Wheels Digital Reading | Spreading on the listing boom surging, five maps perspective "A Disason A" full landscape

Author:Costrit Finance Time:2022.09.22

Fengkou Finance reporter Wang Xue

A -share spin -off and listing gradually heated up. Recently, there are two other A -share companies subsidiaries who are about to split and listed -Starnet Ruijie Holdings Ruijie Network GEM IPO has been registered with the China Securities Regulatory Commission, and the Great Wall Information GEM IPO of the Great Wall of China has also been recently received The GEM Listed Committee was approved. According to incomplete statistics, since the first spin -up listed stock in A shares in February last year, more than a year, 17 have been split listed stocks to land in the A -share market. Which spin -off enterprises are successfully listed? Which sectors have become multi -hair areas for spin -off and listing? How many companies are planning to divide and go public? Wind Finance uses data to bring you the secret "A".

After "Demolition of the New Regulations", "A Disassembling A" accelerates

A -share spin -off and listing can be traced back to 2000. In 2000, Tongrentang spin -off its subsidiary Tongrentang Technology to the Hong Kong Stock Exchange to list, becoming the first share of the A -share listed company for spin -up and listing. Since then, the A -share market has not been split and listed. Until 2010, ZTE completed the splitting of national technology and became the first case in the history of A -share history. However, the parent company no longer has a controlling equity for subsidiaries after spin -off. With the clear attitude of the regulatory release, the spin -off and listing ushered in an important turnaround. In 2019, the CSRC issued the "Several Provisions of the Listing Pilot of Listing Subsidies of Listed Companies", which was officially allowed to perform related operations of "A Disassembly A" in A -share companies , The parent company retains the control of the spin -off subject to the official permission, and the number of enterprises that spin -up and listed A shares have increased significantly.

