Rating!The Federal Reserve continues to "release the eagle", the Asia -Pacific stock market fell together, how to go in the market outlook

Author:Poster news Time:2022.09.22

Zhongxin Jingwei, September 22 (Yang Jingchuan) In the early morning of the 22nd, Beijing time, less than two months before the last rate of 75 basis rates, the Fed once again announced that the benchmark interest rate was raised by 75 basis points to 3.00%-3.25%. Fifth rate hike.

A total of 300 basis points have been raised during the year

Specifically, in the early morning of the 22nd, Beijing time, the Federal Federal Public Marketing Committee (FOMC) issued a statement saying that they agreed to pass the decision of 75 basis points in interest rate hikes.

The Federal Reserve Chairman Powell said at a press conference held after the meeting that in order to reduce the current high inflation to the Fed's target level, the US economy will go through a period of growth below the trend level, but this is a pain that needs to be afforded because the recovery price is restored to price Stability is especially important.

At the same time, Powell also reiterated its eagle signal released in late August, that is, emphasizing the determination of the Federal Reserve to reduce inflation, to be alert to the serious consequences of premature relaxation of monetary policy and high inflation and solidification.

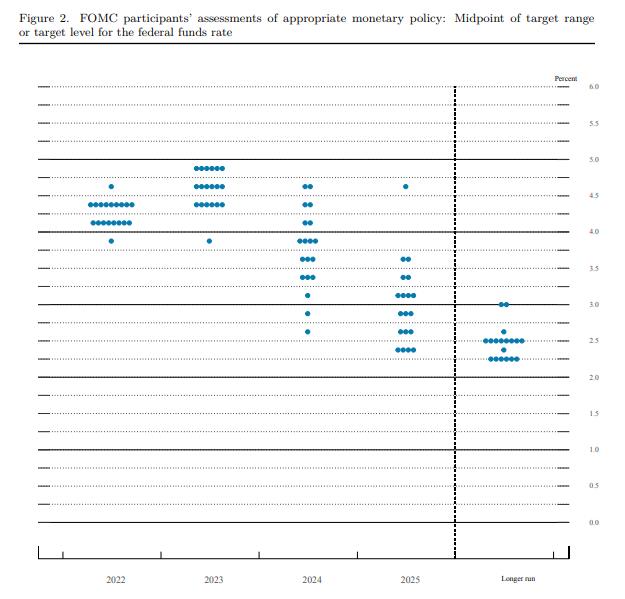

In addition, according to the predictions of the dot -matrix chart announced by the Federal Reserve, by the end of 2022, the federal fund interest rate will rise to more than 4.0%, of which 9 people are expected to be 4.25%to 4.5%, and one person is even expected to exceed 4.5%.

Point -to -line picture of the Federal Reserve Source: Federal Reserve website

However, this interest rate hike may not be the "end point" of the Federal Reserve's interest rate hike. Based on 4.25%to 4.5%of the interest rate range estimation, by the end of this year, the Fed will raise a total of 125 basis points after interest rate hikes.

In addition, according to the "Fed Observation Tools" of the Chicago Commodity Exchange, the probability of the Federal Reserve raised interest rates from 50 basis points to 3.50%to 3.75%in November of 36.5%, and the probability of 75 basis points in interest rate hikes was 63.5%.

This also confirms Powell's attitude of "must persist in raising interest rates" at the Jackson Hall Annual Conference. At that time, he emphasized that in order to curb inflation, the Fed may need to maintain the federal fund interest rate at a high level within a period of time.

Previously, Goldman Sachs also predicted that the Fed will raise interest rates 50 basis points in November and December; federal fund interest rates will reach 4%to 4.25%by the end of the year. Nomura Securities raised the final interest rate forecast of February 2023 in a research report to increase 50 basis points to 4.50%-4.75%.

Combing and found that the Federal Reserve has raised interest rates five times during the year, respectively on March 17, Beijing time, rating 25 base points on May 5th; on May 5th, rate hikes 50 base points; June 16, 75 base points; July 28th; July 28th , Rating 75 base points and 75 base points in this (September 22); cumulative raising rates of 300 basis points.

Inflation is one of the roots of the Federal Reserve's interest rate hike. Previously, according to data disclosed by the US Labor Statistics, the US CPI in August increased by 8.3%year -on -year, higher than the market expectations of 8.1%.

Fed officials have mentioned that they are seeking "soft landing" of the US economy and curb inflation by slowing economic growth, but it will not cause economic recession. However, some economists are worried that over time, the sharp interest rate hikes of the Fed will lead to a significant layoffs and unemployment rates in US companies, and a comprehensive economic recession broke out at the end of this year or early next year.

