Selling boards for the new materials of the European and Sofia Sanwei New Materials: Can the third IPO investment of the company's actual controller succeed?

Author:Daily Economic News Time:2022.09.21

In the A -share market, Hongya CNC (SZ002833, a stock price of 13.86 yuan, and a market value of 5.880 billion yuan) is currently the only listed company that is completely based on woodworking machinery. Although the actual controller of the company Li Maohong and Liu Yuhua were born in Linmu -related majors, they seem to invest well: 3 years ago, Den Seiko (SZ300780, stock price of 14.61 yuan, market value of 2.143 billion yuan) was listed. A total of more than 10%; today, the plate companies that the two actually controlled have also reached the IPO pass.

In July of this year, Guangxi Sanwei Home Furnishing New Materials Co., Ltd. (hereinafter referred to as Sanwei New Materials) disclosed the prospectus (declaration draft), and the reporter of "Daily Economic News" found that as early as December 2016, Guangzhou Kaide Machinery Co., Ltd. The company (hereinafter referred to as Kaide Machinery) entered Sanwei New Materials through equity transfer. After that, Li Maohong and Liu Yuhua behind Kaide Machinery gradually increased relevant shareholding and eventually became the actual controller of Sanwei. The "food" of the upstream industrial chain of the board -type home furnishings.

On the other hand, the upstream and downstream of the entire customized home shows the pattern of "big industries, small enterprises", and the board industry is no exception -2020 artificial board output (1.77 million m³) ranks first in the country, accounting for the industry's production capacity The proportion is less than 1%.

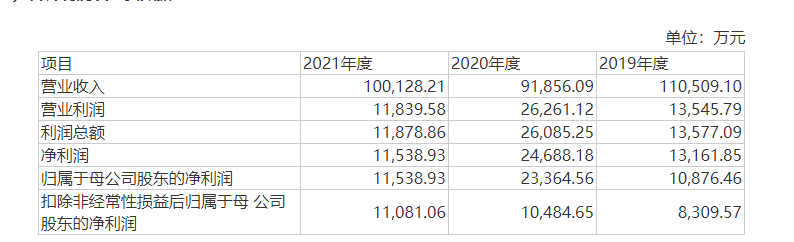

Sanwei's new material is also one of the head enterprises. In 20221, its total production capacity reached 1.035 million m³, ranking among the top in the country; its revenue from 2019 to 2021 was 1.105 billion yuan, 919 million yuan, and 1.01 billion yuan. Mother's net profit was 109 million yuan, 234 million yuan, and 115 million yuan, respectively.

Photo source: prospectus (declaration draft) screenshot

However, the problem that Sanwei New Materials may not be able to bypass this time is that its wood suppliers are mainly natural persons, not corporate operations. Sanwei New Materials has purchased more than 20 million yuan to some growers.

The actual controller is investing in the way, and another company needs an IPO

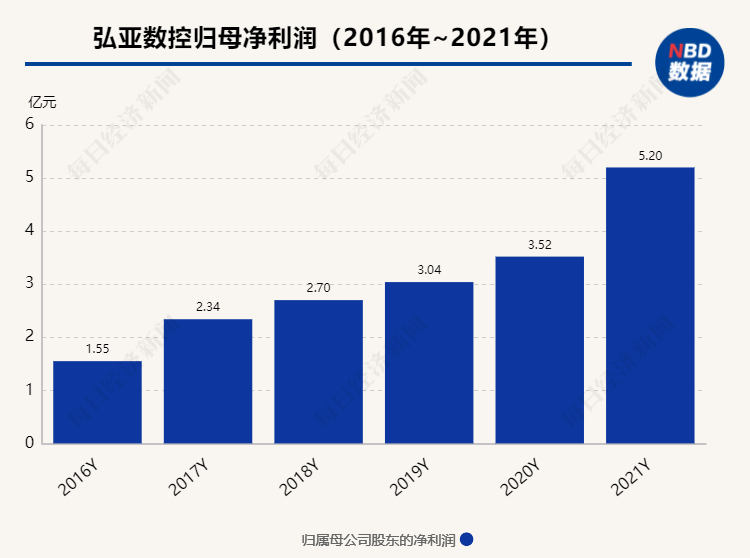

At the end of 2016, 10 years after the creation of Hongya CNC, Li Maohong and Liu Yuhua and his wife came to the company to listed on the Shenzhen Stock Exchange to list the bell on the Shenzhen Stock Exchange. Today, the scale of Hongya CNC revenue has increased from 534 million yuan (2016) to 2.371 billion yuan (2021), and its net profit has also continuously increased.

