Another garden enterprise Yi Lingnan Lingnan Co., Ltd. will be changed to Zhongshan Torch District Management Committee

Author:Daily Economic News Time:2022.09.21

As a listing company in Dongguan, Guangdong, Lingnan (SZ002717, stock price is 2.98 yuan, and a market value of 50.21 billion yuan) ushered in the aid of state -owned assets in Zhongshan.

On the evening of September 20, Lingnan shares issued an announcement saying that through shareholders' equity transfer, voting right commission, non -public offering of shares, Zhongshan Huaying Industrial Investment Partnership (Limited Partnership) (hereinafter referred to as Huaying Industrial Investment) will become the company's controlling shareholder, The company's actual controller will be changed to Zhongshan Torch District Management Committee. On the morning of the 21st, Lingnan's stock price rose sharply, and once touched the daily limit, and gradually fell. As of the release of 2.98 yuan, it fell 1.65%.

"Daily Economic News" reporter noticed that in recent years, garden listed companies have generally faced problems such as difficulty recovery, limited financing channels, and challenges. Local state -owned assets have become the "living water" of activated garden companies. According to incomplete statistics from reporters, since 2019, four listed companies have invested in state -owned assets. On the morning of September 21, Zhang Ping, the secretary of Lingnan Co., Ltd., said in an interview with the reporter of "Daily Economic News" that after the state -owned assets, the company's payment and financing pressure will be further relieved. In the future, management will use the existing team in the future. For the main, state -owned shareholders will consider further empowerment of the company.

Zhongshan state -owned assets

On the evening of September 20, Lingnan issued a number of announcements. Through three steps of shareholders' equity transfer, voting power entrustment, and fixed increase, the company's control will be changed.

First of all, Lingnan's controlling shareholder, actual controller Yin Hongwei, and shareholder Yin Zhiyang, Qin Guoquan invested 80.47 million shares (about 4.78%of the total share capital), 3.37 million shares (about 0.20%of the total share capital), and 42 Wan shares (about 0.02%of the total share capital) shares, Huaying Industrial Investment will receive a total of 84.26 million shares of the company, accounting for about 5.00%of the company's total share capital.

Second, Yin Hongwei entrusted the remaining 292 million shares (about 17.32%of the company's total share capital), which was entrusted to Huaying Industrial Investment. After the above shares transfer and voting rights are entrusted, Huaying Industrial Investment will have 22.32%of the voting rights of the company. The company's controlling shareholder will be changed from Yin Hongwei to Huaying Industrial Investment. The actual controller will be changed from Yin Hongwei to the Zhongshan Torch District Management Committee.

Third, Huaying Industrial Investment will further subscribe for 417 million shares issued by Lingnan's non -public issuance, injecting about 1 billion yuan of mobile funds into Lingnan shares to enhance the control of listed companies, and the voting right will rise to 37.72%.

Hua Ying Industrial Investment, the newly -owned shareholder, was established in September 2022. The main business is equity investment. As of the signing of the plan, it has not actually carried out business activities or foreign investment. The controlling shareholder of Huaying Industrial Investment is Zhongshan Torch Huaying Investment Co., Ltd., which is a state -owned comprehensive financial investment company approved by Zhongshan Torch District Management Committee. At present Essence

"Daily Economic News" reporter noticed that Zhongshan Torch District is a high -tech industrial development zone. It is positioned to build a national first -class national high -tech zone, Zhongshan's strategic emerging industry cluster development benchmark, Zhongshan manufacturing digital intelligent transformation and upgrading demonstration zone Essence

Before entering the main Lingnan Co., Ltd., the main actions of the state -owned assets in the Torch District of Zhongshan City in the capital market were the participation of the Zhongju High -tech (SH600872, the stock price of 31.01 yuan, and the market value of 24.35 billion yuan). According to the half -annual report of 2022, Zhongshan Torch Group Co., Ltd., which is controlled by the Torch District of Zhongshan City, holds Zhongzhu High -tech 10.72%equity and is its second largest shareholder.

