The Federal Reserve will raise interest rates in the early morning of the 22nd to accept economic recession in the name of anti -inflation. Global economic growth is expected to be close to historical lows

Author:Red Star News Time:2022.09.21

On the afternoon of September 21, local time, the Fed will end a two -day interest -making meeting. Fed Chairman Powell will speak at 2:30 pm (early September 22, Beijing time). It is reported that he is expected to emphasize that the central bank will do everything to fight inflation, and it is unlikely to reverse the interest rate hike process. The market is generally expected that the Fed will still raise interest rate hikes in this round, and there are also some expected to raise interest rates 100 basis points.

Fed officials also publicly acknowledged that the higher the interest rates they raised to calm their inflation, the greater the risk of damage to economic growth and employment. Powell said last month that this "will bring some pain to families and enterprises."

Not only the Federal Reserve, but the other central banks around the world have no concealment that they are determined to win the struggle with prices, even if they have to have a slowdown in economic growth or even shrinking. About 90 central banks raised interest rates this year, half of them raised at least 75 basis points in one fell swoop. Economists warn that central banks around the world are working in the same direction, which exacerbates the risk of global economic recession.

↑ Federal Reserve Chairman Powell

The United States may raise 75 basis points

It will accept economic recession in the name of anti -inflation

According to reports, at 2 pm local time on September 21 (early September 22, Beijing time), the Fed will release quarterly predictions on inflation, economy and future interest rate paths. The Federal Reserve President Powell will speak at 2:30 pm, and it is expected that he will emphasize that the central bank will do everything to fight inflation, and it is unlikely to reverse the interest rate hike process quickly.

According to data released by the US Department of Labor this month, the US Consumer Price Index (CPI) rose 0.1%in August, eliminating more fluctuating foods and energy prices, and inflation indicators increased by 0.6%from July, which is the two increase in July. Times; 6.3%compared to the same period of 2021, all higher than previous expectations. Therefore, the market is generally expected that the Fed will still raise interest rate hikes this round, which will also mean that the Federal Reserve has been so aggressive to raise interest rates for the third time. Some economists also predict that even 100 basis points may even raise interest rates. However, some analysts believe that the possibility of 100 basis points in interest rate hikes is less likely, because a greater interest rate hike may cause questioning of the Fed's overall strategy.

Under the expectations of great interest rate hikes, concerns about economic recession are also increasing. However, the analysis shows that the "Eagle" seems to be willing to put the United States into a decline for the target of the Federal Reserve. Jim Caron, head of the macro strategy of Morgan Stanley Investment Management Corporation, said that the Federal Reserve ’s interest rate hike is also a process of increasing the risk of recession. "It can be used to reduce inflation, because this is completely to reduce economic demand," he said. "But the sacrifice is future economic growth." Because the Federal Reserve's continuous interest rate hikes will quickly increase the cost of borrowing, and higher loan costs will be Forcing consumers to reduce housing, automobiles and other project expenses, and slowing corporate borrowing, which leads to a decline in the economy.

Fed officials have also publicly acknowledged that the higher the interest rates increased by calming inflation, the greater the risk of damage to economic growth and employment. Powell said last month, "this will bring some pain to families and enterprises, such as unemployment. The analysis pointed out that the low unemployment rate in the United States has reduced the "recent concerns" of the United States' recession to some extent, but the next tightening policy will be difficult to maintain this balance and bring greater risks to the employment market. The Fed's focus on the goal of inflation to 2%means that the "deep decline" of the US economy and more than 3 million people have unemployment.

According to a recent public opinion survey in the United States, most Americans are not satisfied with the current economic situation. About 29%of the American adults expressed their good economic conditions, and 71%said "poor performance." The survey also pointed out that 53%of them did not agree with the way the Biden government responded to inflation, and 72%of them also said that things were developing in the wrong direction.

↑ In addition to the interest rate decision this week, Fed officials will also release new interest rate forecasts

Global central bank rate hikes are like "competitions"

World Bank warning

According to reports, Powell described inflation shocks as "temporary" most of the time in 2021. In November last year, the European Central Bank (ECB) president Christina Lagarda said that the euro zone was unlikely to raise interest rates in 2022. As a result, the Fed will not only raise interest rates for three consecutive times, but the European Central Bank also decided to increase the interest rate of the euro zone by 75 basis points earlier this month and consider repeating this operation in October. Some analysts said that for central banks of various countries, if their reputation is damaged for temporary inflation, restoring reputation through tightening monetary policy will become their primary task.

Data show that about 90 central banks raised interest rates this year, of which half of them raised at least 75 basis points. The Bank of England is expected to increase 50 basis points, and Indonesia, Norway, the Philippines, Sweden and Switzerland are also expected to be adjusted. Credit Suisse economists say that central banks of other wealthy economies, including Britain, Europe, and Canada, have raised interest rates in history, and global monetary policy has emerged as the fastest tightening speed since 1989. According to data from JPMorgan Chase, the world's major central bank rate hikes this quarter will be the largest among 1980, and it will not stop here.

