570 billion investment in the air outlet accelerated, and important news of the "cornerstone" of the manufacturing industry

Author:Kanjie Finance Time:2022.09.22

At the critical moment, the CSRC has a big move.

Recently, the Securities Regulatory Commission approved 6 theme ETFs, including 2 CSIC Machine Tool ETF, 2 Science and Technology Board Chip ETFs, and 2 New Materials ETFs. It is worth noting that these six theme ETFs have only taken 2 days from the application materials to obtaining approval, which can be described as fast.

Among them, Huaxia Zhongzheng Machine Tool ETF (159663, referred to as: machine tool ETF) will be released on the market from September 23. Machine Tool ETF tracking the CSI Machine Tool Index (code: 931866). The index selected 50 businesses from the Shanghai -Shenzhen market involving machine tools and their key component manufacturing and services as samples to reflect the overall performance of securities of listed companies in the machine tool industry.

Some analysts point out that this action of the regulatory level is so fast and rare. The deep meaning behind it may be that the capital market will implement the major national development strategy of the capital market and guide market funds to pay attention to strategic emerging industries, especially the industry chain independent controllable and controllable. Fields include machine tools, chips, new materials, etc.

The world's largest "consumer country+production country"

The machine tool has always been called the "mother of industry". It is a machine for manufacturing machines. It is 40%-60%of the total number of machine manufacturing. It is the cornerstone of modern manufacturing. One of the signs. Therefore, the machine tool is also called "the heavy weapon of the country", and its controlling strategic position is particularly prominent.

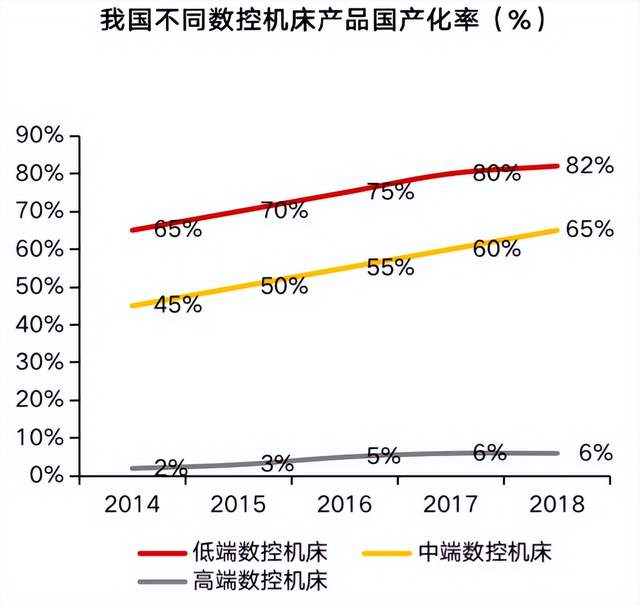

As of the end of 2020, my country has become the largest consumer and producer in the world's machine tools, accounting for 32%and 29%, respectively. At present, China has certain advantages in the low -end machine tool market, but the mid -to -high -end market is still highly dependent on imports. The top ten machine tool giants in the world are US, Japanese, and German companies. According to data from the Foresight Industry Research Institute, the localization rates of low -grade and mid -range CNC machine tools in China in 2018 were 82%and 65%, while the localization rate of high -end CNC machine tools was only 6%.

From "30 %" to "70 %" broad space

The core components of CNC machine tools mainly include the CNC system and functional components (spindle, rolling components, blade tower, etc.). At present, in terms of CNC systems, domestic Kodak CNC and Huazhong CNC technical strength gradually align with overseas leaders; in terms of functional components, many domestic OEMs are actively deploying their own production. After years of development, the numerical control rate of machine tools has continued to increase. In 2021, the numerical control rate of Chinese metal processing machine tools reached a record high of 36.21%, an increase of 11.2%year -on -year. Compared with more than 70%of developed countries such as Europe and the United States, my country's CNC rate is still large. Some institutions predict that with the stability of the manufacturing industry, the domestic industrial machine tool market will exceed 570 billion yuan in 2024 (data source: Nanjing Securities, 2022.09.08; First Financial, 2022.09.07).