The reporter also noticed that the relevant agreement of the changes in equity also involved the relocation arrangement of listed companies, which means that Lingnan shares, which established and resigned for 24 years in Dongguan, will be relocated to Zhongshan.

Talking about the process of contact between the two parties, Zhang Ping, the secretary of Lingnan Co., Ltd. said to the reporter of "Daily Economic News": "We have been preparing to introduce strategic investors this year. In operation, the two parties at the business level also have a large degree of fit, so the two parties will be closed at a shot. "

There have been 4 garden companies to become state -owned enterprises

The reporter learned that the garden industry is a capital-intensive industry. The core characteristics are cashier. When the scale is increased, it is necessary to continue to increase the orderly operation of external financing guarantee operation activities. A project operation model of government and social capital cooperation).

The research report released by Northeast Securities in January 2022 pointed out that the rise and decline of the PPP model have exacerbated the impact of the cushion on the garden engineering. After 2018, the industry entered a period of decline. It is characterized by the decline in revenue and the debt ratio has maintained a high level.

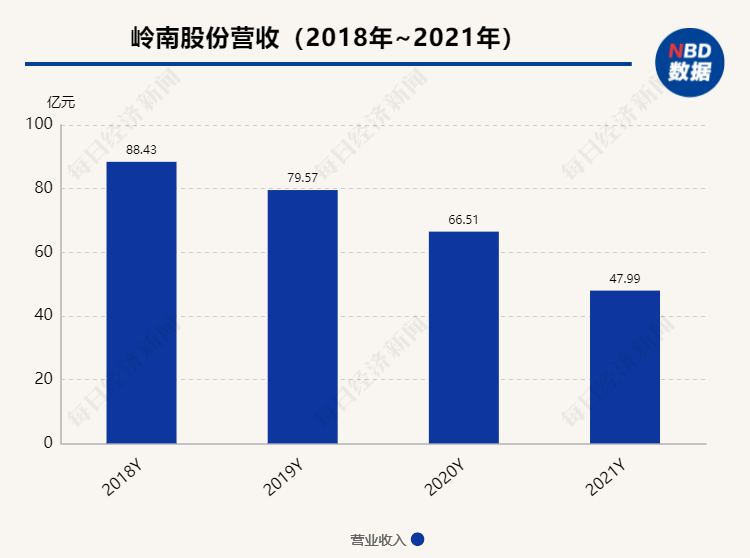

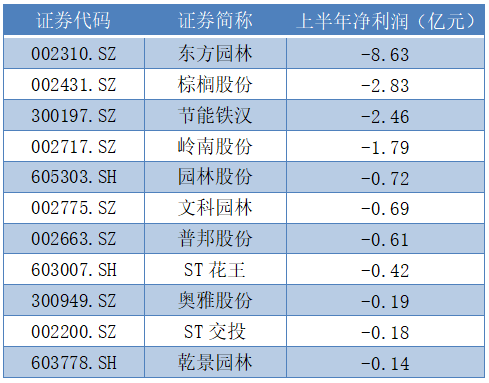

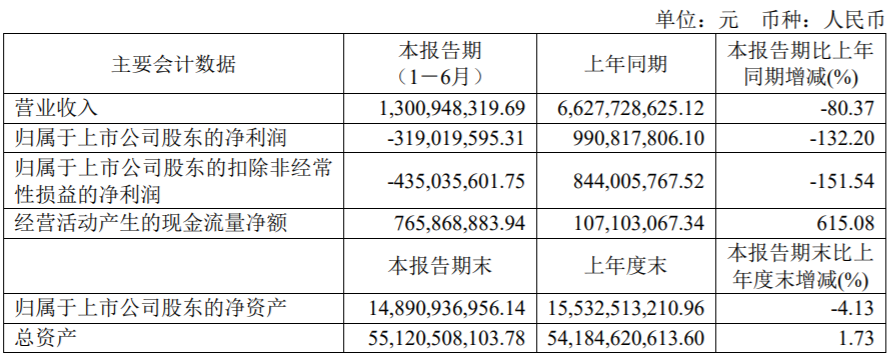

The reporter inquired that Lingnan Co., Ltd. achieved operating income of 7.957 billion yuan, 6.651 billion yuan, and 4.799 billion yuan in 2019 to 2021, the scale continued to shrink, and in 2020, it lost 460 million yuan. In the first half of this year, Lingnan Co., Ltd. lost 179 million yuan. Losses are not alone. Wind data show that in the first half of this year, nearly half of the 24 listed companies in the Shenwan Garden Project Category fell into losses.

Data Source of Listed Corporation of Garden Engineering in the first half of this year: Wind

In the announcement, Lingnan also mentioned that due to the large scale of capital investment in the ecological environment and garden construction industry, long recovery cycle and full market competition, capital strength is an important guarantee for the company's continuous development of business in the industry; as of June 2022, in June 2022 On the 30th, the company's asset -liability ratio was 71.93%. The higher asset -liability structure not only increased the company's financial costs, but also