Youhemake -controlled acquaintances have left and right to turn around assets tens of millions of yuan in transactions.

Author:Jin Ziyan Time:2022.09.21

"Golden Syllars" Southern Capital Center Dew/Author Sanshi Nanjiang/Risk Control

Back to history, on July 23, 2010, Sichuan Youji Industrial Co., Ltd. (hereinafter referred to as "Youji Co., Ltd.") impacting the GEM for its sustainable profitability or major uncertainty, and the listing "folding halberd" Essence After many years, Youji finally succeeded in "ashore", and its issue price of 7 yuan/share landed on June 24, 2022 to the Bei Stock Exchange.

Behind it, Youhe or "thorns". On the one hand, in the history of Youji, the state -owned assets were "low -priced", that is, 50%of the equity of Chengdu Hangxing Cast Steel Industrial Co., Ltd. (hereinafter referred to as "Hangxing Cast Steel"). Later, Youji said that due to the low end of Hangxing Casting Steel, and the affordable "old acquaintance" was transferred to the actual controller, at this time, Hangxing Cast Steel no longer tied the subsidiary of Youji. In fact, at that time, Youji has cooperated with Hangxing Steel for many years, and there is business habits that purchase products from them. What is regrettable is that Hangxing Cast Steel, which has been separated from Youji, has served as suppliers and customers of Youji Co., Ltd. at the time of another company controlled by the controlling shareholder, with a transaction of over 10 million yuan. Later, the "old acquaintance" of the actual controller transferred one company as a customer of Youji and transferred it to Youji. Occupible company rolled around and finally became the subsidiary of Youji Co., Ltd. to avoid suspicion? In the previous GEM's listing declaration, Youji Co., Ltd., behind the acquaintance transaction, may lead its business independence and authenticity.

1. The low price acquisition of the 5719 factory navigation Xingxing Steel equity, or the loss of national capital loss nearly 1.5 million yuan

With the diversification of equity circulation, cases that erode state -owned assets in the name of reform occur. In history, Youji has acquired state -owned assets at a low price.

1.1 After signing an agreement agreement in 2009, Luo Ji and Ou Yi became the actual controller of Youji Co., Ltd.

According to the signing date of Youji Co., Ltd. is the "First Public Public Offering of Stocks and the Prospectus of the GEM" on June 11, 2010 (hereinafter referred to as the "previously declared the prospectus"), in December 2001, Luo Ji, Ou Yi, and Tang Mingli, Gu Lidong, and Liao were five, and set up Sichuan Yoshimoto Trade Co., Ltd. (predecessor of Youji) with 28%, 28%, 18%, 13%, and 13%, respectively. In November 2009, Luo Ji and Ou Yi became unanimous actors by signing a unanimous action agreement.

According to the public transfer instructions (hereinafter referred to as the "Public Transfer Manual") and the signing date of the public transfer instructions (hereinafter referred to as the "Public Transfer Manual" on September 7, 2015 (hereinafter referred to as the "Prospectus") After November 2009, Luo Ji and Ou Yi held a total of more than 50%of the equity of Youji Co., Ltd. in a direct or indirect way to be the controlling shareholder and actual controller of Youji.

1.2 Enterprises controlled by the actual controller of Youji Co., Ltd. in June 2009, Sichuan Yingji,

According to the previously applied for the prospectus, Sichuan Yiji Industrial Co., Ltd. (hereinafter referred to as "Sichuan Yingji") is an enterprise controlled by the actual controller of Youji Co., Ltd., which has been liquidated and canceled on June 5, 2009. Before the cancellation of the Sichuan British collection, the actual controller Luo Ji and Ou Yi of Youji Co., Ltd. held 39.5%and 25.5%of the Sichuan Yingji equity.