The demand for the machine tool industry recovers, and the logic of "mother of industry" invests

In this context, the domestic private machine tool industry has ushered in key development opportunities. Some downstream industries have begun to prioritize domestic machine tools to ensure the safety and reliability of the manufacturing industry chain.

On the other hand, the market demand of machine tools is being released. The most important downstream -automotive industry, especially new energy vehicles are growing rapidly. In addition, the needs of aerospace military industry, 3C electronics (5G+Apple), engineering machinery, molds and other manufacturing industries are also currently. Restore will further drive the needs of the machine.

In addition, the demand for equipment renewal provides strong support for the high degree of view of the industry. The update cycle of the general number control device is around 7-10 years. From 2011 to 2014 is the last round of peaks for sales of my country's machine tool industry. Therefore We ushered in concentrated renewal demand, and the advent of renewal demand provides strong support for the continuation of the industry's high degree of prosperity.

From the company level, it can also be observed that the demand for the Chinese machine tool industry has recovered. Among them, Taksda, Haitian Precision, Guosheng Zhike and other listed companies have sufficient orders in hand; Kord's CNC predicts that the growth rate of new orders may be faster than the growth rate of production capacity. In addition, some domestic machine tool companies are positioning new energy as the second growth curve. Among them, Haitian Precision and Guosheng Zhike have deployed new energy vehicles in advance; Huazhong CNC has increased significantly in the first half of this year in the field of new energy power battery equipment and automation equipment.

Xiangcai Securities stated that looking forward to the fourth quarter of 2022, with the continuous efforts of domestic stable growth policies, the demand indicators such as medium- and long -term loans and manufacturing profits in domestic enterprises are expected to gradually stabilize, driving the demand for the machine tool industry to recover.

Nanjing Securities predicts that with the stability of the manufacturing industry, the domestic industrial machine tool market will exceed 570 billion yuan in 2024.

The underestimation index of the full coverage of the Chinese machine tool industry chain

It is understood that the China CSI Machine Tool Index was released on May 9th. From the Shanghai -Shenzhen market, 50 listed company securities were selected as samples. The design, manufacturing and service of components.

A total of 50 securities in the latest phase of the CSI Machine Tool Index, with a total market value of 664.1 billion yuan in total, and a free circulation market value of 390.3 billion yuan. The average market value of sample stocks was 13.3 billion yuan, and the median number was 5.4 billion yuan.

