan, 595 million yuan, 891 million yuan and 200 million yuan, respectively, accounting for 47.44%, 47.33%, 51.50%, and 44.76%, accounting for 47.44%, 47.33%, 51.50%, and 44.76%, accounting for accounting It's high.

Recomm

- END -

The latest social security retracting policy is coming!

The new policy in Shenzhen is here! According to the national and Guangdong stages of slow -payment related policies, 5 specialty industries and 17 expanded industries and epidemic conditions have aff

Yuan Cosmic Commercial Weekly | Shanghai Baoshan released the three -year action plan of the industrial Yuan universe; 2022 World Artificial Intelligence Conference first set up the Yuan universe exhibition area

List this week:In terms of local trends this week, new progress has been made in Shanghai Baoshan, Xiong'an New District, Zhengzhou, and Hangzhou. Among them, the Three -Year Action Plan for the Deve...