The fundamentals of the light vehicle are still strong, and the layout can be layout everybody

Author:Capital state Time:2022.09.21

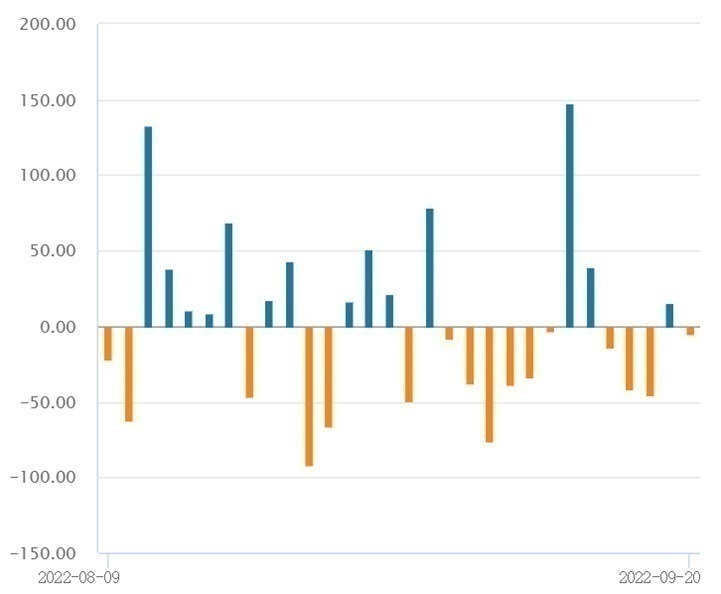

On September 20, A shares fluctuated and rose, and the topic stocks showed a general rising pattern. The Shanghai Index stopped four consecutive consecutive declines, and the entrepreneurial board index rose by more than 2%. Photovoltaic and lithium batteries led the track stocks to rebound. The automobile parts sector set off a wave of stopping, and retail stocks were repeatedly active; financial and real estate performed weak performance. The volume can be renewed at a new low.

The Shanghai Stock Exchange Index closed up 0.22%at 3122.41 points, the Shenzhen Stock Exchange Index rose 0.69%to 11283.92 points, the GEM index rose 0.7%to 2366.9 points, the science and technology 50 index rose 0.98%to 985.15 points, and the full A rose 0.72%. Wan De Shuangchuang rose 1.08%. The market turnover further shrinks to 65203 billion yuan; the northbound funds are risen and then suppressed, and the actual net sales of 523 million yuan.

Data source: wind

On September 20, the new energy sector rebounded collectively.

Data source: wind

The new energy vehicle sector has been adjusted successively since July. The elements of market concerns are based on transactions, and the fundamentals are mainly reflected in worrying about next year.

The first is to worry about changes in the penetration rate to change the ceiling of the industry. The new China Merchants Television team pointed out that domestic electric vehicles are currently trillion -dollar, and it is obviously unrealistic to maintain the growth rate of the past few years. However, the concerns of the penetration rate were fermented several times last year. At that time, the global penetration rate was less than 9%. At present, nearly 13%of the penetration rate in the world (high in China). Compared with the number of new power installed power installations in the world It is still prosperous (the proportion of existing power generation accounts for about 12-13%).

The second is to worry that the profit trend will not match the high valuation. The price and profitability of lithium battery materials are close to the end of the end of last year to the beginning of this year, and the overall profitability will return to a reasonable level. On the one hand, it is necessary to see the profitability of the company in some links, such as lithium batteries and front -drive head companies. On the other hand, it is necessary to see that with the disclosure of the interim report and phased adjustment, the current valuation level has been greatly digested. For example, according to Wind analysts, the expected growth rate of new energy vehicles in the next two years will be calculated by more than 30%. After this year's annual report, PETTM is expected to fall to about 26 times, and the ranks of PEG <1 next year will be returned to PEG <1. You can continue to pay attention to the new energy vehicle ETF (159806).

There are similar photovoltaic. Although the high valuation has overdrawing the future income, the continuous performance of the expected performance has caused the valuation to decline rapidly. In the past few years, the global photovoltaic development has developed rapidly. The main opportunities for investment in the sector are concentrated on the needs of continuous prosperity and technological progress. In 2021, the output of polysilicon, silicon wafers, batteries, and components in the main links of my country's photovoltaic industry chain reached 506,000 tons, 226.6 GW, 197.9 GW and 181.8 GW, respectively. Gava ranked first in the world for 9 consecutive years.

On September 20, relevant departments held a series of theme launch conferences of the "Industry and Information Development" series of the "New Era". Relevant personnel stated at the meeting that in recent years, my country's photovoltaic industry scale and market applications have achieved rapid development. In the future, we will continue to support the construction of industry associations, and strengthen production integration to support the development of photovoltaic industry.

Demand, Soochow Dianxin pointed out that after European energy control, photovoltaic demand is still strong, domestic distributed and continued to be popular in foreign base projects, and the US extension of ITC's 10 -year -old photovoltaic exhibition. Increased by 50%, 90GW+in China, 350GW+in 23 years, and increased by more than 40%. You can pay attention to photovoltaic 50ETF (159864).

The National Day file is approaching, and the National Day files in 2020 and 2021 after the public health incident achieved 3.967 billion and 4.388 billion box office, respectively, and there were more than 2.5 billion head -up movies such as "My Hometown" and "Changjin Lake" and other box office films. In addition, under the current public health incident and the "holiday" initiative in various places, the box office of the National Day in 2022 is particularly worth looking forward to. For three years in the winter of film and television, the cinema line is currently reducing the time to the release time, as long as a week and a few days. Near National Day, but looking at it, major heavyweight blockbusters have been delayed.

In the past few years, in the context of repeated public health incidents, the film industry has weakened as a whole, the upper seat rate is low, the movie box office is not as expected, and the view of the cinema has fallen; due to the sharp decline in advertising revenue, unstable performance, goodwill thunderbolt, goodwill thunderstorms In terms of supervision such as tax evasion, tax evasion, etc., and film and television companies also face many challenges.

Although the fundamentals of fundamentals have increased the stock price of listed companies in the film and television industry, the long -term value expectations of China's film and television industry have never changed. Film and television, entertainment, and leisure consumption must be a stable and strong growth point in the future. After the baptism of public health incidents and policies in the past few years, the film and television industry currently enters the long -term bottom. More and more investors have begun to re -examine the value of the film and television sector. The capital market has continued to reverse the capital game sector. To.

Data source: wind

- END -

Summary: Overseas people actively evaluate the semi -annual report of the Chinese economy

Xinhua News Agency, Beijing, July 18th. Summary: Overseas people actively evaluate...

The Market Supervision Bureau of Taishan District launched a safety inspection of large water amusement facilities

In order to further enter the summer, in order to further do a good job of special...