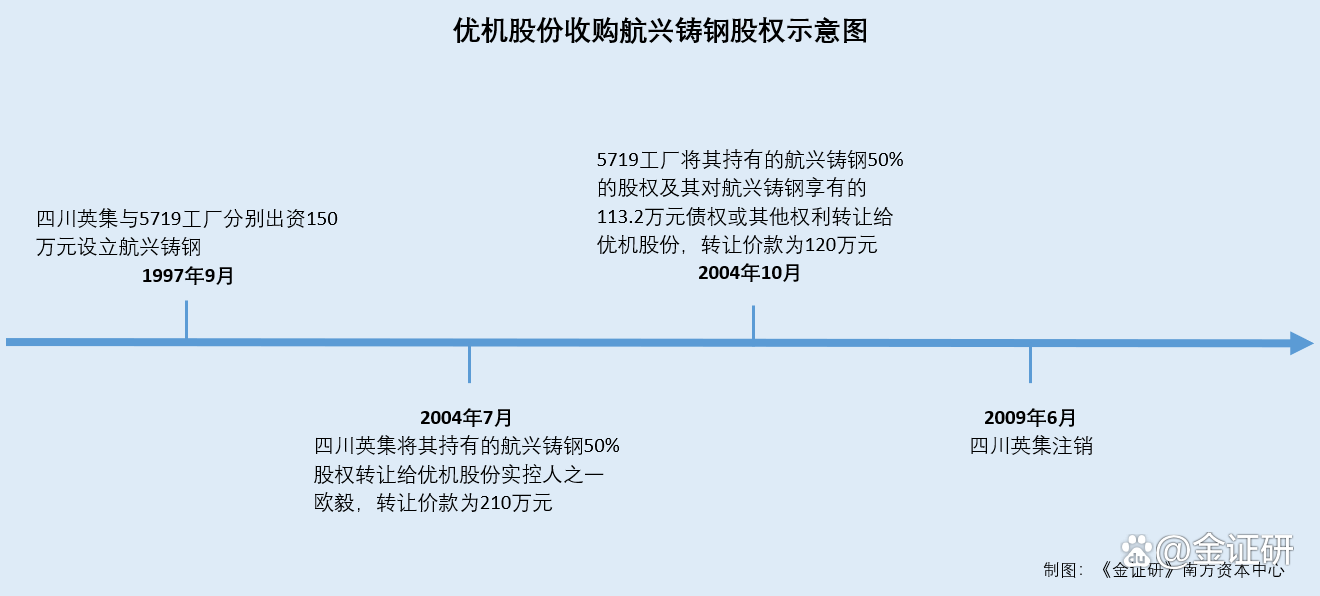

1.3 September 1997, Sichuan Yingji and 5719 Factory invested 50%of the establishment of Hangxing Casting Steel

According to the previously applied for the prospectus, Hangxing Cast Steel was established on September 2, 1997. At the establishment of Hangxing Turtel, its equity structure was 5719 factory and Sichuan Yingji subscribed to 1.5 million yuan, respectively, and the investment ratio was 50%.

1.4 In July 2004, Sichuan Yingji transferred the equity of Hangxing Steel Hangxing Steel to Ou Yi at 2.1 million yuan

According to the previously applied for the prospectus, on July 11, 2004, Sichuan Yingji transferred 50%of the Hangxing Cast Steel equity to Ou Yi, the actual controller of the Youji Co., Ltd., and the transfer price was 2.1 million yuan.

1.5 In October of the same year, the 5719 factory transferred the equity and claims of Hangxing Steel for 1.2 million yuan to Youji

According to the previously declared prospectus, on October 18 of the same year, the 5719 factory and Youji signed the "Equity Transfer Agreement". All claims or other rights are transferred to UFI shares, and the transfer price is 1.2 million yuan.

Among them, the 5719 factory's above -mentioned equity transfer of 1.132 million yuan of debt is specifically: lending to Hangxing cast steel for 1 million yuan for corporate mobile funds; 10,000 yuan.