Everbright Securities pointed out that from a historical point of view, the best way to control the Fed to control inflation is to unswervingly maintain a tightening policy. In the short term, the Fed's continuous and stepping interest rate hike path is difficult to change. Northeast Securities also said that despite the price of slowing economic growth or even decline, the Fed must also prevent the economy from staying in a high inflation state as soon as possible to further deteriorate the situation.

How will it affect the market?

Affected by the Federal Reserve's policy, in terms of US stocks, the three major indexes suddenly fell suddenly after the Fed announced the third consecutive interest rate hikes. The Federal Reserve President Powell spoke briefly and then dive again. As of the closing, the Dow fell 1.7%, the Nasda Index closed down 1.79%, and the S & P 500 index closed 1.71%.

On the morning of the 22nd, the Asia -Pacific stock market fell. The Shanghai Index plummeted 0.59%, and once the market turned red. As of the afternoon closing, the decline was 0.31%; the Hang Seng Index opened by 1.97%; the Nikkei 225 index fell 0.95%; the Korean KOSPI index index fell 1.2%.

In addition, the offshore RMB fell below the 7.1 mark against the US dollar, and it fell more than 300 points within the day, with a minimum of 7.1017, and continued to set a new low since June 2020.

The Hong Kong Monetary Authority also announced on the 22nd that the basic interest rate was raised to 3.50%according to the preset formula. At the same time, the Macau Macao Bureau also raised the basic interest rate of the discount window to 75 basis points to 3.50%.

Guojin Securities Zhao Wei pointed out that for the market, the core focus of the future will be switched to the end of interest rate level and policy steering.

Zhao Wei also said that in the next two quarters, the peripheral market continues the state of high fluctuations; at the economic level, it is at a sensitive stage of "stagflation" to "recession" switching, and the stability of policy expectations is relatively poor.

"In the near future, overseas asset prices will still maintain a large fluctuations, and they need to be alert to their emotional impact on the domestic market." Guosheng Securities Xiongyuan said that the US economy is likely to decline in the first half of next year. At this stage Which of the Fed's steering and economic recession came first.

Ping An's first Jingzhong Zhengsheng also mentioned that for the market, the short -term market risk is relatively large, because the market is still in the stage of digesting the new policy of the Federal Reserve, and the US economic recession has not been fulfilled. In the middle period, policy and economic certainty may also positively affect the financial market confidence, and to a certain extent limit market volatility. "In the future, monetary policy (rather than US economic performance) will still be the core influencing factors of US debt interest rates." Speaking of US stocks and US debt, Zhong Zhengsheng said that US stocks still have pressure in the short term. The climbing of U.S. debt interest rates has further weakened the risk premium. At the same time, valuation and profit expectations still have room for reduction. The killing of U.S. stock profitability to US stocks next year is still not enough, and U.S. stocks have been in place.

In terms of US dollar currency, Zhong Zhengsheng pointed out that the Fed is radical and tightened, and the US debt interest rates have been high, and the negative impact on the non -US financial market may be more severe, and the performance of non -US currency is even more impact. Regardless of the Fed's tightening rhythm or from the perspective of non -US economic pressure, the US dollar exchange rate will still maintain strong.

Yang Delong, chief economist of Qianhai Open Source Fund, also mentioned that because the Fed has adopted a radical interest rate hike strategy this year, the US dollar index has repeatedly reached the 110 integer mark in the near future, and non -US currencies have depreciated sharply.

"On the whole, the monetary policy environment facing the A -share market in the fourth quarter is better than US stocks." When talking about the stock market, Yang Delong said that the external factors of the Federal Reserve raising interest rates have also been adjusted in the past three months. It has fully reacted, so there is not much room for further decline in the A -share market. It is expected to become the turning point of the market in the second half of the year in September.

Yang Delong also mentioned earlier that A -shares were more resistant than U.S. stocks.

"The decline in A shares is expected to be relatively small, and it is recommended to deal with it calmly." Li Daxiao, British Securities, also said that China's inflation is well controlled, and the Chinese economic cycle is not synchronized with the United States. Great and rich policy boxes, this provides strong support for the future Chinese stock market, and the tough characteristics of the A -share market still exist. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

- END -

Interpretation: What idle resources of the development zone will be upright?

Yang Maosheng, deputy director of the Industry and Information Department of In...

Ning Wu: Strengthen the "six batches" measures to help market subjects double

Since the beginning of this year, Ningwu County has firmly established the concept of grasping development must grasp the business environment, the development of the market must grasp the market sub