After more than 6 years after the listing of Hongya CNC, the Sanwei New Materials controlled by Li Maohong and Liu Yuhua also entered the IPO stage. The company, like Hongya CNC, is mainly used in custom home furnishings. If it is successfully listed, the capital territory of Li Maohong and Liu Yuhua and his wife will also span the two industries that were scarce in the two original listed companies.

It should be noted that compared with Hongya CNC belonging to "independent entrepreneurship", Sanwei Xincai is originally a local state -owned enterprise. After the restructuring of state -owned enterprises, Li Maohong's Kaide Machinery and Guangzhou Dinghui Entrepreneurship Investment Co., Ltd. (hereinafter referred to as Dinghui Investment) Gradually get control.

"Daily Economic News" reporter noticed that Kaide Machinery also briefly became Hongya CNC subsidiary.

According to Hongya CNC's prospectus, Kaide Machinery was originally an enterprise that Li Maohong invested 55%of the equity. In 2012, Hongya CNC's predecessor Hongya Co., Ltd. was incorporated in the same industry competition. The price is about 11.58 million yuan; by July 2016, Hongya CNC will sell Kaide Machinery 100%equity on the grounds of the production and operation of Kaide Machinery "no longer engaged in the production and operation of machinery and equipment ... as the main business of concentrated power development". Give Liu Yuhua, the transfer price is 20.5 million yuan.

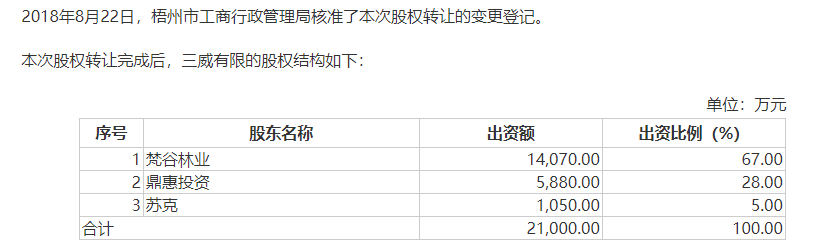

Four months after being stripped out by Hongya CNC, in December 2016, Kaide Machinery was transferred to 18%of the predecessor of Sanwei New Materials for 37.8 million yuan. ", Dinghui Investment, which controlled by him, was transferred to Kaide Machinery at 58.8 million yuan and other shareholders' holdings of Sanyi New Materials, which received a total of 28%of Sanwei New Materials.

Photo source: prospectus (declaration draft) screenshot

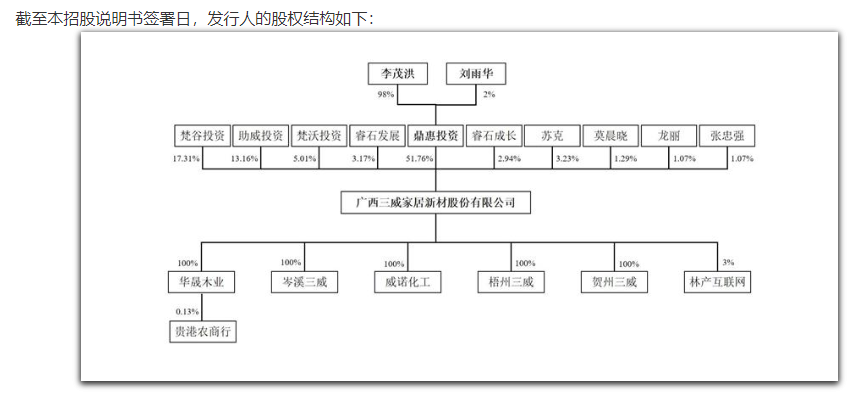

On the date of the prospectus, Dinghui Investment holds 51.76%of Sanwei New Materials, which is the latter controlling shareholder. Li Maohong holds 98%of Dinghui Investment, and Liu Yuhua holds 2%of Dinghui Investment.

Photo source: prospectus (declaration draft) screenshot

Regarding the investment of Li Maohong and Liu Yuhua in Sanwei New Materials, there are two needs to be explained. One is that except Dinghui Investment, the two did not hold the shares in other ways; the other was that except Li Maohong served as a director, the two were not in San San. Weixin Materials holds other positions, and the chairman and general manager of Sanwei New Materials are all roads. The road is also a senior in the industry. He graduated from a doctorate student in wood science and technology of Beijing Forestry University with a titles of senior engineers.