In this regard, the 5719 factory transferred its equity to UFC shares as part of its optimization and integration of civil products. The 5719 factory and Youji shares signed the "Equity Transfer Agreement" on the basis of equal and voluntary negotiation, and are willing to give up the above claims.

1.6 The previous application sponsor and lawyer said that it was impossible to determine whether the above transfer existed in legal flaws

According to the previously applied for the prospectus, the 5719 factory residence is located in Lichun Town, Pengzhou City, and the legal representative Liu Yigui, with a registered capital of 65 million yuan. There is no related relationship between the controlling shareholder and the actual controller and more than 5%of the shareholders holding a shareholding.

Moreover, the 5719 Factory Finance Audit Department issued the "Letter on Transfer of the Primary Navigation Xingchen Steel Co., Ltd." (hereinafter referred to as "" Reply Letter "") explanation: 5719 factory will hold it The equity of Hangxing Casting Steel was transferred to the shares of Youji, and was approved strictly in accordance with the procedures required by state -owned assets management regulations. In addition, the sponsors and lawyers reported by Youji Co., Ltd. believed that it was difficult to obtain relevant information because the 5719 factory was a secondary confidential qualification unit. For this transfer, in addition to obtaining the above "reply letter", it is impossible to directly determine whether the 5719 factory has obtained the approval document approved by the superior department to transfer, so it is impossible to determine whether there are legal flaws in this transfer.

Judging from the above -mentioned stock transfer process, in July 2004, one of the actual controller of Youji Co., Ltd., Ou Yi, purchased 50%of Hangxing Castle Steel's equity from Sichuan Yingji at a price of 2.1 million yuan. Three months after the transaction was completed, Youji also transferred the 50%equity of Hangxing Cast Steel and the 5719 factory from the 5719 factory. 1.2 million yuan. There are obvious differences between the two transfer prices before and after the two transfer prices. Uttime or low prices have been transferred to the 5719 factory assets. Does it damage the interests of the 5719 factory?

It is worth noting that the problems involved in the first GEM declaration of Youji Co., Ltd. are more than that.

Second, the low -end business acquaintance company is taken off, and the atomic company still plays suppliers after de -association

Dipping assets is one of the means of beautifying reports of listed companies. In the first time of the GEM listing declaration of Youji Co., Ltd., Youji has stripped Hangxing Steel with the main business as a low -end manufacturing industry.

