Bloomberg Metal Zhu Yi: Gold, copper, etc. are all varieties with greater future investment opportunities

Author:China Gold News Time:2022.09.22

On September 21, at the mining capital market forum of the China International Mining Conference in 2022 (24th), Bloomberg Metal and Mineral Research Global Supervisor Zhu Yi said, "In global investment in mining projects, gold, copper, aluminum aluminum And like new energy metals, etc., are all varieties with greater future investment opportunities. "

"In the overseas mergers and acquisitions market, gold is the most active variety. From 2014 to 2017, the global gold mine mergers and acquisitions market gradually became active, and the number of annual mergers and acquisitions quickly climbed to its peak. It is copper, and copper and gold show a trend of similar. And in 2016, with the rapid development of new energy vehicles, the demand for cobalt and lithium continues to increase and the price continues to rise, which has driven the mergers and acquisitions market to rise. "Zhu Yi said.

my country is a big country in the production of mining resources in the world, but due to the low endowment of resources, it has caused high production costs. At the same time, my country is also a large consumer country for mining resources. In order to ensure the safety of resources and meet the growing demand, Chinese mining companies have "going global".

Zhu Yi said that from the perspective of the overall situation, China's foreign direct investment has developed steadily. From 2010 to 2020, China's foreign direct investment traffic jumped by 123%, and the secondary industry in foreign direct investment accounted for 21%. The mining industry accounts for 31%of the secondary industry.

Zhu Yi pointed out that Chinese -funded enterprises' overseas acquisitions have spread throughout South America, Australia, Canada, Africa and other places in North America. From the perspective of mergers and acquisitions, there are both single mines and corporate mergers and acquisitions. The trend of overseas mergers and acquisitions will continue with the increase in Chinese mining demand.

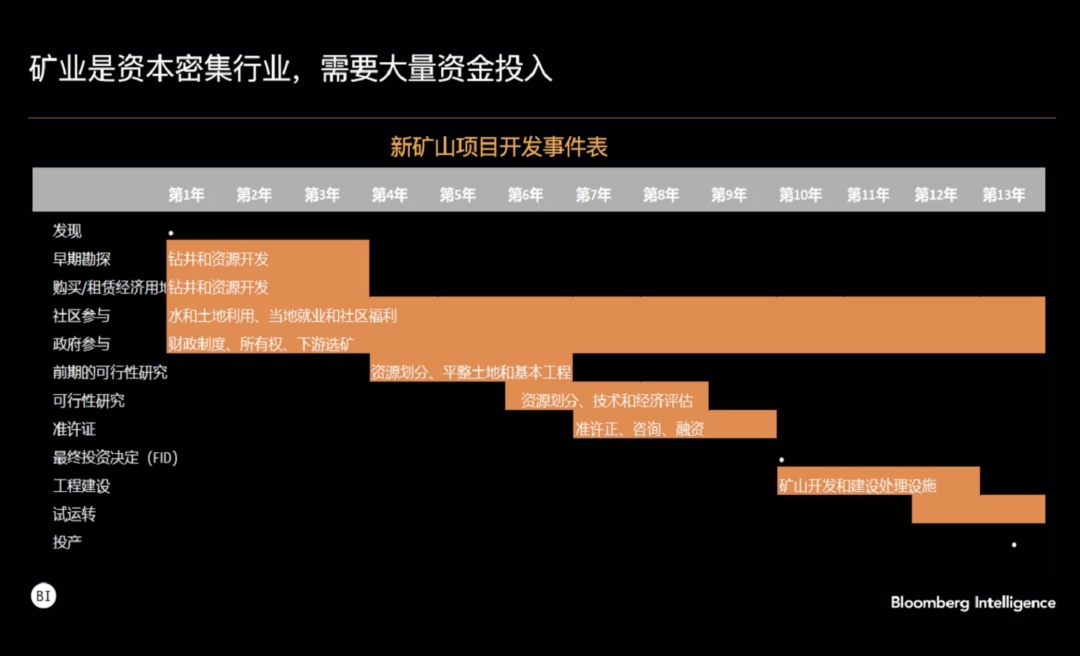

Judging from the current situation of mining development, Zhu Yi introduced that the mining industry is a capital -intensive industry. With the large -scale resource development in recent decades, the depth and difficulty of mining in the world's major mines have gradually increased. At the same time Gradually decreases. Mining is facing problems such as depletion of resources, restrictions on water resources, and increasing mining complexity.

Zhu Yi pointed out that the average production period is increased by 4 years from the discovery of resources to the first batch of mineral products. Long time.