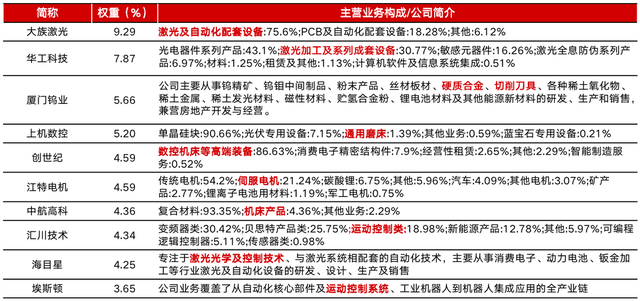

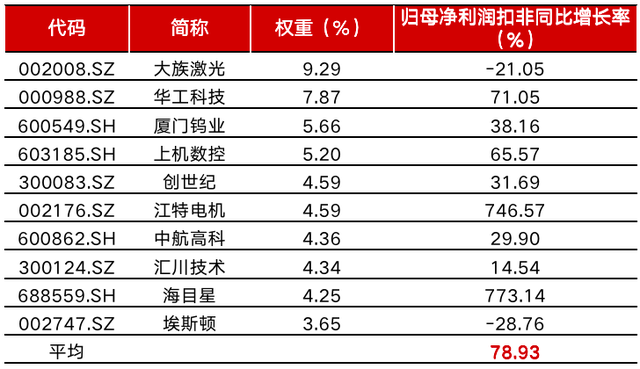

The index concentration is high, with a total of 53.78%of the top ten sample rights, and a total of 32.61%of the top five sample rights, including the leading of the main laser, Huagong Technology, Xiamen tungsten industry, on -board CNC, and Genesis. Despite the influence of domestic epidemic in the first half of 2022, many companies in the machine tool industry are still bright. According to Wind data statistics, in the first half of this year, of the top ten sample companies of the CSI Machine Tool Index, the revenue of 6 companies increased by more than 30%year -on -year, and the net profit of 5 companies increased by more than 30%year -on -year. The average value of non -net profit increased by 78.93%year -on -year.

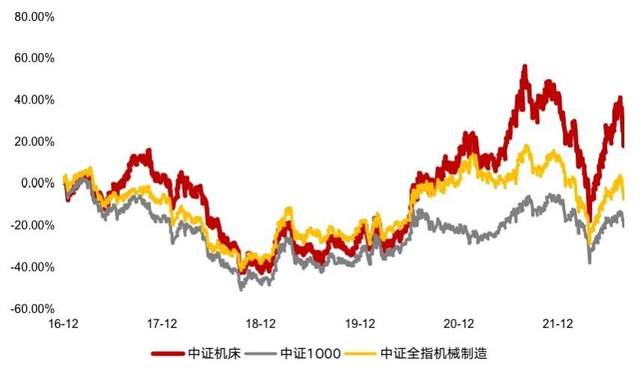

In terms of investment income, the performance of the CSI machine tool index is also quite eye -catching. Through the data back to the past five years, the CSI Machine Tool Index has only a slight retracement in 2018, and has obtained positive returns in other years. The cumulative yield in the past three years has reached 76.35%. , Far exceeded the 9.49%of the CSI 1000 index and 7.98%of the CSI Referential Index Machinery Manufacturing Index.

From the perspective of valuation, as of September 21, 2022, the latest valuation PE-TTM of the CSI Machine Tool Index was 36.72 times. From the perspective of the machine tool plate, as of now, the machine tool section PE-TTM is 31 times, which is lower than 45 times the average of the past five years. The value depression is obvious and has high investment value.

Machine tool ETF is about to be released

Huaxia China CSI Machine Tool Index ETF (referred to as on -site: Machine Tool ETF, Subscribe Code: 159663) will be officially issued from September 23. Investors can use the product to seize the investment opportunities brought by my country's machine tool industry.

Huaxia China CSI Machine Tool Index ETF uses a complete replication strategy and appropriate alternative strategies to better track the CSI machine tool index. The fund's performance comparison benchmark is the target index yield, that is, the SCR machine tool yield.

The Huaxia Fund was founded in 1998. Since 23 years, the industry has pioneered the industry. The management scale of passive equity products exceeds 308 billion yuan. It is worth mentioning that the manager of the Huaxia CSI Machine Tool Index ETF is Si Fan, public information, public information, public information, and public information. It shows that Si Fan is a senior vice president of the number of Huaxia Fund Investment Department. He joined the Huaxia Fund in 2011 and served as an investment in quantitative strategy researchers, investment managers, and responsible for multiple quantitative households.

Risk reminder: The views in the article are for reference only. Index funds have tracking errors. Fund's past performance does not represent the future. Before buying, please read legal documents such as the "Fund Contract" and "Recruitment Manual" before buying, and choose products that are suitable for your risk tolerance. Market risk, the investment need to be cautious.

- END -

Agricultural Development of Guangdong Branch Sales Department invests 4.479 billion yuan of Agricultural Development Infrastructure Fund to help modern transportation and logistics hubs

Agricultural Development of Guangdong Branch Sales Department invests in 4.479 bil...

Welcome to the Twenty Congress of Longjiang "Fengfeng" | Golden "Neumer"

On the way from Qiqihar City, Heilongjiang Province, the golden bean field on both...