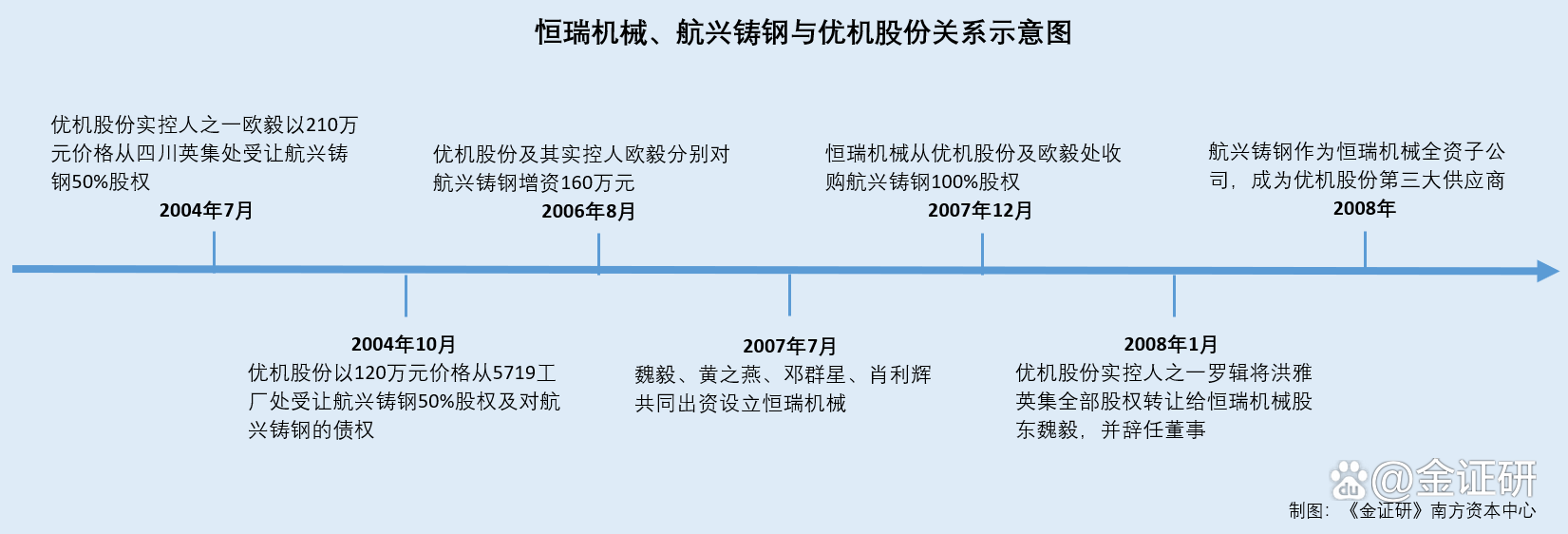

2.1 After the capital to Hangxing Steel in August 2006, the investment cost of UFI stock holding 50%of its equity was 2.8 million yuan

As mentioned earlier, in July 2004, Youji shares transferred 50%of the equity of Hangxing Steel to the actual controller Ou Yi. Three months later, in October 2004, UFIC's 50%equity of Hangxing Cast Steel held by the 5719 factory and its 10.32 million claims or other claims or other claims for Hangxing Castle Steel held by the 5719 factory right.

According to the previously applied for the prospectus, in August 2006, due to the lack of operating funds for Hangxing Casting Steel, UFC and Ou Yi agreed to increase the registered capital of 1.6 million yuan to Hangxing Steel. After the completion of the capital increase, the UCM shares and the controller Ou Yi, which were contributed by 3.1 million yuan in the amount of capital to Hangxing Cast Steel, for a total of 6.2 million yuan.

That is, Yuji Co., Ltd. was transferred to Hangxing Steel 50%of the equity of Hangxing Steel for 1.2 million yuan in July 2004. After an increase of 1.6 million yuan to Hangxing Cast Steel in August 2006, the Hangxing Casting held by Youji shares at that time The investment cost of 50%of steel equity is 2.8 million yuan.

It is worth noting that the next year of the completion of the capital increase of Hangxing Cast Steel, UFC shares transferred 50%of Hangxing Cast Steel at a price of 2.8 million yuan.

2.2 The following year, Youji and the controller actually transferred the equity of Hangxing Castle Steel to Hengrui Machinery for 2.8 million yuan

According to the public transfer instructions, Sichuan Hengrui Machinery Manufacturing Co., Ltd. (hereinafter referred to as "Hengrui Machinery") was established on July 17, 2007. When Hengrui Machinery was established, its registered capital was 10 million yuan, and the first phase of the registered capital was 2 million yuan. Among them, Wei Yi contributed 1.02 million yuan, Huang Yan contributed 340,000 yuan, Deng Qunxing contributed 320,000 yuan, and Xiao Lihui contributed 320,000 yuan. Natural persons Wei Yi, Huang Zhiyan, Deng Qunxing, and Xiao Lihui invested 51%, 17%, 16%, and 16%respectively.

According to data from the Market Supervision and Administration Bureau, Hengrui Machinery used to use Sichuan Yijiang Machinery Casting forging Co., Ltd. (hereinafter referred to as "Yijiang Casting forging"). On December 30, 2010, the name of Hengrui Machinery's corporate name was changed from Yijiang to Hengrui Machinery.

According to the previously applied for the prospectus, on November 30, 2007, Youji held a shareholder meeting. All shareholders agreed to transfer 50%of the equity of Hangxing Cast Steel to Yijiang forging.

