The minimum of the HSI has a minimum of 18,000 points, and there is another frustration of white horse stocks today!Institution: Hong Kong stocks may be rebounded after the US interest rate hike

Author:Daily Economic News Time:2022.09.22

Last night, the Federal Reserve raised interest rate hikes 75 basis boots to land, and US stocks shocked sharply before and after the interest rate hike. Although the Fed's interest rate hike is expected, before and after the interest rate hike, the performance of U.S. stocks can be described as "epic" repeated shocks.

Before the Fed announced the interest rate hike, the US stock market was stable, and the Dow Jones Index and the Nasdaq index even rebounded a mild. However, as the Fed officially announced its interest rate hike, the Dow Jones Index instantly diarrhea 500 points.

Subsequently, the Fed Chairman predicted the US economy in the fourth quarter. In his speech, Powell admitted that in the process of curbing inflation and restoring price stability, it would be very challenging to achieve a relatively mild unemployment increase and achieve economic "soft landing". If the monetary policy needs to be further tightened to a more restrictive level, or it takes longer to tighten, the possibility of "soft landing" will be reduced.

During the speech, the Dow Jones Index once quickly rebounded, but Powell's statement actually showed pessimistic expectations, and the market generally predicted that the US economic recession was inevitable. Therefore, as soon as the speech was finished, the US stocks fell sharply and hit a new low within the day.

Affected by the decline in U.S. stocks, today's Hang Seng Index once fell below the 18,000 -point integer level, a minimum of 17965 points. This point has been a low point since 2011. In February last year, the high point of the Hang Seng Index was 31183 points, and today the minimum accumulated decline was as high as 42%.

Zhongtai International pointed out that the current Hang Seng Index and the MSCI China Index's prediction PE is 7.3%and 36%of the number of segments in the past 15 years, and the valuation is low but not at extreme level. However, after the Fed's interest rate hike, some unclear factors can be eliminated, or a rebound window is brought to Hong Kong stocks.

Looking at the A -share market, another big white horse was suffering a heavy frustration today. In the market, the Chinese medicine leader 癀 (SH600436, the stock price of 260.85 yuan, a market value of 157.4 billion yuan) fell more than 7%, the stock price hit a new low, and the cumulative decline in the year was as high as 40%. In the past seven years, Shiba's stock price has continued to rise for 7 consecutive years, and it has also become the darling of the organization. This year's plunge also foreshadowed the seven -year bull market to come to an end.

Judging from the central report announced by the fund, as of June 30 this year, many heavyweight products such as China -Europe Medical Health, Yinhua Rich, Huitianfu Consumer Industry, Huaxia Shangzheng 50ETF, and Guangfa Medical Care Stocks hold Shizi.

In fact, in addition to Pianzi today, another white horse stocks are also frustrated -SF Holdings (SZ002352, stock price 45.32 yuan, market value of 221.9 billion yuan) has plummeted by more than 6%. Not long ago, SF announced the operating data in August, and August achieved a total revenue of 21.888 billion yuan, an increase of 46.23%year -on -year. Among them, the revenue of express business was 14.7 billion yuan, a year -on -year increase of 10.47%, maintaining a double -digit growth; the business volume was 942 million votes, a year -on -year increase of 9.15%; the single -ticket revenue reached 15.61 yuan, an increase of 1.23%year -on -year; the international and supply chain businesses; Revenue was 7.188 billion yuan, an increase of 332.75%year -on -year.

It is worth noting that in recent times, the big white horses of public funds and other institutions seem to have frustrated stocks every day. For example, in the early stage, the leader of the securities firms, the beauty leader of the medical beauty, the chip leader Sanan Optoelectronics, as well as the CXO leader Yaoming Kant, the leader of the medical equipment, Mai Rui Medical, and the software leader China software.

At present, the above -mentioned big white horse stocks are basically the second echelon white horse stocks that belong to the institutional heavy position. Judging from the disclosure of this year's interim report, only Yaoming Kangde belongs to the top ten heavy stocks held by the fund; the other nine companies are: Guizhou Moutai, Ningde Times, Longji Green Energy, Wuliangye, Luzhou Laojiao, Shanxi Fenjiu, BYD , Huayou Cobalt and Yimei Lithium Energy.

From the perspective of the industry, these companies are mainly concentrated in the two major fields of liquor and new energy.

From the perspective of trend, liquor stocks have relatively strong performance, such as Moutai, Luzhou Laojiao and Shanxi Fenjiu.

In the field of new energy, Longji Green Energy, Huayou Cobalt, and Yimei Lithium Energy are relatively strong, but the previous declines in BYD and Ningde era were actually not small.

For the current market, analysts rarely dare to predict the future trend. Then, you can only find the law from the historical market.

Daily Economic News

- END -

16 listed banks "shot" to increase their holdings, and the industry is optimistic about the trend in the second half of the year

[Dahe Daily · Dahecai Cube] (Reporter Xu Bing) Bank of the bank set off a wave of...

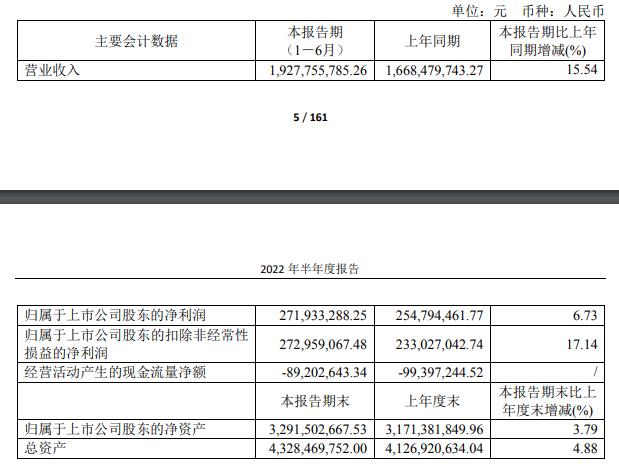

V viewing financial report | Ma Yinglong's net profit in the first half of the year increased by 6.73% year -on -year. The stock price fell more than 20% during the year

Zhongxin Jingwei, August 19th. Ma Yinglong released the semi -annual performance r...