In addition, the Li Maohong couple also invested in the GEM enterprise Den Seiko, who mainly operates mechanical transmission parts, and belongs to the upstream supplier of Hongya CNC. It was listed in May 2019. As of September 8 this year, the two held a total of 7.26%of Den Seiko.

The old saying, "Don't put all eggs in the same basket,", but if you put the eggs in many baskets, you may worry about how to take care of them -recently, Hongya CNC is undergoing non -public issuance matters to regulate The inforgence letter of the agency first focused on the issues of Li Maohong and Liu Yuhua's body and multiple jobs, asking the company to explain the reasons for their multiple jobs and how to ensure that they have enough time and energy for the business development of Hongya CNC.

In the reply letter, Hongya CNC also introduced that in general, Li Maohong and Liu Yuhua did not participate in their daily operations and management of their part -time enterprises (except the holding subsidiary). The manager is responsible for the time and energy it consumes less. Large customers are deployed nationwide, and Sanwei New Materials "adhere to" Guangxi

The decoration building materials industry is a trillion -scale market. The customized home furnishing industry has also spawned a large number of cabinet listed companies. However, in the upstream industrial chain, whether it is plate or woodworking machinery, as of now, there are not many listed companies. The listed companies in the board are mainly Da Ya (SZ000910, the stock price is 8.64 yuan, and the market value is 4.73 billion yuan), Fenglin Group (Fenglin Group SH601996, the stock price of 2.96 yuan, a market value of 3.391 billion yuan); the only companies selling woodworking machinery such as border sealing machines and CNC diamonds are Hongya CNC and Nanxing (SZ002757, the stock price is 10.46 yuan, and the market value is 3.090 billion yuan). Part of the Internet business.

Sanwei New Materials introduced in the prospectus (declaration draft). In recent years, the number of enterprises in the artificial board industry has continued to increase. In 2020, there are more than 16,000 human -made board companies nationwide, but mainly small and medium -sized enterprises, the industry concentration is low. It shows the full competition situation of "big industries and small enterprises".

Among these more than 16,000 family -made board companies, Sanwei New Materials belongs to one of the head enterprises.

According to the prospectus (declaration draft), as of the end of 2021, there were 14 companies with an annual production capacity of more than 500,000 m³ nationwide in the country. There are 8 companies with a production capacity of more than 500,000 m 的, and Sanwei's new material production capacity is 220,000 m³. IPO plans to raise investment plate production capacity of 500,000 m³.

The so -called artificial board mainly includes three categories: plywood, fiber board, and particle board. These are all substrate materials for board furniture. We are the most common "multi -layer splint" and "granular board" when decorating. "Ai Xin Ban", "Kang Chunban", etc., are inseparable from the above three substrates.

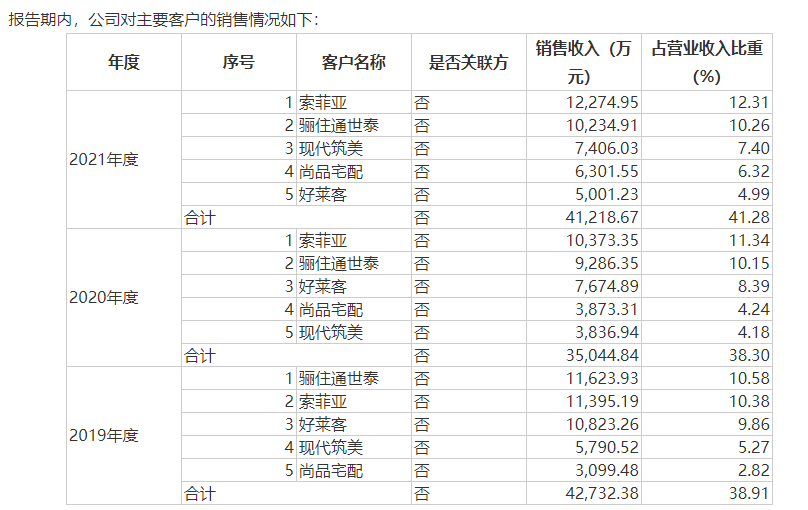

The plate of Sanwei New Materials is also mainly used in the custom home industry. According to Sanwei New Materials, the proportion of sales revenue realized to end customers during the reporting period accounts for about 80%, including Sofia (SZ002572, a stock price of 17.15 yuan, a market value of 15.647 billion yuan), Oupai Home (SH603833, a stock price of 124.60 yuan, a market value 75.9 billion yuan), Hollyou (SH603898, stock price of 10.22 yuan, market value of 3.181 billion yuan) and so on. Among them, Sophia contributed more than 100 million yuan each year and reached more than 10%of sales, and ranked in the top five customers.