On December 1, 2007, Hangxing Cast Steel held a shareholders' meeting. All shareholders agreed to transfer the 50%equity held by Youji and Ou Yi to Yijiang Casting forging. On December 3, Ou Yi and Yijiang Castle signed the "Equity Transfer Agreement". Ou Yi transferred 50%of the equity of Xingxingxing Steel to Yijiang Casting forging, and the transfer price was 2.8 million yuan.

It should be pointed out that the net assets audited by Hangxing Cast Steel as of June 30, 2007 were 4.656 million yuan.

As a result, on December 3, 2007, Youji and the controller Ou Yi actually transferred 50%of the equity of Hangxing Cast Steel Hangxing Castle Steel to the Yijiang Casting Section, which is Hengrui Machinery. 10,000 yuan, totaling 4.6 million yuan.

It is worth noting that Wei Yi or the actual controller of the UFC shares "Old acquaintances".

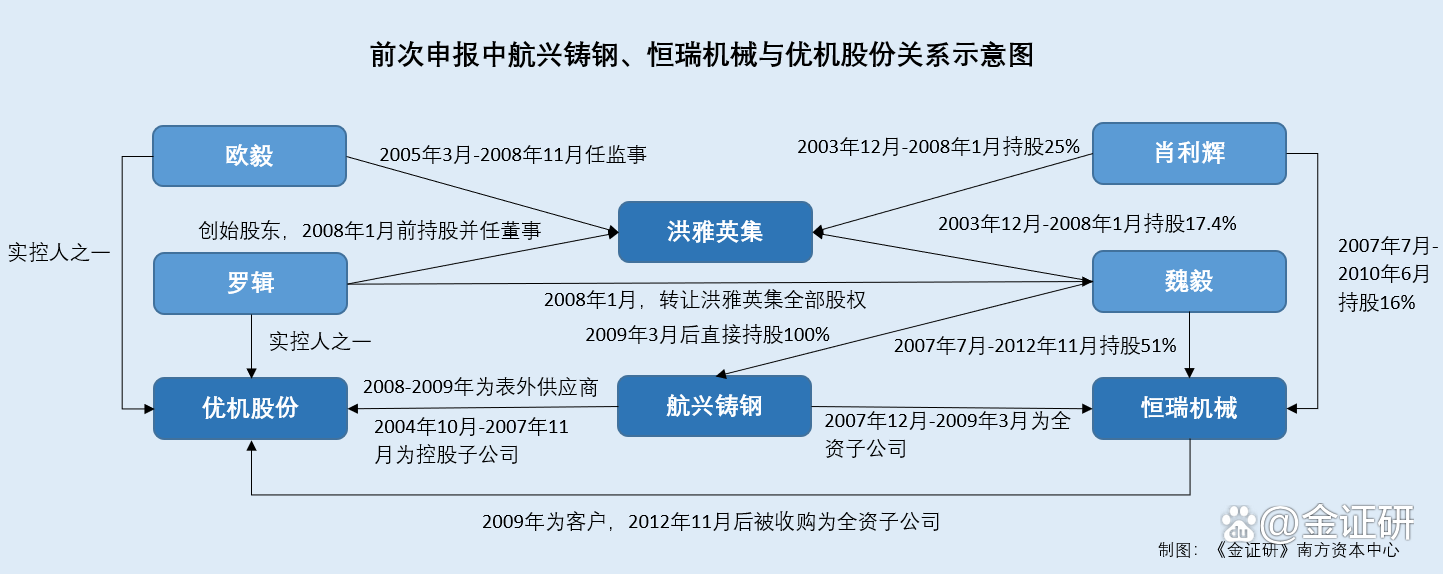

2.3 Wei Yi, the controlling shareholder of Hengrui Machinery, and Xiao Lihui, the shareholder, and the actual controller of Youji is the "old acquaintance"