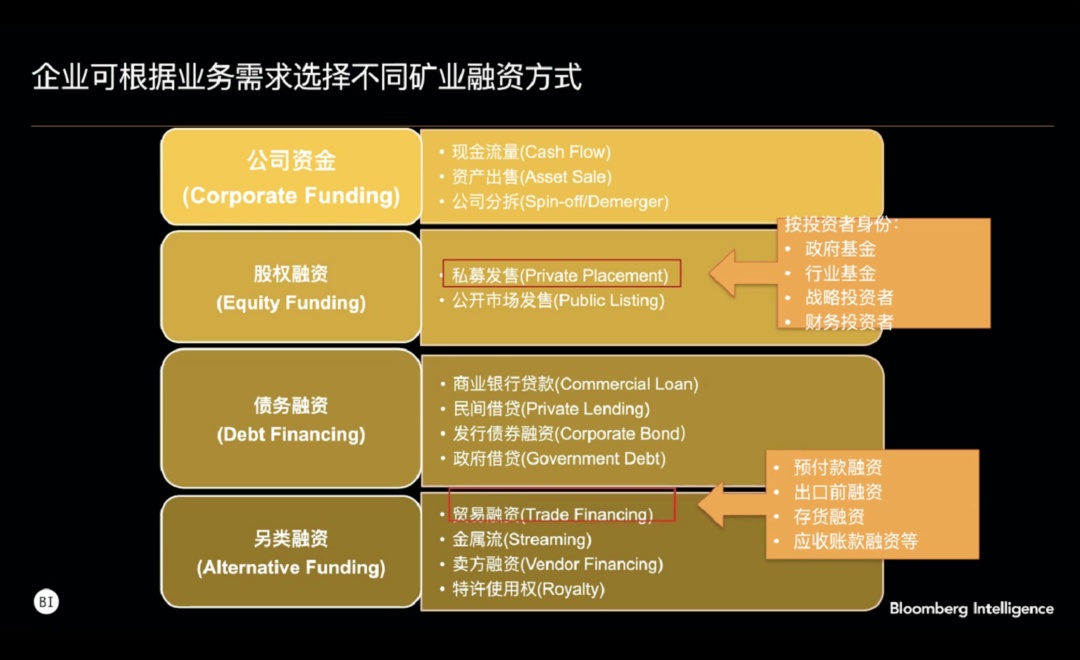

"We predict that with the advancement of global carbon reduction, the demand from green and clean energy will promote the expansion of existing mines and mining of new mines in mining companies, which requires financing of mining companies." Zhu Yi pointed out that mining enterprises Depending on business demand, corporate funds, equity financing, debt financing, and alternative financing are mainly adopted.

Zhu Yi said that in these four types of financing methods, equity financing includes private equity offering and public market sale. Among them, private equity offering is very common in the field of mining investment. Especially for primary mining companies, they can be sold to large companies by private equity. Fund can also get some support from foreign relations such as production technology, and for large companies, they can also lock some benefits at the initial period of the project at a small price.

On the one hand, it can be raised to raise funds through the public market sale. On the one hand, it can raise relatively large -scale funds. On the other hand, the capital market also provides a market -oriented pricing for enterprises. Use the capital market for subsequent financing.

"However, the threshold for public market sale is high. Only when it develops to a certain stage, companies with a good profit model can consider this method. However, due to the long mining development cycle and high risk, it is in the survey and development stage or the size is small. It is difficult for enterprises to go public in many countries. "Zhu Yi said.

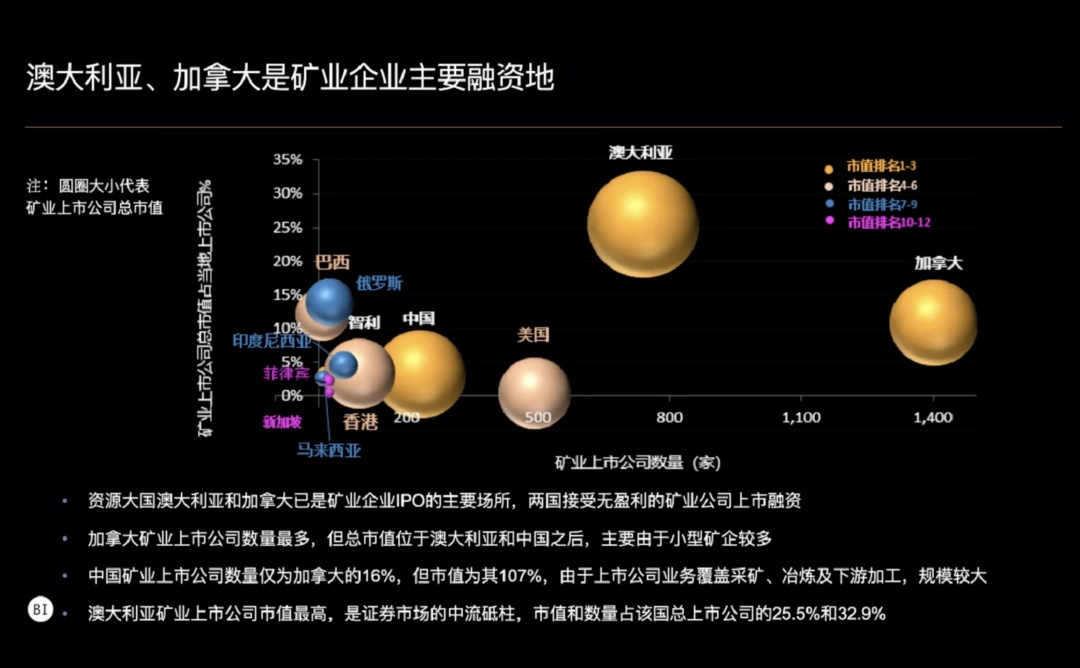

According to Zhu Yi, Canada and Australia have relatively loose listing conditions, and they all accept the listing of non -profit mining companies, which has become a major financing place for global mining companies. The number of listed companies in Canada is the largest, but most of them are small and medium -sized mining companies, with a total market value of third. The number of listed companies in China is only about 16%of Canada. Big, the market value exceeds Canada and ranks second. Benefiting from Australia's unique resource endowment in mineral resources, Australian mining companies have the highest market value.

- END -

Liabilities of more than 500 million yuan, this company "breaking cocoon rebirth"!Hanyang District Court helps "revitalize" funds

Changjiang.com (Correspondent He Ouyang Chen Yali Reporter Zang Shiqin) On June 21, the reporter learned from the Hanyang District Court that recently, the reorganization plan of a coal sales Co., Ltd

The eighth in the country!Five years of calendar practice, Jigang returns to the top 500 nationwide

Reporter YuyueUnder the background of steady growth across the country, the rapid ...