limited the company's continuous financing capabilities to a certain extent and restricted the company's business further development. Zhang Ping told reporters that in recent years, due to the external environmental changes and the impact of the epidemic, the corporate repayment cycle has been extended, and the enterprise does face some difficulties. "After changing to state -owned assets control, the problem of difficulty in financing is solved, and the arrears will be easy to solve."

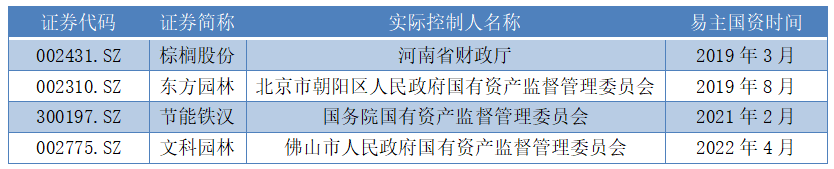

In addition to Lingnan Co., Ltd., there are not a few listed companies that have chosen to embrace state -owned assets in recent years. According to incomplete statistics from reporters, since 2019, 4 listed companies have invested in the embrace of state -owned assets, namely Palm (SZ002431, a stock price of 2.99 yuan, a market value of 4.4 billion yuan), Oriental Garden (SZ002310, stock price 2.27 yuan, 6.1 billion market value of 6.1 billion yuan Energy -saving iron man (SZ300197, stock price is 2.47 yuan, market value of 7 billion yuan), liberal arts garden (SZ002775, stock price 3.98 yuan, and a market value of 2 billion yuan).

Source of the garden listed company of Yizhu's state -owned assets since 2019: Wind and reporters organize

Regarding the stability of the company's operation and management, Zhang Ping said: "The new shareholders come in mainly to control the board of directors and the board of supervisors and control it at the strategic level. Operating autonomy. We are mainly government engineering companies. The new shareholders are large -scale comprehensive investment and asset management platforms in Zhongshan. The two parties are more in line with the large business direction. Some new empowerment, such as orders, financing, credit increase, capital operation, etc. The company will temporarily focus on existing business. The new strategy and business goals need to be determined before the two parties are integrated. "

Daily Economic News

- END -

Real Estate · Half -annual Report Interpretation | In the first half of the year, the net profit of returning to the mother has changed a year -on -year loss, and the Chinese enterprise plans to broaden the investment channels

On August 26, China Enterprise (SH600675, stock price was 2.71 yuan, and a market ...

Ruier Gai County Supply and Marketing Cooperative organized a training meeting for "Welcome Twenty New Supply and Sales to Sales and Sale"

In order to effectively implement the key tasks of serving agriculture and rural a...