According to the previously declared prospectus, Sichuan Hongya Yingji Precision Casting Co., Ltd. (hereinafter referred to as "Hong Yaying Collection"), is the limited liability of Luo Ji and natural person Chen Peng and Huang Xiping in December 1998 The company is mainly engaged in the casting of steel and copper products such as mechanical spare parts, gate valves, ball valves, trial valves, cutters, stop valves and other steels. At the time of the establishment of Hong Yaying's collection, Huang Xiping, Luo Ji, and Chen Peng contributed 200,000 yuan, 150,000 yuan, and 150,000 yuan to Hong Yaying, respectively, with a capital contribution of 40%, 30%, and 30%, respectively. In December 2003, Hong Yaying's registered capital increased to 2 million yuan. After the completion of the capital increase, Xiao Lihui, Huang Xiping, Wei Yi, Chen Zhiping, Su Huanrong, Luo Ji, Chen Peng, and Wang Yuanhua subscribed to Hong Yaying's collection of 500,000 yuan, 348,000 yuan, 348,000 yuan, 234,000 yuan, and 234,000 yuan. 174,000 yuan, 150,000 yuan, 150,000 yuan, and 96,000 yuan, the investment ratio was 25%, 17.4%, 17.4%, 11.7%, 8.7%, 7.5%, 7.5%, 4.8%.

In March 2005, after Chen Peng transferred 5%of Hong Yaying's equity to Luo Ji, the actual controller of Youji Co., Ltd., Luo Ji held 12.5%of Hong Yaying's equity and served as a director. Ou Yi, another real prosecutor of Youji, served as the supervisor of Hong Yaying's collection.

In January 2008, Luo Ji, the actual controller of Youji Co., Ltd., transferred 12.5%of the Hong Yaying's collection of Hong Yaying to Hengrui Machinery's controlling shareholder Wei Yi. Luo Ji no longer holds the equity of Hong Yaying's collection; Transfer 4.8%of the equity to Wei Yi. After the above equity transfer was completed, Wei Yi, Xiao Lihui, Huang Xiping, Chen Zhiping, and Su Huanrong subscribed to Hong Yaying's collection of 694,000 yuan, 550,000 yuan, 348,000 yuan, 234,000 yuan, and 174,000 yuan. 34.7%, 27.5%, 17.4%, 11.7%, 8.7%.

The controlling shareholder of Hengrui Machinery, Wei Yi, and Xiao Lihui, shareholder, and Luo Ji, the actual controller of Youji Co., Ltd., "Old acquaintances", and Luo Ji once served as Hong Yaying's shareholder.

In other words, three months after the establishment of Hengrui Machinery controlled by the old acquaintance, it was transferred to 50%of the Hangxing Cast Steel Hangxing Steel Hangxing Steel held by Ou Yi.

2.4 The reason for the transfer of Hangxing cast steel is its low -end business.

According to the previously declared prospectus, one of the main reasons for the transfer of Hangxing Steel Steel shares to be considered from the business model. The business model of Hangxing Castle Steel is largely different from the UFC business model.

Moreover, Youji said that after years of development, it has successfully achieved industrial upgrading, and has changed from traditional trading enterprises to modern manufacturing service companies. Youji shares form a unique business model and become a modern manufacturing service company for "one -stop customized services", bringing a series of changes and adjustments in terms of business operation, organizational structure, and development strategy.

Hangxing casting steel mainly produces products such as cast steel parts, cast iron parts. It belongs to traditional manufacturing enterprises. The products are at low -end processing and have a small technical content. To maintain the leadership and continuous growth capacity of Hangxing Cast Steel manufacturing capabilities, You need to continue to increase investment in Hangxing Cast Steel to buy high -priced and advanced casting equipment. At the same time We must continue to increase investment. This development strategy of large -scale fixed asset investment in low -end manufacturing capabilities and emphasis on traditional manufacturing capabilities is inconsistent with the development strategy of light asset models and the development strategies of technical services.