17 subsidiaries successfully landed on A shares

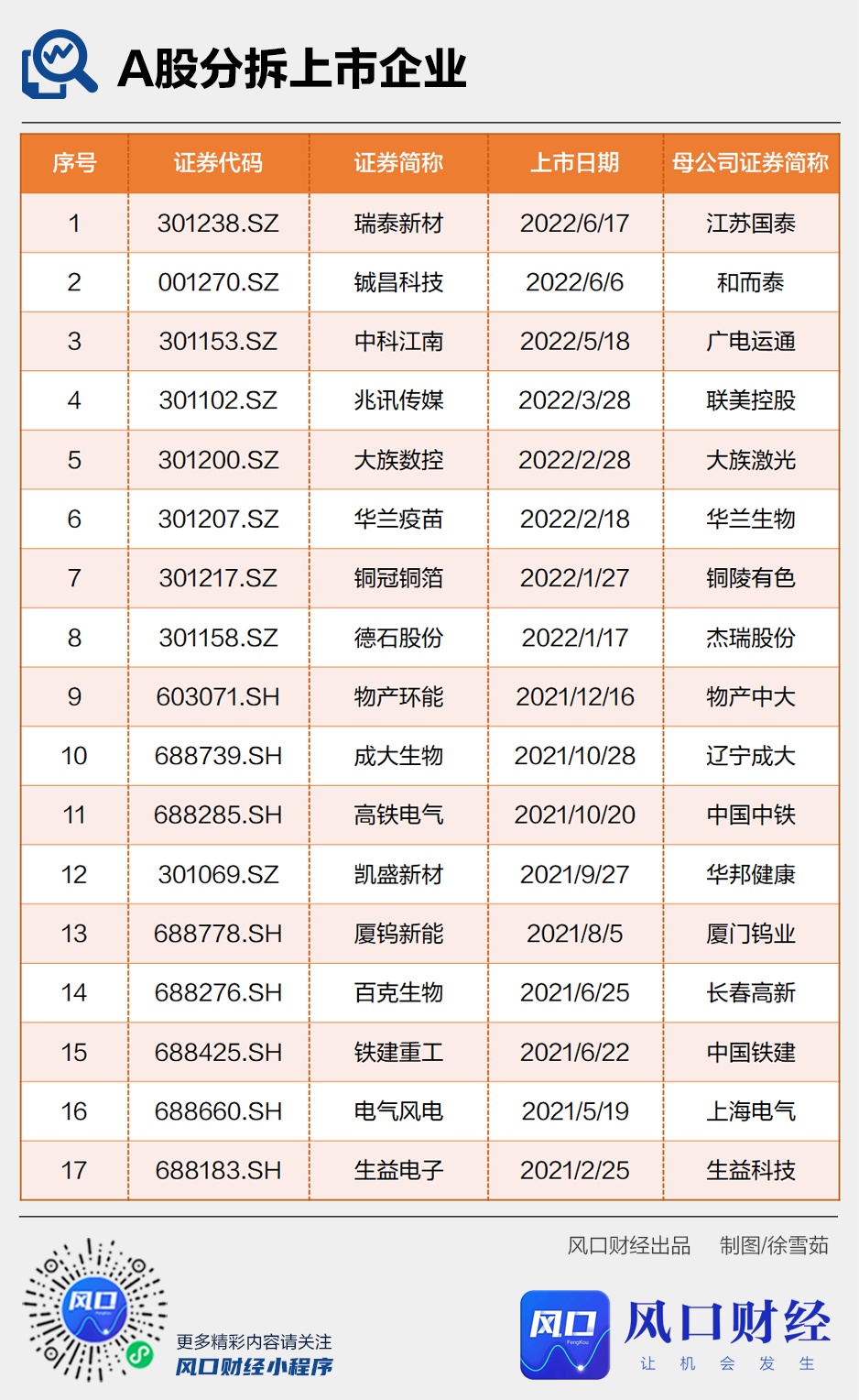

On February 25, 2021, Shengyi Electronics successfully landed on the science and technology board, becoming the first spin -up listed company after the implementation of the "new listing of listing". According to incomplete statistics, for more than a year, 17 subsidiaries have successfully logged in to A shares and ushered in the "A" boom. Among them, there were 9 in 2021 and 8 in 2022. With the registration and meeting of Ruijie Networks and Great Wall information, it is expected to achieve 11 bosss of unpacking subsidiaries in 2022, a record high.

Fengkou Finance combed and found that the spin -up and listed motivation explained by listed companies mainly includes promoting the company's focus on the main business, enhancing independence, broadening financing channels, improving the overall valuation of the company, improving subsidiaries' profitability, optimizing management capabilities, and so on. In this regard, experts also said that spin -up and listing is conducive to the obtaining reasonable valuations of mothers and subsidiaries, further broadening financing channels, and helping to straighten out the company's business structure, promote the development strategy more, and expand development space.

Most of the hard technology companies, science and technology boards and GEM are the main "destinations"

The "A" plan of the listed company is frequent. The spin -up and listing has evolved from the initial state -owned enterprise single soldiers to the state -owned enterprise and private enterprises.

Specifically, nearly 90 % of the aforementioned 17 % of the listed companies are targeting science and technology boards or GEM. Among them, 8 of them were listed on the GEM and 7 were listed on the science and technology board, and only 2 were listed on the motherboard.

From the perspective of the industry, companies that have successfully achieved "A" are concentrated in industries such as machinery and equipment, power equipment, pharmaceuticals, and other industries. Except for Ruitai New Materials and Products and Environmental Protection, the remaining 15 are high -tech enterprises.

CICC also said that there are many listed companies spin -off to GEM and science and technology boards. Thanks to the implementation of the registration system for science and technology boards and GEM, they pay more attention to the scientific and technological attributes of the enterprise; It is the embodiment of the industrial positioning of the two major sectors, which is also a reflection of my country's strategic emerging industries, which helps inspires innovative development.

Nearly 90 companies plan "A disassembly A", concentrated on popular emerging tracks

Since 2021, A -share spin -off and listing has shown a hotspot of continuous acceleration and multi -flowering. Industry experts believe that in view of the financing needs and the development of strategic emerging industries, the future capital market is expected to usher in more "A demolition A demolition A "case.