Photo source: prospectus (declaration draft) screenshot

It should be noted that large -scale customized enterprises have basically deployed manufacturing bases in many places across the country, while the production lines of Sanwei New Materials are located in Guangxi, which brings certain restrictions on their sales radius. Long -distance distribution has also increased the company to increase the company Sales cost. For example, Sanwei New Materials has important customers (one of the top five customers of the year) is located in Dalian City, which is transported from Guangxi to Dalian. The freight is naturally rising.

According to the prospectus (declaration draft), according to the cost of unit cost, the average cost of Sanwei New Materials' self -produced fiber board is about 1300 yuan/cubic meter, of which the average unit freight rose from 85.32 yuan in 2019 to 100.75 yuan in 2021, the increase of the increase Great.

However, as the production of board is limited to the origin of raw materials, Sanwei New Materials is still in Guangxi.

Make a wood business over 20 million yuan with forestry farmers

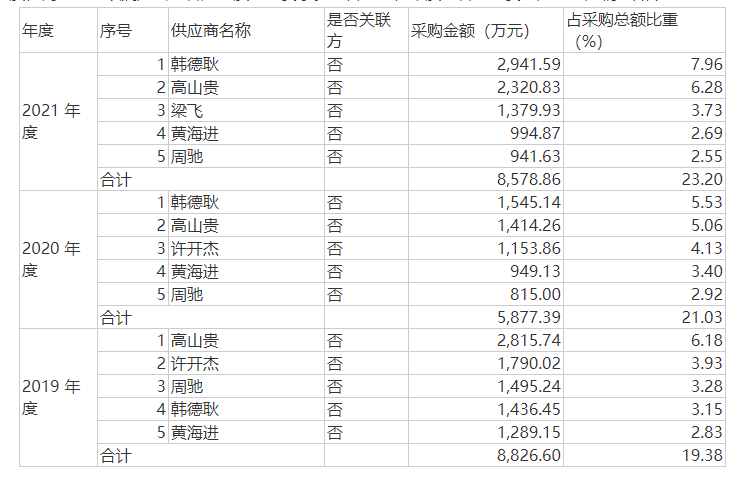

The main raw materials for board production are naturally wood. The total number of forest resources and annual wood production in Guangxi ranks among the forefront of provinces and regions across the country. Sanwei's new material prospectus (declaration draft) also revealed the "big business" of forestry planting - "Daily Economic News" reporters noticed that the wood suppliers of Sanwei New Materials are mainly individuals.

According to the prospectus (declaration draft), the company's procurement of the five wooden raw materials suppliers from the company from 2019 to 2021 is 88.666 million yuan, 58.739 million yuan, and 85.7886 million yuan, respectively. Wait. Among them, three years of purchase of nearly 60 million yuan from Han De Geng, and more than 65.5 million yuan from High Mountain Guigui.

Photo source: prospectus (declaration draft) screenshot

Sanwei's new material explains that the company's location is in Guangxi in the southern collective forest area. The forest area operators are mainly individuals. Wood suppliers are generally farmers who are specialized in wood raw materials, not corporate operations. Through market -oriented means, the purchase of wooden raw materials from individual suppliers is in line with industry practices, and also in line with national and local forestry policies. It belongs to industry qualities, and can meet the company's customers' quality requirements.

The reporter inquired that Dingfeng (873459.NQ), which is also an Oupai Home and Sofia suppliers, tried to sprint the Bei Stock Exchange to list, but it was announced in March this year. Dingfeng's wooden raw material suppliers are also dominated by natural persons, but this phenomenon was previously supervised inquiry. The exchange required Dingfeng to supplement the stability and bargaining ability of raw materials.

In addition, the reporter also inquired that companies including Fenglin Group, Daya Shengxiang, Rabbit Bao and other companies have involved the forestry industry to ensure raw materials supply. Sanwei New Materials also had its own forestry company to engage in forestry planting and sales.Sanwei New Materials stripped this part of the business and no longer engaged in artificial forestry business.Regarding related issues, the reporter tried to interview Sanwei New Materials on August 4 and added emails and telephone interviews on September 21, but as of press time, no reply was yet.

Daily Economic News

- END -

Langfang: Solidly promote research and development expenses plus deduction work to help enterprise scientific and technological innovation and high -quality development

On the afternoon of September 5th, the reporter learned from the press conference ...

WeChat Announcement: Campaign to clean up such accounts!

The WeChat Security Center released the WeChat Personal Account Release of Prohibi...