Therefore, the shareholders of Youji shares will be carefully considered, and believe that UFC should focus on providing one -stop customized services according to customer needs, and outsourcing non -core low -end manufacturing business. Therefore Adjust the same.

On the other hand, UFC also disclosed that another reason for the transfer of Hangxing Tast Steel equity is that from a business perspective, UFC has established a comprehensive supplier system. As of the end of 2007, Youji has 222 qualified foreign association suppliers. The demand for the steel casting and cast iron parts has formed a situation of supplementary and guarantee of multiple reserve enterprises. The transfer of Hangxing cast steel will not adversely affect the production and operation of Youji.

From January to November 2007, Hangxing Steel was included in one of the subsidiaries in the scope of the merger statement. As Hangxing Casting Steel was transferred to Hengrui Machinery by Youhe in December 2007, Hangxing Cast Steel has been no longer included in the merger statement of Youji Co., Ltd. since December 2007.

And after this transfer, Hangxing Casting Steel has nothing to do with Youji.

Interestingly, after Hangxing Casting Steel "separated" UFC, Youji still purchased products from Hangxing Steel.

2.5 In 2008, Hang Xinghuang, as a wholly -owned subsidiary of Hengrui Machinery, became the third largest supplier of Youji Co., Ltd.

According to the previously applied for the prospectus, Youji still has the situation of purchasing from Hangxingchen Steel after the transfer of Hangxing Steel.

In 2008, the third largest supplier of Xiangxing Casting Steel Department of Youheji, the amount (excluding tax) of Youji Co., Ltd. (excluding tax) to Hangxing Castle Steel was 16.1142 million yuan, accounting for the total purchase of UFC (excluding tax) for the same period (excluding tax) The proportion is 6.42%.

In this regard, Youji said that as of June 11, 2010, the company has cooperated with Hangxing Tast Steel for many years and can be used directly for some mills of traditional products, Hangxing Castle Steel itself. After transferring the equity of Hangxing Steel, the company still uses it as one of the suppliers. It is a comprehensive result of the company's habitual continuation of the company's business, and saving its overall costs for the investigation, production tests, and quality testing of new suppliers. It can be seen from the above situation that in December 2007, Hengrui Machinery, which was controlled by Wei Yi for less than half a year, was transferred to the equity of Hangxing Steel Hangxing Steel held by Youji and the controller. In the same year, Hangxing Casting Steel, who has cooperated with Hangxing for many years, has become a wholly -owned subsidiary of Hengrui Machinery, and Youji still purchases products from it.

The problem is not over.

3. "acquaintances" trades tens of millions of yuan, and partners assault Teng Nuo asset -transformed super machine joint -stock company

In fact, in the previous application, the two companies controlled by Wei Yi, a "old acquaintance" of the actual controller of Youji Co., Ltd., had also played the role of customers and suppliers at the same time.

3.1 In July 2009, Youji submitted a listing application for the GEM listing

According to the signing date is September 7, 2015 to the "Feedback of the Sichuan Youji Industrial Co., Ltd.'s listing application documents" on the national SME transfer system limited liability company. The Securities Regulatory Commission submitted an application for the first public offering of shares and listed on the GEM.

3.2 In March 2009, Hengrui Machinery transferred 100%equity of Hangxing Cast Steel to the controlling shareholder Wei Yi

As mentioned earlier, in December 2007, Hengrui Machinery was transferred to Hangxing Cast Steel 100%of the equity from You Yi and the controller Ou Yi.

According to the previously applied for the prospectus, Hangxing Cast Steel ’s industrial and commercial registration documents in 2009 showed that in March 2009, Hengrui Machinery transferred 100%of Hangxing Cast Steel's equity to the time of Hengrui Machinery’ s controlling shareholder. Wei Yi is held.