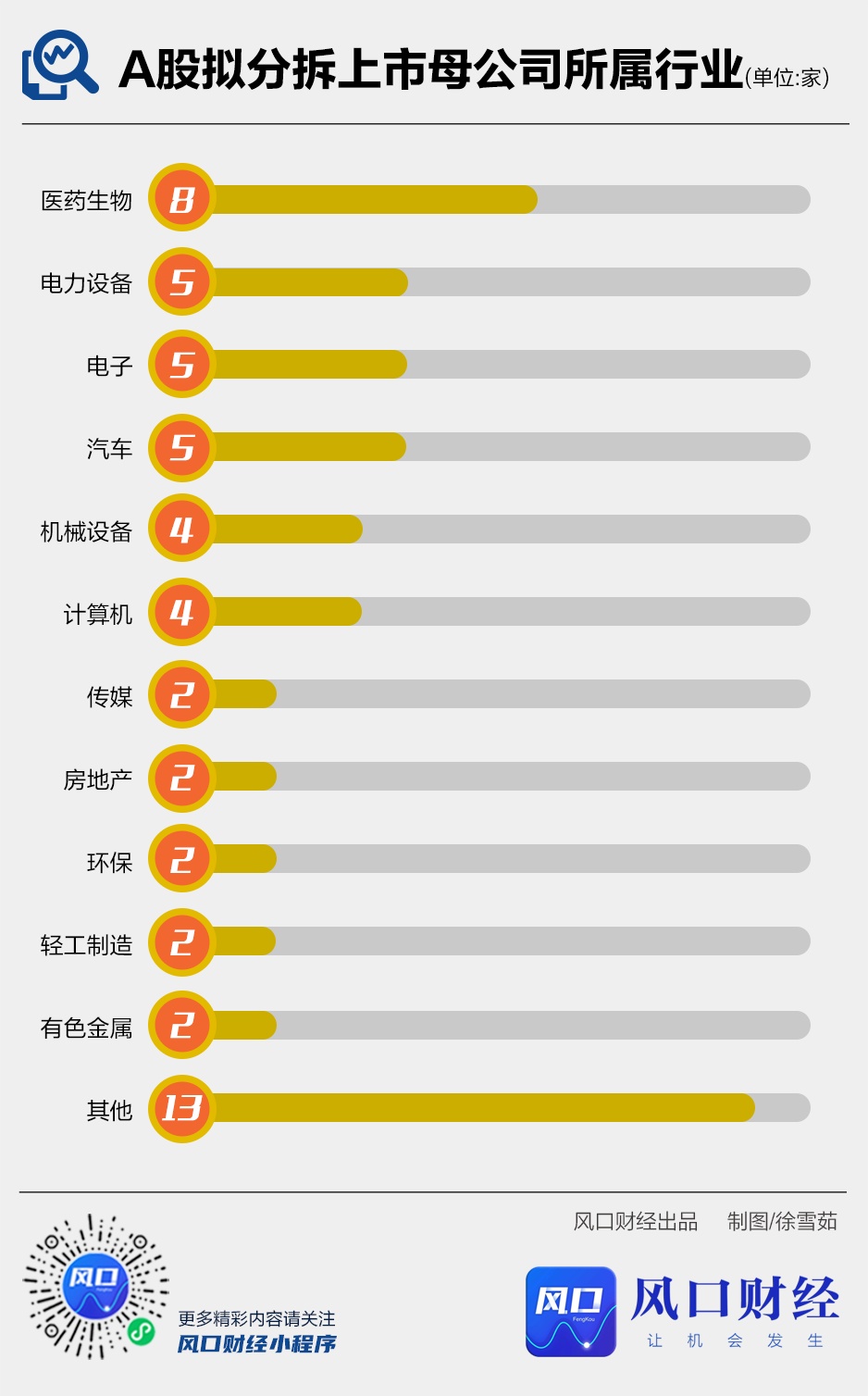

In the incomplete statistics of Fengkou Finance, since the "New Regulations for Demolition of Listing", in addition to the 17 companies that have been split and listed, there are about 90 A -share listed companies to plan the dismantling subsidiary to the domestic exchanges. These A -share listed companies are mainly concentrated in popular tracks such as pharmaceuticals, power equipment, electronics, and automobiles. Among them, there are many leading enterprises in the new energy fields such as BYD and Tidd.

It is worth noting that compared with the previous "A" listing destinations, many selection of science and technology boards and GEM have been selected. The company planning "A" aimed at the "destination" of the spin -off of the North Stock Exchange.

Chen Li, chief economist of Chuancai Securities and director of the Institute of Research, said that many listed companies choose to split subsidiaries to list on the Beijing Stock Exchange. On the one hand, the listing process of the Bei Stock Exchange is further improved, and the listing process of the enterprise is reasonable and convenient; On the one hand, although some spin -up listed companies are competitive, the current scale is relatively small, which is more in line with the positioning of the "specialized new" small and medium -sized enterprises of the Beijing Stock Exchange. At present, the capital market of multi -level interconnection in my country has gradually formed. After the company was listed on the North Stock Exchange, after a period of development, it can also apply for transfer after meeting the requirements of the "double innovation" sector.

- END -

Total investment is 23.1 billion yuan!186 projects in Shaoguan City are concentrated in completion

Text, Figure/Yangcheng Evening News reporter Zhang Wenzer who is Zhang Wenyan, Wu ...

China still holds more than 900 billion US dollars. If all of them are sold, can the United States bear it?

According to the previous data released by the US Finance, China still holds more ...