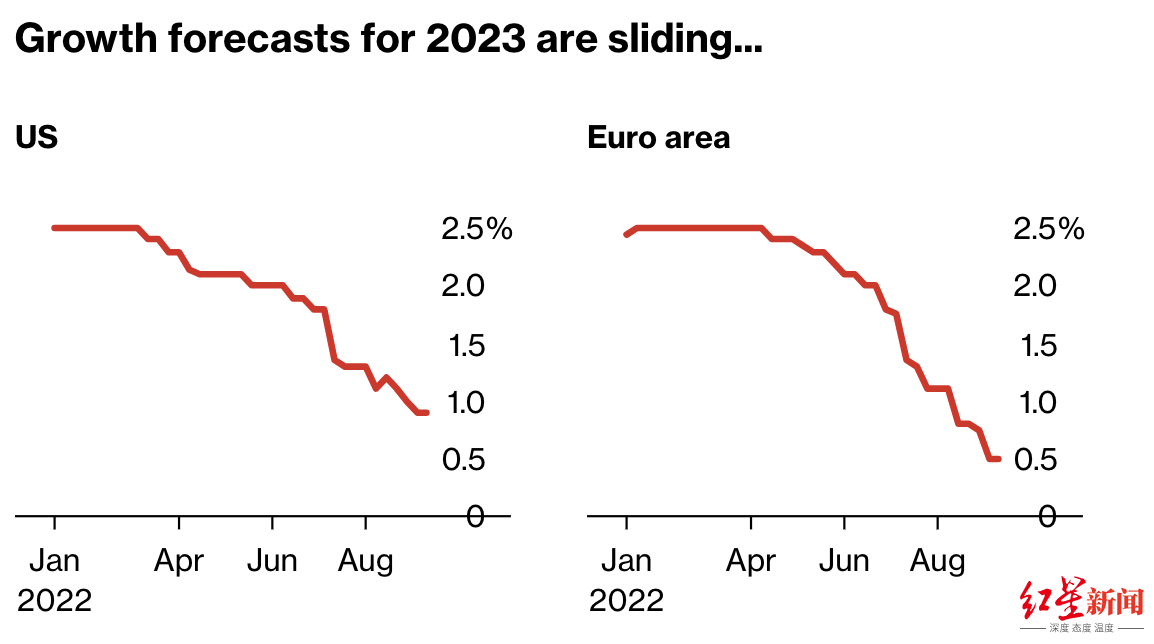

"In my opinion, this is like a terrorist performance of monetary policy," said Eliowen Huntov, the director of macro policy research by Daofu Global Investment Consulting Company. The Bank of America Chief Economist Eshan Harris also referred to the global central bank's interest rate hike as "a competition to see who can raise interest rates faster." The World Bank issued a warning last week that central banks of various countries focus on reducing the soaring inflation. Rate will lead to huge financial pressure, and the threat of global economic recession is increasing. In this case, global GDP growth in 2023 will slow to 0.5%.

↑ The economic growth of the United States and the euro zone in 2023 is expected to decline

Former International Monetary Fund (IMF) chief economist Morris Obst Feld also said that central banks around the world are working hard in the same direction, which exacerbates danger. Since 1980, the average growth rate of the world economy has been 3.4%. Affected by the tightening of currency, the new crown epidemic, and the conflict of Russia and Ukraine, Abst Feld believed that the global economy had slowed to "about 1%".

According to the analysis, policies of various countries do have to have a strategy of two comprehensives to allow them to slow down inflation and not destroy the overall economic growth at all, but there is no yet. Loleita Mest, Governor of the Federal Reserve Bank of Cleveland, said: "But when it is not considered at the moment, it is possible in the future."

Global growth is close to historical low

Singapore becomes a rare global currency winner

A recent survey by Bank of America found that global growth is expected to be close to historical lows. One reason for this worry is that the operation of monetary policy is lagging: it first weakens the financial market, then the economy, and finally inflation. The Bank of America's Harris warned a sharp interest rate hike: "It takes time to let inflation and cool down. If you start discussing the current inflation as the main measurement indicator, then you want to stop (at the same time that affects finance and economy). It's too late. "

Harris believes that the United States is expected to fall into economic recession next year (there are also predictable names at the end of this year), and the British and euro zones will fall into recession in the fourth quarter of this year. In addition, the Bank of England even predicts that the British economic recession will begin by the end of this year and may last until 2024.

Although the European Central Bank officials predict that when updating the policy this month, the euro zone economy will only stagnate and will not shrink. As people are becoming more and more worried that winter energy tightening will lead to the decline in economic activities, the risk of economic recession in the euro zone has reached its highest level since July 2020.

Economists commissioned by Bloomberg News recently gave an evaluation saying that in the next 12 months, the possibility of the euro zone economy continued to decline in two quarterly declines as high as 80%, which was higher than 60%of the last survey conclusion. Among them, as the largest economy in the European Union, it is also one of the most affected economies of natural gas supply. Germany may have aged economic atrophy in this quarter.

In addition, under the Federal Reserve's violence, almost all major currencies against the US dollar are declining, but Singapore has become the strongest Asian currency this year. According to reports, some strategists bet that if the price pressure is forced to tighten the exchange rate policy again next month, Singapore will be further strengthened and may become a rare global currency winner. According to the analysis, unlike the other central banks that adopt interest rate policies, Singapore central banks respond to the rising core inflation to guide the currency appreciation of the major trading partner of the local currency.

Red Star News reporter Ding Wen

Editor Guan Li Xiao Ziqi

- END -

Looking at Liaocheng in the top ten industries | Traditionally and emerging industries go hand in hand, comprehensive "manufacturing strong cities"

New Yellow River Reporter: Xue DongThe common birth of the Yellow River civilizati...

Snowy Plateau "Vegetable Basket" is abundant -Changde aid team in Longzi County, Tibet to develop the vegetable industry

Hunan Daily All Media Reporter Meng Yanyan Correspondent Li JingEntering the Veget...