That is, in 2009, Hangxing Cast Steel was controlled by Hengrui Machinery Sub -Company to a company controlled by Hengrui Machinery's controlling shareholder.

3.3 In 2009, Hang Xinghuang was the largest supplier of Yukai.

According to the previously applied for the prospectus, in 2009, Hangxing Cast Steel was the largest supplier of Youji. The amount (excluding tax) of Uchihan's shares to Hangxing Steel is 18.935 million yuan, accounting for 8.77%of the total procurement (excluding tax) of UFC shares in the same period.

3.4 In 2009, Hengrui Machinery was one of the customers of Youji Co., Ltd., contributing to more than 5 million yuan in sales

According to the previously applied for the prospectus, in 2009, other business income of Youji Co., Ltd. was mainly real estate lease revenue and non -one -stop customized income. Among them, the non -one -stop custom revenue of Youji Co., Ltd. included 2.1906 million yuan for sales and smelting equipment revenue and 2.8625 million yuan of forging ingot model revenue sold by Yijiang Casting forging (formerly known as Hengrui Machinery).

In addition, as of December 31, 2009, Yijiang Casting forging (formerly known as Hengrui Machinery) was also the fifth largest account receivable customer of Youhe. The amount of accounts receivable for Yijiang forging (formerly known as Hengrui Machinery) of Yijiang was 3.268 million yuan, and the account age was within one year. The nature of the money was payment.

In other words, in 2009, Hengrui Machinery was one of the customers of UFC. It is worth noting that in November 2012, UFC acquired Hengrui Machinery at a price of 1.5 million yuan.

3.5 In November 2012, Youhehe acquired Hengrui Machinery, Hengrui Machinery became a wholly -owned subsidiary of Youji Co., Ltd.

According to the prospectus, Hengrui Machinery Department Uinges Co., Ltd., a wholly -owned subsidiary acquired by external acquisitions. Hengrui Machinery began to be included in the scope of Youji Co., Ltd. in December 2012. It is one of the production bases in the Youcom Co., Ltd., and is responsible for the research and development, production and sales of cast steel parts and materials.

It is known that on July 17, 2007, Hengrui Machinery was established by natural person Wei Yi, Huang Zhiyan, Deng Qunxing, and Xiao Lihui. Among them, Wei Yi held 51%.

On November 30, 2012, Hengrui Machinery ’s shareholders Wei Yi, Huang Xiping, Deng Qunxing, Zheng Qin and Youji signed the“ Equity Transfer Agreement ”with Youji, respectively. There are 51%, 17%, 16%, and 16%equity of Hengrui Machinery transferred to UFI stocks, and the transfer price is 765,000 yuan, 255,000 yuan, 240,000 yuan, and 240,000 yuan.

After the transfer was completed, Hengrui Machinery became a wholly -owned subsidiary of Youji.

It can be seen above that after a year after the transfer of Hangxing Steel Steel, in March 2009, Hengrui Machinery transferred the equity of Hangxing Tast Steel Hangxing Steel, but the transaction opponent was Wei Yi, his controlling shareholder, After being transferred by Hangxing Casting Steel, they were controlled by Wei Yi and Hengrui Machinery. In the same year, Hangxing Cast Steel was a supplier of Youji Machinery, and Hengrui Machinery was a customer of Youji. As the "old acquaintances" of Luo Ji, one of the actual controller of Youji, Wei Yi controlled the two companies as partners to "turn" in Youji Co., Ltd., and then Wei Yi used one of the companies to act as a customer of Youji. Transfer to Youji Co., Ltd., is it to avoid suspicion? Among the tens of millions of yuan trading, is the interest chain of the interests be associated with? To be checked.

- END -

Logistics guarantee and keeping smooth | Freight logistics continues to recover better

Recently, with the active efforts of various regions and departments, the national...

Caifeng | Blooming green rooms, the midsummer of the Central Plains smelly is red

Zhongtong is straight, the vines and no branches, the incense far, the pavilion is...